US Tariffs: A Convenient Excuse For GM's Reduced Canadian Presence?

Table of Contents

The Impact of US Tariffs on the Auto Industry

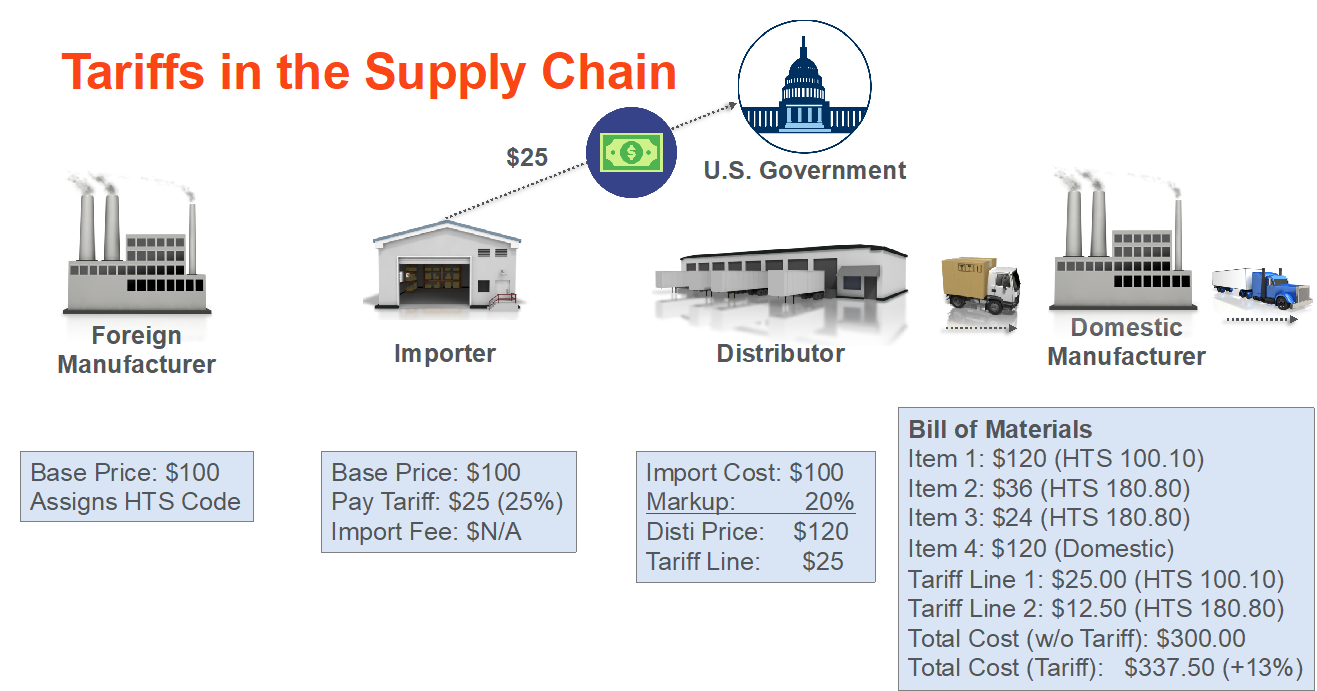

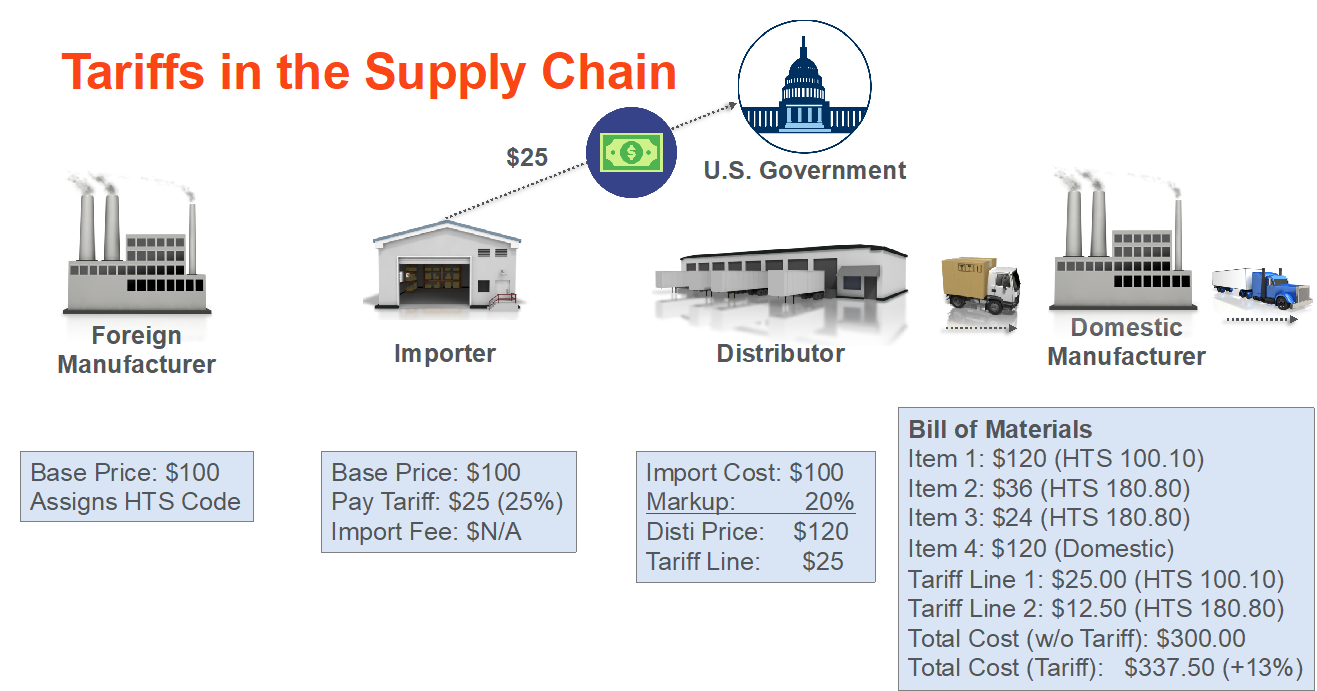

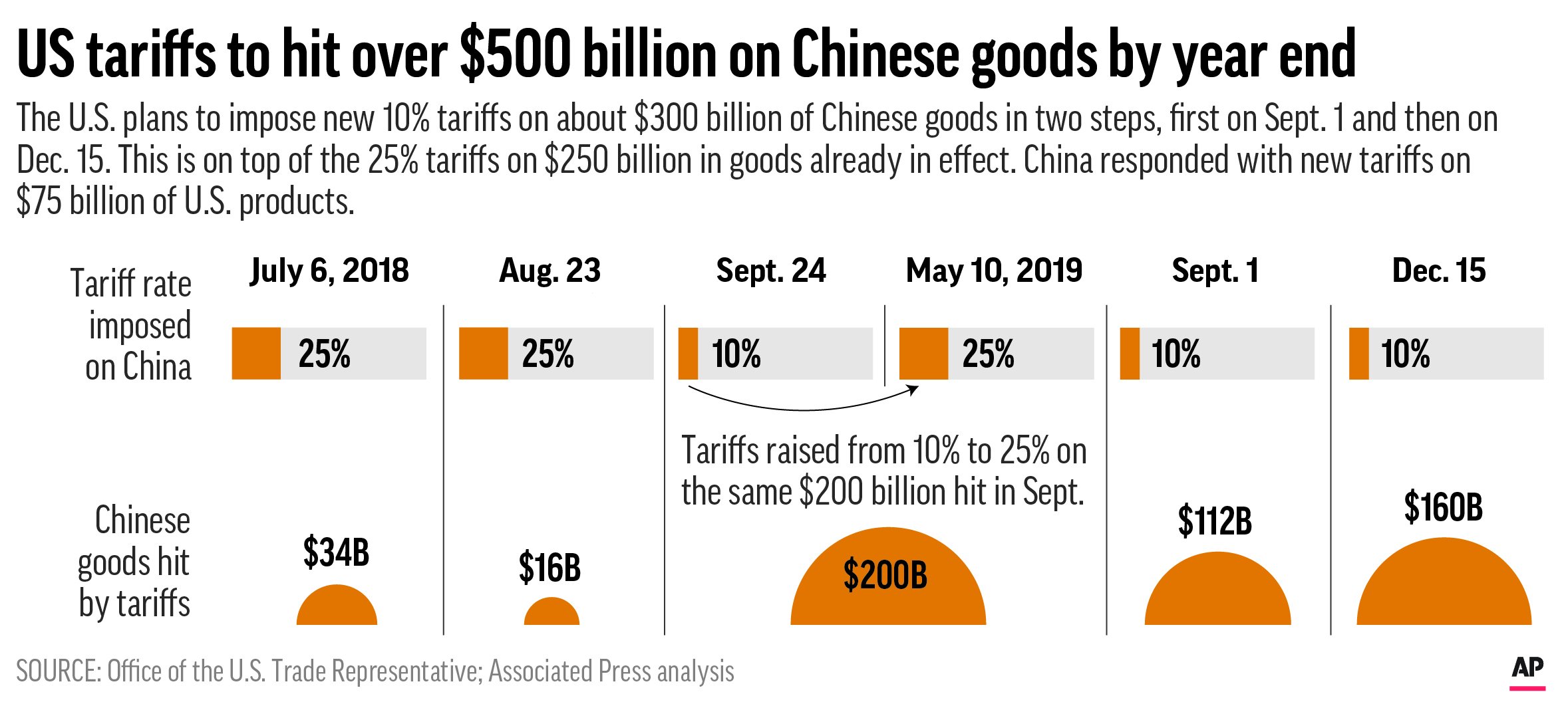

The imposition of US tariffs on imported goods, including automobiles and auto parts, significantly impacted the North American automotive sector. These tariffs, implemented under the guise of protecting domestic industries, increased the cost of importing and exporting vehicles and components between the US and Canada. This had several detrimental effects:

-

Increased costs of importing/exporting vehicles and parts: Tariffs added a substantial surcharge to the price of Canadian-made vehicles sold in the US market, making them less competitive against domestically produced vehicles. Similarly, US parts destined for Canadian assembly plants became more expensive.

-

Reduced competitiveness for Canadian-made vehicles in the US market: The increased costs directly translated to a loss of market share for Canadian auto manufacturers, forcing them to either absorb the increased costs or raise prices, further impacting sales.

-

Potential job losses in the Canadian automotive industry: Reduced competitiveness and decreased production led to plant closures and job losses across the Canadian automotive sector, impacting not only assembly plants but also the broader supply chain.

-

Counter-tariffs implemented by Canada in response: Canada retaliated by imposing its own tariffs on US goods, escalating the trade dispute and exacerbating the negative impacts on both countries' economies. The tit-for-tat tariffs created further uncertainty and hindered cross-border trade.

GM's Shifting Global Strategy and its Canadian Operations

GM's reduced Canadian presence isn't solely attributable to US tariffs. The company's overall global strategy has undergone a significant transformation in recent years, driven by several key factors:

-

Focus on electric vehicles (EVs) and autonomous driving technologies: GM's massive investments in electric vehicle (EV) and autonomous driving technology necessitate a shift in manufacturing focus and resources. This strategic shift might prioritize regions with more favorable conditions for this emerging technology.

-

Investments in other global markets with higher growth potential: GM, like many multinational corporations, is pursuing growth opportunities in emerging markets with expanding automotive sectors and potentially lower manufacturing costs. This reallocation of resources naturally reduces investment in more mature markets.

-

Plant closures and restructuring across North America: GM has undertaken a significant restructuring of its North American operations, including plant closures and workforce reductions, irrespective of the specific impact of tariffs. This restructuring reflects broader economic pressures and strategic adjustments.

-

Potential for automation reducing reliance on Canadian manufacturing: The increasing automation of automotive manufacturing processes means fewer assembly line workers are needed, potentially reducing the reliance on large-scale manufacturing facilities in Canada.

Alternative Explanations for GM's Reduced Canadian Footprint

Beyond US tariffs and GM's global strategy, other factors contribute to the company's diminished Canadian presence:

-

Higher labor costs in Canada compared to other manufacturing locations: Canada's labor costs are generally higher than in many other manufacturing locations, including Mexico and the southern US states. This cost differential makes Canada less attractive for manufacturing operations sensitive to labor costs.

-

Aging Canadian manufacturing facilities requiring significant investment: Many Canadian automotive plants are older and require substantial capital investment in upgrades and modernization. This expense can be a deterrent for companies seeking to maximize returns.

-

Shifting consumer demand impacting production needs: Consumer preferences are shifting towards SUVs and trucks, potentially impacting the production needs of facilities optimized for different vehicle types. This shift in demand can lead to plant closures or underutilization.

-

Increased competition from other automakers: The Canadian automotive market is highly competitive. Increased competition from other automakers, both domestic and international, adds pressure on GM's market share and profitability.

Analyzing GM's Public Statements on the Issue

GM's public statements regarding its Canadian operations and the role of US tariffs require careful scrutiny. While the company frequently cites tariffs as a significant challenge, a closer look reveals some inconsistencies:

-

Examine the consistency of their messaging: GM's messaging concerning the impact of tariffs on its Canadian operations should be examined for internal consistency over time. Any changes in messaging could be revealing.

-

Look for potential discrepancies between stated reasons and actions: A critical analysis should compare GM's stated reasons for reducing its Canadian presence with its actual actions and investments in other regions. Discrepancies might suggest alternative motivations.

-

Consider the use of tariffs as a public relations tool: It's important to consider whether GM might be using US tariffs as a convenient public relations narrative to justify pre-existing strategic decisions.

Conclusion

While US tariffs undoubtedly pose significant challenges to the automotive industry and have negatively impacted GM's operations in Canada, they are unlikely to be the sole reason for its reduced presence. A complex interplay of factors, including GM's global strategic shifts, economic realities, and competitive pressures, play a more significant role. Attributing the decline solely to tariffs presents an oversimplified narrative. A deeper analysis reveals a far more nuanced and intricate picture.

Call to Action: Understanding the intricate interplay between US tariffs and the automotive industry is crucial. Further research into the impact of US tariffs on GM's Canadian presence and the broader automotive sector is necessary to form a complete and accurate understanding of this complex issue. Continue the conversation and delve deeper into the complexities surrounding US tariffs and the Canadian automotive industry.

Featured Posts

-

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Counting Crows 1995 Snl Performance A Career Defining Moment

May 08, 2025

Counting Crows 1995 Snl Performance A Career Defining Moment

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025 -

Top Ps 5 Pro Enhanced Games A Must Play List

May 08, 2025

Top Ps 5 Pro Enhanced Games A Must Play List

May 08, 2025 -

Lower Interest Rates In China A Response To Trade Tensions And Tariffs

May 08, 2025

Lower Interest Rates In China A Response To Trade Tensions And Tariffs

May 08, 2025

Latest Posts

-

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025 -

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025