Analyst Predicts $4,000 Ethereum Price: CrossX Indicators And Institutional Buying Drive Forecast

Table of Contents

The Role of CrossX Indicators in the Ethereum Price Prediction

CrossX indicators, a suite of technical analysis tools, are playing a crucial role in this bullish Ethereum price prediction. These indicators analyze various market data points – price, volume, and momentum – to provide insights into potential price movements. Unlike simpler indicators, CrossX often combines multiple data sources for a more holistic view.

Specific examples of CrossX indicators pointing towards a potential $4,000 Ethereum price include:

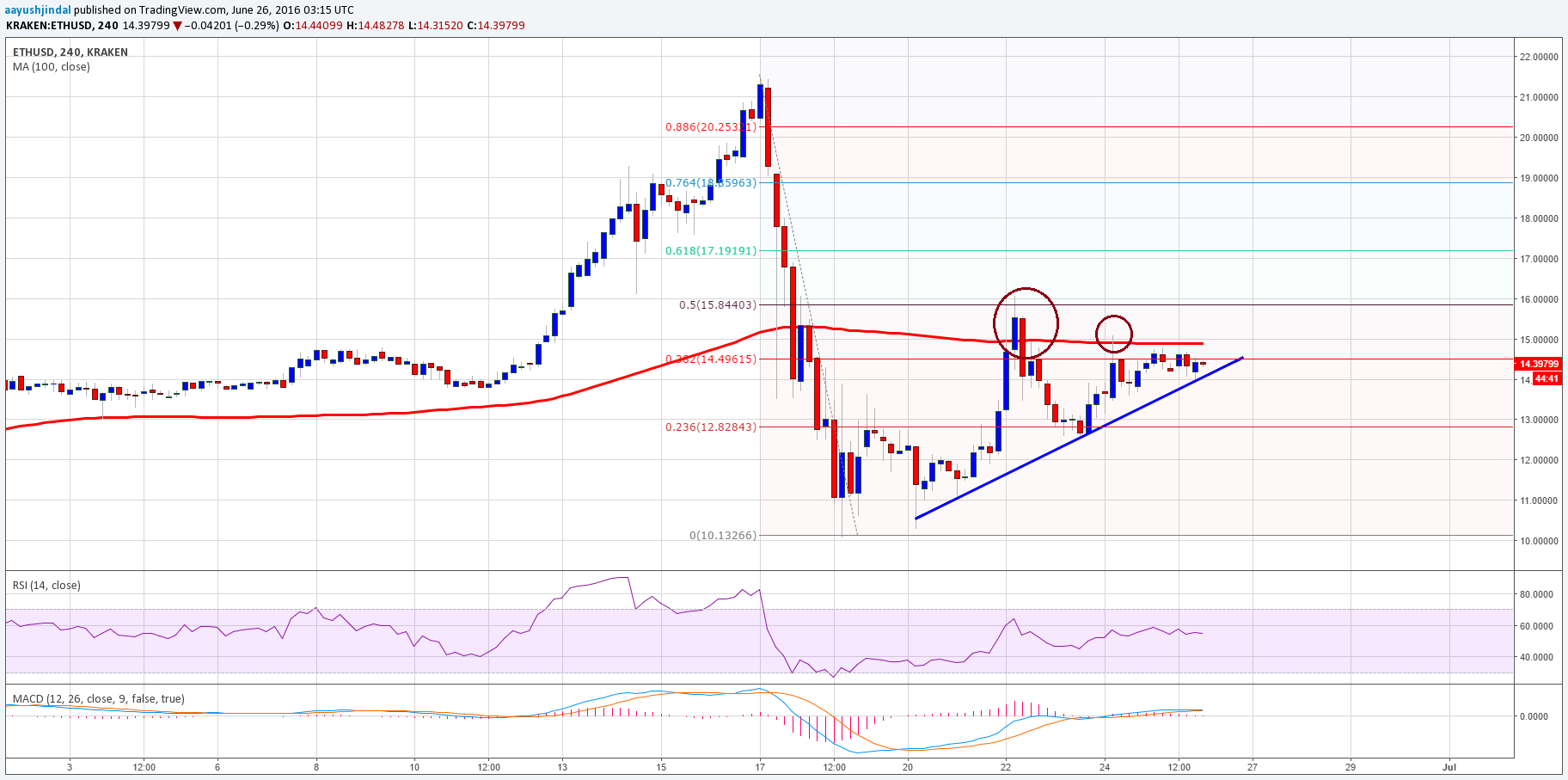

- Strong upward trend in the CrossX RSI indicator: A reading above 70 often suggests overbought conditions, but in a strong bull market, this can signal continued upward momentum.

- CrossX MACD showing bullish momentum: A bullish crossover of the MACD lines (the fast-moving average crossing above the slow-moving average) suggests a strengthening trend.

- CrossX volume analysis indicating high trading activity: Increased trading volume accompanying price increases confirms the strength of the bullish trend.

(Note: Ideally, this section would include charts and graphs visualizing the CrossX indicator data. These visuals would significantly enhance the article's impact and SEO.)

Institutional Investment Fueling Ethereum's Potential Rise

The growing interest from institutional investors is another key driver behind the $4,000 Ethereum price prediction. Large-scale investment firms and hedge funds are increasingly allocating capital to Ethereum, recognizing its potential as a foundational layer for decentralized applications (dApps) and smart contracts.

Evidence of this institutional buying includes:

- Grayscale Investments' significant holdings of ETH: Grayscale, a prominent digital asset manager, holds a substantial amount of Ethereum, demonstrating institutional confidence.

- Reports of numerous pension funds and endowments exploring ETH investments: These traditional investment vehicles are increasingly diversifying into crypto assets, with Ethereum being a popular choice.

- The rise of ETH staking: Institutional investors are actively participating in Ethereum staking, further solidifying their commitment to the platform. This also increases network security and efficiency.

The influx of institutional capital can significantly drive up the price of Ethereum due to increased demand and reduced selling pressure. The development of Ethereum ETFs (Exchange-Traded Funds) will likely further amplify this effect, making it easier for institutional investors to access and manage their ETH holdings.

Potential Challenges and Risks to the $4,000 Ethereum Price Target

While the bullish outlook is compelling, it's crucial to acknowledge potential challenges and risks that could hinder Ethereum's price rise:

- Regulatory uncertainty: Government regulations surrounding cryptocurrencies remain fluid and unpredictable, posing a significant risk to market stability.

- Overall market downturn: A broader economic downturn or a crypto market crash could negatively impact Ethereum's price, regardless of its underlying fundamentals.

- Competition from other cryptocurrencies: Ethereum faces competition from other blockchain platforms and smart contract ecosystems, which could divert investment and development efforts.

- Security breaches and exploits: While Ethereum's security has improved, vulnerabilities remain a persistent risk.

It's essential to maintain a balanced perspective and acknowledge these potential downsides. While a $4,000 price is possible, it's not guaranteed.

Analyzing Ethereum's Market Capitalization and Supply

Ethereum's market capitalization and circulating supply are crucial factors influencing its price. A rising market cap, driven by increased demand and adoption, often leads to price appreciation. Conversely, a large circulating supply can dilute the value of each ETH token. The relationship between Ethereum's price and its market dominance relative to Bitcoin also plays a significant role. Increased market dominance generally suggests investor confidence in Ethereum's long-term prospects.

Conclusion: Investing in the Future of Ethereum: Will it Reach $4,000?

The $4,000 Ethereum price prediction rests on a foundation of promising CrossX indicators suggesting strong bullish momentum and significant institutional investment driving increased demand. However, it's crucial to remember that the cryptocurrency market is highly volatile and susceptible to unforeseen events. Regulatory uncertainty, broader market downturns, and competition all pose significant challenges.

While the potential for a $4,000 Ethereum price is exciting, it’s vital to approach it with a realistic and cautious mindset. Consider researching Ethereum further and exploring potential investment opportunities, always remembering to invest responsibly and manage your risk carefully. The potential for a $4,000 Ethereum price is exciting, but informed decisions are key.

Featured Posts

-

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025 -

Ethereum Buy Signal Weekly Chart Analysis And Price Prediction

May 08, 2025

Ethereum Buy Signal Weekly Chart Analysis And Price Prediction

May 08, 2025 -

Xrp Outperforms Bitcoin And Top Cryptos Following Sec Grayscale Etf Filing

May 08, 2025

Xrp Outperforms Bitcoin And Top Cryptos Following Sec Grayscale Etf Filing

May 08, 2025 -

Psg Angers Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025

Psg Angers Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025