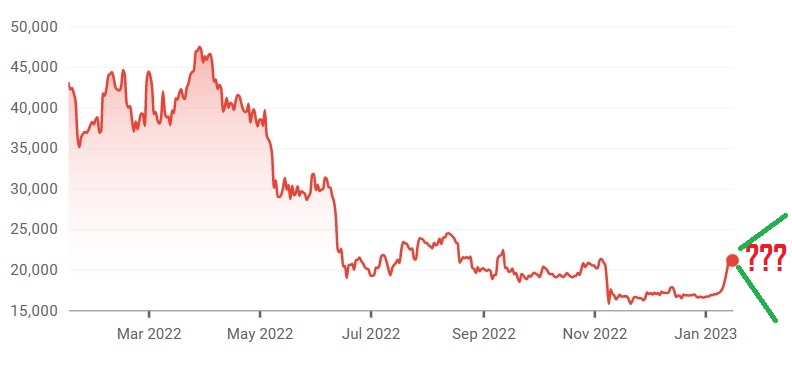

Ethereum Price Analysis: $2,700 On The Horizon? Wyckoff Accumulation Hints At Rally

Table of Contents

H2: Current Ethereum Price and Market Sentiment

Currently, Ethereum's price is [Insert Current Price Here]. This represents a [Percentage Change] from its recent [High/Low]. Market sentiment towards Ethereum is currently [Bullish/Bearish/Neutral], largely influenced by [mention recent news, e.g., successful Shanghai upgrade, regulatory developments, etc.]. Several factors contribute to this sentiment:

- Trading Volume: Recent trading volume has been [High/Low/Moderate], suggesting [Increased/Decreased/Stable] investor activity.

- Exchange Activity: Major exchanges like Binance, Coinbase, and Kraken are showing [Increased/Decreased/Stable] ETH trading volume.

- Social Media Sentiment: Social media discussions surrounding Ethereum are predominantly [Bullish/Bearish/Neutral], as reflected in sentiment analysis tools. Positive news about [mention specific news, e.g., new DeFi applications, NFT projects, etc.] has boosted overall sentiment.

H2: Wyckoff Accumulation Pattern Recognition

The Wyckoff Accumulation method is a technical analysis technique identifying periods of quiet accumulation before a significant price increase. It involves identifying specific phases:

-

Signs of Distribution (SOD): This phase reveals selling pressure before accumulation begins. We observe [describe specific price action and volume characteristics].

-

Spring: A sharp drop designed to shake out weak holders, creating a buying opportunity. This occurred around [price point] with [volume characteristics]. (Insert Chart Image with alt text: "Wyckoff Spring pattern in Ethereum price chart")

-

Markup: A period of rising prices, testing potential resistance. (Insert Chart Image with alt text: "Wyckoff Markup phase showing Ethereum price increase")

-

Secondary Test: A retest of support levels to confirm the accumulation phase. We can see this occurring at [price point]. (Insert Chart Image with alt text: "Wyckoff Secondary Test in Ethereum price chart")

-

Identifying Key Price Points and Volume Changes: The recent price action around [specific price points] coupled with [volume data] strongly suggests a Wyckoff accumulation pattern is unfolding. The significance lies in the consistent buying pressure despite temporary price dips.

-

Phase Significance: Each phase within the Wyckoff model plays a vital role in confirming the accumulation. The consistent buying pressure during the secondary test is particularly bullish.

-

Limitations: It's crucial to remember that Wyckoff analysis is not foolproof. Other factors can influence price movements, rendering the pattern invalid.

H2: On-Chain Metrics Supporting the Upward Trend

Several on-chain metrics support the bullish outlook for Ethereum:

-

Active Addresses: The number of active addresses [Increased/Decreased/Remained Stable] recently, indicating [Increased/Decreased/Stable] network activity. Data from [link to on-chain analytics platform, e.g., Glassnode] confirms this trend.

-

Transaction Fees: Gas fees have been [High/Low/Moderate], suggesting [High/Low/Moderate] network congestion and demand. This correlates with increased user activity.

-

Development Activity: Ethereum's development activity remains strong, with [mention specific developments, e.g., new protocol upgrades, DeFi projects]. This positive development activity often foreshadows price appreciation.

-

Data Interpretation: High active addresses and sustained transaction fees indicate strong network usage, bolstering the argument for a price increase.

-

Comparison to Previous Bull Runs: Comparing current on-chain metrics to those observed during previous bull runs reveals striking similarities.

-

Future Implications: The sustained positive on-chain metrics suggest a strong foundation for future price growth.

H2: Potential Resistance and Support Levels

Key resistance levels to watch include [price points], which represent previous highs. Support levels, which could cushion price drops, are located around [price points].

- Resistance and Support Levels: These levels are derived from previous price action and represent areas where buyers and sellers clash.

- Historical Significance: Breaking through these levels often signifies a significant shift in market sentiment.

- Probability of Breakouts: The probability of Ethereum breaking through resistance depends on several factors, including overall market sentiment and news events.

H2: Risks and Considerations

Investing in cryptocurrencies carries inherent risks. Several factors could negatively impact the price of Ethereum:

- Regulatory Uncertainty: Regulatory changes in various jurisdictions pose a significant threat to the cryptocurrency market.

- Competition: Competition from other blockchain platforms and cryptocurrencies could impact Ethereum's market share and price.

- Market Conditions: Overall macroeconomic conditions and investor sentiment can greatly influence the price of crypto assets.

3. Conclusion

This Ethereum price analysis suggests a strong potential for ETH to reach $2,700. The evidence, including a potential Wyckoff accumulation pattern, positive on-chain metrics, and growing market interest, paints a bullish picture. However, it's crucial to remember the inherent risks associated with cryptocurrency investments. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Continue following our Ethereum price analysis updates for further insights. Share your thoughts and predictions on Ethereum's future price in the comments below!

Featured Posts

-

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025 -

Recent Crypto Market Rally Analyzing Dogecoin Shiba Inu And Suis Performance

May 08, 2025

Recent Crypto Market Rally Analyzing Dogecoin Shiba Inu And Suis Performance

May 08, 2025 -

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025 -

Is Forza Horizon 5 Coming To Ps 5 Release Date And Time Details

May 08, 2025

Is Forza Horizon 5 Coming To Ps 5 Release Date And Time Details

May 08, 2025 -

The Impact Of Tariffs Chinas Lowered Rates And Stimulative Lending Policies

May 08, 2025

The Impact Of Tariffs Chinas Lowered Rates And Stimulative Lending Policies

May 08, 2025

Latest Posts

-

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025 -

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025 -

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025