Wyckoff Accumulation In Ethereum: Price Poised For $2,700 Breakout?

Table of Contents

Understanding Wyckoff Accumulation in Crypto Markets

What is Wyckoff Accumulation?

The Wyckoff Method is a sophisticated technical analysis approach used to identify market manipulation and predict significant price movements. Wyckoff Accumulation is a specific phase within this method, characterized by a period of price consolidation where large investors (often called "smart money") are quietly accumulating assets before a major price advance. This accumulation phase typically unfolds in several stages, including a "Spring" (a brief test of support), a "Markup" (a gradual price increase), and a "Secondary Test" (a retest of support to confirm accumulation). In the context of Ethereum, this means observing its price behavior for signs of this controlled accumulation before a potential breakout.

Identifying Wyckoff Accumulation in Ethereum's Chart

Identifying Wyckoff Accumulation requires analyzing Ethereum's price chart for specific characteristics. Key indicators include:

- Testing Support: Noticeable periods where the price consistently tests and holds a specific support level.

- Low Volume: Generally low trading volume during the accumulation phase, suggesting limited selling pressure.

- Gradual Price Increases: Slow, incremental price increases, often punctuated by periods of consolidation, rather than sharp, impulsive moves.

- Wyckoff Schematic: Identifying specific patterns such as the "Sign of Weakness," "Spring," and "Secondary Test" from the Wyckoff schematic on the Ethereum price chart.

[Insert a chart here showing Ethereum's price action with clear indications of potential Wyckoff Accumulation phases, annotated with support levels, volume, and key price points.] Analyzing charts using tools that allow for volume overlay and support/resistance drawing is crucial. This visualization helps solidify the concepts of support levels and volume analysis within the framework of the Wyckoff Method.

Evidence of Wyckoff Accumulation in Ethereum

Price Action Analysis

Ethereum's recent price action exhibits several characteristics consistent with a Wyckoff Accumulation.

- Support at $1600: The price repeatedly tested the $1600 support level, holding relatively well despite market downturns.

- Gradual Upswing: Following the support test, we’ve observed a gradual, sustained price increase, without any major sell-offs, indicating a buying pressure build up.

- Volume Analysis: While significant volume spikes accompany the price increases, we've also witnessed periods of lower volume during consolidation, which is a key characteristic of accumulation. [Include a chart highlighting specific price points, dates, and volume data to support this analysis.]

On-Chain Data Supporting Accumulation

On-chain data further strengthens the case for Wyckoff Accumulation:

- Decreasing Exchange Reserves: A decline in the amount of ETH held on exchanges suggests that large holders are accumulating rather than selling.

- Increasing Active Addresses: A growing number of active Ethereum addresses indicate increased network activity and potentially increased adoption.

- Smart Money Accumulation: Analysis of large transaction movements (Whale activity) suggests significant accumulation by institutional investors. Observing their behavior provides further confirmation.

[Include bullet points with specific data points from reputable on-chain analytics platforms, citing sources.]

Potential for a $2700 Breakout

Target Price Calculation

Based on several technical indicators and the pattern of Wyckoff Accumulation observed, a price target of $2700 is plausible.

- Fibonacci Retracement: Using Fibonacci retracement levels from previous highs and lows, $2700 aligns with a significant Fibonacci extension level.

- Historical Price Action: Historical price action shows that Ethereum often experiences significant breakouts following periods of accumulation.

[Insert a chart illustrating the Fibonacci retracement levels and the $2700 target price.]

Factors That Could Influence the Breakout

Several factors could influence whether Ethereum reaches the $2700 target:

- Regulatory Clarity: Positive regulatory developments could significantly boost the price.

- Macroeconomic Conditions: Global economic uncertainty could hinder the breakout.

- Bitcoin Price: A strong Bitcoin price generally correlates with positive altcoin performance, including Ethereum.

- Ethereum Development: Upcoming Ethereum upgrades and developments could increase market confidence.

Considering these factors is crucial for a comprehensive analysis of future price potential.

Conclusion

The evidence suggests Ethereum is currently undergoing a Wyckoff Accumulation phase. The combination of price action analysis and supportive on-chain data points towards a potential breakout towards $2700. While external factors could influence the timing and magnitude of this potential breakout, understanding the principles of Wyckoff Accumulation provides valuable insights into Ethereum's price dynamics. Remember that this analysis is for informational purposes only, and thorough due diligence is essential before making any investment decisions. Learn more about harnessing the power of Wyckoff Accumulation in Ethereum trading today!

Featured Posts

-

Xrp To 5 In 2025 Analyzing The Potential And Challenges

May 08, 2025

Xrp To 5 In 2025 Analyzing The Potential And Challenges

May 08, 2025 -

Rogue One Actor Shares Surprising Thoughts About Beloved Character

May 08, 2025

Rogue One Actor Shares Surprising Thoughts About Beloved Character

May 08, 2025 -

1 6 Scale Galen Erso Figure A Hot Toys Japan Exclusive

May 08, 2025

1 6 Scale Galen Erso Figure A Hot Toys Japan Exclusive

May 08, 2025 -

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025 -

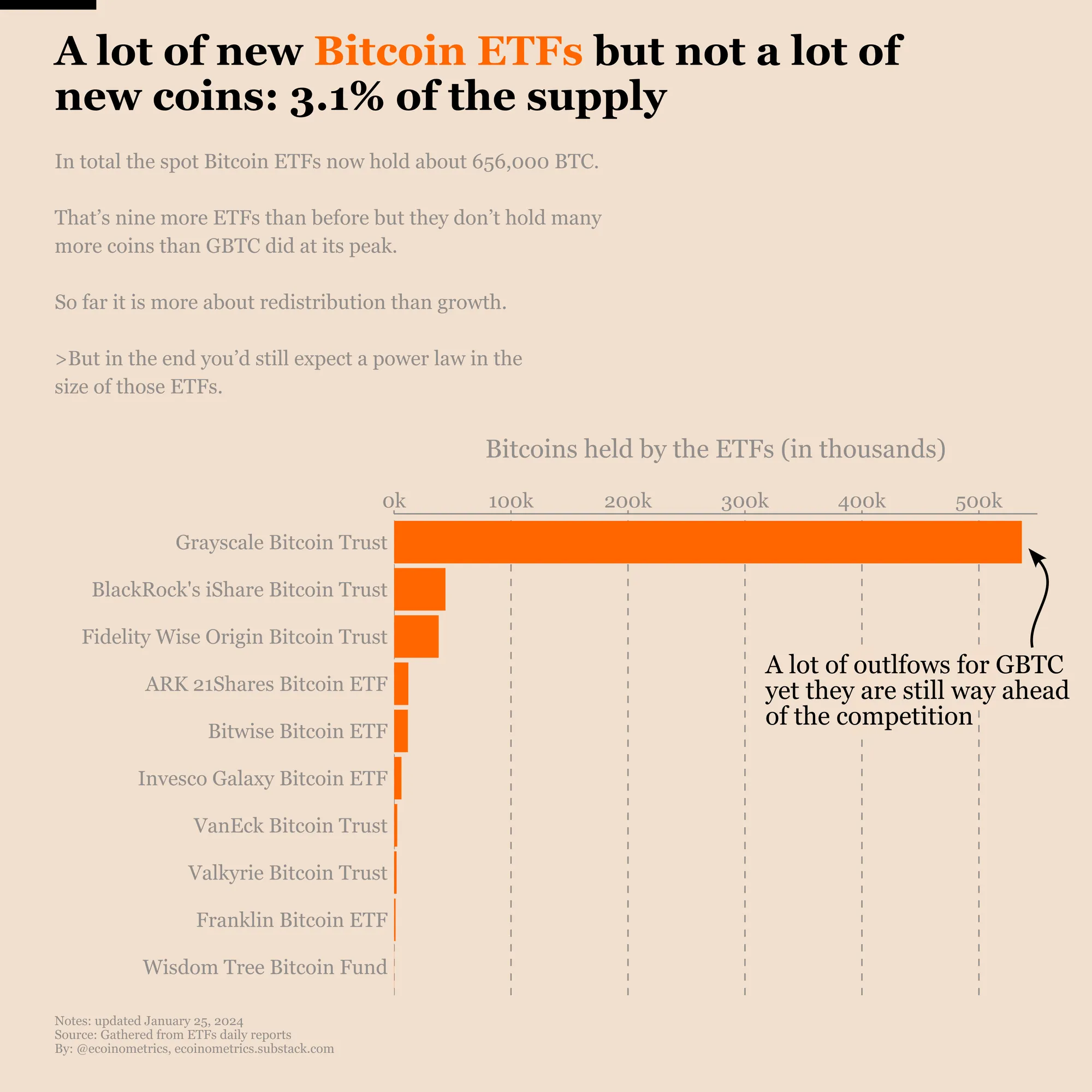

Comparing Micro Strategy And Bitcoin Investments A 2025 Perspective

May 08, 2025

Comparing Micro Strategy And Bitcoin Investments A 2025 Perspective

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025