Lower Interest Rates In China: A Response To Trade Tensions And Tariffs

Table of Contents

The Impact of Trade Tensions and Tariffs on the Chinese Economy

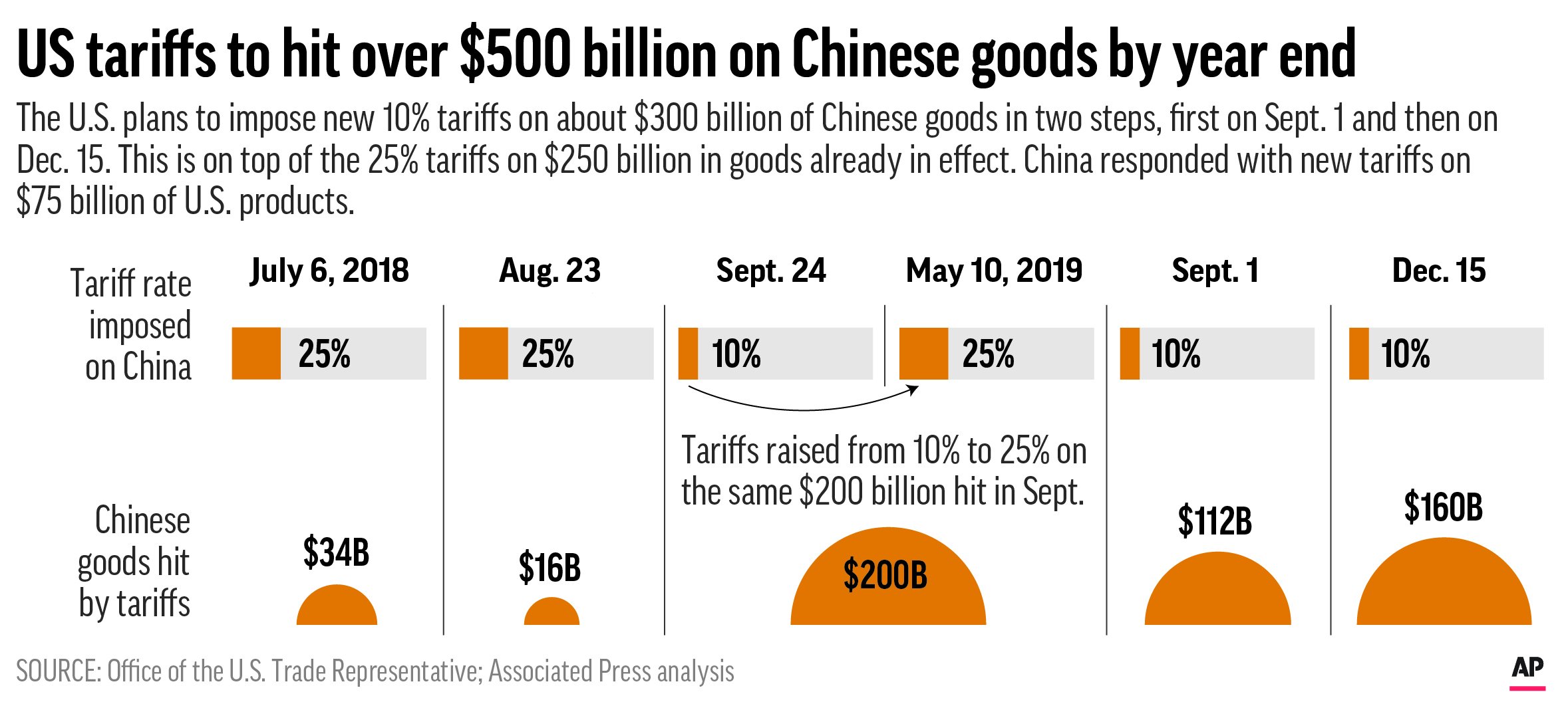

The ongoing trade war, characterized by escalating tariffs and trade barriers, significantly impacted the Chinese economy. Tariffs imposed on Chinese exports reduced demand for Chinese goods in key markets, leading to decreased export volume and slower GDP growth. Industries heavily reliant on exports, such as manufacturing and agriculture, were particularly hard hit.

- Decreased Export Volume: Tariffs increased the cost of Chinese goods, making them less competitive in international markets. This directly translated into a decline in export revenue.

- Reduced Foreign Investment: Uncertainty surrounding trade policies discouraged foreign investment in China, impacting both new projects and expansion plans.

- Slowdown in GDP Growth: The combined effects of decreased exports and reduced investment contributed to a noticeable slowdown in China's GDP growth rate.

- Increased Unemployment in Certain Sectors: The reduced demand for Chinese goods led to job losses, particularly in export-oriented industries like manufacturing and textiles.

Specific examples include the impact on Chinese agricultural exports to the US and the disruption of global supply chains for electronics manufacturing, where China plays a central role. The imposition of tariffs led to a restructuring of these supply chains, forcing companies to seek alternative sourcing and manufacturing locations.

Lower Interest Rates as a Monetary Policy Response

In response to the economic slowdown, the PBOC employed a classic monetary policy tool: lowering interest rates. This aimed to stimulate the economy by making borrowing cheaper and encouraging investment and consumption. The PBOC implemented several rate cuts throughout [Insert specific dates and magnitudes of rate cuts here], reducing both the benchmark lending rate and the reserve requirement ratio for banks.

- Reduced Borrowing Costs for Businesses: Lower interest rates reduced the cost of borrowing for businesses, making it more attractive to invest in new projects, expand operations, and hire more workers.

- Incentivizes Investment in Infrastructure and New Ventures: Lower borrowing costs encouraged investment in large-scale infrastructure projects, as well as smaller ventures in emerging sectors.

- Stimulates Consumer Spending through Cheaper Loans: Lower interest rates translated into cheaper loans for consumers, potentially stimulating spending on housing, durable goods, and other discretionary purchases.

Effectiveness and Potential Risks of Lower Interest Rates

The effectiveness of China's lower interest rate policy is a subject of ongoing debate. While some argue that it helped mitigate the negative impact of trade tensions, others point to its limited success in achieving significant economic stimulus. Data on investment and consumer spending growth are needed to fully assess the effectiveness of the policy.

However, lower interest rates also carry potential risks:

- Increased Inflation: Lower interest rates can lead to increased money supply and subsequently, higher inflation.

- Potential Asset Bubbles: Easy access to credit may inflate asset prices (like real estate), creating potentially unsustainable bubbles.

- Depreciation of the Chinese Yuan: Lower interest rates can make the Yuan less attractive to foreign investors, leading to a depreciation of the currency.

- Exacerbation of Existing Debt Problems: Lower rates might encourage further borrowing by already highly indebted companies and individuals, potentially worsening existing financial risks.

China might consider alternative policy responses, such as fiscal stimulus (increased government spending) or targeted support for specific industries.

Global Implications of China's Monetary Policy Response

China's decision to lower interest rates had significant global implications. The ripple effects were felt across global markets, influencing trade, supply chains, and investment flows.

- Impact on Global Commodity Prices: Changes in Chinese demand, influenced by the interest rate policy, impacted global commodity prices.

- Shift in Global Supply Chains: Companies may reassess their supply chains in response to changes in Chinese production costs and market conditions.

- Effects on Other Export-Oriented Economies: China's actions can affect the competitiveness of other export-oriented economies, creating both opportunities and challenges.

- Implications for International Trade Agreements: China’s economic response to trade tensions highlights the interconnectedness of the global economy and the importance of international cooperation.

The potential for further escalation or de-escalation of trade tensions significantly impacts the effectiveness and global implications of China's monetary policy.

Conclusion: Lower Interest Rates in China: A Strategic Response and Future Outlook

China's lower interest rate policy was a strategic response to the economic challenges posed by trade tensions and tariffs. While it aimed to stimulate economic activity, its effectiveness remains a subject of ongoing evaluation. The policy carries potential risks, including inflation and asset bubbles. The global implications are significant, affecting trade flows, supply chains, and the competitive landscape for other economies. Future projections depend on the evolution of trade relations and the success of the policy in achieving its intended goals.

Stay informed on the ongoing developments in China's economic policy and the implications of lower interest rates on global trade by regularly checking our website for updates on China's economic response to trade tensions and tariffs.

Featured Posts

-

Lotto 6aus49 Ergebnis Mittwoch 9 4 2025 Alle Gewinnzahlen

May 08, 2025

Lotto 6aus49 Ergebnis Mittwoch 9 4 2025 Alle Gewinnzahlen

May 08, 2025 -

Stephen Kings The Long Walk Trailer Reaction And Adaptation Analysis

May 08, 2025

Stephen Kings The Long Walk Trailer Reaction And Adaptation Analysis

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025 -

Exclusive Malaysias Extradition Request For Ex Goldman Partner In 1 Mdb Case

May 08, 2025

Exclusive Malaysias Extradition Request For Ex Goldman Partner In 1 Mdb Case

May 08, 2025 -

Hargreaves Predicts Arsenal Psg Champions League Final Clash

May 08, 2025

Hargreaves Predicts Arsenal Psg Champions League Final Clash

May 08, 2025

Latest Posts

-

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025 -

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025