Ethereum Market Analysis: Accumulation And The Outlook For ETH Price

Table of Contents

Analyzing On-Chain Metrics for Accumulation

Analyzing on-chain data provides valuable insights into investor behavior and potential future price movements for Ethereum. By examining key metrics, we can identify signs of accumulation or distribution, offering a clearer picture of the current market sentiment.

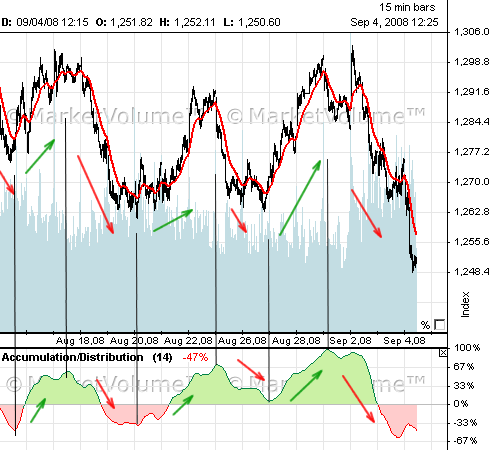

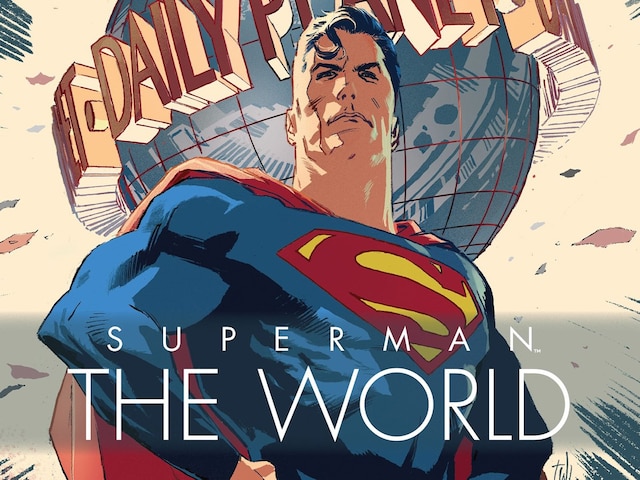

Exchange Reserves

Exchange reserves represent the amount of ETH held on centralized exchanges. A decreasing trend in exchange reserves often suggests accumulation by large holders, as they move their ETH off exchanges into self-custody wallets. Conversely, increasing reserves might signal potential selling pressure. Analyzing data from multiple exchanges, such as Coinbase, Binance, and Kraken, provides a more comprehensive view.

- Decreasing exchange reserves: Often indicate accumulation by large holders, suggesting bullish sentiment.

- Increased reserves: May suggest selling pressure or a lack of confidence, potentially leading to price drops.

- Analyzing data from multiple exchanges: Provides a more robust and accurate representation of overall market sentiment.

[Insert chart/graph visualizing exchange reserve data here]

Active Addresses and Transaction Volume

The number of active addresses and the overall transaction volume on the Ethereum network are strong indicators of network activity and user engagement. Higher active addresses suggest increased network usage and growing adoption, potentially driving up demand and the ETH price. Similarly, increased transaction volume often correlates with higher prices.

- High active addresses: Indicate increased network usage and growing adoption, often correlating with price increases.

- Increased transaction volume: Usually reflects higher trading activity and potentially bullish sentiment.

- Analyzing historical data: Comparing current metrics with historical data helps to establish trends and predict future price movements.

[Insert chart/graph visualizing active addresses and transaction volume here]

ETH Supply Distribution

Analyzing the distribution of ETH across different wallets—exchanges, large holders (whales), and long-term holders—reveals crucial information about the market's dynamics. A concentration of ETH in long-term holder wallets suggests a strong belief in the asset's long-term value and potential for accumulation.

- Concentration of ETH in long-term holder wallets: Suggests accumulation and a positive outlook for the Ethereum price.

- Increased ETH on exchanges: Might signal potential selling pressure, potentially leading to price drops.

- Analyzing historical data: Comparing the current distribution with past trends offers valuable context and insights.

[Insert chart/graph visualizing ETH supply distribution here]

Assessing Macroeconomic Factors Impacting Ethereum Price

Beyond on-chain metrics, macroeconomic factors significantly influence the Ethereum price. Understanding these factors is essential for a complete market analysis.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies significantly impacts investor confidence and market sentiment. Positive regulatory developments can boost investor confidence, leading to increased demand and potentially higher prices. Conversely, negative regulatory actions can create uncertainty and lead to price drops.

- Positive regulatory developments: Can boost investor confidence and lead to increased demand for ETH.

- Negative regulatory actions: Can create uncertainty and potentially lead to price drops.

- Staying informed: Keeping abreast of regulatory updates is crucial for informed decision-making.

Overall Market Sentiment

The overall cryptocurrency market sentiment significantly influences the price of Ethereum. A bullish Bitcoin market often positively correlates with ETH price, while a bearish Bitcoin market can have a negative impact. Social media sentiment and news coverage also play a role in shaping investor perception.

- Bullish Bitcoin market: Often positively affects the ETH price due to positive spillover effects.

- Bearish Bitcoin market: Can negatively impact ETH, resulting in price drops.

- Sentiment indicators: Analyzing social media trends and news coverage helps understand overall market sentiment.

Technological Developments

Upcoming Ethereum upgrades, such as sharding, significantly influence investor expectations and the ETH price. Successful upgrades enhancing scalability and efficiency can boost confidence and increase demand. Conversely, delays or issues with upgrades can create uncertainty and negatively impact the price.

- Successful upgrades: Boost confidence and can increase demand, potentially driving up the ETH price.

- Delays or issues with upgrades: Can create uncertainty and negatively affect investor sentiment.

- Roadmap analysis: Analyzing the roadmap for future developments helps predict potential price movements.

Predicting Future Ethereum Price based on Accumulation Trends

Based on the analysis of on-chain metrics and macroeconomic factors, several potential price scenarios for Ethereum can be considered. While signs of accumulation exist, the Ethereum price remains sensitive to broader market forces and regulatory developments.

- Bullish scenario: Continued accumulation, positive regulatory developments, and successful upgrades could drive the ETH price higher.

- Bearish scenario: Negative regulatory actions, a broader market downturn, or issues with upgrades could lead to price drops.

- Neutral scenario: A period of sideways trading or consolidation is also possible, with the price fluctuating within a specific range.

It's crucial to remember that price predictions inherently involve uncertainty. Risk management is paramount.

Conclusion

This Ethereum price analysis reveals that understanding on-chain metrics and macroeconomic factors is crucial for predicting future trends. While signs of accumulation are present, the Ethereum price remains susceptible to broader market forces and regulatory developments. It's vital to continuously monitor these indicators to make informed decisions regarding your investments in ETH. Stay informed on the latest developments regarding the Ethereum price and its market dynamics for optimal investment strategies. Conduct your own thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025 -

The Hunger Games Directors Stephen King Adaptation A 2025 Horror Release

May 08, 2025

The Hunger Games Directors Stephen King Adaptation A 2025 Horror Release

May 08, 2025 -

Liga Na Shampioni Arsenal Go Dochekuva Ps Zh

May 08, 2025

Liga Na Shampioni Arsenal Go Dochekuva Ps Zh

May 08, 2025 -

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025 -

Sommers Thumb Injury A Setback For Inters Serie A And Champions League Hopes

May 08, 2025

Sommers Thumb Injury A Setback For Inters Serie A And Champions League Hopes

May 08, 2025

Latest Posts

-

Understanding The Recent Surge In Bitcoin Mining Operations

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Operations

May 08, 2025 -

Bitcoin Madenciligi Sonlandirma Noktasi Ve Yeni Olanaklar

May 08, 2025

Bitcoin Madenciligi Sonlandirma Noktasi Ve Yeni Olanaklar

May 08, 2025 -

Analysis The Unexpected Spike In Bitcoin Mining Activity

May 08, 2025

Analysis The Unexpected Spike In Bitcoin Mining Activity

May 08, 2025 -

Bitcoin Madenciliginin Sonu Yaklasirken Gelecegi Degerlendirmek

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasirken Gelecegi Degerlendirmek

May 08, 2025 -

This Weeks Bitcoin Mining Boom Causes And Implications

May 08, 2025

This Weeks Bitcoin Mining Boom Causes And Implications

May 08, 2025