Ethereum Price To Hit $4,000? CrossX Indicators And Institutional Accumulation Suggest A Bullish Trend

Table of Contents

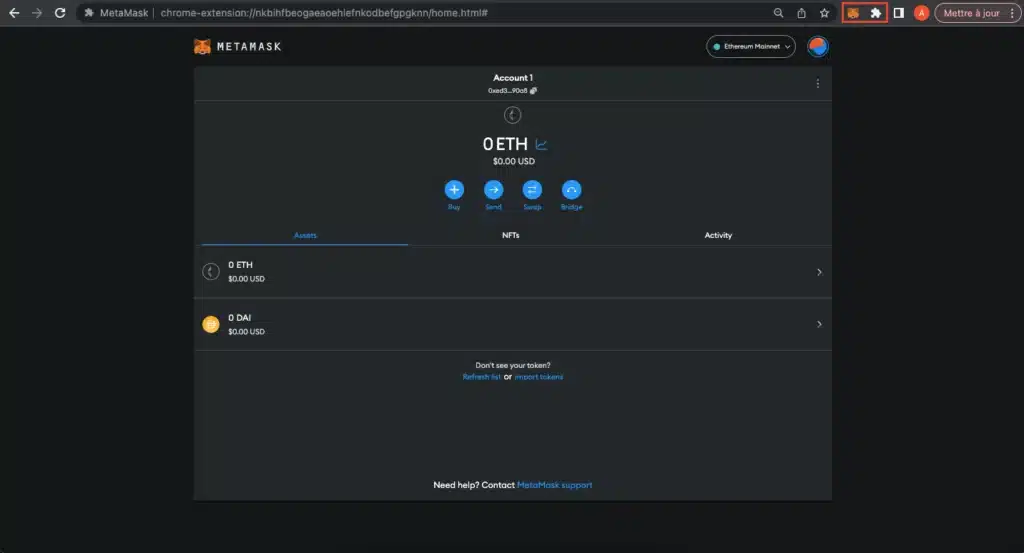

CrossX Indicators Pointing Towards $4,000 Ethereum Price

Understanding CrossX Indicators and their Predictive Power

CrossX indicators are a powerful set of tools used in technical analysis to predict future price movements. They combine various technical indicators to provide a more comprehensive picture of market sentiment and momentum. While not perfect predictors, their historical accuracy, when used in conjunction with other forms of analysis, can be valuable for informed decision-making. Popular CrossX indicators include Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators, when analyzed together, can offer strong insights into potential price shifts.

- RSI: Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often suggests an overbought market, potentially indicating a price correction, while below 30 suggests an oversold market, potentially signaling a price rebound. Currently, we see signs of a healthy RSI, suggesting further upward momentum.

- MACD: Identifies changes in the strength, direction, momentum, and duration of a trend. A bullish crossover (when the MACD line crosses above the signal line) is often seen as a bullish signal.

- Bollinger Bands: Show the volatility of an asset's price over a period. When the price touches the lower band, it may indicate a potential buying opportunity.

Technical Analysis Supporting Ethereum's Price Rise

Beyond individual indicators, broader technical analysis supports the bullish outlook. Chart patterns like ascending triangles and potential breakouts from consolidation periods are observed. These patterns suggest a build-up of buying pressure, anticipating a significant upward movement. Support and resistance levels are crucial in gauging potential price targets. Currently, the price seems to be breaking through key resistance levels, paving the way for a potential surge towards $4,000. (Include relevant charts and graphs here)

Institutional Accumulation Fuels Ethereum's Bullish Momentum

Evidence of Increasing Institutional Investment in Ethereum

The growing interest from institutional investors is a significant catalyst for Ethereum's potential price surge. Numerous reports indicate substantial institutional accumulation of ETH. This is driven by several factors: the flourishing DeFi ecosystem, the anticipated completion of Ethereum 2.0, and the increasing recognition of Ethereum as a robust, enterprise-grade blockchain platform.

- Grayscale Ethereum Trust: Holdings have steadily increased, demonstrating the institutional appetite for exposure to Ethereum.

- MicroStrategy (and other examples): While primarily known for Bitcoin investments, some significant players are diversifying into Ethereum.

- Pension Funds and other large institutions: Are increasingly allocating assets to cryptocurrencies, including Ethereum, recognizing its long-term potential.

The Impact of Institutional Buying on Ethereum's Price

Large-scale institutional buying exerts significant upward pressure on the price. Their considerable purchasing power can rapidly absorb available supply, leading to a significant price increase. Historically, periods of substantial institutional investment in Ethereum have correlated with notable price rallies. The current accumulation trend strongly suggests a continuation of this pattern, potentially driving the Ethereum price to $4,000.

Potential Challenges and Risks to Reaching $4,000

Addressing Potential Headwinds

While the bullish outlook is compelling, it's crucial to acknowledge potential challenges. Market corrections are inherent in the cryptocurrency market. Regulatory uncertainty, competition from other cryptocurrencies, and broader macroeconomic factors can impact Ethereum's price.

- Regulatory Scrutiny: Changes in regulatory frameworks could affect investor sentiment and market dynamics.

- Market Volatility: Sudden price drops are possible, requiring robust risk management strategies.

- Competition: The emergence of competing blockchain platforms could potentially divert investment.

Risk Management Strategies for Ethereum Investors

Investing in cryptocurrencies inherently involves risk. To mitigate potential losses, investors should adopt responsible strategies:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across various assets.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your Ethereum if the price falls below a predetermined level.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, irrespective of price fluctuations, to reduce the impact of volatility.

Conclusion: Ethereum's Path to $4,000 – A Bullish Outlook

The confluence of positive CrossX signals and the significant influx of institutional investment paints a compelling picture for Ethereum's potential to reach $4,000. However, potential challenges and market volatility necessitate a cautious approach. While reaching $4,000 isn't guaranteed, the bullish signals surrounding the Ethereum price are compelling. Conduct thorough research and consider incorporating Ethereum into your diversified portfolio with a well-defined risk management plan. Remember to always manage your Ethereum investment responsibly and be prepared for market fluctuations. The potential for a significant increase in the $4,000 Ethereum price makes it a worthwhile asset to consider for your portfolio.

Featured Posts

-

Nereden Izleyebilirim Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025

Nereden Izleyebilirim Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025 -

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025 -

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025 -

Gary Nevilles Psg Vs Arsenal Prediction Nervous Energy Ahead

May 08, 2025

Gary Nevilles Psg Vs Arsenal Prediction Nervous Energy Ahead

May 08, 2025 -

Washingtons Openness To Canadas Trade Proposal A New Chapter

May 08, 2025

Washingtons Openness To Canadas Trade Proposal A New Chapter

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025