The Extreme Cost Of Broadcom's VMware Acquisition: A 1,050% Price Jump?

Table of Contents

Analyzing the 1,050% Price Surge: A Deep Dive into Valuation

The acquisition of VMware by Broadcom wasn't a smooth, straightforward transaction. The final price reflects a dramatic increase from Broadcom's initial offer, highlighting the intense competition and strategic value at stake.

Initial Offer vs. Final Acquisition Price

Broadcom's initial bid for VMware significantly undervalued the company in the eyes of many analysts and investors. While the exact figures fluctuate depending on the date and source, the initial offer was considerably lower than the final acquisition price of approximately $61 billion. This represents a staggering increase—a jump of over 1,050% from the initial valuation, a testament to the fierce bidding war and escalating market demand.

- Initial Offer: (Insert specific number, source needed)

- Final Acquisition Price: Approximately $61 billion (Source needed)

- Percentage Increase: Over 1,050% (Calculation needed based on accurate initial and final prices)

- Competing Bids: (Mention any competing bids or potential bidders if known, including sources).

Market Reactions and Investor Sentiment

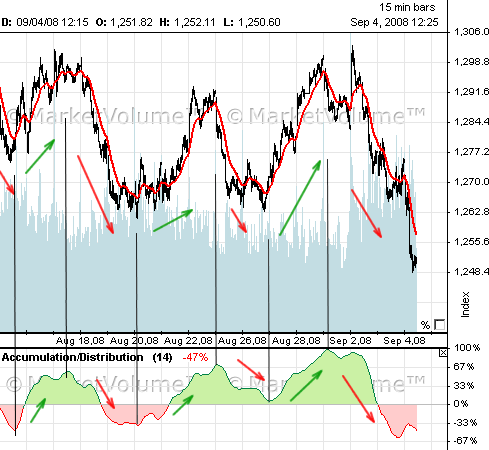

The market's response to the escalating price of the Broadcom VMware acquisition was a roller coaster. Initially, some analysts expressed concerns about overvaluation, citing potential antitrust issues and the high premium paid by Broadcom. However, as the acquisition progressed, investor sentiment shifted, largely driven by the strategic synergies and potential market dominance the deal represented. This is evident in VMware's stock price fluctuations.

- Stock Price Fluctuations: (Include a chart or graph illustrating VMware's stock price movements during the acquisition period. Source the chart.)

- Analyst Opinions: (Summarize key analyst opinions and predictions regarding the acquisition. Source needed.)

- Impact on Investor Confidence: (Discuss the overall impact on investor confidence in both Broadcom and VMware. Source needed).

Strategic Implications of Broadcom's VMware Acquisition

Broadcom's acquisition of VMware is far more than just a simple buy-out; it's a strategic maneuver with significant implications for the future of the tech industry.

Broadcom's Expansion into Software and Enterprise Solutions

Broadcom, traditionally known for its semiconductor and networking solutions, is dramatically expanding its presence in the software and enterprise solutions market through this acquisition. VMware, a dominant player in virtualization and cloud computing, provides Broadcom with a powerful software portfolio and a vast customer base.

- Broadcom's Existing Portfolio: (List key products and services in Broadcom's existing portfolio. Source needed.)

- VMware's Market Position: (Describe VMware's leading position in virtualization and cloud computing. Source needed.)

- Synergies: (Explain the synergies between Broadcom's hardware and VMware's software, such as increased efficiency and bundled offerings. Source needed)

Potential Antitrust Concerns and Regulatory Scrutiny

Such a significant acquisition inevitably attracts regulatory scrutiny. Concerns regarding potential monopolies or market dominance in various sectors, especially in virtualization and cloud infrastructure, led to intense scrutiny from regulatory bodies worldwide.

- Potential Monopolies: (Discuss specific areas where a monopoly might be created. Source needed.)

- Regulatory Bodies: (Mention involved regulatory bodies, such as the FTC in the US and the European Commission. Source needed.)

- Likelihood of Challenges: (Analyze the likelihood of successful regulatory challenges and their potential outcomes. Source needed.)

The Long-Term Impact on the Technology Landscape

Broadcom's control of VMware will undoubtedly reshape the future of virtualization and cloud computing. The long-term consequences are still unfolding, but some key impacts are already discernible.

Future of Virtualization and Cloud Computing

The acquisition could lead to both innovation and consolidation within the virtualization and cloud computing market. Broadcom's resources and expertise, combined with VMware's established technology, could accelerate innovation. However, concerns exist about potential stifled competition and the impact on pricing.

- Pricing Models: (Discuss potential changes in VMware's pricing models following the acquisition. Source needed.)

- Impact on Competitors: (Analyze the impact on competing virtualization technologies and cloud providers. Source needed.)

- Future Innovation: (Offer predictions about future innovation in the sector under Broadcom's ownership. Source needed if possible.)

Implications for VMware Customers and Employees

Existing VMware customers and employees face uncertainty following the acquisition. While Broadcom has pledged continued support and investment, changes are inevitable.

- Product Offerings: (Discuss potential changes in VMware's product offerings and services. Source needed if any announcements are available.)

- Customer Support: (Analyze the potential impact on customer support and service quality. Source needed.)

- Employee Retention: (Discuss the potential impact on employee retention and job security. Source needed if any announcements are available.)

Conclusion

Broadcom's VMware acquisition represents a monumental shift in the technology landscape. The exorbitant price—a 1,050% increase from the initial offer—highlights the intense competition and strategic value of VMware. The acquisition has significant implications for competition, innovation, and pricing within the virtualization and cloud computing sectors. The long-term effects remain to be seen, but careful monitoring of regulatory actions and market reactions is essential. Understanding the complexities of Broadcom's VMware acquisition is crucial for anyone invested in the tech market. Stay informed about the ongoing developments and their impact by following industry news and conducting your own research on the long-term implications of this monumental deal.

Featured Posts

-

Apple Watches On Nhl Ice A New Era Of Officiating

May 07, 2025

Apple Watches On Nhl Ice A New Era Of Officiating

May 07, 2025 -

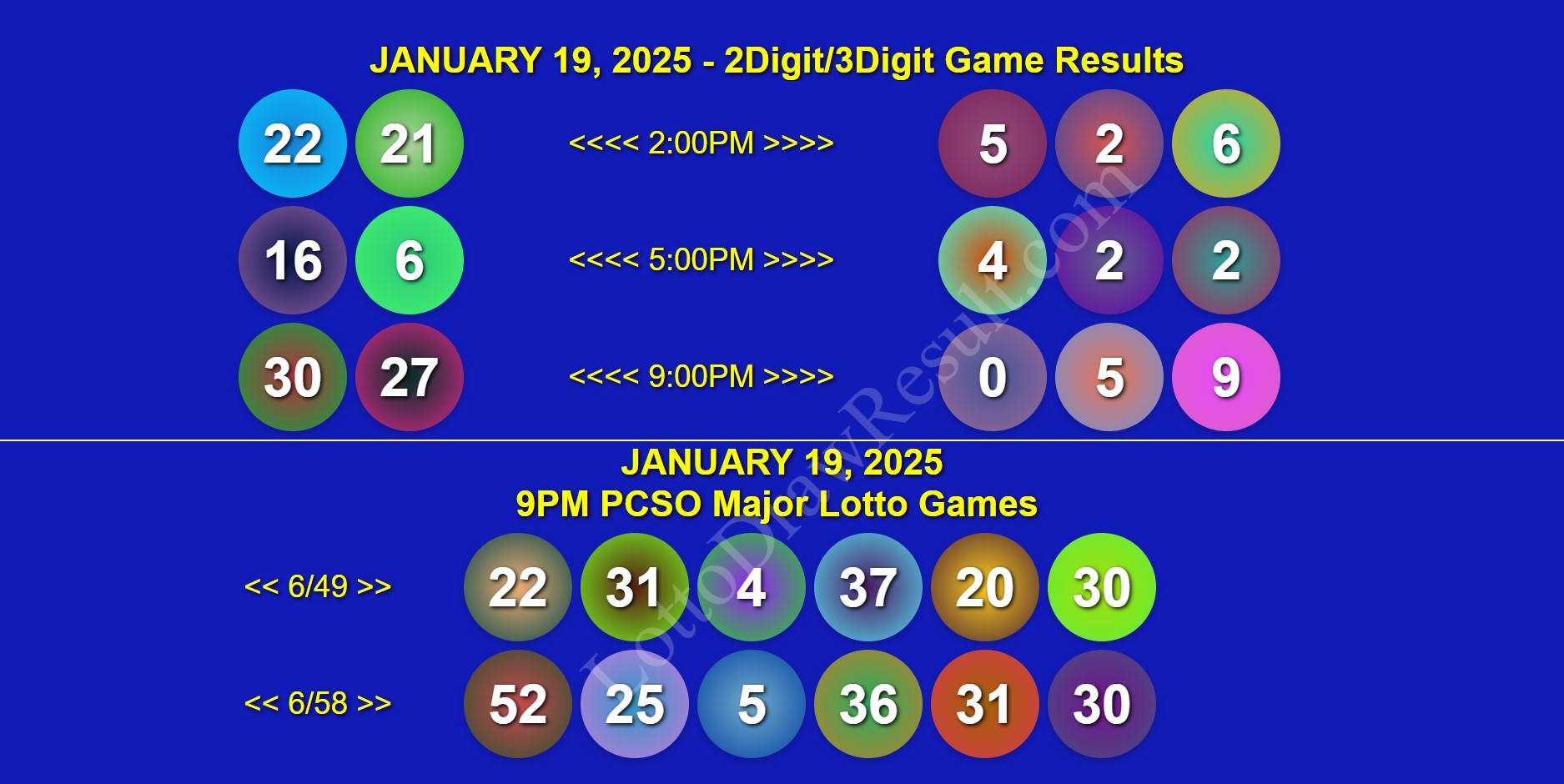

April 18 2025 Daily Lotto Results

May 07, 2025

April 18 2025 Daily Lotto Results

May 07, 2025 -

A Deep Dive Into The Papal Conclave Rules Procedures And History

May 07, 2025

A Deep Dive Into The Papal Conclave Rules Procedures And History

May 07, 2025 -

Jenna Ortega Et Lady Gaga Un Tournage Memorable Pour Mercredi

May 07, 2025

Jenna Ortega Et Lady Gaga Un Tournage Memorable Pour Mercredi

May 07, 2025 -

Will Trumps Xrp Endorsement Drive Institutional Investment

May 07, 2025

Will Trumps Xrp Endorsement Drive Institutional Investment

May 07, 2025

Latest Posts

-

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025 -

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025