Will Trump's XRP Endorsement Drive Institutional Investment?

Table of Contents

Trump's Influence on the Crypto Market

The Power of Celebrity Endorsements

Celebrity endorsements wield immense power in shaping market trends. History is replete with examples of how a famous face can significantly boost the value of a product or investment. From sports stars endorsing sneakers to musicians promoting tech gadgets, the impact of celebrity influence is undeniable. In the cryptocurrency space, this effect is even more pronounced due to the inherent volatility and speculative nature of the market.

- Examples of past successful celebrity endorsements in finance and technology: Consider the impact of well-known figures endorsing specific stocks or companies in the past. While direct comparisons to cryptocurrency are not always perfect, these examples illustrate the principle of celebrity-driven market movements.

- Analysis of the potential reach and influence of a Trump endorsement: A Trump endorsement of XRP would reach a massive global audience. His significant social media following and unwavering media attention would almost certainly cause a surge in XRP awareness and interest. This heightened exposure could attract a new wave of retail investors and, potentially, institutional interest.

- Discussion of the potential for a negative impact if the endorsement is perceived as insincere or manipulative: Conversely, a perceived insincere or manipulative endorsement could backfire spectacularly. If investors believe Trump's endorsement is solely for personal gain, it could severely damage XRP's reputation and drive prices downward. The credibility of the endorsement is paramount.

XRP's Current Market Position and Challenges

Regulatory Uncertainty and SEC Lawsuit

XRP's current market position is significantly affected by the ongoing SEC lawsuit against Ripple Labs. This legal battle casts a long shadow over institutional adoption, creating uncertainty and risk aversion among potential investors.

- Explanation of the SEC's case against Ripple and its implications for XRP: The SEC alleges that Ripple sold XRP as an unregistered security, a claim that has had far-reaching consequences for the cryptocurrency's price and market sentiment. A negative outcome could severely damage XRP's prospects.

- Discussion of the regulatory landscape surrounding XRP and its impact on institutional investors' risk assessment: Institutional investors are extremely risk-averse, often requiring substantial due diligence and regulatory clarity before making significant investments. The SEC lawsuit introduces considerable risk, making institutional adoption challenging.

- Overview of XRP's technological capabilities and its potential use cases: Despite the regulatory hurdles, XRP boasts certain technological advantages, including its speed and low transaction fees. Its potential use cases in cross-border payments remain compelling, making it attractive to some investors despite the challenges.

Institutional Investors' Perspective on XRP

Risk Tolerance and Due Diligence

Even with a Trump endorsement, institutional investors remain highly cautious. Their decisions are driven by rigorous due diligence and a careful assessment of risk-reward profiles.

- Discussion of the factors institutional investors consider when making investment decisions: Institutional investors consider a range of factors, including regulatory compliance, market volatility, technological soundness, and the overall financial health of the underlying project.

- Analysis of the risk-reward profile of XRP in comparison to other assets: Compared to more established cryptocurrencies like Bitcoin or Ethereum, or even traditional assets, XRP's risk profile remains relatively high. The potential rewards from a Trump endorsement need to be weighed against this inherent risk.

- Exploration of the due diligence process typically undertaken by institutional investors before making investments: Institutional investors conduct extensive due diligence, including thorough legal and technical reviews, before committing capital. The SEC lawsuit significantly complicates this process for XRP.

Predicting the Impact of a Trump Endorsement

Potential Short-Term and Long-Term Effects

A Trump endorsement could trigger significant short-term price volatility. However, the long-term impact is far less predictable.

- Discussion of potential short-term price spikes and subsequent corrections: An immediate price surge is highly likely following a Trump endorsement. However, this spike might be temporary, followed by a correction as investors assess the lasting impact of the endorsement.

- Analysis of the long-term impact on XRP's market capitalization and adoption: The long-term effect is uncertain. While a Trump endorsement might boost awareness, the SEC lawsuit and broader regulatory concerns remain significant barriers to widespread institutional adoption.

- Consideration of other factors that could influence XRP's price independent of Trump's endorsement: Numerous factors influence XRP's price, including overall market sentiment, technological advancements, and regulatory developments. A Trump endorsement is only one piece of a complex puzzle.

Conclusion

A Donald Trump endorsement of XRP could create significant short-term market excitement and price volatility. However, the long-term success of XRP will depend on far more than a celebrity endorsement. The ongoing SEC lawsuit, regulatory uncertainty, and the inherent risks of the cryptocurrency market remain substantial challenges. While a Trump endorsement might provide a short-term boost, it's crucial to approach XRP investment with caution.

While a Trump endorsement might create short-term volatility, the long-term success of the XRP market will hinge on factors beyond celebrity influence. Continue to research the XRP market, understand the risks and opportunities surrounding XRP investment, and make informed decisions based on thorough due diligence. Stay tuned for further updates on the impact of potential political endorsements on the future of XRP and institutional investment.

Featured Posts

-

Xrp Surges Past Bitcoin Secs Grayscale Xrp Etf Filing Sparks Crypto Rally

May 07, 2025

Xrp Surges Past Bitcoin Secs Grayscale Xrp Etf Filing Sparks Crypto Rally

May 07, 2025 -

Cavaliers Le Vert Free Agency Concerns A Report

May 07, 2025

Cavaliers Le Vert Free Agency Concerns A Report

May 07, 2025 -

Must Read Top 5 Nie Articles Of Q1 2025

May 07, 2025

Must Read Top 5 Nie Articles Of Q1 2025

May 07, 2025 -

Warszawa Ksiazka O Konklawe Ks Przemyslaw Sliwinski Ujawnia Kulisy Wyborow Papieskich

May 07, 2025

Warszawa Ksiazka O Konklawe Ks Przemyslaw Sliwinski Ujawnia Kulisy Wyborow Papieskich

May 07, 2025 -

Ralph Macchio Hollywoods Absence Key To Long Term Marriage

May 07, 2025

Ralph Macchio Hollywoods Absence Key To Long Term Marriage

May 07, 2025

Latest Posts

-

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

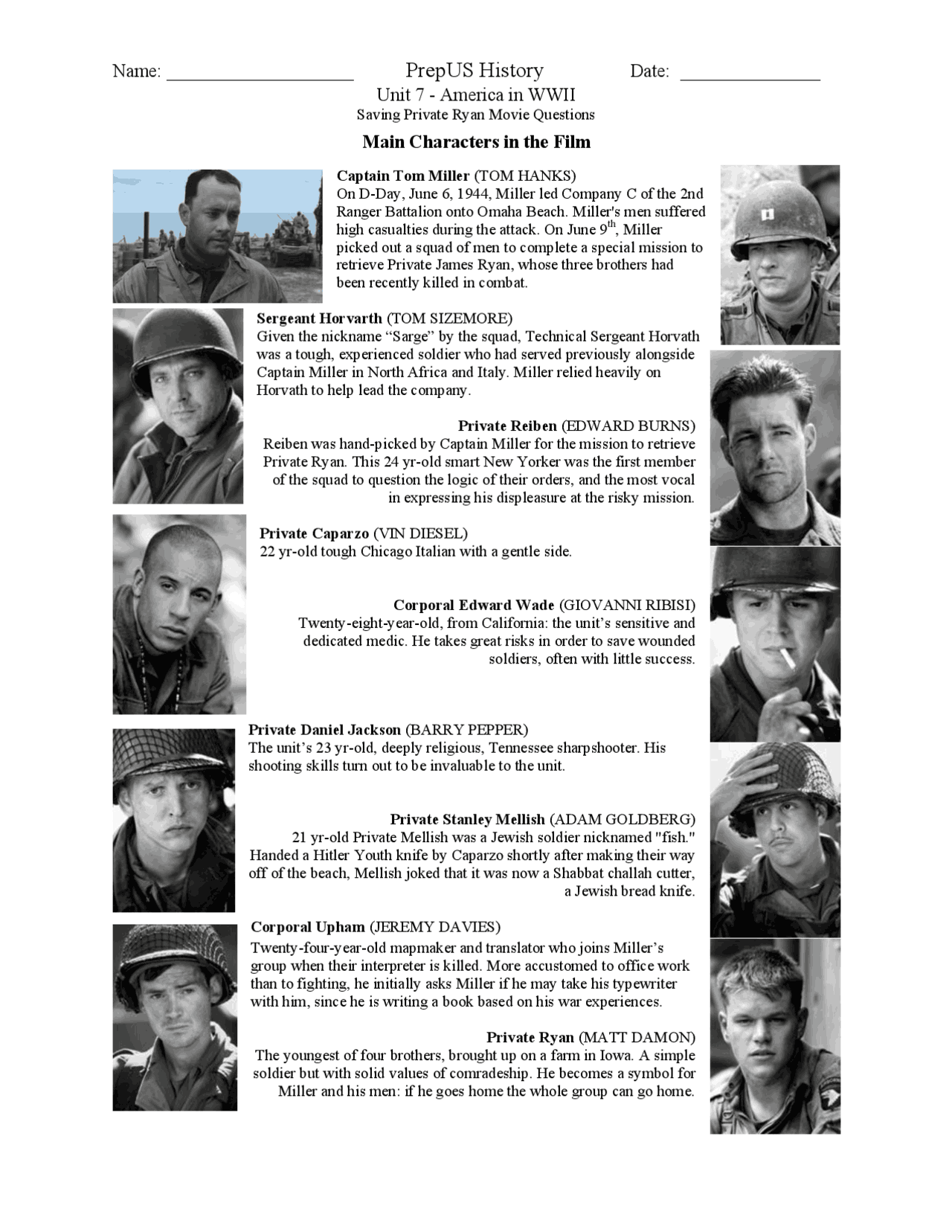

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025 -

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025 -

Nathan Fillions Three Minute Masterclass In Saving Private Ryan

May 08, 2025

Nathan Fillions Three Minute Masterclass In Saving Private Ryan

May 08, 2025