New Developments In US-China Trade Relations: Tariff Adjustments

Table of Contents

Recent Tariff Adjustments and Their Impact

The imposition and subsequent alteration of tariffs between the US and China have had profound economic consequences. These tariff adjustments, frequently implemented under Section 301 of the Trade Act of 1974, have targeted a wide range of sectors. Understanding the impact requires analyzing both tariff increases and reductions.

-

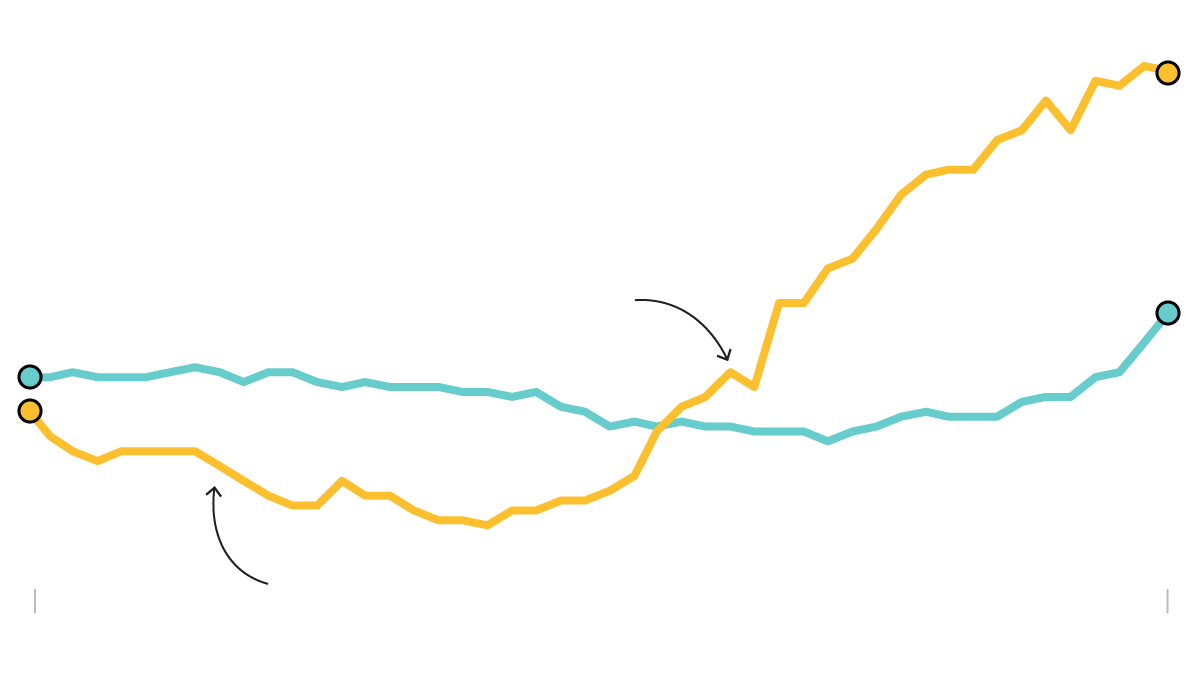

Tariff Increases: Significant tariff increases, particularly in the early stages of the trade war, heavily impacted sectors like agriculture (soybeans), manufacturing (steel and aluminum), and technology (semiconductors). These increases led to substantial market volatility, impacting consumer prices and business investment decisions.

-

Tariff Reductions: While some tariffs have been reduced or eliminated through subsequent negotiations, the lingering effects of previous increases continue to ripple through global supply chains. The rationale behind these reductions often involves strategic considerations related to de-escalation efforts and the pursuit of more stable bilateral trade agreements.

-

Economic Impact: The economic impact of these tariff adjustments has been substantial. Studies have shown varying degrees of impact on GDP growth, inflation rates, and specific industries. The effects are not uniform, with some sectors experiencing more significant negative consequences than others. For example, the agricultural sector in the US faced considerable hardship due to Chinese retaliatory tariffs on soybeans.

-

Rationale and Perspectives: The US has often justified its tariff increases by citing concerns over unfair trade practices, intellectual property theft, and the need to protect domestic industries. China, on the other hand, has viewed these tariffs as protectionist measures that harm global trade and disrupt international economic cooperation.

-

Consumer and Business Impacts: Increased tariffs have, undoubtedly, led to higher consumer prices for various goods. Businesses have also faced challenges in managing costs and supply chains, leading to uncertainty and impacting investment decisions.

The Ongoing Trade Negotiations and Their Influence on Tariffs

The ongoing trade negotiations between the US and China play a critical role in shaping future tariff adjustments. These negotiations, often characterized by periods of intense dialogue and apparent breakthroughs followed by setbacks, are far from over.

-

State of Negotiations: The current state of negotiations involves ongoing efforts to address long-standing trade disputes and create a more predictable and balanced trade relationship. Success depends on compromises from both sides.

-

Role of International Organizations: The World Trade Organization (WTO) plays a significant role, albeit sometimes a challenged one, in providing a framework for dispute resolution and ensuring fair trade practices. The compliance of both nations with WTO rules remains a pivotal factor.

-

Future Scenarios: Potential future scenarios range from a complete de-escalation of the trade war, with significant tariff reductions, to a continuation of heightened tensions with potentially even more restrictive trade measures. The outcome is heavily influenced by political considerations in both countries.

-

Domestic Political Pressures: Domestic political pressures in both the US and China significantly impact the direction of trade negotiations and the willingness of each side to compromise.

-

De-escalation Attempts: While there have been attempts at de-escalation, some have proven successful, while others have fallen short, leaving much of the long-term future uncertain.

The Role of Technology in Shaping Tariff Strategies

Technology has emerged as a central element in shaping US-China tariff strategies. The strategic use of tariffs reflects a broader geopolitical competition over technological dominance.

-

Technology Transfer Concerns: Tariffs have been used as a lever to address concerns over technology transfer, intellectual property rights, and the dominance of Chinese firms in specific technological sectors.

-

Impact on Tech Sectors: The semiconductor industry, telecommunications, and artificial intelligence have been particularly affected by tariff adjustments, with ripple effects felt across various interconnected industries.

-

Geopolitical Implications: The use of tariffs as a tool in technological competition highlights the increasingly intertwined nature of trade policy and geopolitical strategy.

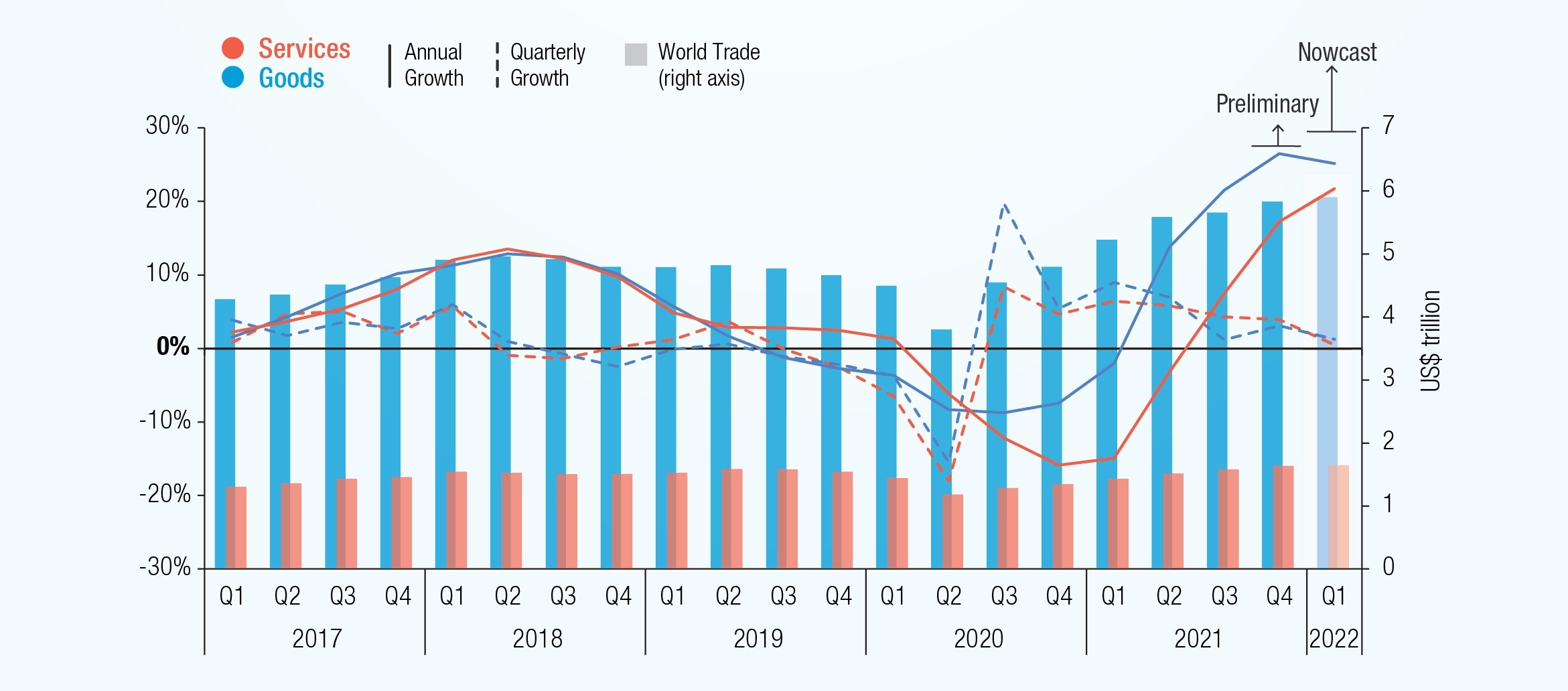

The Impact of Tariff Adjustments on Global Supply Chains

Tariff adjustments have had a significant impact on global supply chains, forcing businesses to adapt and restructure their operations.

-

Supply Chain Disruptions: The imposition of tariffs has disrupted established global supply chains, causing delays, increased costs, and uncertainty for businesses.

-

Relocation and Reshoring: Many companies have responded by relocating production facilities to other countries or by reshoring manufacturing operations to reduce dependence on China. The concept of "nearshoring," moving production to nearby countries, has also gained traction.

-

Impact on Global Trade Flows: Tariff adjustments have altered global trade flows, leading to a shift in sourcing patterns and impacting the overall level of economic interdependence between nations.

Conclusion

The ongoing adjustments to tariffs in US-China trade relations demonstrate the complex and dynamic nature of this crucial bilateral relationship. From the initial imposition of significant tariffs impacting numerous sectors to the ongoing negotiations and the role of technology, the consequences have been far-reaching, impacting global supply chains, consumer prices, and international relations. Understanding these developments, and their potential future iterations, is essential for businesses and policymakers alike.

Stay informed about the latest changes in US-China trade relations and tariff adjustments by regularly consulting reputable news sources and economic analyses. Understanding these developments is crucial for navigating the complexities of global trade.

Featured Posts

-

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025 -

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025 -

V Mware Pricing At And T Reports A Staggering 1050 Increase Proposed By Broadcom

Apr 28, 2025

V Mware Pricing At And T Reports A Staggering 1050 Increase Proposed By Broadcom

Apr 28, 2025 -

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025 -

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025

Latest Posts

-

Examining The Financials The Impact Of Musks X Debt Sale

Apr 28, 2025

Examining The Financials The Impact Of Musks X Debt Sale

Apr 28, 2025 -

Decoding Xs Financials Post Musk Debt Sale Analysis

Apr 28, 2025

Decoding Xs Financials Post Musk Debt Sale Analysis

Apr 28, 2025 -

The Changing Face Of X A Look At The Financials Following Musks Debt Sale

Apr 28, 2025

The Changing Face Of X A Look At The Financials Following Musks Debt Sale

Apr 28, 2025 -

Analysis Of Musks X Debt Sale Impact On Company Finances

Apr 28, 2025

Analysis Of Musks X Debt Sale Impact On Company Finances

Apr 28, 2025 -

New X Financials How Musks Debt Sale Reshaped The Company

Apr 28, 2025

New X Financials How Musks Debt Sale Reshaped The Company

Apr 28, 2025