The Changing Face Of X: A Look At The Financials Following Musk's Debt Sale

Table of Contents

The Debt Burden: A Deep Dive into X's Finances Post-Acquisition

Musk's acquisition of X saddled the company with a substantial debt burden. Precise figures remain somewhat opaque, but reports suggest billions of dollars in loans and bonds were secured to finance the deal. This massive debt represents a significant financial risk. The interest payments alone place considerable pressure on profitability, potentially impacting X's ability to invest in growth and innovation.

- Specific figures: While exact figures are not publicly available, estimates place the debt in the billions of dollars.

- Sources of debt: The financing likely involved a mix of bank loans, high-yield bonds, and potentially equity contributions from Musk himself.

- Debt-to-equity ratio: This ratio, crucial for assessing financial risk, is likely considerably higher for X post-acquisition than industry benchmarks. Further analysis is needed to determine the precise figure and its implications.

- Industry benchmarks: Comparing X's debt levels and debt-to-equity ratio to similar social media companies is essential to gauge its relative financial health and risk profile.

Revenue Generation Strategies: How X is Seeking Financial Stability

To offset the enormous debt, X is aggressively pursuing diverse revenue streams. Advertising remains a cornerstone, but the platform is increasingly reliant on its subscription model, X Premium, and exploring potential avenues in payments. The success of these strategies will be critical in determining X's financial future.

- Revenue Breakdown: Advertising likely still constitutes the largest chunk of revenue, but the exact percentage is not publicly released. X Premium subscription numbers are growing, though the financial impact is yet to be fully assessed.

- Year-over-Year Comparison: Comparing current revenue figures to Twitter's pre-acquisition performance is necessary to understand the impact of the rebranding and new strategies.

- X Premium Performance: The success of X Premium in attracting paying subscribers will be a key factor in achieving financial stability.

- Advertising Revenue Trends: The advertising market is highly competitive, making it vital for X to maintain or increase its share while also innovating its ad products and targeting capabilities.

Cost-Cutting Measures: Musk's Approach to Financial Restructuring

To navigate the financial challenges, Musk has implemented significant cost-cutting measures, most notably through substantial layoffs and reduced spending across various departments. These actions have generated short-term savings but carry potential long-term risks.

- Layoffs and Efficiency: The reduction in workforce, while leading to immediate cost savings, raises concerns about its impact on operational efficiency, product development, and employee morale.

- Cost-Cutting Initiatives: Examples include streamlining departments, reducing operational expenses, and potentially renegotiating contracts with suppliers.

- Talent Loss: The aggressive cost-cutting raises concerns about the potential loss of skilled employees, which could negatively impact future innovation and growth.

- Long-Term Effects: A drastic reduction in staff could compromise product quality and innovation, impacting X's ability to compete effectively in the long term.

The Future of X's Financial Outlook: Predictions and Uncertainties

The long-term financial sustainability of X is a complex question. The heavy debt burden presents a significant challenge, while the success of its revenue generation strategies remains uncertain. Several factors will influence X's future financial performance.

- Future Funding: X may require additional funding rounds to manage its debt and continue operations, potentially diluting existing shareholders' equity.

- Market Competition: Intense competition from other social media platforms puts pressure on X's ability to attract and retain users and generate revenue.

- Debt Risk: The high level of debt poses a significant risk, particularly if revenue growth fails to meet expectations.

- Regulatory Challenges: Facing potential regulatory scrutiny in various jurisdictions adds another layer of uncertainty to X's financial outlook.

Conclusion: The Evolving Financial Landscape of X – A Path Forward

The financial landscape of X has undergone a dramatic transformation since Musk's acquisition and debt sale. The massive debt burden, coupled with aggressive cost-cutting measures and evolving revenue strategies, presents both significant challenges and opportunities. The long-term success of X will depend on its ability to manage its debt, innovate its revenue streams, and adapt to the dynamic social media landscape. Continue following the evolving story of "The Changing Face of X" by staying informed about its financial performance and related news. Subscribe to receive updates on future analysis of X's financial performance and related topics, and be sure to check back for future articles analyzing the intricacies of this ever-changing platform.

Featured Posts

-

Replacing Tyler O Neill Red Sox Roster Moves And Prospects For 2025

Apr 28, 2025

Replacing Tyler O Neill Red Sox Roster Moves And Prospects For 2025

Apr 28, 2025 -

Red Sox Breakout Star Unexpected Player Poised For Success

Apr 28, 2025

Red Sox Breakout Star Unexpected Player Poised For Success

Apr 28, 2025 -

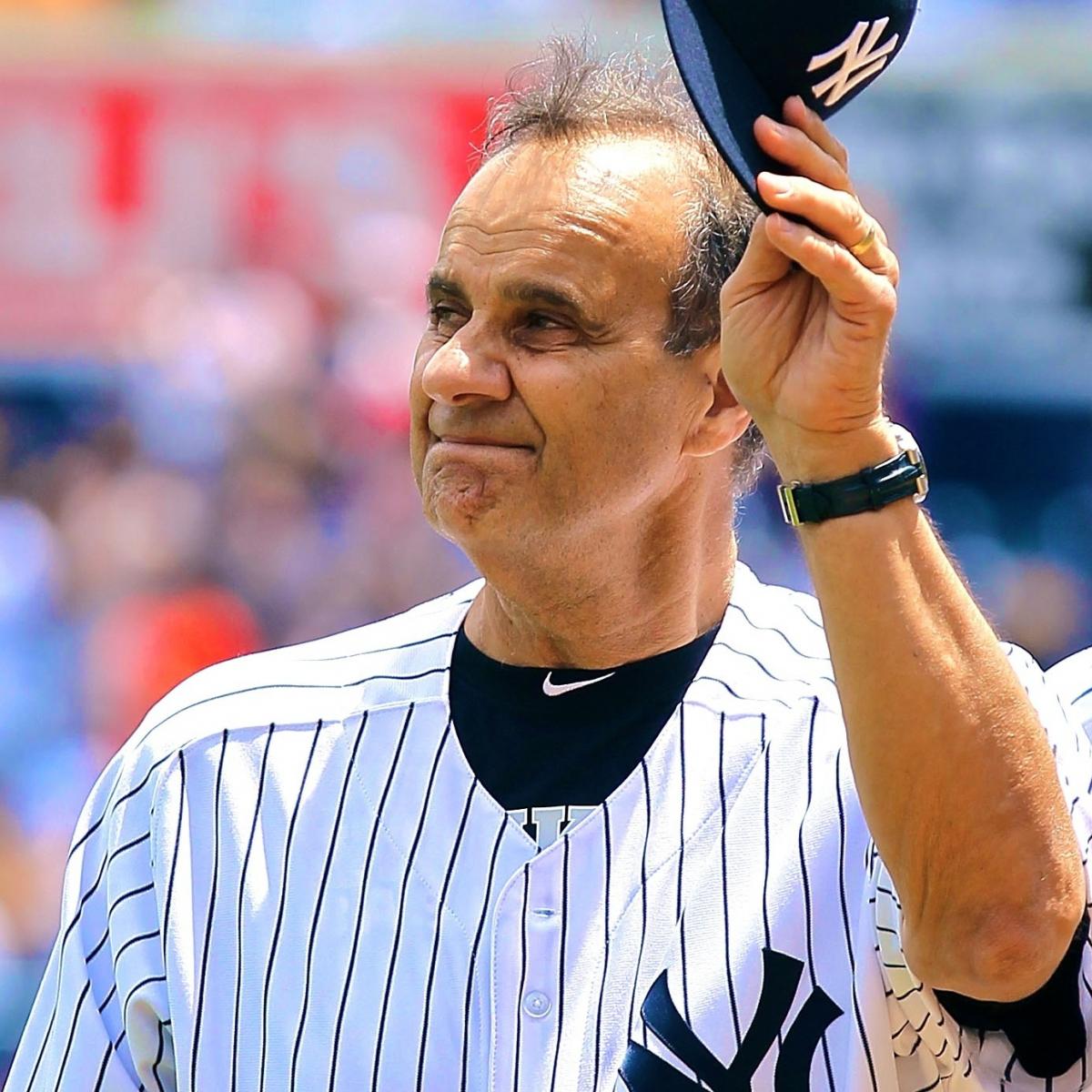

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance Against The Twins

Apr 28, 2025

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance Against The Twins

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Products

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Products

Apr 28, 2025

Latest Posts

-

Updated Richard Jeffersons New Espn Role And Nba Finals Prospects

Apr 28, 2025

Updated Richard Jeffersons New Espn Role And Nba Finals Prospects

Apr 28, 2025 -

Richard Jefferson Espn Promotion And Nba Finals Commentary Status

Apr 28, 2025

Richard Jefferson Espn Promotion And Nba Finals Commentary Status

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025