Analysis Of Musk's X Debt Sale: Impact On Company Finances

Table of Contents

The Scale of Musk's X Debt Sale

Debt Amount and Sources

The exact figures surrounding Musk's X debt sale remain somewhat opaque, but reports suggest a substantial amount of debt was raised. Sources likely included a combination of high-yield bonds, bank loans, and possibly even private equity investments. The opacity surrounding the details is itself noteworthy, as it limits the ability of analysts to fully assess the risk associated with this debt.

- Specific figures on the debt: While precise numbers haven't been publicly released, estimates place the total debt raised in the billions of dollars.

- Breakdown of different debt instruments used: The mix of debt instruments likely included a combination of senior secured debt and subordinated debt, reflecting varying levels of risk for lenders.

- Notable investors or lenders: Identifying the specific investors and lenders involved would provide crucial insight into the terms of the financing and the perceived risk associated with X.

Analysis: The sheer scale of the debt is concerning. While it provides X with immediate liquidity, the question remains whether X's current revenue streams – including advertising, subscriptions, and potential new revenue streams from integration with other Musk businesses – are sufficient to service this substantial debt burden. A high debt-to-equity ratio could severely limit future strategic options.

Immediate Impact on X's Financial Position

Increased Leverage and Debt-to-Equity Ratio

Musk's X debt sale has dramatically increased X's leverage. The debt-to-equity ratio, a key indicator of financial risk, has undoubtedly risen significantly. This means X is now more reliant on debt financing than equity, making it more vulnerable to economic downturns and interest rate hikes.

- Calculation of the debt-to-equity ratio before and after the sale: Accurate calculations require publicly available financial statements, which haven't been fully disclosed for X post-acquisition. Independent financial analysis will be crucial to determine the precise impact.

- Discussion of the increased financial risk: A higher debt-to-equity ratio indicates increased financial risk. X's ability to meet its debt obligations becomes more dependent on stable revenue streams and efficient cost management.

- Mention any credit rating changes: Credit rating agencies will likely downgrade X's credit rating reflecting the increased financial risk. This downgrade could make future financing more expensive and difficult to obtain.

Analysis: The immediate impact on X's liquidity and solvency is a crucial area of concern. The company's ability to meet its short-term financial obligations will be directly impacted by its increased debt burden.

Long-Term Implications for X's Financial Strategy

Impact on Future Investments and Growth

The substantial debt incurred through Musk's X debt sale will undoubtedly affect X's future investment capacity and growth trajectory. Securing future funding for new projects and technologies will become significantly more challenging.

- Discussion of potential challenges in securing future funding: Lenders will be more cautious about extending further credit to X due to the existing high debt load.

- Analysis of the impact on innovation and expansion: The need to prioritize debt repayment could force X to cut back on research and development, hindering innovation and future growth.

- Mention any potential restructuring plans: X might need to consider restructuring its debt to manage its burden effectively. This could involve extending repayment terms or refinancing at more favorable rates.

Analysis: The long-term sustainability of X's financial model is questionable in the face of such a significant debt burden. Aggressive cost-cutting measures or a strategic shift in focus may be necessary to ensure financial viability.

Market Reaction and Investor Sentiment

Stock Price Fluctuations (if applicable)

While X is a privately held company and doesn't have publicly traded stock, the market reaction to Musk's actions affecting similar companies and the overall tech sector provides insight into investor sentiment.

- Chart illustrating stock price changes (if applicable): Analyzing comparable companies in the tech sector can reveal investor sentiment towards similar debt-heavy strategies.

- Analysis of investor statements and reports: Statements from analysts and investors regarding the debt sale reveal concerns about X's future prospects.

- Mention any significant changes in market capitalization (if applicable): While not directly applicable to X, analyzing similar companies can give a sense of the market's reaction to heavy debt.

Analysis: Investor confidence is crucial for X's long-term success. The debt sale may erode investor confidence, potentially impacting future fundraising efforts.

Comparison with Other Tech Companies' Debt Strategies

Benchmarking X's Approach

Comparing X's debt strategy to other tech companies helps gauge the effectiveness of its approach.

- Examples of other companies that have undertaken similar debt financing: Many tech companies have utilized debt financing for expansion, though the scale of Musk's actions is exceptional.

- Analysis of their successes or failures: Studying the outcomes of similar debt strategies in other companies provides valuable lessons.

- Comparison of debt-to-equity ratios: A comparative analysis of debt-to-equity ratios across tech companies helps understand the relative risk of X's current position.

Analysis: X's debt strategy appears aggressive compared to many peers. While it may offer short-term gains, the long-term implications require careful monitoring and strategic adjustments.

Conclusion: Assessing the Long-Term Effects of Musk's X Debt Sale

This analysis of Musk's X debt sale reveals a complex picture. While the debt provides immediate liquidity, the increased leverage significantly raises concerns about X's long-term financial health. The high debt-to-equity ratio, potential challenges in securing future funding, and the impact on investment and growth all point to significant risks. The market reaction, while difficult to measure directly for X, suggests that investor sentiment towards such heavily indebted strategies is cautious.

Key Takeaways: The scale of the debt is substantial, immediately increasing financial risk and potentially hindering future growth. Long-term sustainability is uncertain, necessitating careful financial management and potentially strategic restructuring.

Call to Action: To gain a clearer understanding of the ramifications of Musk's X debt sale and its broader financial strategies, further research into X's financial statements (once available), analysis of comparable companies' debt restructuring, and examination of the broader impact of high-debt strategies in the tech sector are crucial. Continued scrutiny of Musk's financial decisions concerning X is vital for assessing the company's long-term viability and future prospects.

Featured Posts

-

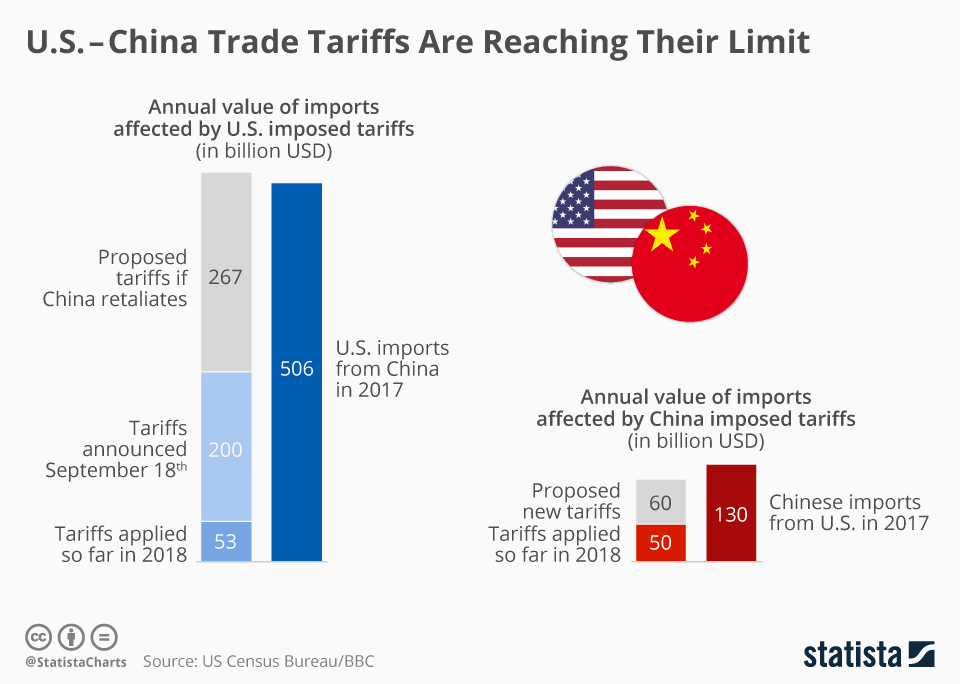

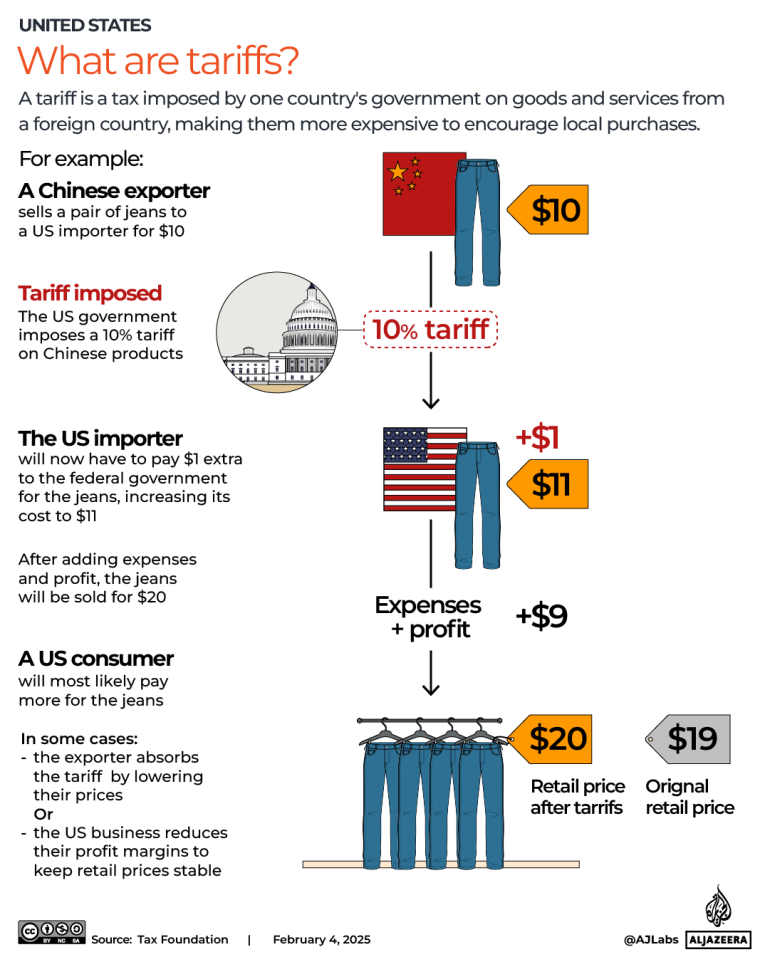

Chinas Tariff Policy Shift Implications For Us Businesses

Apr 28, 2025

Chinas Tariff Policy Shift Implications For Us Businesses

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025 -

Tiga Warna Baru Jetour Dashing Resmi Meluncur Di Iims 2025

Apr 28, 2025

Tiga Warna Baru Jetour Dashing Resmi Meluncur Di Iims 2025

Apr 28, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025 -

Recent Developments China Adjusts Tariffs On Us Imports

Apr 28, 2025

Recent Developments China Adjusts Tariffs On Us Imports

Apr 28, 2025

Latest Posts

-

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025 -

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025