New X Financials: How Musk's Debt Sale Reshaped The Company

Table of Contents

The Debt Sale: Details and Implications

The Scale of the Debt

The debt sale undertaken by X Corp was substantial, involving a complex mix of bonds and loans totaling an estimated [Insert Estimated Amount Here] billion dollars. The funds were primarily used to refinance existing debt incurred during the acquisition, cover substantial operational expenses, and potentially fuel future acquisitions or investments. The specific details of the debt structure, including the allocation of funds and the identity of lenders, remain partially undisclosed, but publicly available financial statements provide some insight.

- Specific figures: [Insert specific figures regarding the debt, including breakdown of loan types and amounts if available].

- Financial institutions: [List known participating financial institutions, if available. If not, mention the type of institutions likely involved].

- Interest rates and repayment terms: [Provide information on interest rates if publicly available. Mention the repayment schedule, highlighting any potential risks related to repayment].

Immediate Financial Consequences

The massive debt sale immediately impacted X's financial standing. The company's debt-to-equity ratio increased significantly, raising concerns among financial analysts about its financial risk profile. While the immediate impact on its credit rating varied depending on the rating agency, [Mention specific credit rating changes if available, otherwise discuss the potential for downgrades or the maintenance of existing ratings]. These financial shifts also had a notable effect on shareholder value, which [Describe the impact on shareholder value – increased volatility, decrease, increase, etc.].

- Before and after comparison: [Provide a table comparing key financial metrics, such as debt-to-equity ratio, before and after the debt sale, if data is available].

- Credit rating changes: [Mention any credit rating upgrades or downgrades by major agencies].

- Impact on shareholder value: [Analyze the effect on shareholder value, including stock price fluctuations].

Restructuring and Strategic Shifts Post-Debt Sale

Changes in Operational Strategy

The substantial debt load forced X to implement significant changes to its operational strategy. This included substantial cost-cutting measures and a renewed focus on revenue generation.

- Cost-cutting initiatives: [Give specific examples of cost-cutting measures implemented, including layoffs, reduced marketing spend, etc.].

- New revenue streams: [Describe new revenue strategies implemented, such as premium subscription models, changes in advertising strategies, and potential explorations of new revenue streams].

- Product changes: [Discuss changes to existing products or services and the launch of new features to generate revenue].

Impact on X's Corporate Structure

The debt sale also led to changes in X's corporate structure. While details are often kept confidential, the need for fiscal responsibility has likely impacted organizational structure and leadership.

- Leadership changes: [Highlight any significant changes in leadership positions or appointments of new executives].

- Restructuring of departments: [Discuss changes made to the organization's internal structure, departmental mergers, or the creation of new departments].

- Legal entity changes: [Note any changes to X's legal structure, such as mergers, acquisitions, or changes in its legal entity's location].

Long-Term Outlook and Future Implications of New X Financials

Financial Stability and Sustainability

The long-term financial stability of X remains a subject of ongoing debate. While the debt sale provided immediate financial relief, the considerable debt burden presents ongoing challenges.

- Future cash flow and profitability: [Analyze projections for X's future cash flow and profitability, considering the debt repayment schedule and ongoing operational costs].

- Potential challenges: [Discuss potential risks that could jeopardize X's financial stability, such as increased competition, an economic downturn, or unforeseen operational challenges].

- Debt obligation fulfillment: [Assess X's capacity to meet its debt obligations in the foreseeable future].

Impact on the Tech Industry

X's financial restructuring has significant implications for the wider tech industry. It highlights the risks and challenges associated with high-debt acquisitions and serves as a case study for companies contemplating similar strategies.

- Comparison to similar situations: [Compare X's situation with similar instances of debt-laden acquisitions in the tech industry].

- Implications for other tech companies: [Analyze the potential impact of X's experience on other companies planning large-scale acquisitions].

- Impact on investor confidence: [Discuss the effect of X's experience on overall investor confidence in the tech sector].

Conclusion: New X Financials: A Reshaped Landscape

The debt sale significantly impacted X's financial landscape, necessitating substantial strategic shifts and raising questions about its long-term financial stability. The changes in operational strategy, corporate structure, and the overall financial risk profile are profound. While challenges remain, X's ability to navigate its debt burden and adapt to the evolving market will be crucial in determining its future success. To stay abreast of these "New X Financials" and the evolving story of X Corp, subscribe to our newsletter, follow us on social media, and regularly check back for updates on its financial performance and strategic adjustments. Understanding the intricacies of X's financial restructuring is vital for anyone interested in the future of the tech industry.

Featured Posts

-

New X Financials How Musks Debt Sale Reshaped The Company

Apr 28, 2025

New X Financials How Musks Debt Sale Reshaped The Company

Apr 28, 2025 -

The Reach Of Trumps Campus Crackdown A Nationwide Analysis

Apr 28, 2025

The Reach Of Trumps Campus Crackdown A Nationwide Analysis

Apr 28, 2025 -

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025 -

Ai Browser Battle Perplexity Ceos Strategy To Challenge Google

Apr 28, 2025

Ai Browser Battle Perplexity Ceos Strategy To Challenge Google

Apr 28, 2025 -

V Mware Costs To Skyrocket 1050 At And T On Broadcoms Proposed Price Increase

Apr 28, 2025

V Mware Costs To Skyrocket 1050 At And T On Broadcoms Proposed Price Increase

Apr 28, 2025

Latest Posts

-

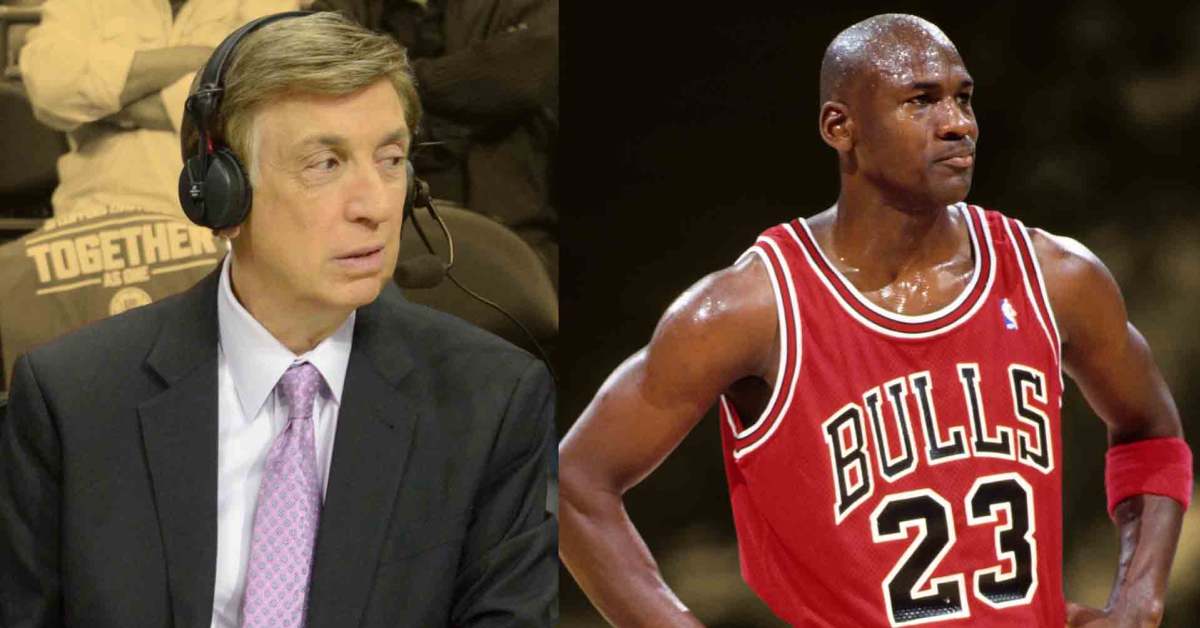

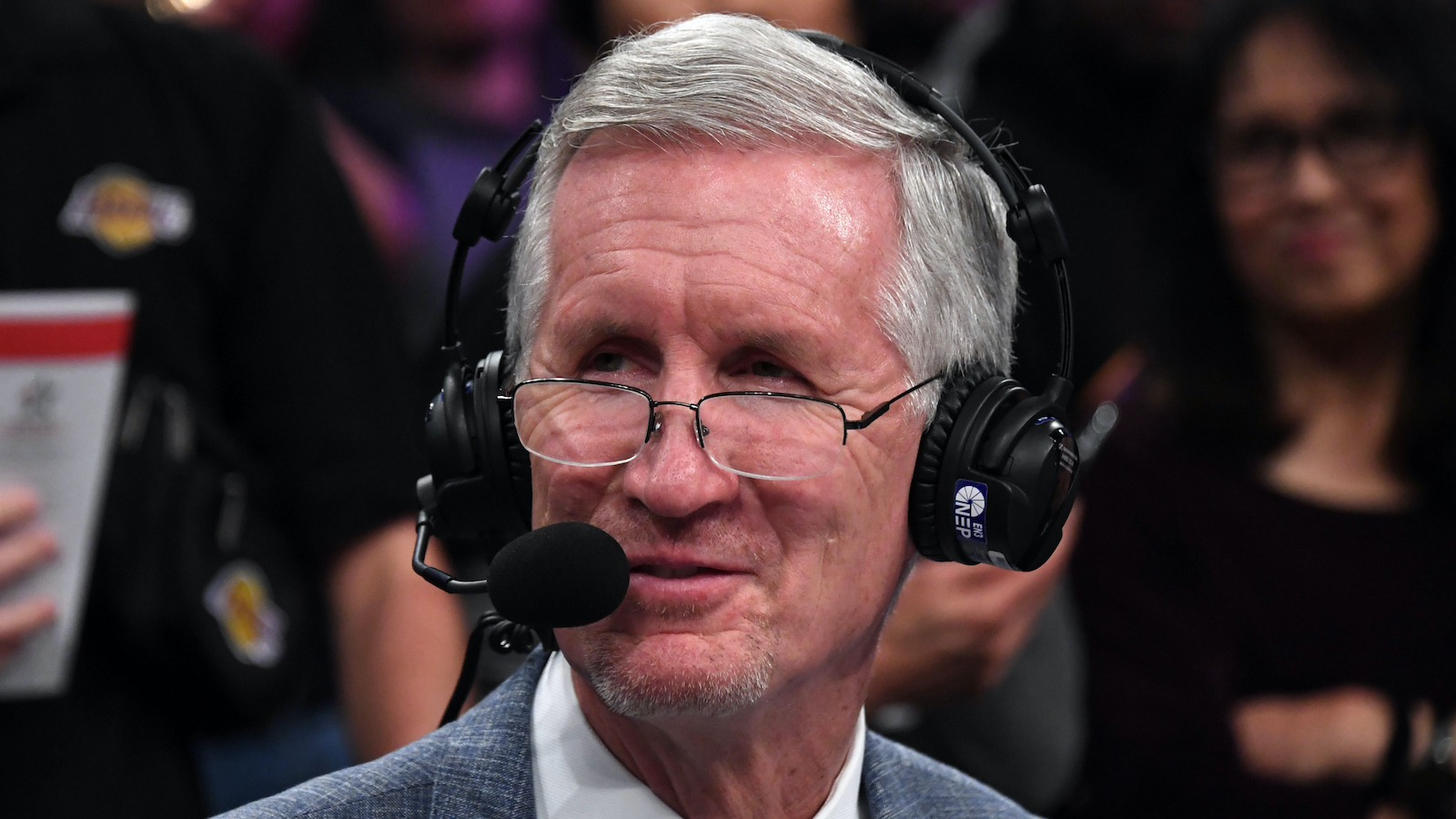

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

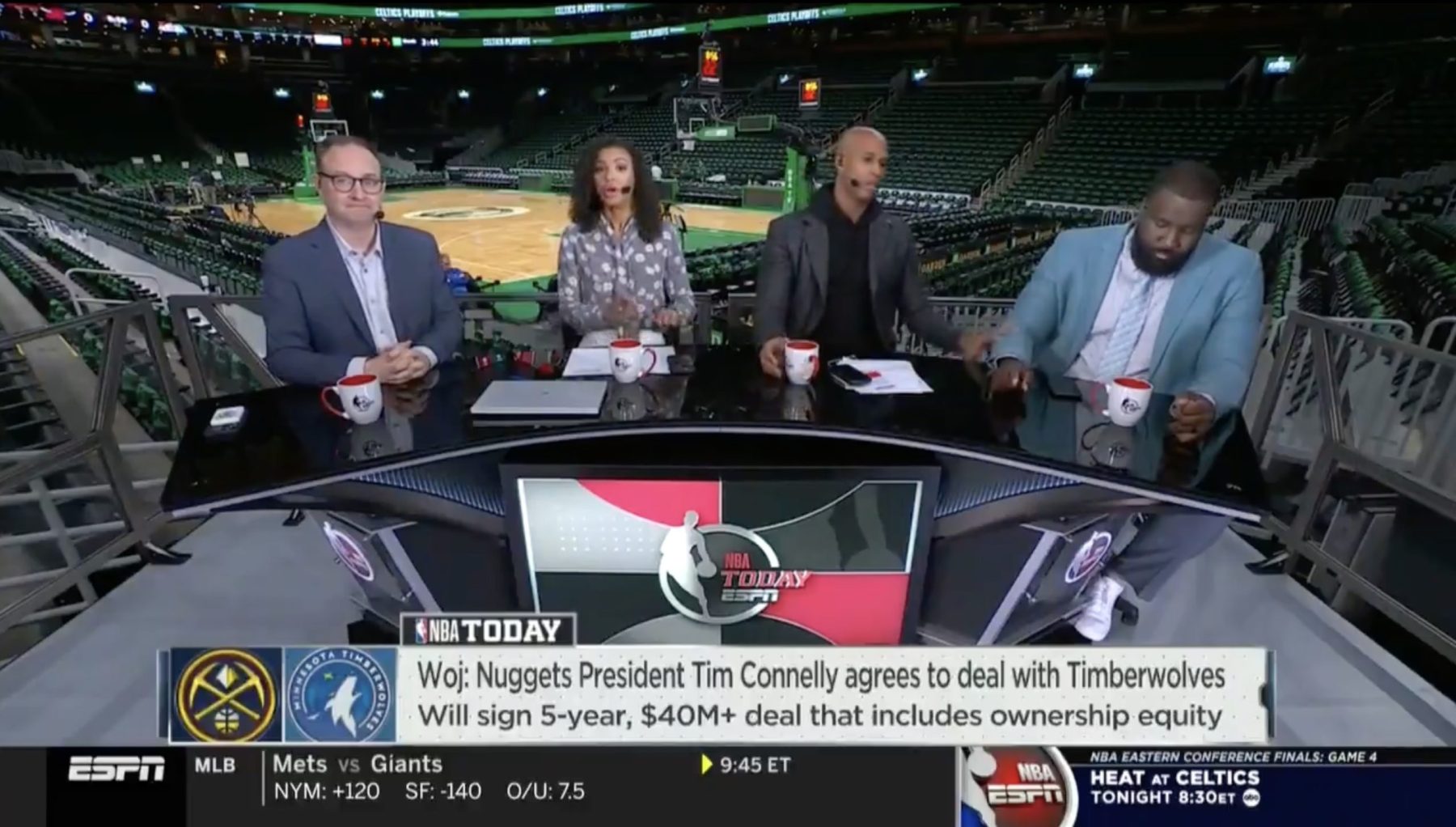

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025 -

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025