Decoding X's Financials: Post-Musk Debt Sale Analysis

Table of Contents

The Debt Burden's Impact on X's Financial Health

The massive debt incurred during the acquisition significantly impacts X's financial health. Analyzing key metrics reveals the extent of this impact and potential risks.

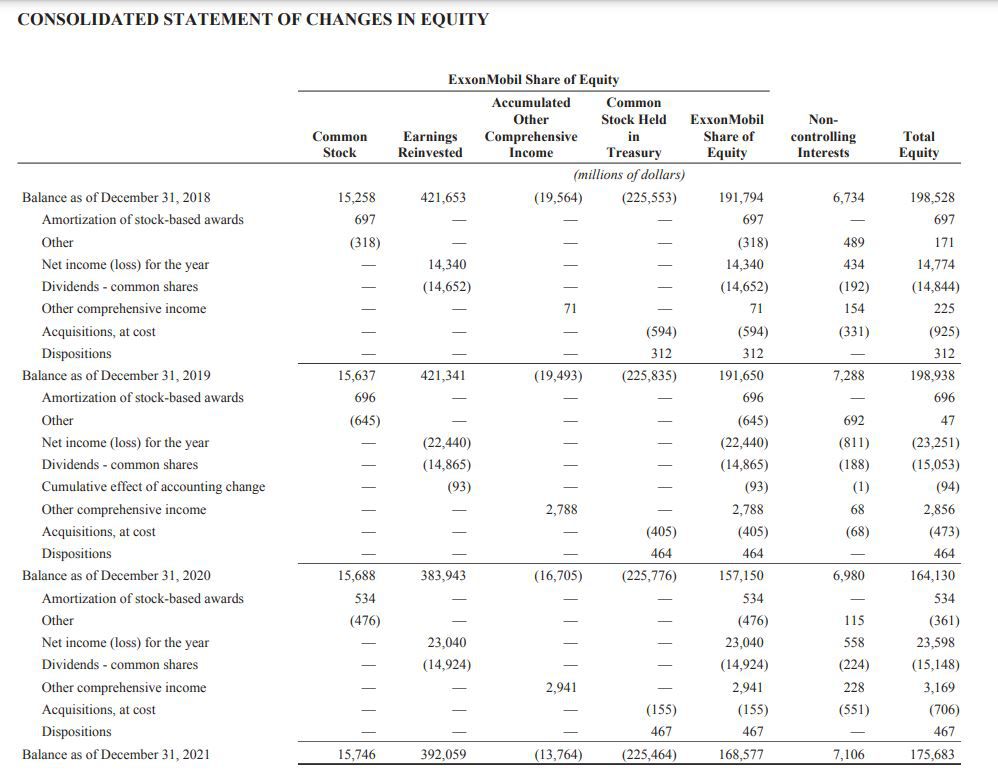

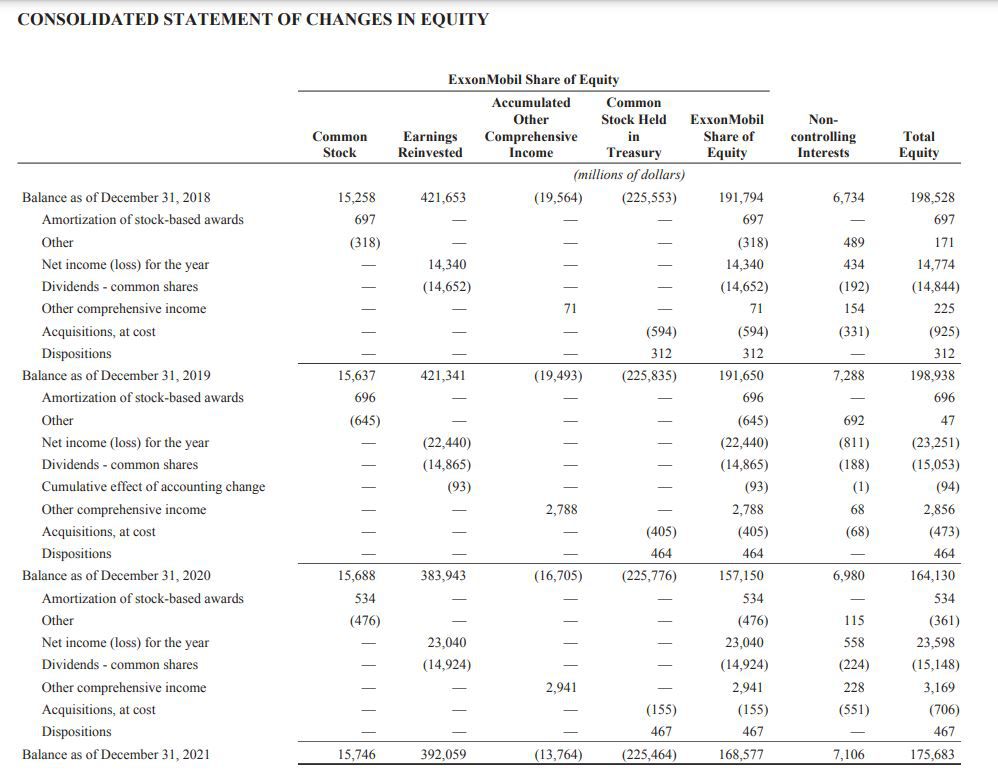

Leverage Ratios and Solvency

X's debt-to-equity ratio, a key indicator of financial leverage, experienced a dramatic increase post-acquisition. This high leverage significantly impacts the company's solvency, meaning its ability to meet its financial obligations. A high debt-to-equity ratio increases the risk of default, particularly during economic downturns or unexpected revenue shortfalls. Credit rating agencies are closely monitoring this metric, and a downgrade could further increase borrowing costs and hinder future investments.

- Compare key leverage ratios with industry benchmarks: Analyzing X's ratios against competitors like Meta or Alphabet provides valuable context and reveals whether X's leverage is significantly higher than industry norms.

- Analyze interest expense as a percentage of revenue: A large percentage indicates a substantial portion of revenue is consumed by debt servicing, reducing funds available for growth and other operational expenses.

- Discuss potential covenant violations: Loan agreements often include covenants that X must adhere to. Failure to meet these covenants could trigger default and potentially lead to bankruptcy.

Cash Flow and Liquidity

Analyzing X's cash flow and liquidity positions post-debt sale is crucial to understanding its ability to service its debt. Reduced subscription revenue and potential advertiser boycotts have impacted cash flow, making debt servicing a critical concern.

- Analyze trends in cash flow: Examining the trends in operating cash flow and free cash flow reveals the company's ability to generate cash from its operations. Negative free cash flow, where cash outflow exceeds inflow, is a significant red flag.

- Discuss the implications of any negative free cash flow: Negative free cash flow necessitates reliance on external financing or asset sales to meet operational expenses and debt obligations.

- Explore potential strategies for improving cash flow: X needs to implement strategies to improve its cash flow, such as cost-cutting measures, more efficient revenue collection, and exploring alternative revenue streams beyond advertising and subscriptions.

Revenue Generation Strategies and Their Effectiveness

X's revenue generation strategy relies heavily on subscriptions and advertising. The effectiveness of these strategies directly impacts its ability to manage its debt.

Subscription Model Performance

X's subscription model, X Premium, aims to generate recurring revenue. Its success is critical for X's financial health.

- Analyze subscriber growth: Tracking the number of subscribers and the rate of growth is essential to assessing the success of the subscription model. Slow or negative growth would be a major concern.

- Discuss average revenue per user (ARPU): Analyzing ARPU reveals the average revenue generated per subscriber. Increasing ARPU through higher-tier subscriptions or additional features is key to profitability.

- Compare subscription revenue to advertising revenue: Understanding the relative contribution of each revenue stream to the overall revenue is crucial. A heavy reliance on advertising makes X vulnerable to advertiser boycotts.

Advertising Revenue Trends

Advertising revenue constitutes a significant portion of X's revenue. The impact of advertiser boycotts and changes in advertising policies significantly impacts its financial performance.

- Analyze advertising revenue growth or decline: Tracking advertising revenue trends provides a clear picture of the performance of this key revenue stream. A declining trend signals major issues.

- Discuss changes in advertising rates: Changes in advertising rates can reflect market demand and X's ability to attract advertisers. Lower rates can indicate weaker market position.

- Explore alternative monetization strategies: X needs to explore diverse revenue streams to reduce reliance on advertising alone. This could include partnerships, premium features, or data licensing.

Future Outlook and Financial Projections for X

X's future hinges on its ability to manage its debt and adapt its business model.

Debt Refinancing and Restructuring

X faces the challenge of refinancing its substantial debt. This will be crucial for its long-term survival.

- Discuss the potential for debt forgiveness: While unlikely, the possibility of debt forgiveness or restructuring through negotiations with creditors should be considered.

- Analyze the impact of interest rate changes: Rising interest rates increase the cost of servicing the debt, adding further pressure on X's finances.

- Discuss the possibility of bankruptcy: If X fails to address its debt burden, bankruptcy remains a potential outcome.

Long-Term Sustainability and Growth Potential

X's long-term sustainability depends on adapting to the changing social media landscape and innovating its revenue model.

- Discuss the potential for new revenue streams: Exploring new revenue streams, such as e-commerce integration or expanding its API access for developers, can help diversify its income.

- Analyze the competitive landscape: X faces intense competition from other social media platforms like Meta and TikTok. Maintaining a competitive edge is crucial for growth.

- Explore the company's innovation capabilities: X's ability to innovate and adapt to changing user preferences will be key to its long-term success.

Conclusion

This analysis of X's financials following the Musk debt sale reveals a complex financial picture. The substantial debt burden presents significant challenges, requiring careful management of cash flow and revenue generation strategies. While the subscription model shows promise, its long-term success remains uncertain. The future of X hinges on its ability to successfully refinance its debt, attract and retain advertisers, and innovate to maintain its position in the competitive social media market. Further monitoring of key financial metrics is crucial for understanding the evolving financial health of X. Continue to follow our analysis for more in-depth insights into X's financials and stay updated on the latest developments impacting X's financial stability.

Featured Posts

-

Double Trouble In Hollywood Actors Join Writers Strike Impacting Film And Tv Production

Apr 28, 2025

Double Trouble In Hollywood Actors Join Writers Strike Impacting Film And Tv Production

Apr 28, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025 -

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025 -

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Hamas Leaders In Cairo For Ceasefire Talks Amid Trumps Gaza Comments

Apr 28, 2025

Hamas Leaders In Cairo For Ceasefire Talks Amid Trumps Gaza Comments

Apr 28, 2025

Latest Posts

-

Updated Richard Jeffersons New Espn Role And Nba Finals Prospects

Apr 28, 2025

Updated Richard Jeffersons New Espn Role And Nba Finals Prospects

Apr 28, 2025 -

Richard Jefferson Espn Promotion And Nba Finals Commentary Status

Apr 28, 2025

Richard Jefferson Espn Promotion And Nba Finals Commentary Status

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025