Could The U.S. Dollar Experience Its Worst Start Since Nixon? An Economic Assessment

Table of Contents

The Legacy of Nixon and the Current Economic Landscape

The Nixon Shock of 1971, which ended the Bretton Woods system and ushered in an era of floating exchange rates, significantly altered the global monetary system. This pivotal moment serves as a cautionary tale, highlighting the fragility of even the most dominant currencies. While a direct comparison between the 1970s and today is imperfect, several parallels exist that warrant careful consideration.

Let's compare key economic indicators:

- Inflation rates: The early 1970s saw runaway inflation, similar to the inflationary pressures experienced in recent years. However, the scale and underlying causes differ somewhat. The 1970s inflation was partly fueled by oil price shocks, whereas today's inflation is a more complex phenomenon involving supply chain disruptions, robust demand and potentially other factors.

- Global geopolitical tensions: Both eras have been marked by significant geopolitical instability. The Cold War dominated the 1970s, while today's global landscape is characterized by rising great power competition and regional conflicts. This instability affects investor confidence and capital flows, impacting currency values.

- The role of the Federal Reserve: Then, the Federal Reserve's response to inflation was arguably slow and ineffective. Now, the Fed is aggressively raising interest rates to combat inflation, a strategy with its own potential drawbacks for the dollar's value.

- Strength of the US economy: The US economy in the early 1970s was facing significant challenges, including stagflation. Today, the US economy is more complex, and while strong in some sectors, it faces challenges like high inflation and a large national debt.

These similarities and differences highlight the complexities in directly comparing the current situation to that of the Nixon era. However, history suggests that a confluence of economic and geopolitical factors can significantly weaken even the most robust currency.

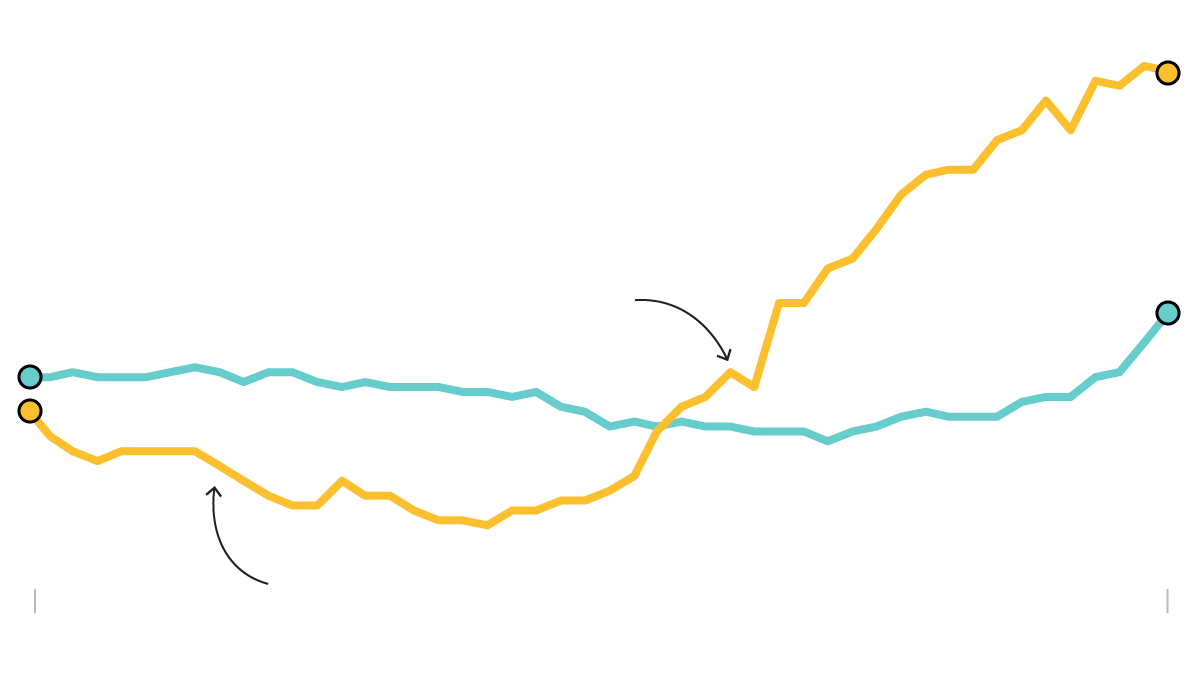

Factors Potentially Leading to a Weak Dollar

Several key factors could combine to produce a historically weak dollar:

Rising Inflation and Interest Rate Hikes

High inflation erodes the purchasing power of a currency, making it less attractive to hold. The Federal Reserve's response – raising interest rates – aims to curb inflation, but it can also strengthen the dollar in the short term by attracting foreign investment seeking higher returns. However, aggressively raising interest rates carries risks, such as slowing economic growth and potentially triggering a recession.

- Potential consequences of aggressive interest rate hikes:

- Reduced economic growth

- Increased unemployment

- Potential for a recession

- Increased borrowing costs for businesses and consumers

Geopolitical Instability and the US Dollar's Role

The U.S. dollar's status as a safe-haven asset is being challenged. Geopolitical instability, such as the war in Ukraine, increases demand for safe assets but also undermines confidence in the global system, potentially driving investors to alternative currencies or assets. The rise of alternative global payment systems also poses a long-term threat to the dollar's dominance.

- Specific geopolitical events and their potential impact on the dollar:

- The war in Ukraine and its impact on energy prices

- Rising tensions between the U.S. and China

- Instability in other key regions of the world

The Growing National Debt and Fiscal Deficit

The U.S. national debt is substantial and continues to grow. A large debt raises concerns about the long-term solvency of the U.S. government and can reduce investor confidence in U.S. assets, potentially weakening the dollar.

- Statistics on US debt and deficit: (Insert relevant statistics here)

- Potential solutions and their impact: Fiscal responsibility and responsible government spending are crucial to maintain investor confidence and ensure the stability of the dollar.

Shifting Global Economic Power Dynamics

The rise of emerging economies like China and India is reshaping the global economic landscape. These nations are accumulating foreign exchange reserves, and a shift away from the dollar as the primary reserve currency could significantly impact its value.

- Examples of emerging economies and their growing influence: China's growing economic clout and its expanding role in international trade and finance are prime examples of this shift.

Conclusion: Assessing the Risk of a Historically Weak Dollar

This economic assessment has highlighted several factors that could contribute to a historically weak U.S. dollar. While the current situation doesn't perfectly mirror the events leading up to the Nixon Shock, the parallels are concerning. The combination of high inflation, geopolitical instability, a large national debt, and shifting global power dynamics creates a complex and uncertain environment for the dollar.

However, it's crucial to acknowledge the dollar's inherent resilience. Its deep integration into global financial markets and its role as a reserve currency provide a degree of stability. Nevertheless, understanding the potential for the US dollar to experience its worst start since Nixon requires ongoing monitoring of these key economic indicators. Continue your economic assessment by following [link to relevant resource, e.g., Federal Reserve website, reputable financial news source].

Featured Posts

-

Yankees 2000 A Game Recap Victory Over The Royals

Apr 28, 2025

Yankees 2000 A Game Recap Victory Over The Royals

Apr 28, 2025 -

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025 -

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025 -

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025 -

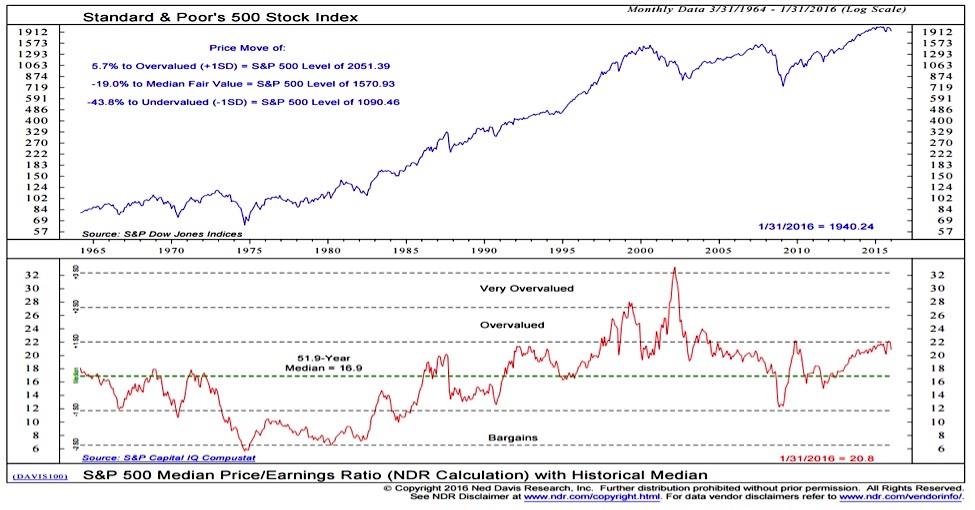

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025

Understanding High Stock Market Valuations A Bof A Viewpoint

Apr 28, 2025

Latest Posts

-

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025