Examining The Financials: The Impact Of Musk's X Debt Sale

Table of Contents

The Scale of the Debt and its Implications

The exact amount of debt raised by Musk for X remains somewhat opaque, but reports suggest a substantial figure, potentially billions of dollars. The intended use of these funds is multifaceted, encompassing everything from paying off existing debt to funding ambitious product development goals and covering operational expenses. This massive debt load carries significant implications:

- Interest Payments and Operational Burden: Servicing such a large debt will require substantial interest payments, potentially placing a significant strain on X's operational budget. This could necessitate cost-cutting measures or hinder investment in new features and improvements.

- Impact on X's Valuation: The increased debt burden could negatively impact X's stock valuation, particularly if the company struggles to demonstrate sufficient revenue growth to justify the debt. Investors may become wary of the increased financial risk associated with X.

- Comparison to Previous Financing: This debt sale represents a significant departure from previous financing rounds and acquisitions undertaken by Musk’s companies. Previous endeavors often relied on a combination of equity financing and debt, but this X debt sale shows a heavier reliance on debt, potentially signaling a higher degree of risk-taking.

The implications of high-interest rates are particularly concerning. Repayment schedules will likely be challenging, especially considering the current economic climate. The type of debt—whether secured or unsecured—and any collateral involved will also influence the overall risk profile. Secured debt, backed by assets, offers some protection to lenders, but it also puts X's assets at risk in case of default.

Impact on X's Financial Stability and Operational Efficiency

The debt sale undoubtedly raises questions about X's long-term financial stability and operational efficiency. Can X's current revenue streams sustainably cover the debt servicing?

- Revenue Streams and Debt Servicing: X's primary revenue sources are advertising, subscriptions, and potentially future revenue streams from integrated payment systems. The challenge lies in determining whether these revenue sources can sufficiently offset the substantial interest payments associated with the newly acquired debt.

- Cost-Cutting Measures: To mitigate the financial burden, X is likely to implement various cost-cutting measures. This could include layoffs, reduced spending on marketing and product development, and a streamlining of operational processes.

- Impact on Product Development and Innovation: The need for cost-cutting may directly impact X’s capacity for product development and innovation. Reduced investment in research and development could stifle growth and hinder the platform's ability to compete effectively in the evolving social media landscape.

Further rounds of funding or even restructuring might be necessary if X fails to demonstrate improved financial performance. The impact on employee morale and retention is also a crucial consideration. Cost-cutting measures, coupled with uncertainty surrounding the platform's future, could lead to a loss of talent and negatively affect productivity.

The Broader Market Reaction and Investor Sentiment

The market's reaction to the news of the debt sale has been largely negative, reflecting concerns about X's financial health and future prospects.

- Stock Market Performance: While X is a privately held company, the debt sale has impacted the perception of its overall valuation. This could influence investor sentiment towards other Musk-related ventures.

- Investor Confidence and Future Prospects: Investor confidence in X’s future is undoubtedly diminished, at least in the short term. The massive debt load introduces considerable financial risk, making it less attractive to potential investors.

- Comparison to Other Tech Companies: The market reaction can be compared to the reactions to similar financial moves by other tech companies. Often, such large-scale debt financing is viewed with caution unless there's a clear demonstration of a plan to use the funds for growth and improved profitability.

Financial news sources have offered varied opinions, with some expressing skepticism about X's ability to service its debt, while others point to potential long-term opportunities. Musk's reputation and track record also play a significant role in shaping investor sentiment.

Alternative Funding Options and Their Consequences

Musk could have explored alternative financing strategies, such as:

- Equity Financing: Raising capital by selling a stake in X would have diluted existing ownership but avoided the burden of debt repayments.

- Strategic Partnerships: Collaborating with other companies could have provided funding and potentially expanded X’s capabilities.

However, the chosen debt financing strategy likely offered Musk greater control over the company's direction and avoided diluting his ownership stake. This decision, however, comes with the significant risk of jeopardizing the company's financial stability if revenue projections fail to materialize.

Conclusion

Musk's debt sale for X has created significant financial implications, impacting its stability, operational efficiency, and market perception. The massive debt burden requires careful management, potentially demanding substantial cost-cutting measures that could affect product development and innovation. Investor sentiment remains cautious, reflecting the increased financial risk. Understanding the ramifications of this debt sale is crucial for comprehending X's future trajectory. Understanding the financial ramifications of Musk's X debt sale is crucial for staying informed about the future of this influential platform. Continue to follow our analysis for further insights into the evolving financial landscape of X and its impact on the broader tech industry. Stay updated on future developments regarding Musk's X debt and its long-term consequences by subscribing to our newsletter.

Featured Posts

-

Laid Off Federal Workers The Difficult Transition To State And Local Jobs

Apr 28, 2025

Laid Off Federal Workers The Difficult Transition To State And Local Jobs

Apr 28, 2025 -

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025 -

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025 -

Last Chance Hudsons Bay Liquidation Sale With 70 Off

Apr 28, 2025

Last Chance Hudsons Bay Liquidation Sale With 70 Off

Apr 28, 2025 -

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025

Latest Posts

-

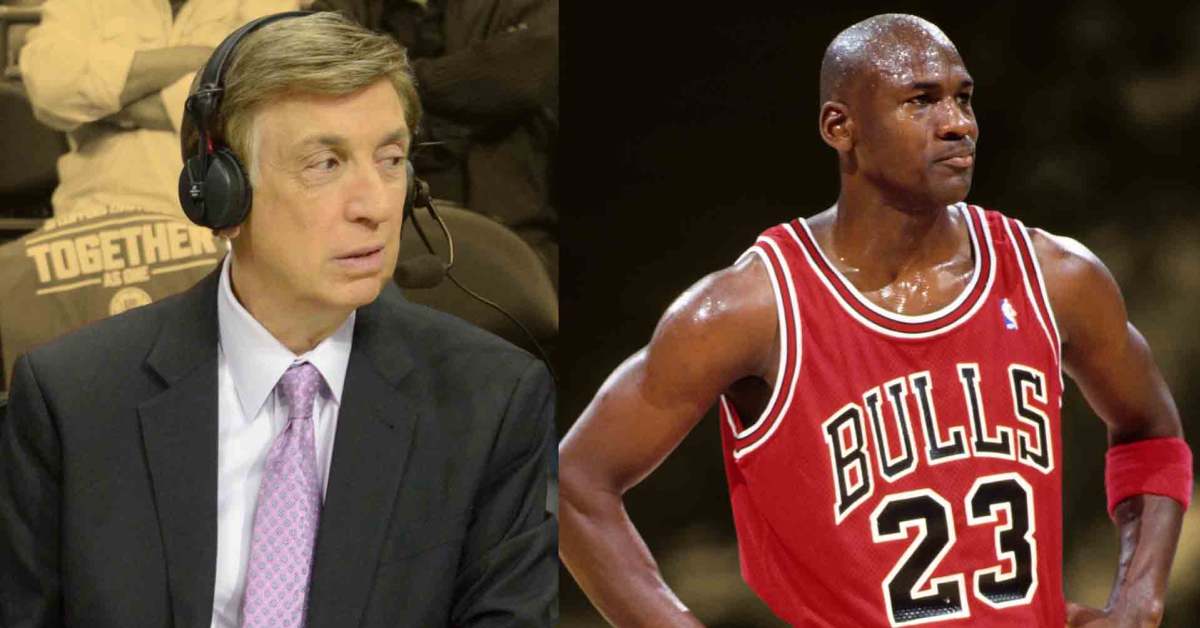

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

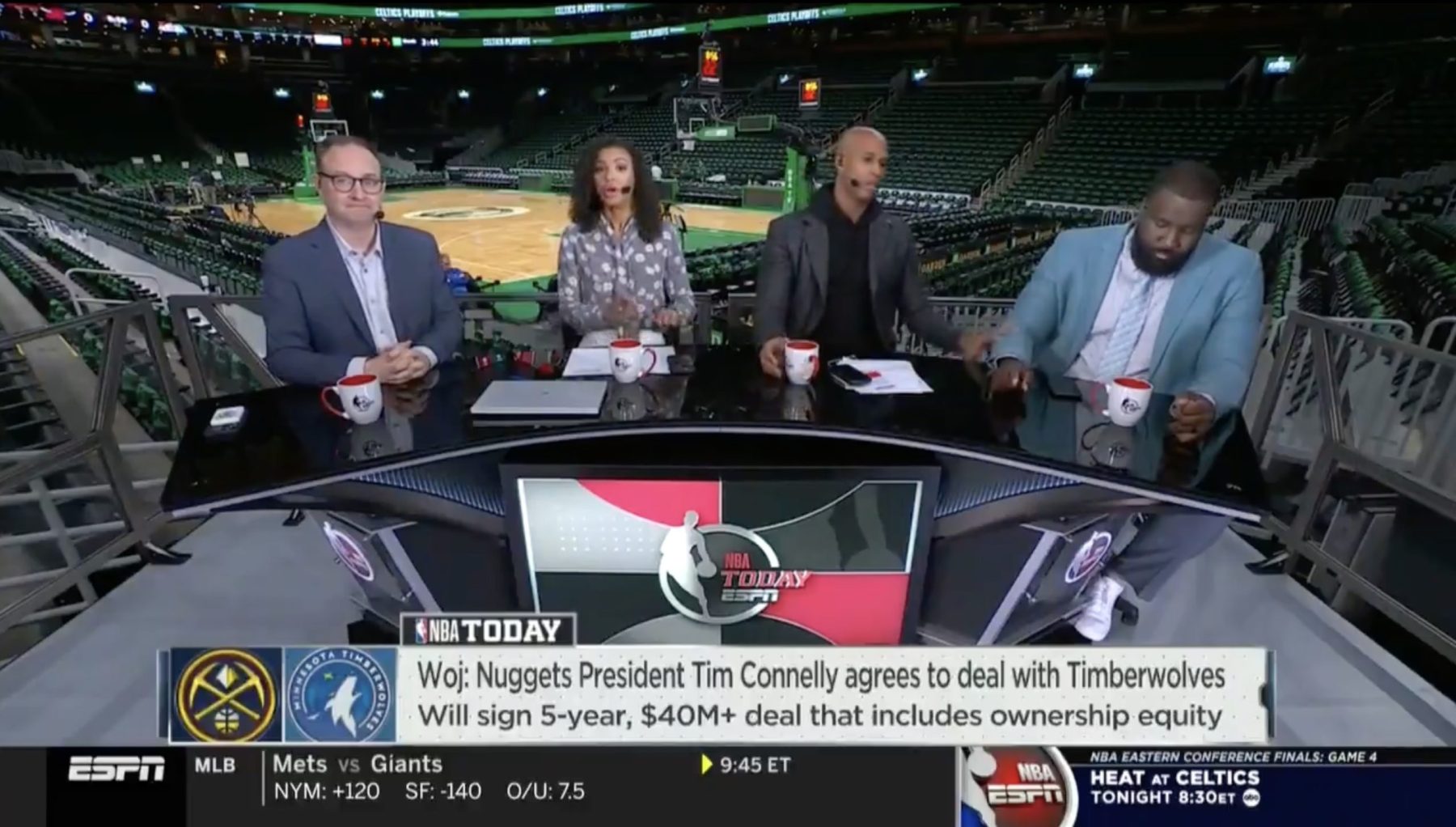

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025 -

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025