Bitcoin Price Prediction: Analyzing The Potential Impact Of Trump's Economic Plans

Table of Contents

Understanding Trump's Economic Legacy and its Ripple Effects

Trump's economic policies, characterized by significant fiscal maneuvers and a focus on deregulation, had profound and multifaceted consequences for the global economy. Understanding these ripples is key to predicting Bitcoin's price trajectory.

Fiscal Policy and its Influence on Bitcoin

Trump's administration implemented substantial tax cuts and increased government spending. These policies aimed to stimulate economic growth, but they also had implications for inflation and investor sentiment:

- Increased Inflation: Stimulus packages and tax cuts can lead to increased inflation, potentially driving investors towards alternative assets like Bitcoin as a hedge against inflation erosion.

- Investor Sentiment: Positive economic growth fueled by these policies could boost investor confidence, potentially leading to increased investment in riskier assets, including Bitcoin. Conversely, concerns about rising inflation could trigger the same effect.

- Regulatory Changes: While Trump's administration didn't implement specific Bitcoin regulations, the overall regulatory environment affected investor confidence. Any hint of increased regulatory scrutiny could negatively impact Bitcoin's price.

These policies' impact on the US dollar is crucial. A weakening dollar could increase the demand for Bitcoin, driving its price upwards, whereas a strengthening dollar might have the opposite effect.

Trade Wars and Global Market Instability

Trump's trade policies, including tariffs and trade disputes, significantly impacted global market stability. This uncertainty can influence investment decisions in various asset classes:

- Increased Volatility: Trade wars introduce considerable uncertainty into global markets, making investors seek safer havens or alternatively, opportunities in volatile markets.

- Safe Haven or Risky Asset?: Bitcoin's position as a safe haven or risky asset is a subject of ongoing debate. In times of uncertainty, some investors might flock to Bitcoin as a decentralized store of value, while others might view it as too volatile during periods of instability.

- Examples: The trade disputes with China during Trump's presidency created significant market uncertainty, impacting Bitcoin's price in unpredictable ways. Analyzing these periods can offer valuable insights.

The correlation between global market volatility and Bitcoin's price fluctuations is well-documented, making trade-related instability a critical factor in any Bitcoin price prediction.

Deregulation and its Implications for Cryptocurrencies

Trump's administration's overall approach to deregulation could have had indirect but significant effects on the cryptocurrency market:

- Increased Adoption: A less regulated environment could potentially encourage wider adoption of cryptocurrencies, boosting Bitcoin's price.

- Investor Confidence: Regulatory clarity (or lack thereof) is a key driver of investor confidence. Uncertainty regarding the regulatory landscape can hinder Bitcoin's price growth.

- Innovation: A more relaxed regulatory environment could stimulate innovation within the cryptocurrency sector, which could, in turn, positively affect Bitcoin’s price.

The lack of explicit cryptocurrency regulation under Trump’s administration left the space relatively open, yet this lack of clarity could also be seen as a source of uncertainty for some investors.

Analyzing Historical Bitcoin Price Movements in Relation to Trump's Actions

To improve the accuracy of our Bitcoin price prediction, analyzing historical price movements in relation to specific Trump administration actions is vital.

Correlation Analysis

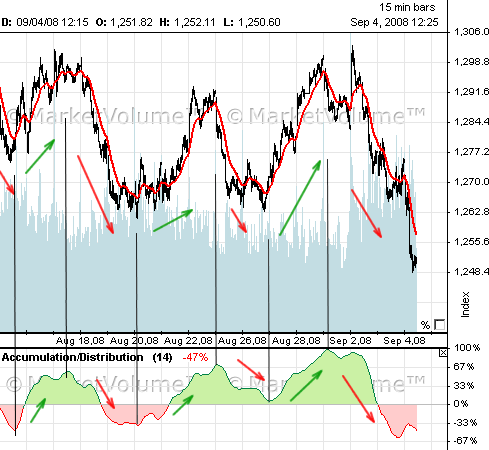

We can use econometric techniques to investigate correlations between specific policy decisions (e.g., tax cuts announcements, tariff implementations) and subsequent Bitcoin price movements.

- Data Sources: Reliable data sources for both Bitcoin prices and policy announcements are essential for conducting a robust analysis.

- Visual Representation: Charts and graphs will visually illustrate the correlations (or lack thereof) between these variables, making the data easier to understand.

- Limitations: Acknowledging limitations in correlation analysis, such as confounding factors and spurious correlations, is crucial for interpreting the results accurately.

While correlation doesn't equal causation, identifying patterns in historical data can provide valuable insights.

Case Studies of Past Events

Analyzing specific events during Trump's presidency, along with their impact on Bitcoin's price, provides valuable real-world examples:

- Tax Cut Announcement: Examining the Bitcoin price reaction following the announcement of the tax cut legislation can help us understand the market's response to significant fiscal policy changes.

- Trade War Escalation: Analyzing Bitcoin's behavior during periods of escalating trade tensions helps us understand its role as a safe haven or risky asset in times of global uncertainty.

Detailed case studies allow for a nuanced understanding of the complex interplay between macroeconomic events and Bitcoin's price.

Predicting Future Bitcoin Price Based on Potential Economic Scenarios

Based on our analysis of Trump's economic legacy and historical data, we can develop several potential scenarios for Bitcoin's future price:

Scenario 1: Continued Economic Growth

If the post-Trump economy continues to experience robust growth, several factors could impact Bitcoin's price:

- Increased Institutional Investment: Strong economic conditions might attract institutional investors to Bitcoin, driving up demand and price.

- Higher Demand: Increased investor confidence and broader market enthusiasm could fuel higher demand for Bitcoin.

This scenario suggests a potentially positive outlook for Bitcoin's price.

Scenario 2: Economic Slowdown or Recession

A significant economic slowdown or recession could drastically alter Bitcoin's price trajectory:

- Flight to Safety: Investors might move toward perceived safe-haven assets, which could negatively impact Bitcoin's price, depending on whether it's viewed as a safe haven or not.

- Decreased Demand: Economic uncertainty might cause a decrease in investment in riskier assets like Bitcoin.

This scenario points toward a potentially more bearish outlook for Bitcoin.

Scenario 3: Unexpected Political or Geopolitical Events

Unforeseen events, such as geopolitical crises or unexpected policy shifts, can introduce significant volatility into the Bitcoin market:

- Significant Price Swings: Such events can cause dramatic and unpredictable price swings in Bitcoin.

- Market Uncertainty: The unpredictable nature of these events makes accurate price prediction extremely difficult.

Conclusion: Bitcoin Price Prediction: Key Takeaways and Call to Action

Predicting Bitcoin's price is a complex endeavor, but considering macroeconomic factors like the lingering impact of Trump's economic policies is crucial. Our analysis revealed several potential scenarios, ranging from continued growth leading to increased institutional investment and higher demand, to economic downturns leading to decreased demand. Unexpected events remain a significant wildcard. Remember that correlation doesn't equal causation, and numerous other factors influence Bitcoin's price.

Therefore, while this article offers insights into the potential impact of Trump's economic legacy on Bitcoin's price, it's crucial to conduct your own thorough research and stay updated on economic news and regulatory changes. Continue to monitor the Bitcoin price prediction landscape, engaging in your own Bitcoin price analysis and Bitcoin price forecast to refine your understanding of this dynamic market. Develop your own Bitcoin price prediction strategy by staying informed and conducting diligent research.

Featured Posts

-

Comparaison De Capacites Geometriques Corneilles Vs Babouins

May 08, 2025

Comparaison De Capacites Geometriques Corneilles Vs Babouins

May 08, 2025 -

Canada Post Strike Looms Potential Service Disruptions Later This Month

May 08, 2025

Canada Post Strike Looms Potential Service Disruptions Later This Month

May 08, 2025 -

Psg Nantes Maci 0 0 Berabere Sonuc

May 08, 2025

Psg Nantes Maci 0 0 Berabere Sonuc

May 08, 2025 -

Kripto Para Piyasasinda Wall Street In Artan Etkisi

May 08, 2025

Kripto Para Piyasasinda Wall Street In Artan Etkisi

May 08, 2025 -

The Bitcoin Rebound What Investors Need To Know

May 08, 2025

The Bitcoin Rebound What Investors Need To Know

May 08, 2025

Latest Posts

-

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025 -

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025 -

Ethereum Nears 2 700 Wyckoff Accumulation Signals Bullish Trend

May 08, 2025

Ethereum Nears 2 700 Wyckoff Accumulation Signals Bullish Trend

May 08, 2025