Ethereum Nears $2,700: Wyckoff Accumulation Signals Bullish Trend

Table of Contents

Ethereum (ETH) is making headlines as its price approaches the significant $2,700 mark. This surge isn't just random; technical analysis, particularly the Wyckoff Accumulation pattern, suggests a potential bullish trend for the leading altcoin. This article delves into the technical indicators pointing towards a sustained price increase and explores what this could mean for Ethereum investors. We'll examine the confluence of on-chain data and classic chart patterns to assess the validity of this bullish Ethereum price prediction.

Understanding Wyckoff Accumulation in Ethereum's Price Action

The Wyckoff Accumulation method is a technical analysis technique used to identify periods of price consolidation before a significant price increase. It postulates that large players, often referred to as "smart money," accumulate assets at lower prices before a major upward price movement. Key phases of Wyckoff Accumulation include:

- Spring: A sharp, but relatively small, price drop designed to shake out weak holders.

- Sign of Weakness (SOW): A further price decline that tests the resolve of remaining holders. This phase often confirms the accumulation process.

- Secondary Test (ST): A final test of the support level, often followed by a significant price increase.

(Insert a chart here showing Ethereum's recent price movement and highlighting a potential Wyckoff Accumulation pattern. Clearly mark the Spring, SOW, and ST phases.)

In the recent ETH price chart, we can observe a potential Wyckoff Accumulation pattern. The price has consolidated around a specific support level, exhibiting characteristics consistent with the phases described above. Furthermore, the increasing volume during this consolidation period, coupled with a positive RSI divergence (rising RSI despite falling price), further strengthens the argument for accumulation. This suggests that large players are accumulating ETH, anticipating a future price increase.

On-Chain Data Supporting the Bullish Ethereum Trend

Beyond technical analysis, on-chain data provides compelling support for the bullish Ethereum trend. Several key metrics paint a picture of growing network activity and adoption:

- Increasing Active Addresses: A rising number of unique addresses interacting with the Ethereum network indicates growing user engagement and adoption. (Insert a chart here showing the trend of increasing active addresses.)

- Rising Gas Fees: Higher gas fees, while potentially inconvenient for users, often signify increased network activity and demand for transaction processing. (Insert a chart showing the trend of gas fees.)

- Growth in DeFi Activity: The flourishing Decentralized Finance (DeFi) ecosystem built on Ethereum continues to attract users and capital, boosting demand for ETH. (Insert a chart showing the growth of Total Value Locked (TVL) in DeFi on Ethereum.)

The combination of these on-chain metrics strongly correlates with the Wyckoff Accumulation theory. The increased network activity suggests a growing underlying demand for ETH, supporting the potential for a sustained price increase.

Potential Catalysts for Further Ethereum Price Growth

Several catalysts could further fuel Ethereum's price growth:

- Ethereum Upgrades: Upcoming upgrades and improvements to the Ethereum network, such as the continued rollout of sharding, will enhance scalability and efficiency, attracting more users and developers.

- New DeFi Applications: The constantly evolving DeFi landscape on Ethereum promises innovation and new applications, driving demand for ETH as collateral and transaction fees.

- Institutional Adoption: Growing institutional interest in Ethereum, with large financial institutions exploring and integrating ETH into their portfolios, could significantly boost demand.

Macro-economic factors, such as Bitcoin's performance and overall market sentiment, also play a role. A positive trend in Bitcoin often correlates with gains in altcoins like Ethereum.

Risk Factors and Considerations for Ethereum Investment

While the outlook appears bullish, it’s crucial to acknowledge inherent risks:

- Market Volatility: The cryptocurrency market is notoriously volatile, and Ethereum's price can experience significant swings.

- Regulatory Uncertainty: Regulatory developments in different jurisdictions can impact the price and adoption of cryptocurrencies.

- Market Corrections: Even with bullish signs, market corrections are a normal part of the cycle.

Therefore, thorough research and a well-diversified investment portfolio are essential. Only invest what you can afford to lose.

Conclusion

Ethereum's price nearing $2,700, coupled with the evidence of a potential Wyckoff Accumulation pattern and supporting on-chain data, paints a picture suggesting a bullish trend. While potential catalysts for further growth exist, it's crucial to remember the inherent volatility of the cryptocurrency market and consider potential downsides. Conduct your own thorough research before making any investment decisions. Is Ethereum's price surge signaling a strong bullish trend, or just a temporary peak? Stay informed about the latest developments in the Ethereum market and continue your research on Ethereum price prediction and Wyckoff Accumulation to make informed investment choices.

Featured Posts

-

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025 -

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025 -

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025 -

Kripto Para Yatirimlarinda Dikkat Rusya Merkez Bankasi Nin Son Uyarisi

May 08, 2025

Kripto Para Yatirimlarinda Dikkat Rusya Merkez Bankasi Nin Son Uyarisi

May 08, 2025 -

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Latest Posts

-

Marriyum Aurangzeb Explains Lahore Zoos Ticket Price Increase

May 08, 2025

Marriyum Aurangzeb Explains Lahore Zoos Ticket Price Increase

May 08, 2025 -

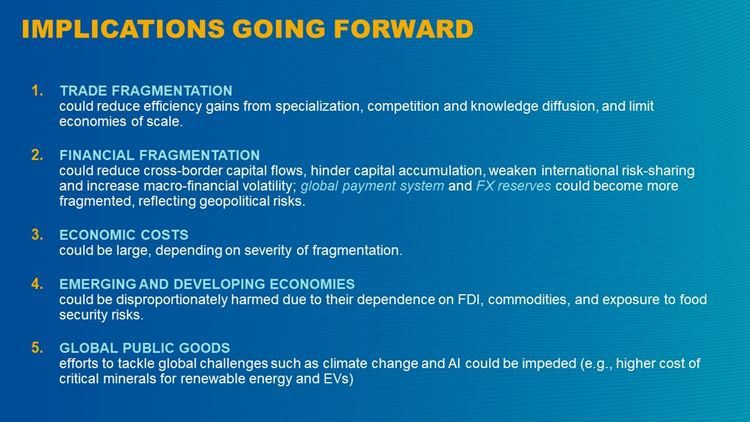

The Great Decouplings Impact On Geopolitics And Trade

May 08, 2025

The Great Decouplings Impact On Geopolitics And Trade

May 08, 2025 -

Is This Cryptocurrency Immune To Trade War Effects

May 08, 2025

Is This Cryptocurrency Immune To Trade War Effects

May 08, 2025 -

Analyzing The Great Decoupling Trends And Forecasts

May 08, 2025

Analyzing The Great Decoupling Trends And Forecasts

May 08, 2025 -

Cryptocurrency Investment Weathering The Trade War Storm

May 08, 2025

Cryptocurrency Investment Weathering The Trade War Storm

May 08, 2025