The Bitcoin Rebound: What Investors Need To Know

Table of Contents

Analyzing the Drivers Behind the Bitcoin Rebound

Several interconnected factors contribute to the current Bitcoin rebound. Let's delve into the key elements shaping this dynamic market.

Macroeconomic Factors

Global macroeconomic conditions significantly impact Bitcoin's price. The narrative of Bitcoin as a safe-haven asset gains traction during times of economic uncertainty.

- Inflation: High inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin more attractive. As a limited supply asset, Bitcoin's value can potentially increase as a hedge against inflation.

- Interest Rates: Rising interest rates can negatively impact the overall market, but they can also lead investors to seek assets perceived as less risky, potentially benefiting Bitcoin.

- Quantitative Easing: Monetary policies like quantitative easing, while initially stimulating growth, can also lead to inflationary pressures, potentially boosting the demand for Bitcoin as a store of value. The impact of these quantitative easing measures on Bitcoin price prediction remains a subject of ongoing debate.

These macroeconomic factors, especially high inflation and uncertainty, are key drivers of the current Bitcoin price.

Regulatory Developments and Institutional Adoption

Regulatory clarity and increasing institutional involvement significantly influence investor confidence.

- Bitcoin Regulation: While regulatory frameworks vary across jurisdictions, growing clarity around Bitcoin regulation can foster investor confidence and potentially drive further price appreciation. Conversely, regulatory uncertainty can create volatility.

- Institutional Investment: The entry of institutional investors, such as large corporations and investment funds, adds significant capital to the market and lends credibility to Bitcoin as an asset class. The approval of Bitcoin ETFs could further catalyze institutional participation.

- Grayscale Bitcoin Trust (GBTC): The performance and market sentiment surrounding GBTC often reflect the overall trajectory of Bitcoin. Its developments are an important signal to track.

Positive developments in these areas have significantly bolstered the Bitcoin rebound.

Technological Advancements and Network Upgrades

Ongoing technological improvements within the Bitcoin ecosystem enhance its functionality and appeal.

- Lightning Network: The adoption of the Lightning Network significantly improves Bitcoin's transaction speed and scalability, addressing long-standing concerns.

- Taproot Upgrade: The Taproot upgrade enhanced Bitcoin's privacy and efficiency, making transactions more secure and cost-effective.

- Bitcoin Scalability: Ongoing developments aimed at improving Bitcoin scalability are crucial for long-term adoption and price stability.

These Bitcoin network upgrades address key technical challenges and positively influence investor sentiment, contributing to the current Bitcoin rebound.

Assessing the Risks and Potential Rewards of Investing in the Rebound

While the Bitcoin rebound offers potential rewards, it's crucial to acknowledge the inherent risks.

Volatility and Price Fluctuations

Bitcoin is notoriously volatile, and sharp price corrections are possible. Investors must be prepared for significant price swings.

- Risk Management: Employing effective risk management strategies, such as diversifying investments and setting stop-loss orders, is essential to mitigate potential losses.

- Crypto Trading Strategies: Sophisticated crypto trading strategies, like hedging and arbitrage, can help manage risk during volatile periods but require expertise.

Market Sentiment and Psychological Factors

Investor psychology plays a significant role in Bitcoin's price fluctuations.

- FOMO (Fear of Missing Out): The FOMO effect can drive impulsive investment decisions, leading to potentially risky market participation.

- Market Manipulation: The possibility of market manipulation remains a concern, emphasizing the need for caution and independent analysis.

- Social Media Influence: The impact of social media influence on market sentiment can be significant, making it crucial to discern credible information from hype.

Strategies for Navigating the Bitcoin Rebound

A well-defined investment strategy is key to successfully navigating the Bitcoin rebound.

Diversification and Portfolio Allocation

Diversifying your investment portfolio across various asset classes is crucial to mitigating risk.

- Risk Tolerance: Understand your risk tolerance before investing in Bitcoin and allocate funds accordingly.

- Asset Allocation: A well-defined asset allocation strategy ensures your investment aligns with your risk profile and financial goals.

- Long-Term Investment Plans: A long-term investment approach helps weather market fluctuations and capitalize on potential long-term growth.

Dollar-Cost Averaging and Other Investment Techniques

Employing smart investment techniques can help optimize returns and manage risk.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount at regular intervals, reducing the impact of market volatility.

- Value Investing: Principles of value investing, focusing on undervalued assets, can be applied to Bitcoin by identifying potential buying opportunities based on fundamental analysis.

- Bitcoin Trading Strategies: Explore various Bitcoin trading strategies to potentially maximize returns during periods of increased volatility.

Conclusion: Making Informed Decisions About the Bitcoin Rebound

The Bitcoin rebound is driven by a confluence of macroeconomic factors, regulatory developments, technological advancements, and investor sentiment. While the potential rewards are enticing, significant risks are inherent. Understanding these factors and implementing appropriate risk management strategies is crucial for informed investment decisions. Remember to conduct thorough research, assess your risk tolerance, and consider consulting a financial advisor before investing in Bitcoin. Stay informed about the Bitcoin rebound and make informed investment decisions based on thorough research and risk assessment. Further explore Bitcoin investment strategies and Bitcoin market analysis to refine your approach.

Featured Posts

-

The Countrys Hottest New Business Locations A Geographic Analysis

May 08, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025 -

Choosing Between Micro Strategy Stock And Bitcoin In 2025

May 08, 2025

Choosing Between Micro Strategy Stock And Bitcoin In 2025

May 08, 2025 -

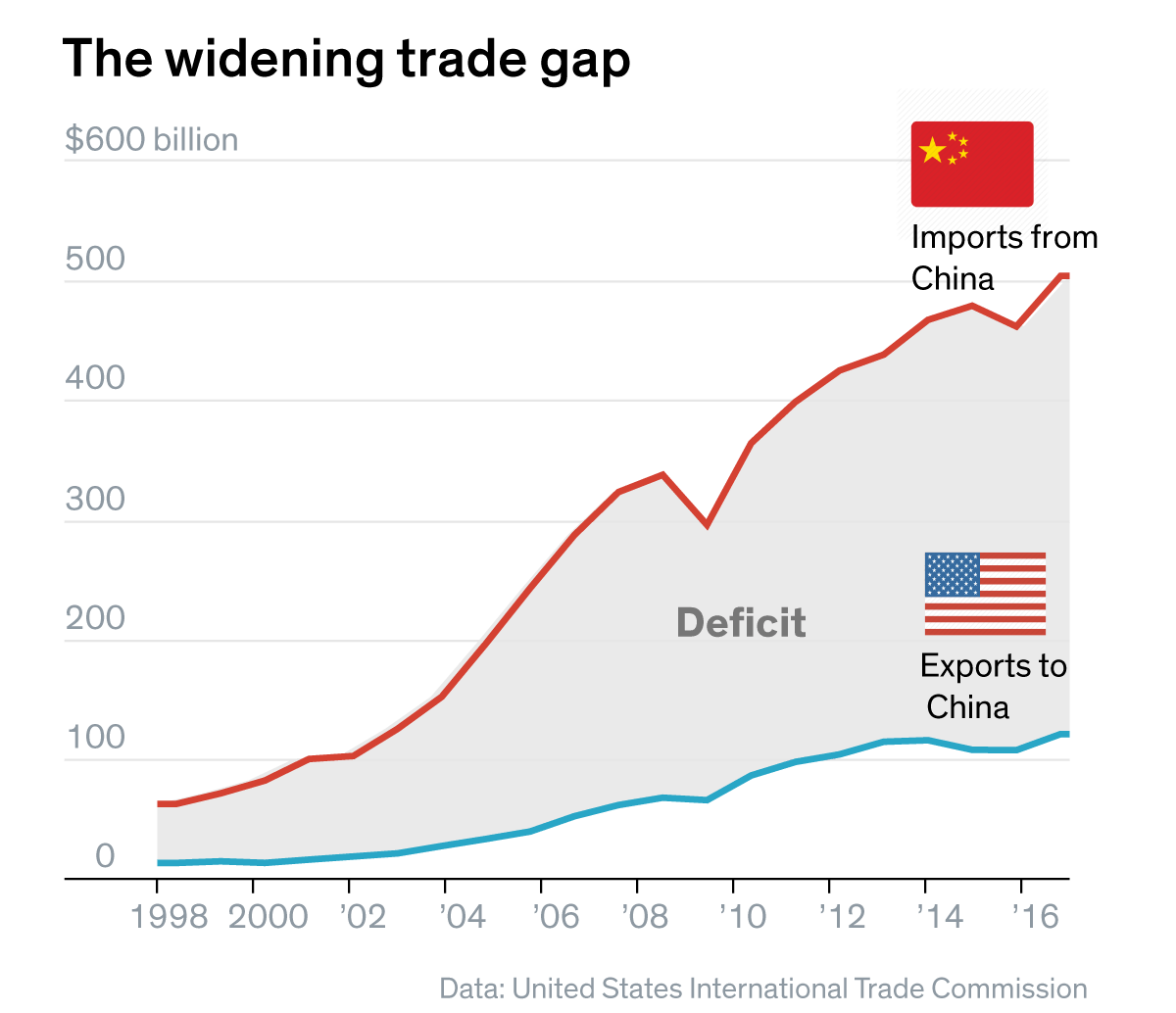

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025 -

Improved Graphics Best Ps 5 Pro Enhanced Exclusive Titles

May 08, 2025

Improved Graphics Best Ps 5 Pro Enhanced Exclusive Titles

May 08, 2025

Latest Posts

-

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025 -

Kripto Lider Yatirimcilar Icin Yeni Bir Firsat Mi Degerlendirmesi

May 08, 2025

Kripto Lider Yatirimcilar Icin Yeni Bir Firsat Mi Degerlendirmesi

May 08, 2025 -

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025