10x Bitcoin Price Prediction: A Wall Street Earthquake?

Table of Contents

Factors Fueling a Potential 10x Bitcoin Price Surge

Several key factors could contribute to a tenfold increase in Bitcoin's price. While no one can predict the future with certainty, analyzing these trends offers valuable insights into the potential for such a dramatic rise.

Increasing Institutional Adoption

Major financial institutions are increasingly recognizing Bitcoin's potential. This institutional Bitcoin adoption is a significant driver of price appreciation.

- Examples of institutional investments: Companies like MicroStrategy have made substantial Bitcoin purchases, demonstrating a growing confidence in its long-term value. Similarly, the Grayscale Bitcoin Trust holds a massive amount of Bitcoin, representing a significant institutional investment.

- Corporate Bitcoin investment: Beyond MicroStrategy, numerous other corporations are adding Bitcoin to their balance sheets, diversifying their holdings and hedging against inflation. This growing trend signals a shift in how institutional investors view Bitcoin, moving from a speculative asset to a strategic one.

- Keyword integration: institutional Bitcoin adoption, corporate Bitcoin investment.

Global Macroeconomic Uncertainty and Inflation

Global macroeconomic uncertainty and persistently high inflation rates are pushing investors towards alternative assets like Bitcoin. Bitcoin's deflationary nature and limited supply make it an attractive hedge against inflation and economic instability.

- Discussion of inflation rates: High inflation erodes the purchasing power of fiat currencies, driving investors to seek assets that retain their value.

- Examples of geopolitical events impacting markets: Geopolitical events, such as wars and sanctions, often lead to market volatility and investor uncertainty, further boosting Bitcoin's appeal as a safe haven asset.

- Bitcoin's role as a store of value: Many investors see Bitcoin as a store of value, similar to gold, offering a potential hedge against inflation and economic turmoil.

- Keyword integration: Bitcoin inflation hedge, Bitcoin as a safe haven asset.

Growing Network Effects and Developer Activity

The increasing usage of Bitcoin and the ongoing development of its underlying technology contribute to its long-term growth. A stronger network effect makes Bitcoin more valuable and resilient.

- Number of Bitcoin transactions: The increasing number of daily transactions indicates growing adoption and usage.

- Lightning Network adoption: The Lightning Network, a layer-2 scaling solution, is enhancing Bitcoin's scalability and transaction speed, making it more practical for everyday use.

- Development of new Bitcoin applications: The Bitcoin ecosystem is constantly evolving, with new applications and services being developed, further solidifying its position as a leading cryptocurrency.

- Keyword integration: Bitcoin network growth, Bitcoin development activity, Bitcoin scalability.

Scarcity and Halving Events

Bitcoin's fixed supply of 21 million coins is a key driver of its potential for long-term price appreciation. Halving events, which reduce the rate of new Bitcoin creation, further contribute to scarcity.

- Bitcoin's fixed supply: Unlike fiat currencies, Bitcoin has a limited supply, making it inherently scarce and potentially more valuable over time.

- Explanation of the halving mechanism: Every four years, the reward for Bitcoin miners is halved, reducing the rate of new Bitcoin entering circulation.

- Historical price movements after halving events: Historically, halving events have been followed by periods of price appreciation, highlighting the impact of scarcity on Bitcoin's value.

- Keyword integration: Bitcoin halving, Bitcoin scarcity, Bitcoin supply.

Challenges and Potential Roadblocks to a 10x Prediction

While a 10x Bitcoin price prediction is enticing, several challenges and potential roadblocks could hinder its realization.

Regulatory Uncertainty and Government Intervention

Government regulations and policies towards cryptocurrencies pose significant uncertainty. Increased regulation could stifle Bitcoin's growth and adoption.

- Examples of regulatory actions in different countries: Different countries have adopted varying regulatory approaches, creating uncertainty and potential headwinds for Bitcoin's global adoption.

- Potential for increased regulation: Governments worldwide are increasingly scrutinizing cryptocurrencies, and further regulation could impact Bitcoin's price.

- Keyword integration: Bitcoin regulation, government Bitcoin policy.

Market Volatility and Price Corrections

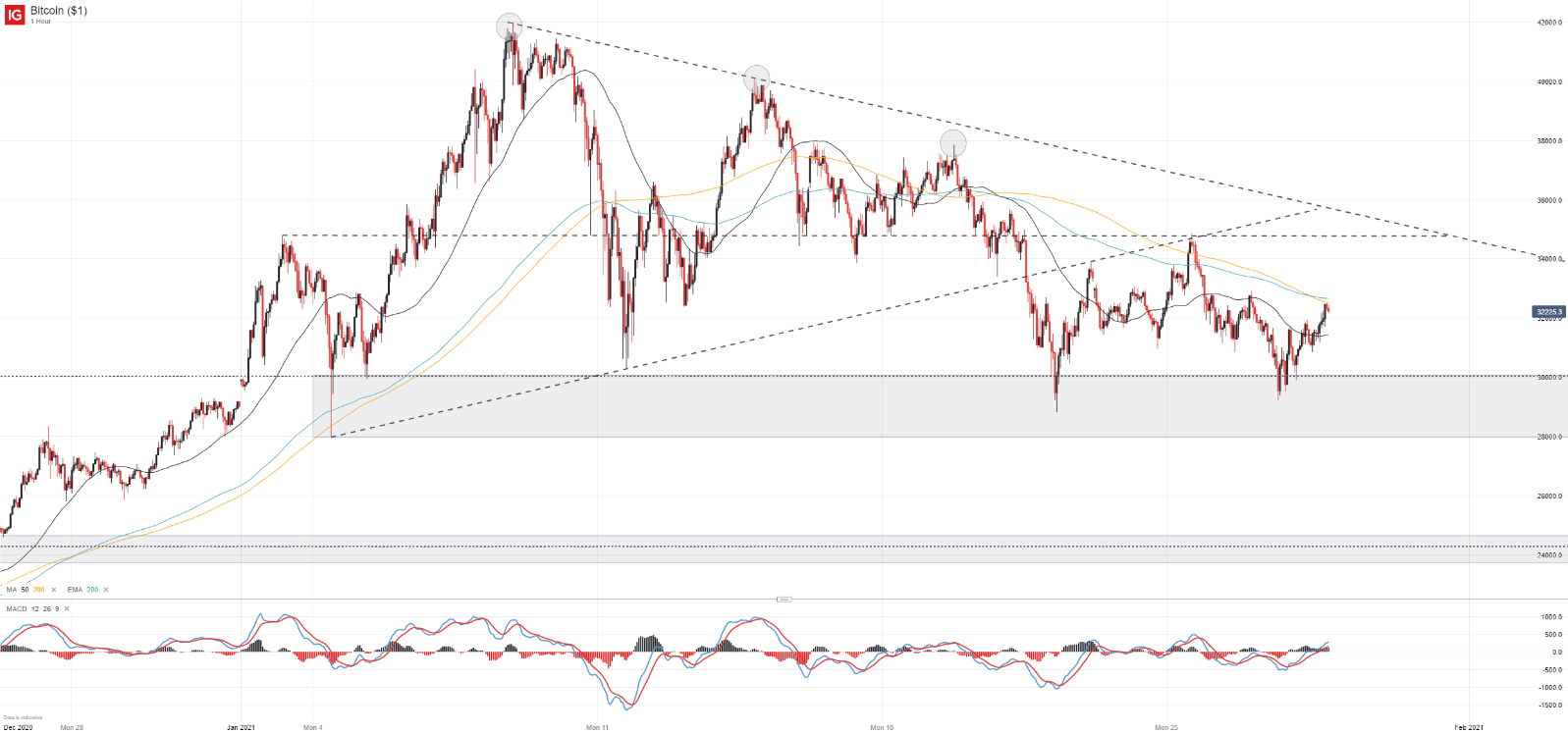

The cryptocurrency market is inherently volatile. Significant price corrections are common, and a 10x price increase would likely involve substantial fluctuations.

- Historical price fluctuations: Bitcoin's history is characterized by periods of rapid growth followed by significant price drops.

- Analysis of bear markets: Understanding the dynamics of bear markets is crucial for assessing the risks associated with a 10x price prediction.

- Keyword integration: Bitcoin volatility, Bitcoin price correction.

Competition from Other Cryptocurrencies

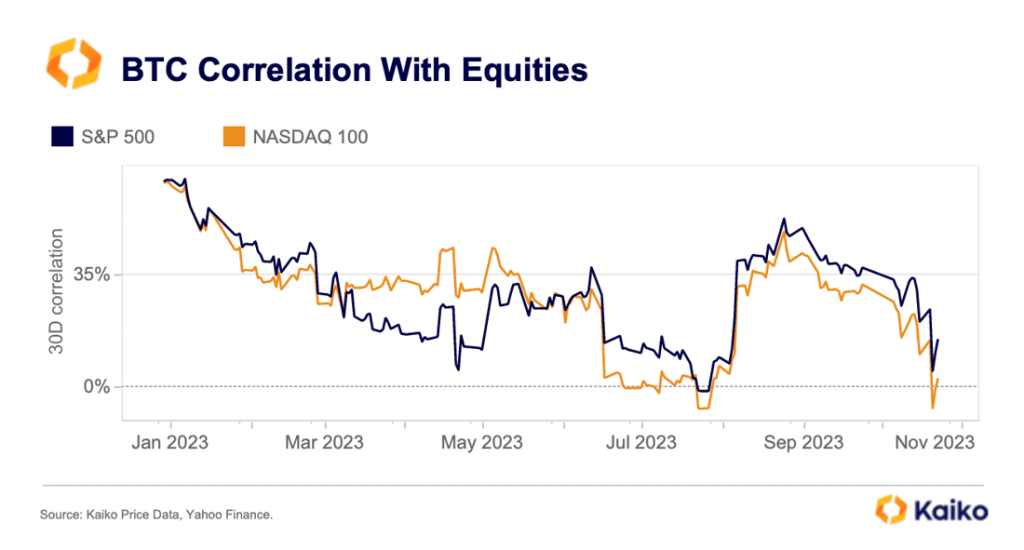

The cryptocurrency landscape is highly competitive. The emergence of other cryptocurrencies, particularly altcoins, could potentially challenge Bitcoin's dominance.

- Discussion of Ethereum, other major cryptocurrencies: Ethereum and other cryptocurrencies offer different functionalities and features, potentially attracting investors away from Bitcoin.

- Market share analysis: Monitoring Bitcoin's market share relative to other cryptocurrencies is important for understanding its long-term potential.

- Keyword integration: Bitcoin vs altcoins, Bitcoin market dominance.

Conclusion

A 10x Bitcoin price prediction represents a bold, yet not impossible, scenario. While factors like increasing institutional adoption, macroeconomic uncertainty, network growth, and Bitcoin's inherent scarcity could fuel such a surge, challenges like regulatory uncertainty, market volatility, and competition from altcoins remain significant obstacles. The potential impact on Wall Street and the global financial system would be profound. This 10x Bitcoin potential is a topic that demands careful consideration. Conduct your own thorough research and analysis before making any investment decisions. Don't solely rely on price predictions. Consider diversifying your investment portfolio and developing a robust Bitcoin investment strategy. The future of Bitcoin is uncertain, but its disruptive potential is undeniable. Explore further resources on Bitcoin price prediction analysis to gain a deeper understanding of this dynamic market.

Featured Posts

-

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025 -

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025 -

Bitcoin In Rally Zone Analysts Chart Suggests Potential Upswing May 6th

May 08, 2025

Bitcoin In Rally Zone Analysts Chart Suggests Potential Upswing May 6th

May 08, 2025 -

Is Rogue The Right Choice For X Men Leader

May 08, 2025

Is Rogue The Right Choice For X Men Leader

May 08, 2025 -

Where To Stream Los Angeles Angels Games A 2025 Guide

May 08, 2025

Where To Stream Los Angeles Angels Games A 2025 Guide

May 08, 2025

Latest Posts

-

Decoding The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025

Decoding The Ethereum Weekly Chart A Buy Signal Emerges

May 08, 2025 -

Ethereums Price Action Conquering Resistance Targeting 2 000

May 08, 2025

Ethereums Price Action Conquering Resistance Targeting 2 000

May 08, 2025 -

Is Ethereums Price Rise Sustainable Bullish Market Analysis

May 08, 2025

Is Ethereums Price Rise Sustainable Bullish Market Analysis

May 08, 2025 -

Ethereum Price Plunge 67 M In Liquidations Spark Concerns

May 08, 2025

Ethereum Price Plunge 67 M In Liquidations Spark Concerns

May 08, 2025 -

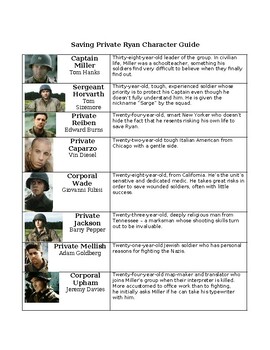

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025

The 10 Greatest Characters From Saving Private Ryan

May 08, 2025