Ethereum Price Plunge: $67M In Liquidations Spark Concerns

Causes of the Ethereum Price Plunge

The sharp decline in Ethereum's price, impacting many ETH holders, wasn't a singular event but rather a confluence of factors. Understanding these contributing elements is key to grasping the severity of the situation and predicting future price movements.

Macroeconomic Factors

Broader market trends significantly influence cryptocurrency prices, including Ethereum. The current macroeconomic climate plays a crucial role.

- Correlation between stock market performance and ETH price: Historically, a negative correlation exists between traditional markets and cryptocurrencies. When stock markets decline, often due to factors like inflation or interest rate hikes, investors tend to move towards safer assets, leading to sell-offs in riskier investments like crypto.

- Impact of regulatory uncertainty on investor sentiment: Regulatory uncertainty regarding cryptocurrencies in various jurisdictions creates significant volatility. Fear of impending regulations or stricter enforcement can trigger mass sell-offs as investors seek to minimize their exposure to potential legal ramifications.

- Influence of overall risk aversion in the market: During periods of high risk aversion, investors tend to divest from volatile assets, including cryptocurrencies. This flight to safety often exacerbates price drops in already fragile markets.

Specific Events Triggering the Drop

Beyond macroeconomic pressures, specific events can act as catalysts for significant price drops.

- Mention specific negative news stories: For example, negative news concerning a major Ethereum-based project, a significant security breach on a DeFi platform, or regulatory actions targeting specific crypto exchanges can all contribute to a sudden price decline. These events often trigger panic selling, further accelerating the drop.

- Explain the impact of large-scale sell orders on liquidity: Large sell orders can overwhelm the market's liquidity, leading to a sharp and rapid decline in price. This is particularly true in less liquid markets, where even moderate sell pressure can lead to significant price drops.

- Discussion of any significant changes in market sentiment: Shifting market sentiment, fueled by news, social media trends, or influencer opinions, can also significantly impact Ethereum's price. Negative sentiment can lead to widespread sell-offs, amplifying the impact of other factors.

The Role of Liquidations

The $67 million in liquidations represents a crucial aspect of this price plunge.

- Explain the mechanism of liquidations in decentralized finance (DeFi): In DeFi, liquidations occur when borrowers fail to maintain the required collateralization ratio for their loans. This triggers the automatic sale of their collateral (often ETH) to repay the loan, further depressing the price.

- Impact of liquidations on overall market stability: Mass liquidations can create a cascading effect, further destabilizing the market and accelerating the price decline. As more positions are liquidated, selling pressure intensifies, impacting other investors and potentially leading to further liquidations.

- Analysis of the types of positions liquidated (long or short): Understanding whether primarily long or short positions were liquidated provides further insights into the market dynamics. A predominance of long position liquidations suggests a bearish market sentiment, while short liquidations might indicate a temporary squeeze.

Impact on Investors and the Market

The Ethereum price plunge has far-reaching consequences for investors and the broader cryptocurrency ecosystem.

Investor Sentiment and Confidence

The sharp price drop significantly impacts investor confidence.

- Analysis of social media sentiment and news coverage: Monitoring social media and news coverage reveals the prevailing sentiment – fear, uncertainty, and doubt (FUD) often dominate during such events, further fueling sell-offs.

- Impact on long-term investors versus short-term traders: Long-term investors might view this as a buying opportunity, while short-term traders are more likely to panic sell.

- Potential for further sell-offs due to panic selling: The fear of further losses can trigger a vicious cycle of panic selling, exacerbating the price decline.

Effect on DeFi Applications

The price drop has cascading effects on applications built on the Ethereum network.

- Impact on lending and borrowing platforms: Declining ETH prices affect the collateralization ratios of loans on DeFi platforms, potentially leading to more liquidations.

- Consequences for decentralized exchanges (DEXs): Reduced liquidity and volatility in ETH prices directly impact trading volumes and the overall functionality of DEXs.

- Potential for cascading failures in the DeFi ecosystem: The interconnected nature of DeFi means that a crisis in one area can quickly spread, leading to systemic risk.

Future Outlook for Ethereum Price

Predicting the future Ethereum price is challenging, but analyzing potential scenarios is crucial.

- Discussion of short-term and long-term price predictions (with disclaimers): While making definitive predictions is impossible, exploring possible scenarios based on current market conditions and historical trends is valuable. (Disclaimer: This is not financial advice).

- Analysis of factors that could drive a price rebound: Factors like positive regulatory developments, successful Ethereum upgrades, or increased institutional adoption could potentially trigger a price rebound.

- Potential for a period of price consolidation: Following a significant price drop, a period of consolidation is likely before any substantial price movement occurs, either up or down.

- Mention the importance of fundamental analysis versus technical analysis in predicting the price: Both fundamental and technical analyses should be considered to form a comprehensive outlook. Fundamental analysis considers the underlying value of Ethereum, while technical analysis focuses on price charts and trading patterns.

Conclusion

The significant Ethereum price plunge and the resulting $67 million in liquidations highlight the inherent volatility of the cryptocurrency market. Macroeconomic factors, specific events, and the significant impact of liquidations all contributed to this downturn. While the future outlook remains uncertain, understanding these factors is vital for navigating the market successfully. Stay informed about future developments impacting the Ethereum price to make sound investment decisions. Continue following our coverage for updates on this evolving situation and further analysis of the Ethereum price and its impact on the cryptocurrency market.

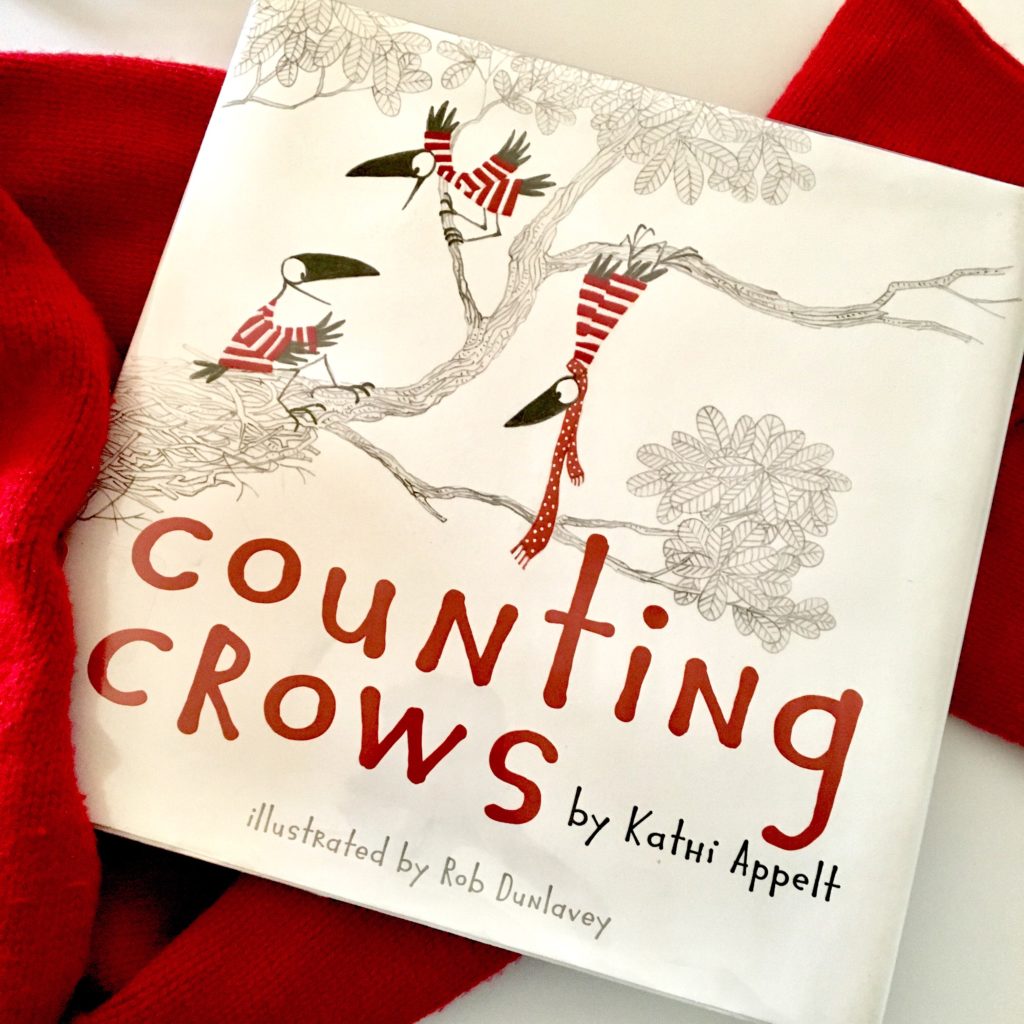

The Story Behind Counting Crows Slip Into The Shadows On The Aurora Album

The Story Behind Counting Crows Slip Into The Shadows On The Aurora Album

Predicted Counting Crows Setlist For 2025 Concerts

Predicted Counting Crows Setlist For 2025 Concerts

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

See The Winning Lotto Numbers 12 04 2025

See The Winning Lotto Numbers 12 04 2025

Will Ps 5 And Ps 4 Games Be Announced At The March 2025 Nintendo Direct

Will Ps 5 And Ps 4 Games Be Announced At The March 2025 Nintendo Direct