Decoding The Ethereum Weekly Chart: A Buy Signal Emerges

Table of Contents

Identifying Key Support Levels on the Ethereum Weekly Chart

Analyzing the Ethereum weekly chart requires a keen eye for support and resistance levels. These levels act as potential turning points, influencing price direction. Understanding these levels is crucial for making informed decisions regarding ETH price prediction and cryptocurrency trading.

Analyzing the Recent Price Action and Bounce

The recent price action has been particularly noteworthy. After reaching a low of [Insert Specific Price Point], Ethereum experienced a significant rebound, suggesting a potential bottoming-out.

- Price Point: The bounce began around [Insert Specific Price Point], indicating a strong reaction from buyers.

- Volume Change: The volume increased considerably during this bounce, confirming the strength of the buying pressure. We observed a [Percentage]% increase in trading volume compared to the previous week, a clear indicator of increased market interest.

- Bullish Divergence: Interestingly, the Relative Strength Index (RSI) showed a bullish divergence during this period, indicating a potential shift in momentum despite the price decline. The MACD also displayed a similar trend, further confirming the possibility of a trend reversal.

The significance of this bounce lies in its relationship to previous support levels. This rebound successfully held above the long-term trend line established in [Month, Year], suggesting a strong foundation for future price appreciation.

Evaluating the Strength of Support

The strength of the support level isn't solely determined by the price; other factors are crucial.

- Order Book Analysis: Examining the order book reveals a significant accumulation of buy orders around the [Insert Specific Price Point] level, demonstrating substantial buyer interest at this support level. This implies a substantial resistance to further price drops.

- On-Chain Metrics: On-chain data shows that large Ethereum holders (“whales”) have not been actively selling, suggesting a lack of selling pressure and potential accumulation. This accumulation signals confidence in the long-term value of Ethereum.

- News Events: The recent positive news surrounding [Mention relevant positive news, e.g., Ethereum network upgrades, DeFi developments] could have positively impacted market sentiment and contributed to the strengthened support.

The combination of these factors indicates a robust support level, further bolstering the case for a potential buy signal in the Ethereum weekly chart.

Examining Bullish Indicators on the Ethereum Weekly Chart

Technical analysis indicators often provide valuable insights into market trends. Examining these indicators on the Ethereum weekly chart reveals further evidence supporting a potential buy signal.

RSI and MACD Analysis

The RSI and MACD are two widely used momentum indicators. Their current readings are very revealing.

- RSI Reading: The RSI currently sits at [Insert RSI Value], indicating that Ethereum is no longer significantly oversold. While not deeply in overbought territory, it is moving into a range suggestive of bullish momentum.

- MACD Reading: The MACD is showing [Describe the MACD behavior – e.g., a bullish crossover, a move above the signal line]. This signifies a potential shift from bearish to bullish momentum.

This confluence of indicators points towards a potential trend reversal, strengthening the bullish signal identified on the Ethereum weekly chart.

Volume Confirmation

The price movement must be supported by sufficient trading volume to be considered valid.

- Volume Comparison: Comparing the recent price increase's volume to previous similar price movements shows a [Percentage]% increase, signifying genuine buying pressure and not just a short-lived price surge.

Strong volume is crucial, validating the bullish signal and indicating that the price movement is not merely a result of manipulation or short-term speculation. This sustained volume increase underscores the belief in the Ethereum price prediction and confirms the potential for further growth.

Assessing Potential Resistance Levels and Price Targets for Ethereum

While the bullish indicators are promising, identifying potential resistance levels and price targets provides a more comprehensive view.

Identifying Key Resistance Levels

Several resistance levels could hinder further price appreciation.

- Resistance Levels: Key resistance levels are located at [Insert Specific Price Points]. These represent previous high points and psychological barriers that could present challenges to further upward movement.

Overcoming these resistance levels would be a significant validation of the bullish trend, potentially unlocking further price gains and confirming the initial positive Ethereum price prediction.

Setting Realistic Price Targets

Based on the technical analysis conducted, several potential price targets emerge.

- Short-Term Target: A short-term price target could be [Insert Price Point], based on the recent price action and overcoming the nearest resistance level.

- Long-Term Target: A more ambitious long-term target could be [Insert Price Point], assuming continued positive market sentiment and further adoption of Ethereum.

These targets are contingent on several factors, including overall market sentiment, regulatory developments, and technological advancements in the Ethereum network.

Conclusion

The Ethereum weekly chart presents a compelling case for a potential buy signal, supported by robust support levels, positive technical indicators (RSI, MACD), and volume confirmation. However, cryptocurrency markets are volatile, and this Ethereum price prediction isn't a guarantee. Thorough research and risk management are paramount. Continue monitoring the Ethereum weekly chart, analyzing key indicators, and stay updated on market developments to optimize your Ethereum investment strategy. Remember to manage risk effectively and diversify your portfolio. Carefully study the Ethereum weekly chart and make informed decisions about your ETH holdings.

Featured Posts

-

Psg Nje Fitore E Ngushte Pas 45 Minutave

May 08, 2025

Psg Nje Fitore E Ngushte Pas 45 Minutave

May 08, 2025 -

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025

Ethereum Market Crash 67 M In Liquidations And The Potential For More

May 08, 2025 -

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025 -

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025 -

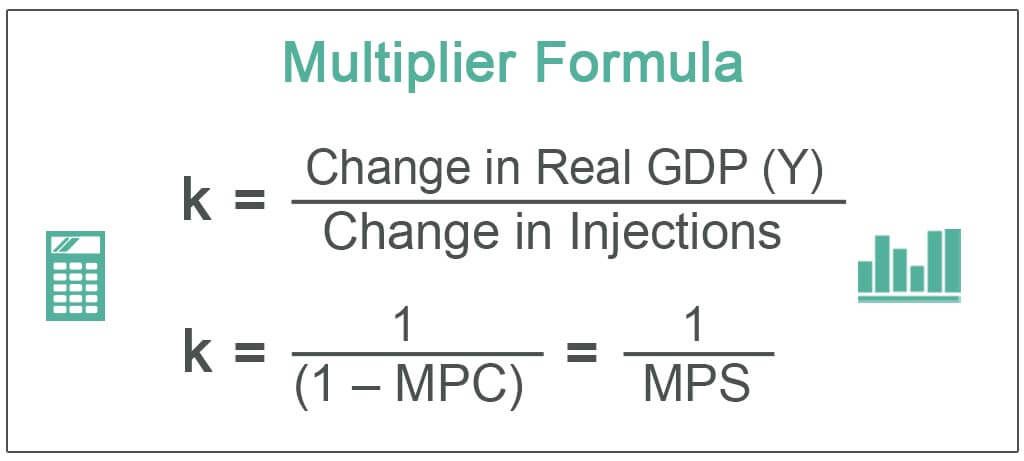

The 10x Bitcoin Multiplier Impact On Wall Street And Beyond

May 08, 2025

The 10x Bitcoin Multiplier Impact On Wall Street And Beyond

May 08, 2025

Latest Posts

-

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

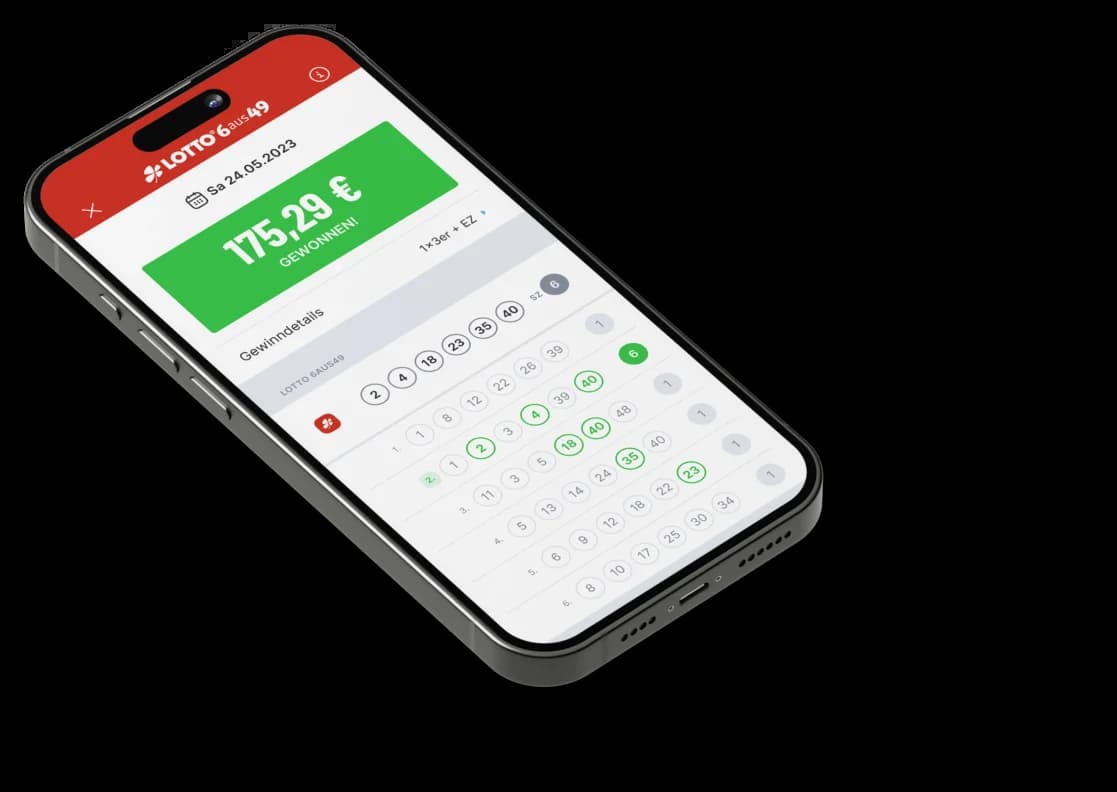

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025 -

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025