Bitcoin In Rally Zone? Analyst's Chart Suggests Potential Upswing (May 6th)

Table of Contents

Analyst's Chart Indicators Suggesting a Bitcoin Rally

The analysis utilizes a candlestick chart incorporating moving averages (specifically, the 50-day and 200-day moving averages) and the Relative Strength Index (RSI). Key indicators pointing towards a potential upswing include:

- Bullish Candlestick Patterns: The chart shows a series of bullish engulfing patterns and a significant breakout above a key resistance level. These patterns, often interpreted as signs of increased buying pressure, suggest a potential upward trend. We'll embed a screenshot of the chart itself for visual clarity [Insert Chart Screenshot Here].

- Breaking Above Resistance Levels: Bitcoin's price recently broke decisively above a significant resistance level around $[Insert Price Level], a crucial psychological barrier that had previously capped price increases. This breakout is often viewed as a positive signal for further upward movement.

- Positive RSI Divergence: While the price of Bitcoin experienced a recent dip, the RSI indicator showed a less severe decline, indicating a potential bullish divergence. This suggests that buying pressure may be building, even during periods of price consolidation.

Bullet Points:

- Technical Indicators Identified: A clear MACD crossover and a potential Golden Cross (the 50-day MA crossing above the 200-day MA) were observed on the chart.

- Price Levels: The breakout above $[Insert Price Level] triggered the bullish signal.

- Historical Context: Similar indicator combinations have preceded previous Bitcoin rallies, adding weight to the potential for a renewed upswing. However, past performance is not indicative of future results.

Factors Supporting a Potential Bitcoin Price Upswing

Several macroeconomic and on-chain factors bolster the case for a potential Bitcoin price upswing:

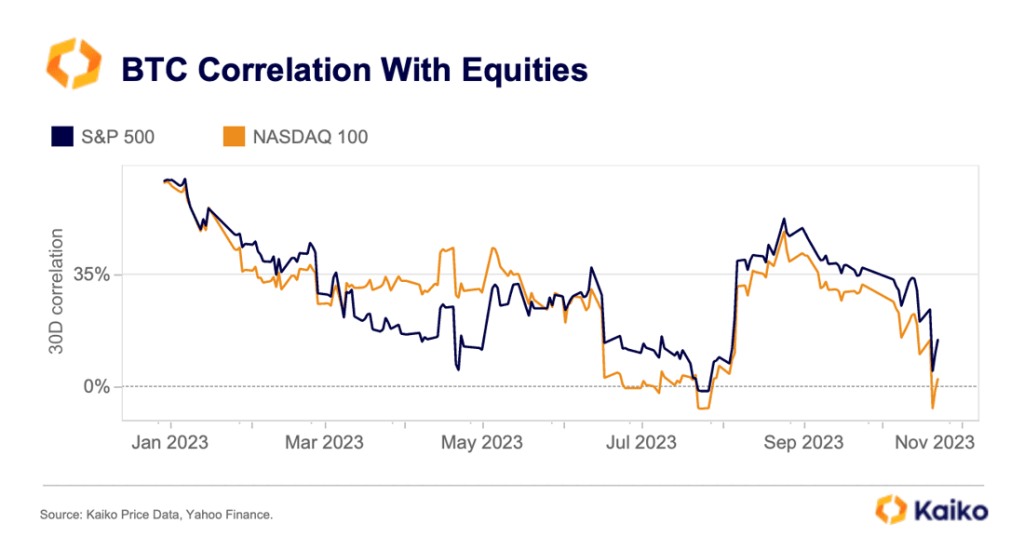

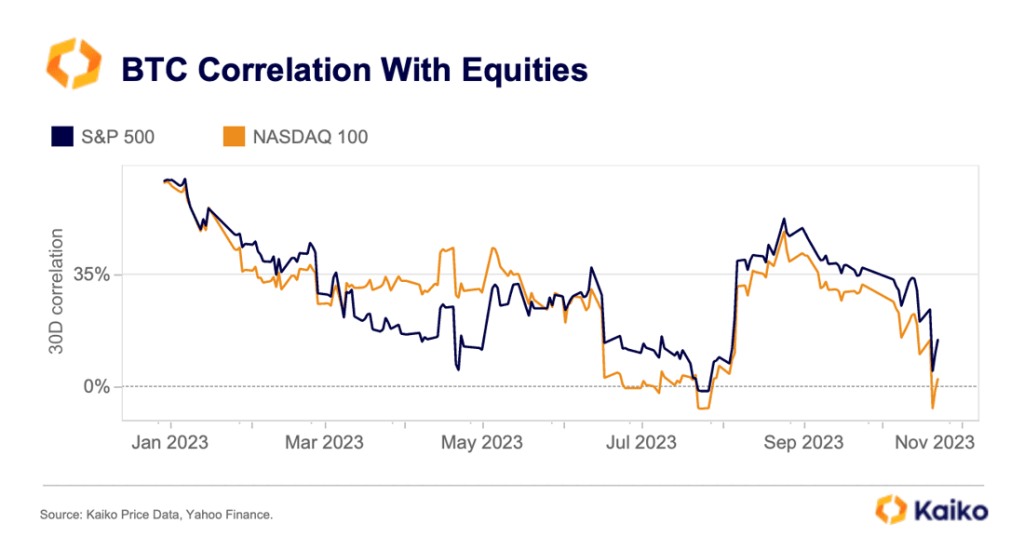

- Macroeconomic Factors: Rising inflation and uncertainty in traditional markets are driving investors to seek alternative assets, potentially increasing demand for Bitcoin as a hedge against inflation. Geopolitical instability also contributes to this trend.

- On-Chain Metrics: Increased network activity and a growing number of active Bitcoin addresses suggest increasing adoption and accumulation. There is also evidence of growing institutional interest, with larger firms accumulating Bitcoin as part of their investment portfolios.

Bullet Points:

- Macroeconomic Events: The ongoing inflation in many countries and the ongoing war in Ukraine are key drivers of uncertainty in traditional markets, potentially fueling Bitcoin's price.

- On-Chain Data: Increased Bitcoin transaction volume and a steady rise in the number of active addresses point to rising network usage.

- Regulatory Changes: Recent positive regulatory developments in certain jurisdictions could improve investor sentiment.

Potential Risks and Considerations for a Bitcoin Upswing

While the analysis suggests a potential Bitcoin rally, it's crucial to acknowledge potential risks:

- Regulatory Crackdowns: Increased regulatory scrutiny or outright bans on cryptocurrency trading in key markets could significantly impact Bitcoin's price.

- Market Corrections: Even during bullish trends, Bitcoin is known for its volatility and is susceptible to sudden and sharp corrections.

- Economic Downturn: A global economic downturn could negatively impact investor sentiment and reduce demand for risk assets like Bitcoin.

Bullet Points:

- Regulatory Risks: New regulations restricting cryptocurrency trading or stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance could dampen investor enthusiasm.

- Historical Precedents: Bitcoin's history is punctuated by sharp price corrections, even during extended bull markets.

- Macroeconomic Conditions: A recession or significant economic slowdown could negatively affect the entire cryptocurrency market.

Diversification and Risk Management in a Potential Bitcoin Rally

Regardless of the potential for a Bitcoin rally, diversification and risk management are paramount. Investing in volatile assets like Bitcoin requires a cautious approach.

Bullet Points:

- Diversification Strategies: Diversify your crypto portfolio by investing in a range of cryptocurrencies and other asset classes.

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses if the market turns bearish.

- Responsible Investment: Thorough research and understanding your risk tolerance are crucial before investing in any cryptocurrency.

Bitcoin Rally Potential – What's Next?

This analysis, based on the May 6th chart, suggests a potential "Bitcoin in Rally Zone" scenario. However, it's essential to consider both bullish and bearish possibilities. The analyst's chart provides valuable insight, but it's not a crystal ball. Various factors could influence the market, including unforeseen regulatory changes or macroeconomic shifts.

While this analysis suggests a potential Bitcoin rally, remember to do your own research before making any investment decisions. Stay informed about the latest Bitcoin price movements and market trends to make informed choices that align with your risk tolerance. The question remains: are we truly entering a "Bitcoin in Rally Zone"? Only time will tell.

Featured Posts

-

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025 -

The Long Walk 2023 Trailer Impressions And Expectations

May 08, 2025

The Long Walk 2023 Trailer Impressions And Expectations

May 08, 2025 -

Rogue One Actor Shares Surprising Thoughts About Beloved Character

May 08, 2025

Rogue One Actor Shares Surprising Thoughts About Beloved Character

May 08, 2025 -

Counting Crows Snl Performance A Turning Point In Their Career

May 08, 2025

Counting Crows Snl Performance A Turning Point In Their Career

May 08, 2025 -

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Latest Posts

-

Artis Goesteren Sms Dolandiriciligi Sikayetleri Guevenliginizi Saglayin

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Guevenliginizi Saglayin

May 08, 2025 -

Finding Reliable Crypto News In A Sea Of Misinformation

May 08, 2025

Finding Reliable Crypto News In A Sea Of Misinformation

May 08, 2025 -

Bitcoin In Buguenkue Degeri Piyasa Analizi Ve Tahminler

May 08, 2025

Bitcoin In Buguenkue Degeri Piyasa Analizi Ve Tahminler

May 08, 2025 -

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025 -

Building Trust In Crypto The Role Of Reliable News Sources

May 08, 2025

Building Trust In Crypto The Role Of Reliable News Sources

May 08, 2025