Ethereum's Price Action: Conquering Resistance, Targeting $2,000

Table of Contents

Analyzing Current Ethereum Price Resistance Levels

Key Resistance Levels and Their Significance

Several price points are currently acting as significant resistance for Ethereum's price. The $1800 and $1900 levels have historically proven challenging to break through. These levels hold importance due to past performance and technical analysis indicators.

-

Chart Patterns: Past price action shows potential head and shoulders patterns near the $1900 mark, suggesting a possible bearish reversal if the price fails to break through decisively. Conversely, a successful break above this resistance could signal a strong bullish trend. Analyzing candlestick patterns is also crucial for predicting Ethereum's price movement.

-

Psychological Significance: The $2000 price point carries significant psychological weight. This round number acts as a major psychological barrier for both buyers and sellers, influencing trading behavior. Breaking through $2000 could trigger a wave of further buying.

-

Volume Analysis: Observing trading volume at these resistance levels provides crucial insight. High volume accompanied by a price breakthrough confirms strong buying pressure, while low volume suggests a weaker breakout that could easily reverse. Monitoring on-chain metrics is also an effective way to understand the Ethereum price trend.

Factors Contributing to Resistance

Several factors contribute to the resistance Ethereum's price faces. These include macroeconomic conditions, regulatory developments, and overall market sentiment.

-

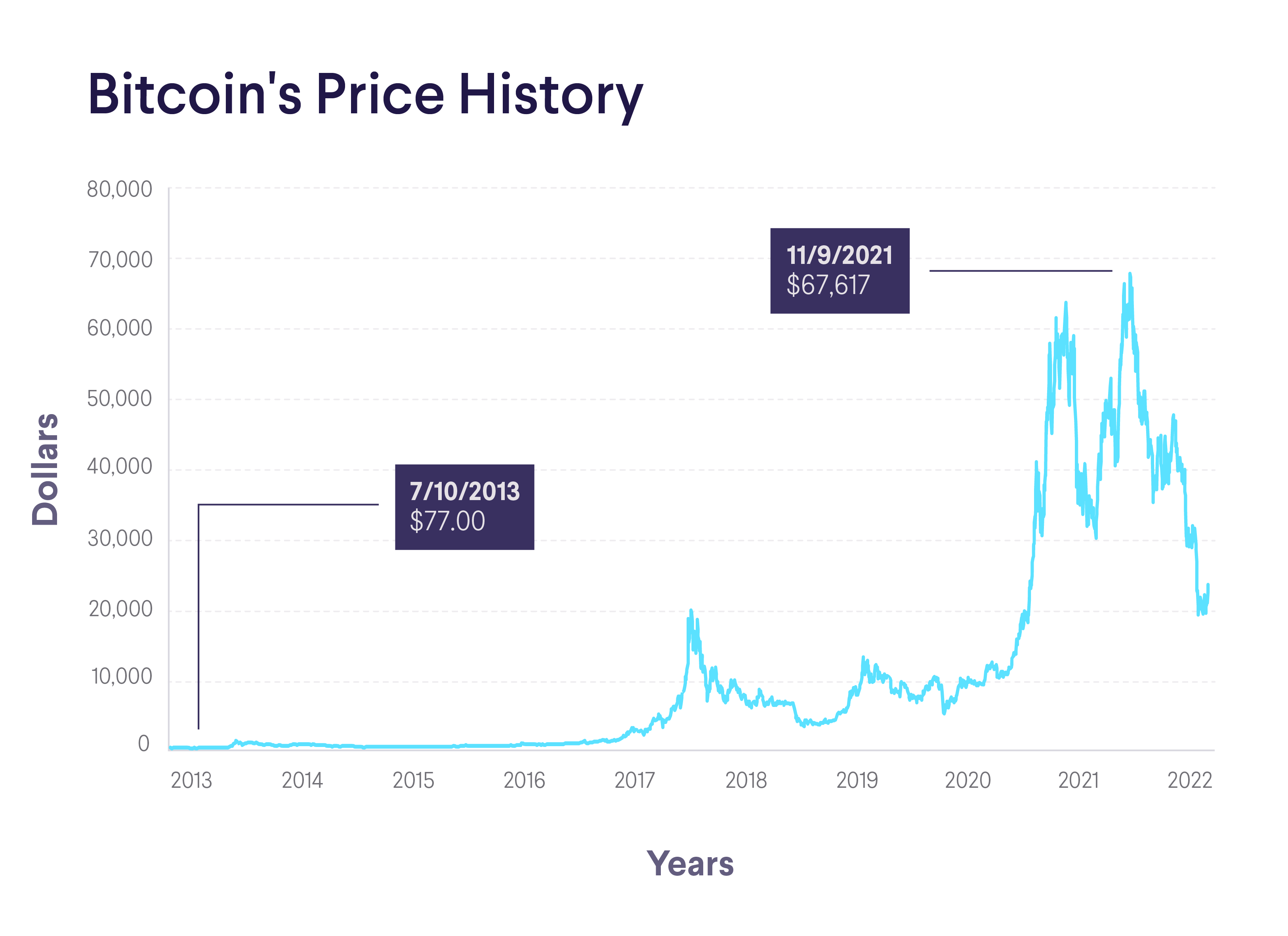

Bitcoin's Influence: Bitcoin often acts as a bellwether for the entire cryptocurrency market. A downturn in Bitcoin's price typically negatively impacts altcoins like Ethereum, creating downward pressure.

-

Network Upgrades and Developments: While network upgrades generally contribute positively in the long run, short-term price volatility can occur during and after implementation. Successfully navigating these periods without significant negative impact on the Ethereum price is a key factor.

-

Market Sentiment: Broad market sentiment significantly influences Ethereum's price. Periods of heightened risk aversion (like during economic uncertainty) can lead to selling pressure, creating resistance for upward price movements. Analyzing sentiment using social media data and news coverage can provide insights into Ethereum's potential.

Potential Catalysts for a Price Surge Towards $2,000

Positive Market Sentiment and Institutional Adoption

Increased institutional investment and growing adoption by large corporations could be powerful catalysts for an Ethereum price surge.

-

ETFs and Investment Vehicles: The approval of Ethereum-based exchange-traded funds (ETFs) would likely increase institutional investment, injecting significant capital into the market.

-

Institutional Adoption: Examples of major corporations integrating Ethereum blockchain technology into their operations could boost investor confidence and drive up demand.

-

Positive News Coverage: Positive news coverage focusing on Ethereum's technological advancements and potential applications can positively impact investor sentiment, creating upward price pressure.

Upcoming Ethereum Network Upgrades and Developments

Anticipated upgrades and developments on the Ethereum network have the potential to fuel significant price growth.

-

Scalability Improvements: Upgrades focused on improving scalability (like sharding) can attract a wider user base, increasing demand and consequently driving up the Ethereum price.

-

Enhanced Security: Any improvements in network security significantly enhance trust and attract more users and investors, creating a positive feedback loop for the Ethereum price.

-

Upgrade Timelines: The successful and timely implementation of planned upgrades can positively influence investor confidence and create a bullish narrative around the Ethereum price.

Risks and Potential Downside for Ethereum Price

Macroeconomic Uncertainty and Regulatory Risks

Several risks could impede Ethereum's price from reaching $2,000.

-

Macroeconomic Conditions: Global economic uncertainty, such as rising interest rates or a potential recession, can significantly impact investor risk appetite, leading to selling pressure in the cryptocurrency market, including Ethereum.

-

Regulatory Scrutiny: Increased regulatory scrutiny of cryptocurrencies, including potential restrictions or bans, could negatively impact the Ethereum price and overall market sentiment.

-

Negative News and Events: Negative news or unexpected events related to Ethereum or the broader cryptocurrency market can trigger sell-offs and create downward price pressure.

Competition from Other Cryptocurrencies

Ethereum faces competition from other cryptocurrencies, which could affect its market share and price.

-

Comparison with Competitors: Ethereum's strengths (smart contracts, decentralized applications) and weaknesses (transaction fees, scalability) must be compared to competitors like Bitcoin and Solana to understand its competitive position.

-

Market Share Shifts: Changes in market share among cryptocurrencies can influence the relative price of Ethereum. A shift towards competitors could exert downward pressure on the Ethereum price.

Conclusion

Ethereum's price journey towards $2,000 is a complex interplay of factors. While positive catalysts, such as institutional adoption and network upgrades, offer strong potential for price growth, macroeconomic uncertainty and competition represent significant headwinds. Understanding the dynamics of Ethereum price action, including resistance levels, influential factors, and potential risks, is crucial for informed decision-making. Keep a close watch on the Ethereum price and its progress towards conquering resistance levels. Understanding the factors driving Ethereum's price action is crucial for navigating the dynamic cryptocurrency market and making sound investment choices. Stay informed on the latest developments to effectively track the Ethereum price and capitalize on potential opportunities.

Featured Posts

-

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025 -

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025 -

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025