Is Ethereum's Price Rise Sustainable? Bullish Market Analysis

Table of Contents

Ethereum's Growing Ecosystem and DeFi's Role

The explosive growth of Ethereum's ecosystem is a major factor contributing to the rising Ethereum price. Two key components driving this growth are the Decentralized Finance (DeFi) boom and the rise of NFTs and the metaverse.

Decentralized Finance (DeFi) Boom

The DeFi space, built largely on Ethereum, has seen unprecedented expansion. Users flock to DeFi applications offering innovative financial services like lending, borrowing, and yield farming. This increased activity directly translates into higher demand for ETH, pushing the price upward.

- Increased transaction fees (gas fees): High demand for DeFi applications leads to increased network congestion, resulting in higher gas fees. This, paradoxically, contributes to ETH's value as users need to pay for transactions in ETH.

- Locked ETH in DeFi protocols (TVL): The total value locked (TVL) in DeFi protocols built on Ethereum signifies the massive amount of ETH being actively utilized within the ecosystem, reducing the circulating supply and potentially influencing the Ethereum price.

- Growth in lending and borrowing platforms: Platforms like Aave, Compound, and MakerDAO have facilitated massive growth in lending and borrowing, further increasing ETH demand and usage.

NFTs and the Metaverse

Non-Fungible Tokens (NFTs) have taken the world by storm, and Ethereum is the dominant blockchain for NFT creation and trading. The surge in NFT popularity, coupled with the burgeoning metaverse, significantly boosts ETH demand.

- High-value NFT sales: High-profile NFT sales, often fetching millions of dollars, showcase the value proposition of NFTs and increase the visibility and desirability of Ethereum as the underlying blockchain.

- Increasing NFT marketplaces: The proliferation of NFT marketplaces like OpenSea, Rarible, and others has further cemented Ethereum's position as the leading platform for NFT trading, driving up demand for ETH.

- Growing metaverse projects built on Ethereum: Many metaverse projects are being built on Ethereum, leveraging its robust infrastructure and smart contract capabilities. This expands the use cases for ETH and fuels its price appreciation.

Technological Advancements and Network Upgrades

Ethereum's ongoing development and technological advancements are crucial for long-term price sustainability. The transition to a more efficient and scalable network is a significant factor.

Ethereum 2.0 and its Impact (Now Ethereum Consensus Layer)

The shift to the Ethereum Consensus Layer (formerly known as Ethereum 2.0) marks a pivotal moment for the network. This upgrade introduces several key improvements:

- Sharding: This technique will dramatically improve scalability by dividing the network into smaller, more manageable shards, increasing transaction throughput.

- Proof-of-Stake (PoS) consensus mechanism: PoS significantly reduces energy consumption compared to the previous Proof-of-Work (PoW) mechanism, making the network more environmentally friendly and potentially more attractive to investors.

- Reduced transaction costs: Improved scalability and efficiency lead to lower gas fees, making Ethereum more accessible to a wider range of users and applications.

- Improved scalability: The overall improvements in scalability will enable Ethereum to handle a significantly larger volume of transactions, paving the way for mass adoption.

Layer-2 Scaling Solutions

Layer-2 scaling solutions like Optimism and Arbitrum address Ethereum's scalability challenges by processing transactions off-chain, significantly increasing transaction speed and reducing gas fees.

- Increased transaction throughput: Layer-2 solutions dramatically increase the number of transactions Ethereum can process per second, improving the user experience.

- Lower gas fees: By offloading transactions, Layer-2 solutions significantly reduce the cost of interacting with the Ethereum network.

- Improved user experience: Faster transactions and lower fees contribute to a smoother and more efficient user experience, attracting more users and developers to the Ethereum ecosystem.

Macroeconomic Factors and Market Sentiment

External factors also play a significant role in determining the Ethereum price. Institutional adoption and overall market conditions are key influences.

Institutional Adoption

The growing interest from institutional investors is a strong indicator of Ethereum's long-term potential.

- Grayscale Ethereum Trust: The significant holdings of ETH by Grayscale, a major institutional investor, demonstrate confidence in Ethereum's future.

- Corporate treasury holdings of ETH: Several corporations are adding ETH to their treasury reserves, viewing it as a valuable asset.

- Growing institutional investment funds: Dedicated investment funds focusing solely on Ethereum and other cryptocurrencies are emerging, signifying growing institutional interest.

Overall Market Conditions

The broader cryptocurrency market significantly impacts the Ethereum price.

- Correlation between Bitcoin and Ethereum: Ethereum often moves in correlation with Bitcoin, meaning Bitcoin's price movements can significantly affect Ethereum's price.

- Overall crypto market capitalization: The overall health and growth of the cryptocurrency market influence investor sentiment and directly impact Ethereum's price.

- Regulatory landscape and its potential effect on the market: Regulatory clarity and stable regulatory environments positively influence investor confidence and can contribute to price stability.

Conclusion

The sustainability of Ethereum's price rise hinges on the interplay of its thriving ecosystem, successful technological upgrades, and favorable macroeconomic conditions. While the bullish outlook is strong, fueled by DeFi, NFTs, institutional adoption, and technological advancements, potential challenges such as regulatory uncertainty and competition from other blockchain platforms remain. However, the continuous development and innovation within the Ethereum ecosystem strongly suggest a positive long-term outlook for ETH. To stay updated on the latest developments and potential shifts in the Ethereum price, continue following market analysis and stay informed about the latest upgrades and advancements.

Featured Posts

-

Dcs Batman A Fresh Start With A New 1 Issue And Costume

May 08, 2025

Dcs Batman A Fresh Start With A New 1 Issue And Costume

May 08, 2025 -

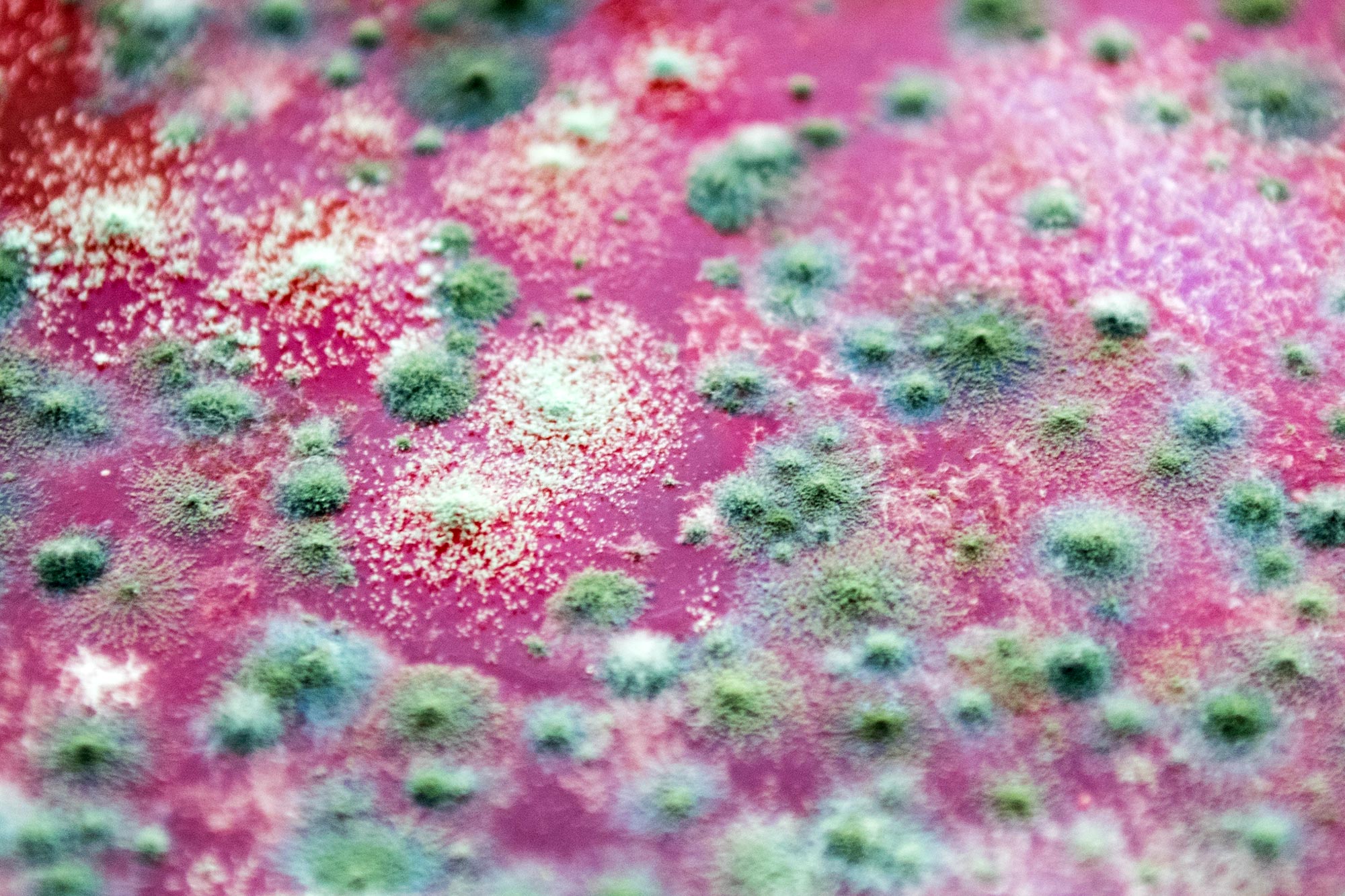

The Rise Of Deadly Fungi A Looming Public Health Emergency

May 08, 2025

The Rise Of Deadly Fungi A Looming Public Health Emergency

May 08, 2025 -

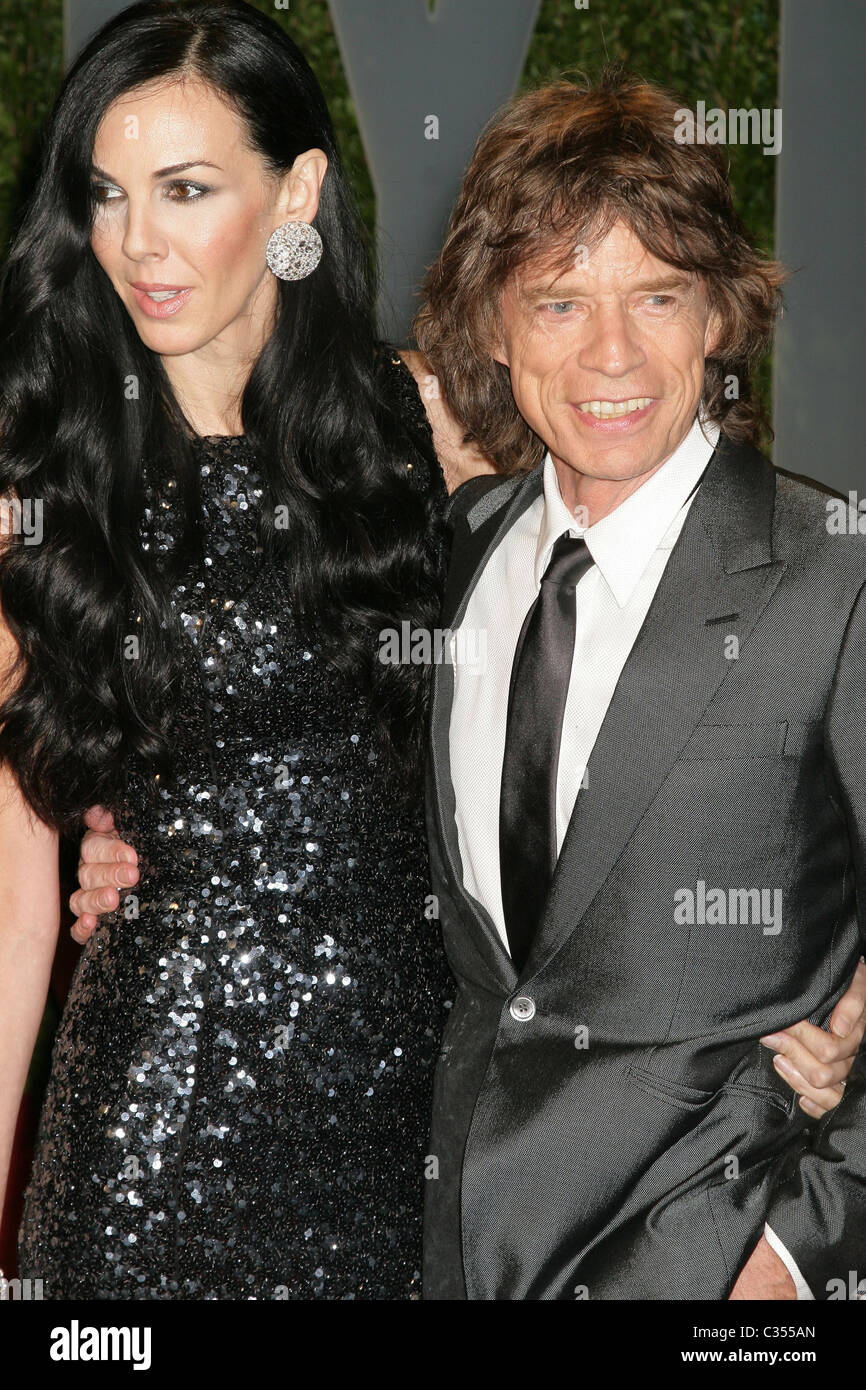

Mick Jagger No Oscar Brasileiros Temem Pe Frio

May 08, 2025

Mick Jagger No Oscar Brasileiros Temem Pe Frio

May 08, 2025 -

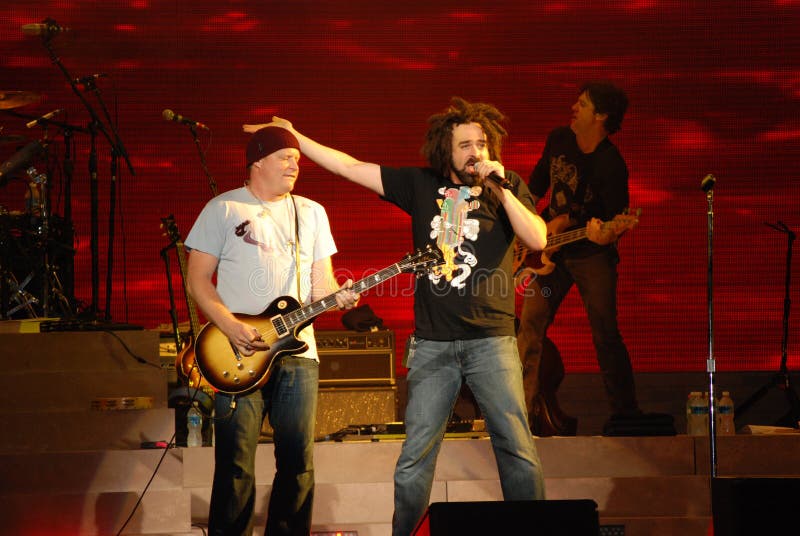

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025 -

Ripples Xrp Navigating The Sec Landscape And The Etf Opportunity

May 08, 2025

Ripples Xrp Navigating The Sec Landscape And The Etf Opportunity

May 08, 2025

Latest Posts

-

Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025 -

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025 -

Armghan Kys Krachy Pwlys Chyf Ka Naahly Ka Aetraf

May 08, 2025

Armghan Kys Krachy Pwlys Chyf Ka Naahly Ka Aetraf

May 08, 2025 -

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025