Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

Table of Contents

Trade Negotiations and Bitcoin's Correlation

The relationship between global trade uncertainty and Bitcoin's price is complex. While not always directly correlated, positive developments in trade negotiations often have a bullish effect on Bitcoin. Historically, periods of heightened global trade uncertainty, such as during trade wars, have sometimes seen investors move away from riskier assets. However, a positive outlook on trade negotiations can significantly boost investor confidence, creating a "risk-on" environment. In this scenario, investors are more willing to allocate capital to higher-risk, higher-reward assets like Bitcoin.

- Decreased global uncertainty reduces risk aversion among investors. When trade tensions ease, investors feel more secure, leading them to explore potentially more profitable, albeit riskier, options.

- Investors seek higher returns in riskier assets like Bitcoin. Bitcoin, with its potential for significant price appreciation, becomes an attractive alternative during times of increased investor confidence.

- Positive trade news often coincides with increased market liquidity. Improved global economic sentiment can lead to higher trading volumes across various asset classes, including cryptocurrencies.

- Increased institutional investment in Bitcoin following positive trade news. Large financial institutions may view Bitcoin as a more attractive asset during periods of economic stability, further driving up demand.

Market Sentiment and Investor Behavior

Positive news about trade negotiations significantly influences Bitcoin market sentiment. A more optimistic outlook creates a bullish environment, encouraging investors to buy Bitcoin. This is amplified by the impact of news coverage and social media discussions. The psychology of FOMO (fear of missing out) plays a significant role, as investors rush to buy Bitcoin to avoid potential losses from missing out on the price increase. This herd behavior further accelerates the upward price momentum.

- Positive news creates a bullish market sentiment. This leads to a self-fulfilling prophecy, where positive expectations fuel further price increases.

- Increased social media chatter and news coverage amplify the effect. Positive news spreads rapidly, further fueling investor enthusiasm and driving up demand.

- FOMO can lead to rapid price increases as more investors enter the market. The fear of missing out on potential gains encourages buying, regardless of fundamental valuation.

- Higher trading volume indicates increased market activity and confidence. Increased trading volume is a clear sign of increased market participation and belief in the upward trend.

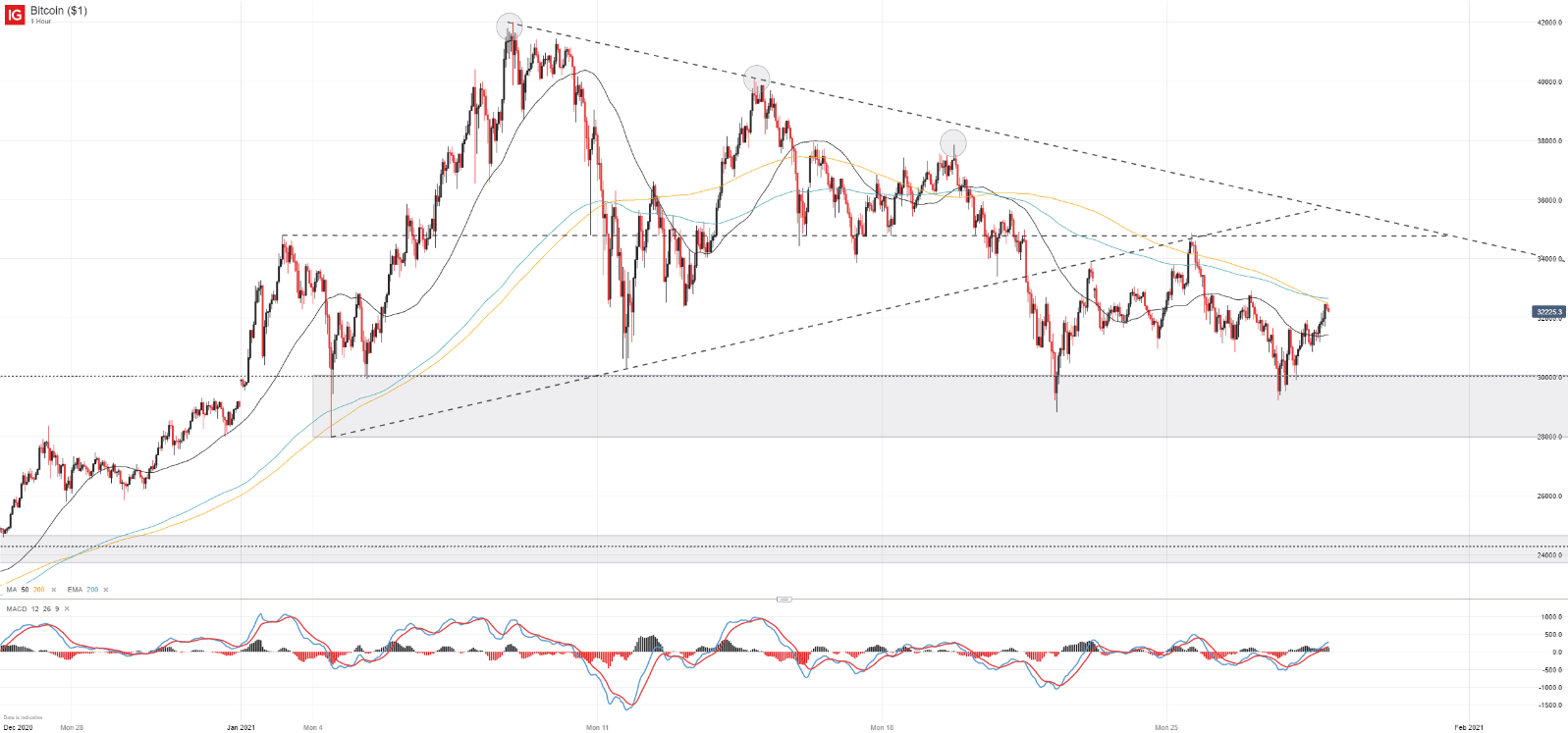

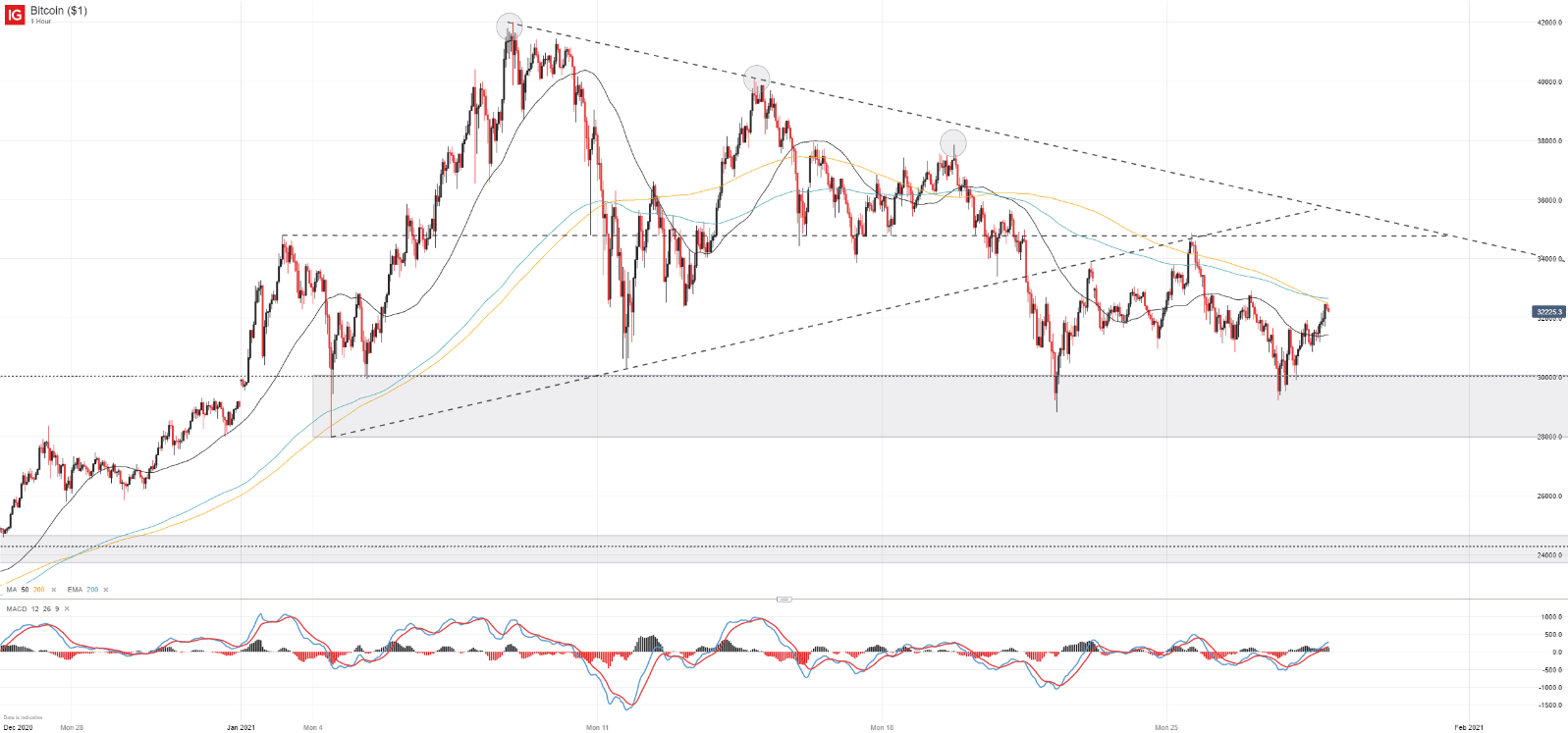

Technical Analysis of the Bitcoin Price Jump

Analyzing the Bitcoin price chart reveals key technical indicators that contributed to the recent surge. A breakout above a key resistance level, coupled with increased trading volume, signals strong bullish momentum. Positive readings in technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) further confirm this trend.

- Breakout above key resistance level. This is a classic technical sign of a potential strong price increase.

- Increased trading volume accompanying the price surge. High volume confirms the breakout and suggests strong buying pressure.

- Positive RSI and MACD readings (or other relevant technical indicators). These indicators provide further confirmation of the bullish trend.

- Potential future support and resistance levels. Identifying these levels helps in predicting future price movements.

Cautionary Notes and Potential Risks

While the current outlook for Bitcoin is positive, it's crucial to remember its inherent volatility. Past performance is not indicative of future results, and a market correction remains a possibility. Sudden price drops can occur, and investors need to be prepared for such events. This information is for educational purposes only and does not constitute financial advice.

Conclusion

The recent Bitcoin price jump is largely attributed to positive developments in international trade negotiations. This improved outlook boosted investor confidence, creating a "risk-on" environment that favored Bitcoin. The positive market sentiment, fueled by FOMO and increased trading volume, contributed to the significant price increase. However, it's crucial to maintain a cautious approach, acknowledging the inherent volatility of Bitcoin and the potential for market corrections.

Call to Action: Stay informed about the latest developments in the Bitcoin market and trade negotiations. Follow our blog for continuous updates on the Bitcoin price and other cryptocurrency news. Learn more about Bitcoin trading and investment strategies to make informed decisions in this dynamic market. Monitor the Bitcoin price carefully and adapt your investment strategy as needed. Remember to always conduct thorough research and consider your risk tolerance before making any Bitcoin investment decisions.

Featured Posts

-

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025 -

Brezilya Da Bitcoin Maas Oedemeleri Yasal Mi Oluyor

May 08, 2025

Brezilya Da Bitcoin Maas Oedemeleri Yasal Mi Oluyor

May 08, 2025 -

0 0 Psg Ve Nantes Tan Puan Paylasimi

May 08, 2025

0 0 Psg Ve Nantes Tan Puan Paylasimi

May 08, 2025 -

New Star Wars Show Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Show Explores The Past Of A Beloved Rogue One Character

May 08, 2025 -

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025

Latest Posts

-

Xrps Surge Outpacing Bitcoin After Secs Grayscale Etf Filing Nod

May 08, 2025

Xrps Surge Outpacing Bitcoin After Secs Grayscale Etf Filing Nod

May 08, 2025 -

Xrp To 5 In 2025 Analyzing The Potential And Challenges

May 08, 2025

Xrp To 5 In 2025 Analyzing The Potential And Challenges

May 08, 2025 -

Could Xrp Reach 5 By 2025 A Realistic Look At The Forecast

May 08, 2025

Could Xrp Reach 5 By 2025 A Realistic Look At The Forecast

May 08, 2025 -

Xrp On The Brink Of A Record High The Role Of The Grayscale Etf

May 08, 2025

Xrp On The Brink Of A Record High The Role Of The Grayscale Etf

May 08, 2025 -

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025