XRP Distribution To Shareholders: Latest Ripple XRP News From SBI Holdings

Table of Contents

SBI Holdings' Strategic Investment in Ripple and XRP

SBI Holdings' involvement with Ripple and XRP is far from superficial; it's a deeply entrenched strategic partnership with significant implications for the XRP market.

SBI Holdings' Partnership with Ripple:

SBI Holdings has been a long-standing partner of Ripple Labs, establishing a strong relationship over several years. This partnership goes beyond simple investment; it involves collaborative projects and shared strategic goals.

- Significant Investment: SBI Holdings has made a substantial financial investment in Ripple, solidifying its position as a key stakeholder. The exact figures are not always publicly disclosed, but reports suggest it's a considerable portion of their overall investment portfolio.

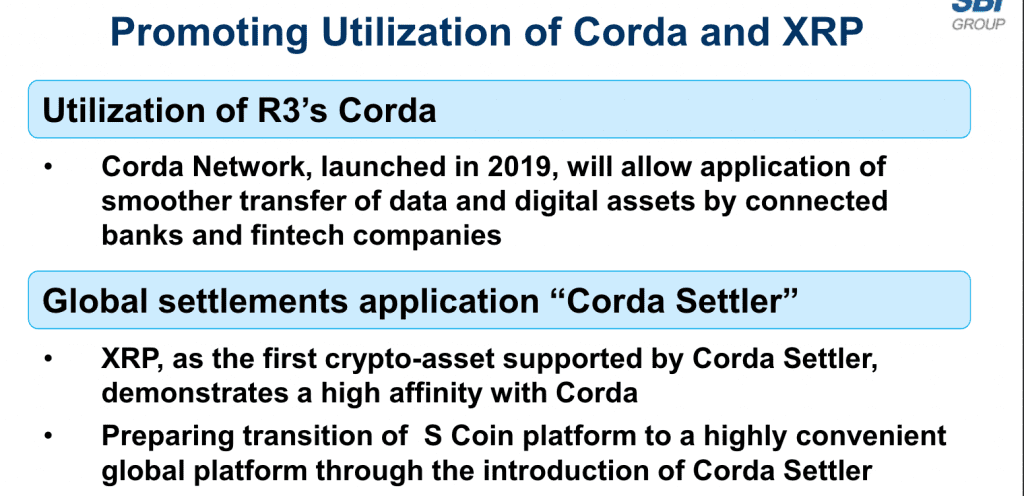

- Joint Ventures: The partnership includes joint ventures aimed at expanding XRP adoption and utility within various financial sectors. These ventures leverage both companies' expertise and resources to drive innovation and market penetration.

- Strategic Alliance: The relationship between SBI Holdings and Ripple extends beyond financial transactions; it's a strategic alliance built on shared vision and mutual benefit, aiming for the long-term success of the XRP ecosystem.

The Significance of SBI Holdings in the XRP Ecosystem:

SBI Holdings plays a pivotal role in shaping the XRP ecosystem. Its influence extends across several key areas:

- XRP Adoption: SBI Holdings actively promotes the adoption of XRP within its extensive network of financial institutions and businesses, increasing its practical use cases.

- Liquidity: The substantial XRP holdings of SBI Holdings contribute significantly to the overall liquidity of the XRP market, contributing to market stability.

- Market Stability: SBI Holdings' strategic actions and market presence have a demonstrable effect on the stability of the XRP price, acting as a buffer against extreme volatility.

Details of the XRP Distribution to Shareholders:

The recent announcement from SBI Holdings regarding the XRP distribution to shareholders has provided much-needed clarity.

The Announcement and its Implications:

SBI Holdings has officially announced a plan to distribute its holdings of XRP to its shareholders. The specifics of this distribution are critical:

- Distribution Method: The exact method of distribution (airdrop or dividend) will likely be detailed in subsequent communications from SBI Holdings, but both options have implications for shareholders.

- Eligibility Criteria: The eligibility criteria for shareholders to receive the XRP distribution will be clearly defined and depend on the rules and regulations governing SBI Holdings' shareholder structure.

- Timeline for Distribution: A specific timeline for the distribution will be announced, outlining the dates for eligibility confirmation and the actual disbursement of XRP to eligible shareholders.

Potential Impact on XRP Price and Market Sentiment:

The market reaction to the news of the XRP shareholder distribution is likely to be multifaceted:

- Price Movements: The distribution could potentially trigger a positive price movement in XRP, as a large volume enters the market. However, the overall impact will depend on how the market absorbs this influx of XRP.

- Trading Volume: It's expected that the distribution will result in a surge in XRP trading volume, as shareholders sell or hold their newly acquired assets.

- Market Sentiment: The announcement could significantly improve the overall market sentiment surrounding XRP, boosting investor confidence and potentially attracting new investment. Expert opinions suggest this could be a catalyst for positive price action.

Analyzing the Future of XRP and SBI Holdings' Involvement:

Long-Term Strategy and Future Plans:

SBI Holdings' actions regarding XRP distribution reflect a long-term strategic vision:

- Unlocking Value: The distribution allows SBI Holdings to unlock the value of its XRP holdings while simultaneously rewarding its shareholders.

- Expanding Ecosystem: This move could further encourage the growth and development of the XRP ecosystem, enhancing its utility and broader adoption.

- Commitment to XRP: The decision to distribute XRP rather than sell it signals SBI Holdings' sustained belief in the long-term potential of XRP and its role in future financial technology.

Potential Risks and Opportunities:

Despite the positive outlook, there are inherent risks and opportunities associated with this move:

- Regulatory Hurdles: Regulatory changes surrounding cryptocurrencies could affect the distribution process and the overall value of XRP.

- Market Volatility: The cryptocurrency market is inherently volatile; unexpected price swings could impact the value of the distributed XRP.

- Tax Implications: Shareholders need to carefully consider the tax implications associated with receiving XRP as a dividend or airdrop.

Conclusion:

The SBI Holdings announcement regarding XRP distribution to shareholders marks a significant development in the XRP ecosystem. The strategic partnership between SBI Holdings and Ripple, coupled with this distribution, signifies a strong commitment to the long-term growth and adoption of XRP. While potential risks exist, the overall outlook appears positive, potentially boosting market sentiment and driving further XRP adoption. To stay informed about future developments regarding XRP distribution to shareholders, follow reputable news sources, join online XRP communities, and actively research using keywords like "XRP distribution updates," "SBI Holdings XRP news," and "Ripple XRP shareholder news." Stay informed and make informed decisions about your XRP holdings.

Featured Posts

-

Bse Share Price Rally Earnings Boost Expected

May 07, 2025

Bse Share Price Rally Earnings Boost Expected

May 07, 2025 -

Top 5 Nie Articles A Q1 2025 Review

May 07, 2025

Top 5 Nie Articles A Q1 2025 Review

May 07, 2025 -

The Trae Young Travel Debate Were The Refs Too Lenient

May 07, 2025

The Trae Young Travel Debate Were The Refs Too Lenient

May 07, 2025 -

The Karate Kid Part Iii Exploring The Films Themes And Legacy

May 07, 2025

The Karate Kid Part Iii Exploring The Films Themes And Legacy

May 07, 2025 -

New Fantasy Film Starring Jenna Ortega And Glen Powell To Film In London This Summer

May 07, 2025

New Fantasy Film Starring Jenna Ortega And Glen Powell To Film In London This Summer

May 07, 2025

Latest Posts

-

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025