BSE Share Price Rally: Earnings Boost Expected

Table of Contents

Strong Corporate Earnings Drive BSE Share Price Rally

Robust Q3-2024 earnings reports from several major BSE-listed companies have played a significant role in the current market optimism. Many companies have exceeded analysts' expectations, contributing to the overall positive sentiment and driving the BSE share price rally. For example, leading IT firms have reported significant growth in revenue and profits due to increased global demand, while pharmaceutical companies have benefited from strong sales of existing products and a pipeline of promising new drugs. FMCG (Fast-Moving Consumer Goods) companies have also shown resilience, indicating sustained consumer spending despite inflationary pressures.

-

Data Points: The combined earnings of top BSE-listed companies have seen a percentage increase of X% (replace X with actual data if available), with the IT sector leading the charge with a Y% increase (replace Y with actual data if available). Pharma and FMCG sectors have also reported healthy growth, further solidifying the positive outlook.

-

Key Impacts:

- Increased profitability leads to higher investor confidence and increased investment in the BSE.

- Positive revision of future earnings forecasts by analysts fuels further buying interest.

- Attractive dividend payouts from several companies are boosting investor returns, encouraging further investment in the BSE.

Positive Economic Indicators Fuel BSE Market Optimism

Beyond strong corporate earnings, several positive macroeconomic factors are contributing to the bullish sentiment surrounding the BSE share price. India's stable GDP growth, coupled with controlled inflation rates, paints a picture of economic resilience. Furthermore, increased foreign direct investment (FDI) inflows demonstrate confidence in the Indian market from international investors. Government policies aimed at boosting infrastructure development and encouraging foreign investment are also contributing positively to investor sentiment.

- Key Indicators:

- Relatively stable inflation rates are reducing uncertainty in the market.

- Strong GDP growth consistently above X% (replace X with actual data if available) indicates a healthy and expanding economy.

- Increased FDI inflows reflect global confidence in the Indian market's potential.

Investor Sentiment and Market Speculation

The anticipated BSE share price rally is not solely driven by fundamentals; investor sentiment plays a crucial role. Increased buying activity from both domestic and foreign institutional investors (FIIs) indicates a strong belief in the market's upward trajectory. Positive media coverage of the Indian economy and the BSE further reinforces this positive sentiment. Market speculation, driven by anticipated future earnings and the overall positive outlook, also contributes to the buying pressure.

- Driving Factors:

- Increased buying activity from both domestic and foreign institutional investors (FIIs).

- Positive media coverage fuels optimism and attracts new investment.

- Speculative trading based on projected future earnings adds further momentum to the rally.

Risk Factors and Potential Challenges

While the outlook is largely positive, it's crucial to acknowledge potential risks. A global economic slowdown, geopolitical uncertainties, and potential interest rate hikes could impact investor sentiment and potentially dampen the BSE share price rally. It's important for investors to maintain a balanced perspective and consider these factors when making investment decisions.

- Potential Headwinds:

- Global economic uncertainty could affect investor risk appetite.

- Geopolitical risks could introduce volatility into the market.

- Potential interest rate hikes could increase borrowing costs, impacting business growth.

Navigating the BSE Share Price Rally – A Look Ahead

The anticipated BSE share price rally is being driven by a confluence of factors, including robust corporate earnings, positive economic indicators, and strong investor sentiment. While the outlook is promising, it is crucial to consider potential risks and challenges. Investors should stay informed about the BSE market outlook and conduct thorough research before making any investment decisions. Considering professional advice is also crucial, so consult a financial advisor for personalized guidance on BSE investment strategies and to effectively manage your portfolio during this period of potential growth. Understanding the nuances of BSE share price performance will help navigate this dynamic market and capitalize on opportunities while mitigating potential risks.

Featured Posts

-

Lotto 6aus49 Mittwoch 9 4 2025 Gewinnzahlen And Quoten

May 07, 2025

Lotto 6aus49 Mittwoch 9 4 2025 Gewinnzahlen And Quoten

May 07, 2025 -

Currys All Star Weekend Capstone A Championship In A Controversial Format

May 07, 2025

Currys All Star Weekend Capstone A Championship In A Controversial Format

May 07, 2025 -

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025 -

Adidas Anthony Edwards 2 Release Date Specs And First Impressions

May 07, 2025

Adidas Anthony Edwards 2 Release Date Specs And First Impressions

May 07, 2025 -

Mkhttat Alkhtwt Almlkyt Almghrbyt Lzyadt Edd Rhlat Saw Bawlw Aldar Albydae

May 07, 2025

Mkhttat Alkhtwt Almlkyt Almghrbyt Lzyadt Edd Rhlat Saw Bawlw Aldar Albydae

May 07, 2025

Latest Posts

-

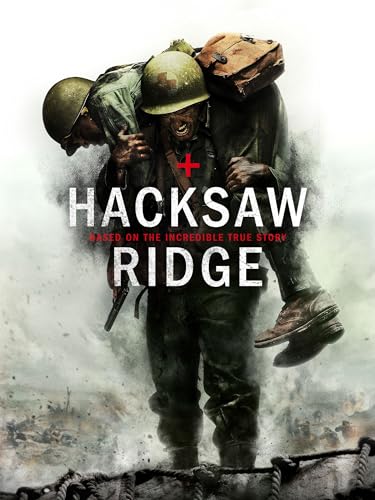

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025 -

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025 -

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025 -

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025 -

Is This Wwii Movie Better Than Saving Private Ryan A Military Historian Weighs In

May 08, 2025

Is This Wwii Movie Better Than Saving Private Ryan A Military Historian Weighs In

May 08, 2025