Technical Analysis: Ethereum's Potential $2,700 Surge Based On Wyckoff

Table of Contents

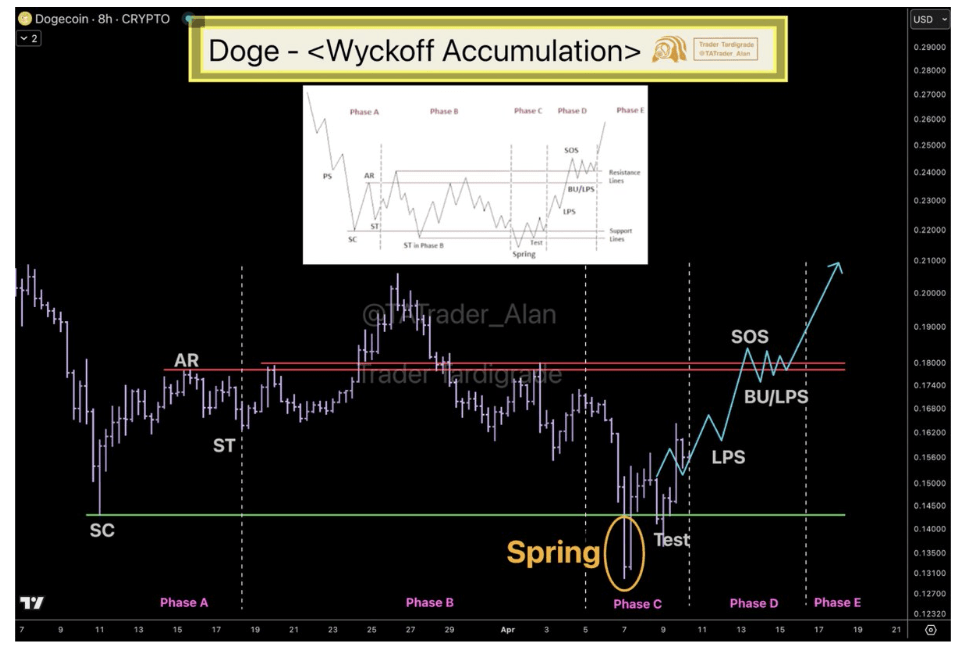

Understanding the Wyckoff Method in Cryptocurrency Trading

The Wyckoff method is a powerful technical analysis technique used to identify market accumulation and distribution phases. Unlike simpler methods focusing solely on price, Wyckoff incorporates volume and price action to pinpoint potential shifts in market sentiment. It's particularly relevant in the volatile cryptocurrency market, where identifying shifts in momentum is crucial. The core principles revolve around four phases:

- Accumulation: A period where large players quietly buy, accumulating the asset before a price increase.

- Markup: The price significantly rises as accumulated assets are sold.

- Distribution: Large players sell their holdings, leading to a price decline.

- Markdown: The price falls as the selling pressure continues.

Identifying these phases on Ethereum's (ETH) price chart requires understanding specific elements:

- The "Spring": A brief, sharp price drop designed to shake out weak holders before a price rise.

- The "Test": A retest of a support level to confirm the strength of the underlying accumulation.

- Support and Resistance Levels: These are crucial areas where price action often reverses. Wyckoff helps pinpoint these levels by analyzing volume and price action during accumulation and distribution phases.

- Volume Analysis: Changes in trading volume are vital. High volume during accumulation suggests strong buying pressure; high volume during distribution points to significant selling.

Wyckoff Analysis Applied to Ethereum's Current Price Chart

(Insert Chart/Graph of Ethereum's price action here. The chart should clearly highlight key support and resistance levels, volume changes, and potential Wyckoff patterns. Annotations should be added to identify specific examples of accumulation and distribution phases, "springs", "tests", and significant candlestick patterns.)

Let's examine specific examples of accumulation/distribution phases on the ETH chart. For example, (describe a specific period on the chart, explaining volume and price action). The high volume during this period combined with the subsequent price increase strongly suggests an accumulation phase, in line with the Wyckoff methodology. Note the significant bullish candlestick patterns (e.g., engulfing candles, hammer candles) further strengthening the bullish signal. Conversely, (describe a period illustrating a distribution phase with supporting evidence).

Potential Scenarios and Risk Assessment Based on Wyckoff Interpretation

Based on this Wyckoff analysis, a $2700 ETH price surge is a potential scenario. The accumulation phase appears to be nearing completion, suggesting a strong possibility of a significant markup phase. However, several other scenarios are possible:

- Bullish Scenario: Successful breakout above a key resistance level, leading to a sustained price increase towards $2700.

- Bearish Scenario: Failure to break through resistance, potentially leading to a further markdown phase.

It's crucial to acknowledge potential risks that could invalidate this analysis:

- Macroeconomic Factors: Global economic conditions, regulatory changes, and overall market sentiment significantly impact cryptocurrency prices.

- Unexpected News: Negative news regarding Ethereum or the broader cryptocurrency market could trigger a sell-off.

Risk management is paramount in cryptocurrency trading. Diversifying your portfolio and using stop-loss orders is crucial to limit potential losses. Other technical indicators, such as moving averages and RSI, can be used to corroborate or contradict the Wyckoff analysis.

Trading Strategies Based on Wyckoff's Ethereum Price Prediction

Based on the identified Wyckoff patterns, several trading strategies may be considered:

- Entry Points: A breakout above a key resistance level, confirmed by increased volume, could signal a favorable entry point.

- Exit Points: Trailing stop-loss orders, or exiting at a pre-determined profit target, helps to protect profits.

- Risk Management: Position sizing (only risking a small percentage of your capital on each trade) and diversification across different assets are crucial to mitigate risks.

Remember, these strategies are just suggestions; adapt them to your own risk tolerance and trading style. Always conduct thorough due diligence before entering any trade.

Conclusion: Ethereum Price Prediction and the Wyckoff Method

Our Wyckoff analysis suggests a potential $2700 price target for Ethereum, based on the identified accumulation phase and potential breakout. However, it's crucial to remember that this is just a prediction, and the cryptocurrency market is inherently volatile. Thorough risk management is paramount. While this Wyckoff analysis suggests a potential surge, remember to conduct your own thorough research before making any trading decisions related to Ethereum. Use this analysis as a tool to inform your approach to Ethereum price prediction and always prioritize responsible risk management. Further study of the Wyckoff method and other technical indicators is recommended for making informed decisions about ETH trading.

Featured Posts

-

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025 -

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025 -

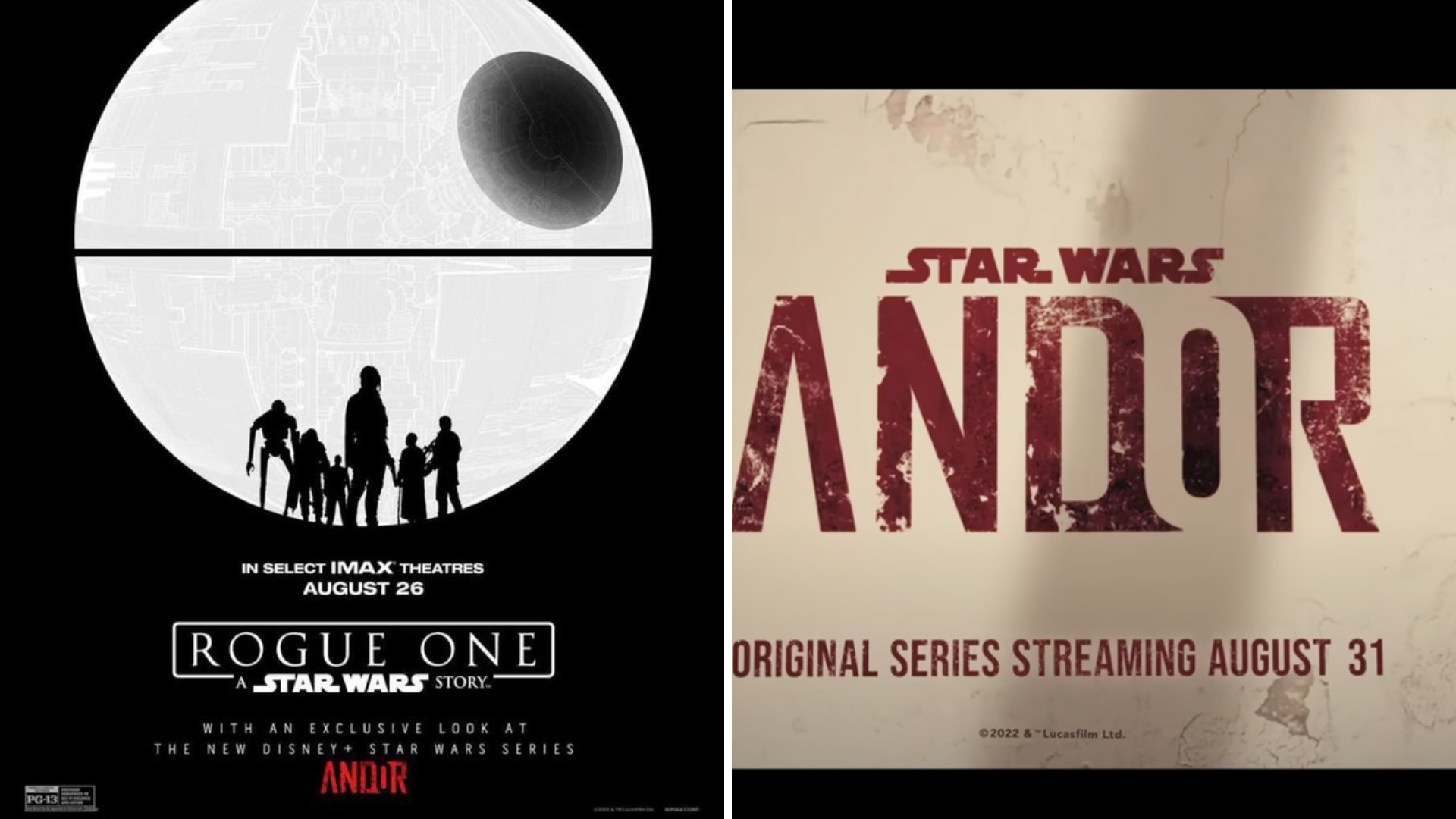

New Star Wars Show Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Show Explores The Past Of A Beloved Rogue One Character

May 08, 2025 -

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025