Significant Drop In Toronto Home Sales And Prices: 23% And 4% Respectively

Table of Contents

Reasons Behind the 23% Drop in Toronto Home Sales

Several interconnected factors have contributed to the considerable decline in Toronto home sales.

Impact of Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes have played a dominant role. Increased borrowing costs directly translate to reduced purchasing power for homebuyers.

- Increased borrowing costs: Higher interest rates significantly increase the monthly mortgage payments, making homeownership less affordable for many.

- Reduced purchasing power: With higher interest rates, buyers can afford to borrow less, shrinking the pool of potential properties they can consider.

- Tighter lending criteria: Lenders are also becoming more cautious, implementing stricter lending criteria, further limiting access to mortgages.

For example, the Bank of Canada increased its benchmark interest rate by 1% in the last quarter, directly impacting mortgage rates offered by financial institutions. This increase alone has demonstrably reduced the number of buyers able to afford homes in the current market.

Economic Uncertainty and Inflation

High inflation and growing economic uncertainty are eroding consumer confidence, discouraging potential buyers from entering the market.

- Fear of recession: The looming threat of a recession is prompting many to postpone major purchases, including homes.

- Job security concerns: Economic instability is leading to job insecurity, making individuals hesitant to commit to a large financial obligation like a mortgage.

- High inflation eroding purchasing power: The rising cost of living, fueled by inflation, reduces disposable income and leaves less money available for home purchases.

Statistics show a clear correlation between rising inflation rates and a decrease in consumer confidence, impacting the demand for real estate in Toronto.

Reduced Inventory and Market Saturation

The level of available inventory is another critical factor. While a shortage of inventory has been a long-standing characteristic of the Toronto market, a sudden influx of listings (or a perceived surplus) can lead to price corrections.

- Comparison of current inventory to previous years: Analyzing year-over-year data reveals a significant increase in the number of homes listed for sale, exceeding the typical numbers for this time of year.

- Impact of new builds: A surge in newly constructed homes entering the market can also contribute to a perceived oversupply.

- Analysis of market saturation: The current market shows signs of some saturation, particularly in specific segments.

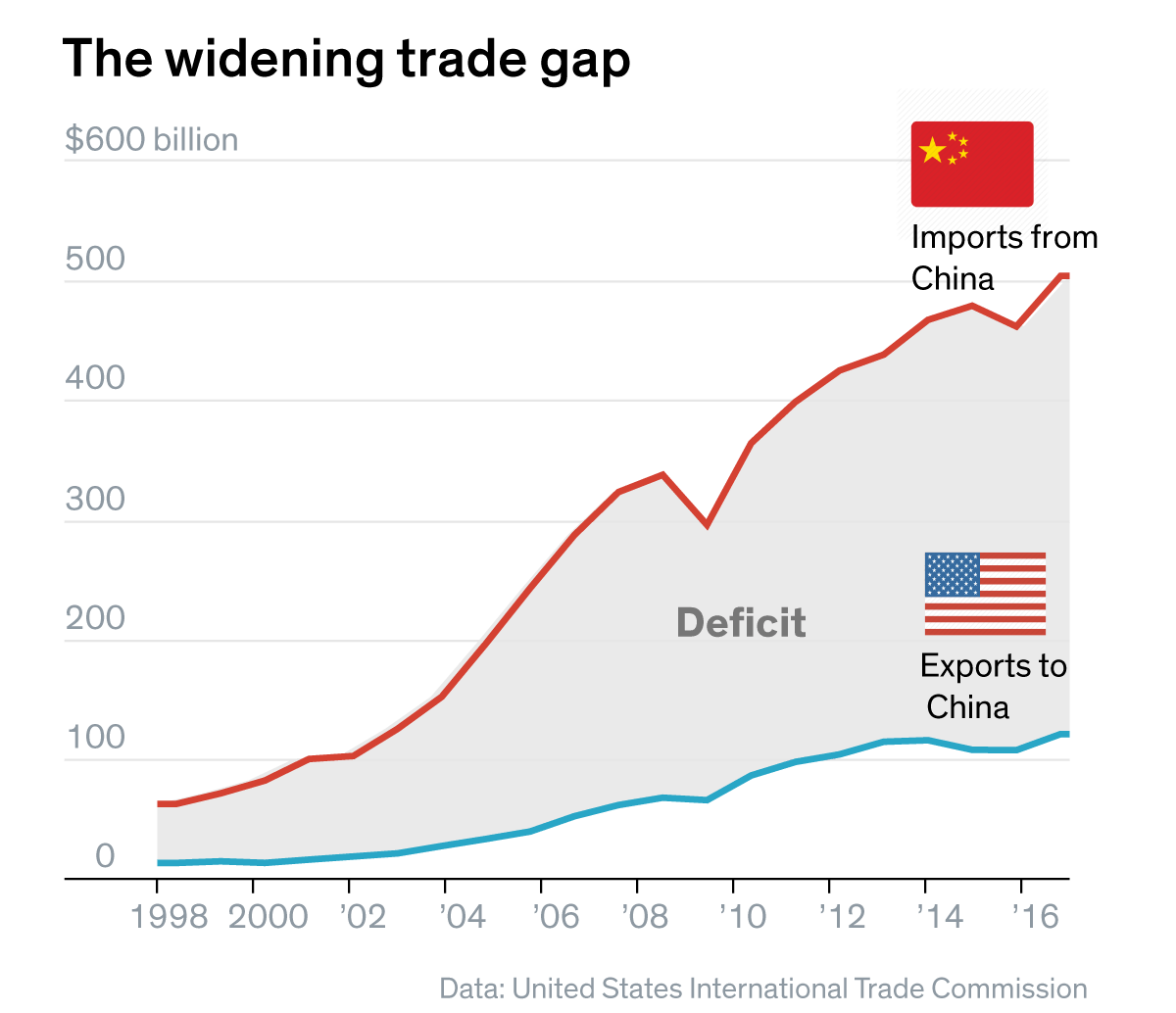

A visual representation (graph or chart) comparing current inventory levels to previous years would clearly illustrate this point.

Analysis of the 4% Decrease in Toronto Home Prices

The 4% drop in average home prices across Toronto reflects a complex interplay of market forces and varies significantly across different neighborhoods and property types.

Price Adjustments in Different Neighbourhoods

Price changes haven't been uniform across Toronto. Some areas have experienced steeper declines than others.

- Price changes in specific areas (e.g., downtown core vs. suburbs): The downtown core, for instance, has seen a more pronounced price decrease compared to some suburban areas.

- Segmentation by housing type (condos, detached homes): Condominiums generally have shown a higher percentage decrease compared to detached homes.

A detailed map visualizing price changes geographically would offer a compelling visual representation of these variations.

Shifting Buyer Demand

Changing buyer preferences have also impacted prices.

- Increased demand for specific amenities: Buyers are increasingly prioritizing properties with specific amenities, such as outdoor space or home offices.

- Shifting preferences towards certain housing types: The demand for certain types of housing, like townhouses or condos, might have increased or decreased, driving price changes.

- Impact of remote work on location choices: The rise of remote work has allowed for a shift in location preferences, leading to price fluctuations in different neighborhoods.

Analysis of recent sales data can reveal specific buyer preferences and their impact on pricing.

Impact on Different Property Types

The price decrease affects different property types differently.

- Percentage change in prices for each property type: Condos might have seen a larger percentage decrease than detached homes.

- Reasons for differing impacts across types: This can be attributed to various factors, including supply and demand dynamics specific to each type of property.

A comparison chart showcasing price changes for condos, townhouses, and detached homes would clearly demonstrate these differences.

Implications for Buyers and Sellers in the Toronto Market

The current market presents both opportunities and challenges for buyers and sellers.

Opportunities for Buyers

The current market offers several advantages for buyers.

- Negotiation power: Buyers now have increased leverage to negotiate favorable prices and terms.

- Potential for better deals: Opportunities to secure properties below asking price are more prevalent.

- Strategies for navigating the market: Buyers should work with experienced real estate professionals to develop successful strategies.

Challenges for Sellers

Sellers currently face a more competitive market.

- Strategies for pricing homes competitively: Sellers need to accurately price their homes to attract buyers in this slower market.

- Importance of market timing: Timing the sale is crucial to maximize the return.

- Need for professional assistance: Engaging a real estate agent with market expertise is vital for sellers.

Conclusion: Navigating the Significant Drop in Toronto Home Sales and Prices

The significant drop in Toronto home sales (23%) and prices (4%) is a result of rising interest rates, economic uncertainty, and shifting buyer demands. This market correction presents both opportunities and challenges for buyers and sellers. Buyers have increased negotiation power and the potential for better deals, while sellers face longer selling times and the need for strategic pricing. Looking ahead, the Toronto real estate market's trajectory will depend on several factors, including interest rate adjustments, economic stability, and ongoing shifts in buyer preferences. To understand the Toronto housing market, make informed decisions about Toronto real estate, and learn more about the Toronto home sales drop and explore current Toronto property prices, contact a real estate professional for personalized guidance. They can help you navigate this dynamic market and make the best decisions for your specific circumstances.

Featured Posts

-

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025 -

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025 -

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025 -

The Long Walk A First Trailer Thats Simply Scary

May 08, 2025

The Long Walk A First Trailer Thats Simply Scary

May 08, 2025 -

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025

Latest Posts

-

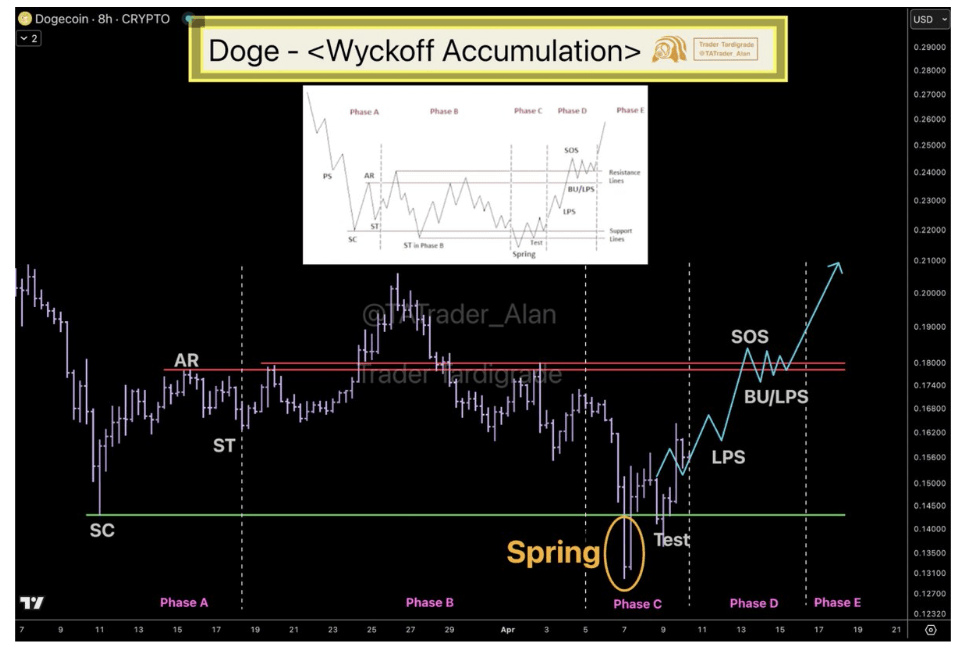

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025