U.S. And China Trade War: What To Expect From The Upcoming Official Meeting

Table of Contents

Potential Outcomes of the U.S.-China Trade Meeting

The upcoming meeting could yield several different outcomes, each with significant implications for the global economy. Understanding these potential scenarios is crucial for navigating the uncertainties surrounding the U.S.-China trade war.

Tariff Reductions or Removal

One potential outcome is a reduction or even removal of existing tariffs on Chinese goods. This would represent a significant de-escalation of the trade war.

- Specific tariff categories that might be targeted: Tariffs on consumer goods, agricultural products, and certain manufactured goods could be prioritized for reduction.

- Potential economic benefits for both nations: Reduced tariffs could lead to lower consumer prices in the U.S., increased exports from China, and a boost to global economic growth.

- Likelihood of complete tariff removal: Complete removal is less likely in the short term, given the political complexities involved. However, a phased reduction remains a possibility.

The probability of significant tariff reductions depends on several factors. Historically, tariff reductions have often been part of broader trade agreements. However, the current political climate and the ongoing tensions between the two nations make predicting the outcome challenging.

New Trade Agreements and Commitments

The meeting might result in new trade agreements addressing long-standing concerns. These could cover intellectual property rights, technology transfer, and market access.

- Specific areas where new agreements might be reached: Increased protection of intellectual property, commitments to fair technology transfer practices, and improved market access for U.S. businesses in China.

- Potential challenges in enforcing these agreements: Ensuring compliance and effective enforcement mechanisms will be crucial for the success of any new agreements.

- Impact on specific industries: Agreements on technology transfer would significantly impact technology companies, while agricultural trade agreements would benefit American farmers.

Negotiating these agreements will be complex, involving intricate details and potential disagreements on enforcement mechanisms. However, successful agreements could significantly reshape the bilateral trade relationship.

Stalemate and Continued Tensions

A third possibility is that the meeting yields no significant breakthroughs, leading to a continuation of the trade war. This scenario carries significant risks.

- Potential consequences of a stalemate: Continued uncertainty, further volatility in global markets, and potential escalation of the trade conflict.

- Impact on global supply chains: Disruptions to global supply chains could lead to shortages of goods and increased prices.

- Risks to economic growth: Continued trade tensions could negatively impact global economic growth.

A stalemate would likely prolong the uncertainty and negatively impact investor confidence, potentially leading to a further escalation of the conflict.

Key Areas of Negotiation in the U.S.-China Trade Talks

Several key areas will likely dominate the negotiations during the U.S.-China trade talks. These areas have been central to the trade conflict from its inception.

Intellectual Property Rights

Protecting intellectual property and preventing technology theft remain crucial objectives for the U.S.

- Specific examples of past intellectual property violations: Forced technology transfer, counterfeiting, and patent infringement.

- Proposed solutions for stronger protection: Improved enforcement mechanisms, stricter penalties for violations, and increased transparency.

Stronger intellectual property rights protection is economically significant, as it encourages innovation and investment.

Agricultural Trade

Expanding agricultural exports from the U.S. to China is another key area of negotiation.

- Specific agricultural products: Soybeans, corn, pork, and other agricultural commodities.

- Potential market size in China: China represents a vast market for U.S. agricultural products.

- Impact on American farmers: Increased exports could significantly benefit American farmers.

Agricultural trade plays a vital role in the economies of both countries.

Technology Transfer

Concerns about forced technology transfer from U.S. companies operating in China remain a major point of contention.

- Examples of forced technology transfer: Requiring U.S. companies to share their technology as a condition for market access.

- Potential remedies: Clearer regulations, stronger enforcement, and greater transparency.

- Impact on U.S. technological competitiveness: Forced technology transfer undermines U.S. technological leadership.

The issue of technology transfer has significant geopolitical implications, impacting both economic and national security interests.

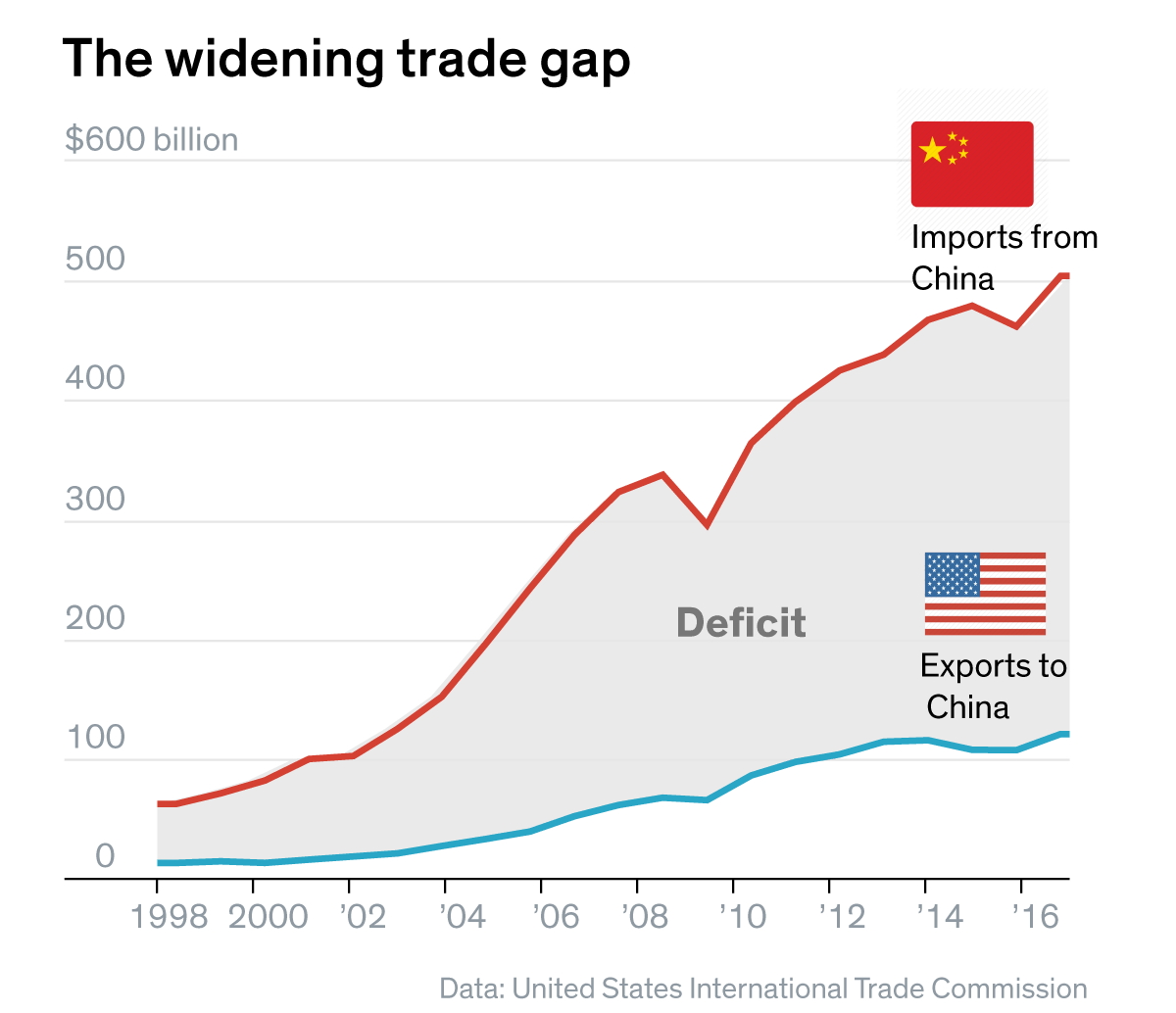

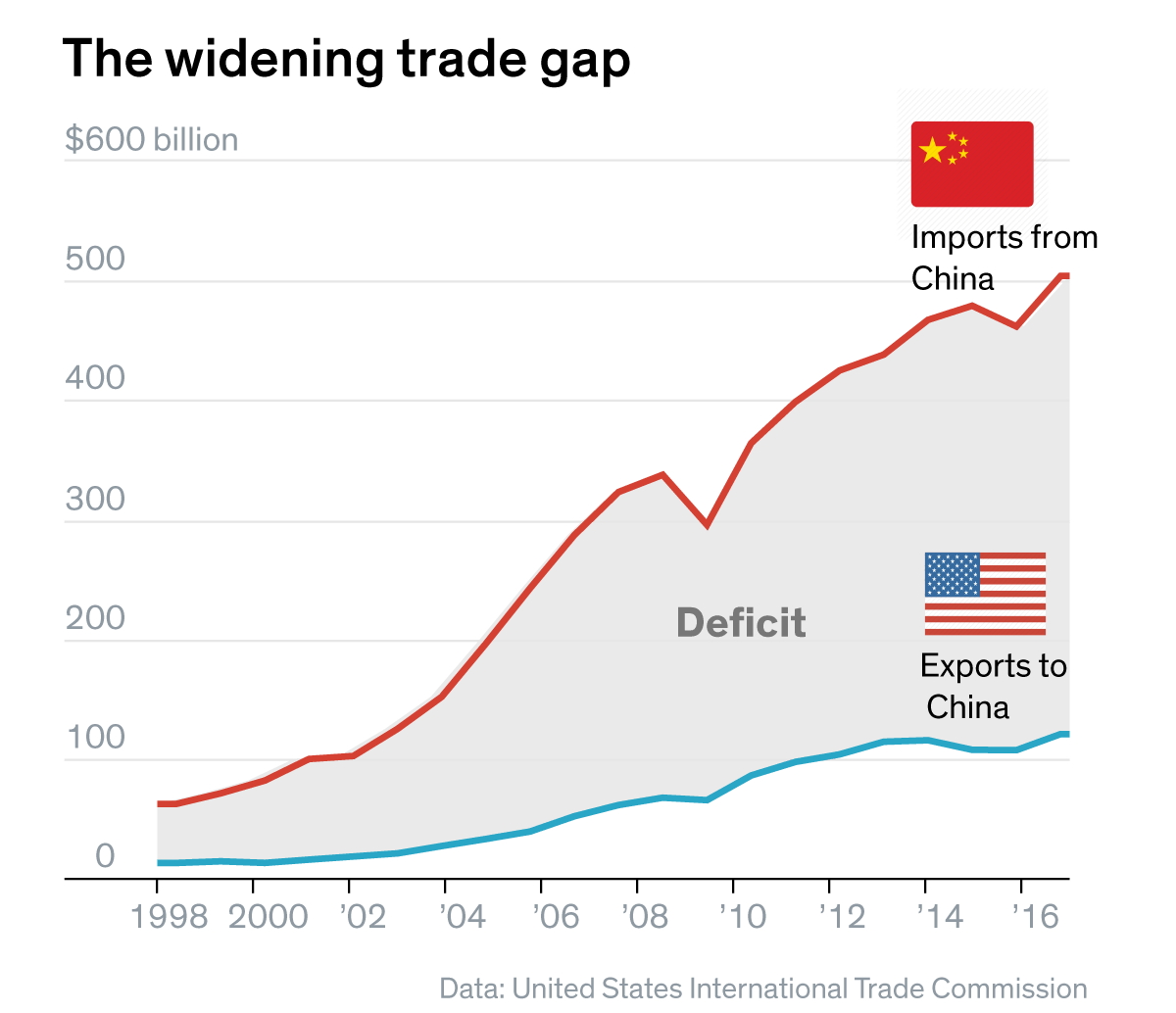

Economic Implications of the U.S.-China Trade War

The U.S.-China trade war has far-reaching economic implications, affecting global markets and individual industries.

Global Market Volatility

The trade war has increased volatility in global stock markets and reduced investor confidence.

- Impact on specific sectors: Technology, manufacturing, and agricultural sectors have been particularly affected.

- Potential for market corrections: The uncertainty caused by the trade war increases the risk of market corrections.

- The role of investor sentiment: Investor sentiment plays a significant role in driving market fluctuations.

The interconnected nature of global markets means that the U.S.-China trade conflict has ripple effects across the globe.

Inflationary Pressures

Tariffs and supply chain disruptions can lead to increased consumer prices.

- Examples of goods affected by tariffs: Consumer electronics, clothing, and furniture.

- Impact on consumer spending: Higher prices can reduce consumer spending and slow economic growth.

- The role of inflation in economic growth: High inflation can erode purchasing power and destabilize economic growth.

Understanding the mechanisms through which trade wars contribute to inflation is crucial for policymakers.

Impact on Specific Industries

Certain industries in both countries are disproportionately affected by the trade war.

- Examples of industries heavily impacted: Manufacturing, technology, and agriculture.

- Potential for job losses or gains: The impact varies across industries and regions.

The economic consequences of the trade war are unevenly distributed, with some sectors benefiting while others suffer.

Conclusion

The upcoming U.S.-China trade meeting holds significant implications for the global economy. While predicting the exact outcome remains challenging, understanding the potential scenarios, key areas of negotiation, and broader economic implications is crucial for businesses and investors. The potential for tariff reductions, new trade agreements, or a continued stalemate will greatly impact various sectors. Staying informed about developments in the U.S.-China trade war is essential for navigating these uncertain times. Continue to monitor updates and analyses regarding the U.S.-China trade war to make informed decisions.

Featured Posts

-

James Gunns Superman 5 Minute Krypto Preview Released

May 08, 2025

James Gunns Superman 5 Minute Krypto Preview Released

May 08, 2025 -

Etf

May 08, 2025

Etf

May 08, 2025 -

Bitcoins Golden Cross Analyzing The Price Surge And Future Predictions

May 08, 2025

Bitcoins Golden Cross Analyzing The Price Surge And Future Predictions

May 08, 2025 -

Beyond Saving Private Ryan Spielbergs 7 Best War Movies Ranked

May 08, 2025

Beyond Saving Private Ryan Spielbergs 7 Best War Movies Ranked

May 08, 2025 -

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025

Latest Posts

-

Daily Lotto Winning Numbers For Friday April 18 2025

May 08, 2025

Daily Lotto Winning Numbers For Friday April 18 2025

May 08, 2025 -

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025 -

Xrp Price Soars 400 Whats Next For The Cryptocurrency

May 08, 2025

Xrp Price Soars 400 Whats Next For The Cryptocurrency

May 08, 2025 -

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025 -

Friday April 18 2025 Daily Lotto Numbers

May 08, 2025

Friday April 18 2025 Daily Lotto Numbers

May 08, 2025