Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: A Detailed Explanation

Table of Contents

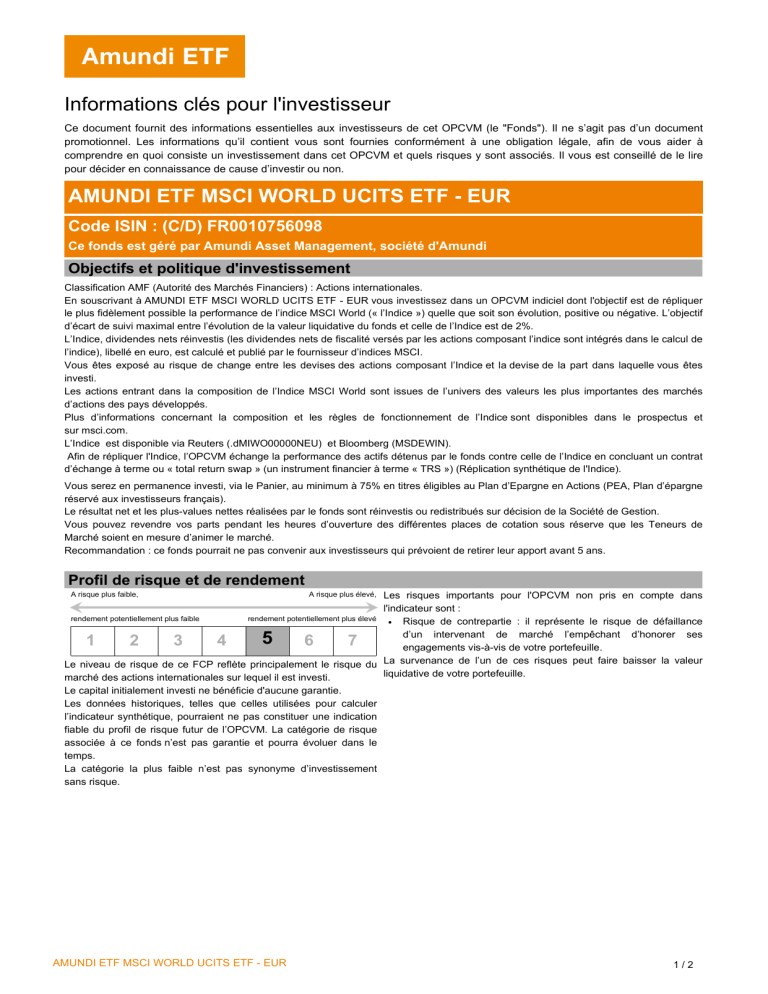

The Amundi MSCI World II UCITS ETF Dist is a popular choice for investors seeking diversified global exposure. Understanding its Net Asset Value (NAV) is crucial for making informed investment decisions. This article provides a comprehensive explanation of the NAV, how it's calculated, and its significance for your portfolio. We'll delve into the specifics of this ETF and what the NAV tells you about its performance.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. In the context of the Amundi MSCI World II UCITS ETF Dist, the NAV reflects the total value of all the underlying securities the ETF holds, less any expenses. This is different from the market price, which is the price at which the ETF shares are currently trading on the exchange.

The NAV is a crucial metric for ETF investors because it provides a more accurate picture of the ETF's intrinsic worth. Understanding the difference between NAV and market price is essential for making sound investment decisions.

- NAV reflects the underlying asset value: It's a direct measure of what the ETF's holdings are worth.

- Market price can fluctuate due to supply and demand: Short-term market fluctuations can cause the market price to deviate from the NAV.

- NAV provides a more accurate picture of the ETF's intrinsic worth: It's a more stable indicator of long-term value compared to the fluctuating market price.

How is the NAV of Amundi MSCI World II UCITS ETF Dist Calculated?

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated daily, typically at the close of the market. The process involves several steps:

- Determining the Market Value of Holdings: The ETF manager calculates the market value of each asset held within the portfolio. This includes a diverse range of equities (stocks) from across the global market, reflecting the MSCI World index.

- Accounting for Currency Conversions: Since the ETF invests globally, currency conversions are necessary to express all asset values in a single currency (likely Euros, given it's a UCITS ETF).

- Deducting Expenses: The ETF's operating expenses, management fees, and other costs are subtracted from the total value of the assets.

- Dividing by Outstanding Shares: The resulting net asset value is then divided by the total number of outstanding ETF shares to arrive at the NAV per share.

- Daily calculation at market close: Ensures the NAV reflects the most up-to-date market prices.

- Sum of the market value of all holdings: This represents the total value of the ETF's underlying investments.

- Deduction of ETF expenses: Provides a true reflection of the net asset value available to investors.

- Division by the number of outstanding shares: Gives the NAV per share, making it easy to compare to the market price.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist?

Several reliable sources provide the NAV of the Amundi MSCI World II UCITS ETF Dist:

- Amundi's official website: The fund manager's website is the most authoritative source for NAV data.

- Major financial data providers (Bloomberg, Refinitiv, etc.): These platforms provide comprehensive financial data, including ETF NAVs.

- Your brokerage account: Most brokerage platforms display the NAV of your ETF holdings alongside the market price.

It's important to understand that NAV data is typically updated daily, usually at the close of the market. Different platforms may have slight variations due to data lags or differing calculation methods, but discrepancies should be minimal.

Using NAV to Make Informed Investment Decisions

The NAV of the Amundi MSCI World II UCITS ETF Dist is a valuable tool for making informed investment decisions. By tracking the NAV, you can:

- Track NAV changes to monitor performance: Compare the NAV over time to assess the ETF's growth or decline.

- Compare NAV to other similar ETFs: Use the NAV to compare the performance of the Amundi MSCI World II UCITS ETF Dist against its competitors.

- Identify potential buying or selling opportunities: Significant discrepancies between the NAV and market price could signal potential investment opportunities. A lower market price relative to the NAV might suggest a buying opportunity, while the opposite could indicate a potential selling opportunity.

Conclusion:

This article provided a detailed explanation of the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist, outlining its calculation, importance, and where to find it. Understanding NAV is crucial for evaluating the ETF's performance and making sound investment decisions. Regularly check the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist holdings and utilize this crucial data to optimize your investment strategy. Stay informed about the NAV and its implications to make the most of your global investment portfolio. Learn more about Amundi ETFs and their NAV calculations today!

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Comprehensive Overview

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Comprehensive Overview

May 24, 2025 -

Esc 2025 Conchita Wurst And Jj To Perform At Eurovision Village

May 24, 2025

Esc 2025 Conchita Wurst And Jj To Perform At Eurovision Village

May 24, 2025 -

Planning Your Country Escape Tips For A Smooth Transition

May 24, 2025

Planning Your Country Escape Tips For A Smooth Transition

May 24, 2025 -

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Peremozhtsiv

May 24, 2025

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Peremozhtsiv

May 24, 2025 -

Confirmed Glastonbury 2025 Acts Olivia Rodrigo The 1975 And Music Legends

May 24, 2025

Confirmed Glastonbury 2025 Acts Olivia Rodrigo The 1975 And Music Legends

May 24, 2025

Latest Posts

-

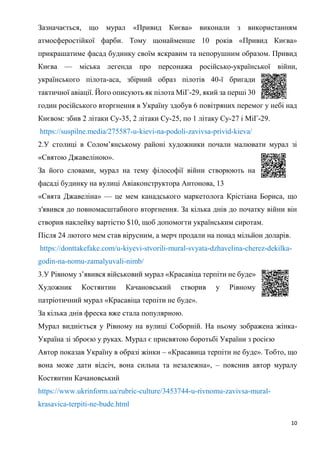

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025 -

Positive Pmi Data Supports Continued Dow Jones Growth

May 24, 2025

Positive Pmi Data Supports Continued Dow Jones Growth

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Dow Joness Measured Rise Strong Pmi Bolsters Market Confidence

May 24, 2025

Dow Joness Measured Rise Strong Pmi Bolsters Market Confidence

May 24, 2025