Positive PMI Data Supports Continued Dow Jones Growth

Table of Contents

Understanding the PMI and its Impact on the Market

The Purchasing Managers' Index (PMI) is a key economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It's a composite index, meaning it's built from multiple data points, offering a comprehensive view of the health of these crucial sectors. A PMI reading above 50 signifies expansion, indicating growth in business activity, while a reading below 50 signals contraction.

- Manufacturing PMI: Measures activity in the manufacturing sector, focusing on production, new orders, employment, and supplier deliveries.

- Services PMI: Tracks the performance of the services sector, encompassing areas like retail, finance, and transportation.

- Composite PMI: Combines both manufacturing and services data for a broader economic picture.

Strong PMI numbers directly impact investor confidence. When businesses report positive activity and growth, it signals increased profitability and future potential. This fuels investor optimism, leading to increased investment and pushing stock market indices, like the Dow Jones, higher.

- PMI reflects business activity and future expectations, providing valuable insight into economic trends.

- Higher PMI often translates to increased corporate profits, attracting further investment.

- Positive PMI encourages investment and boosts market sentiment, creating a positive feedback loop.

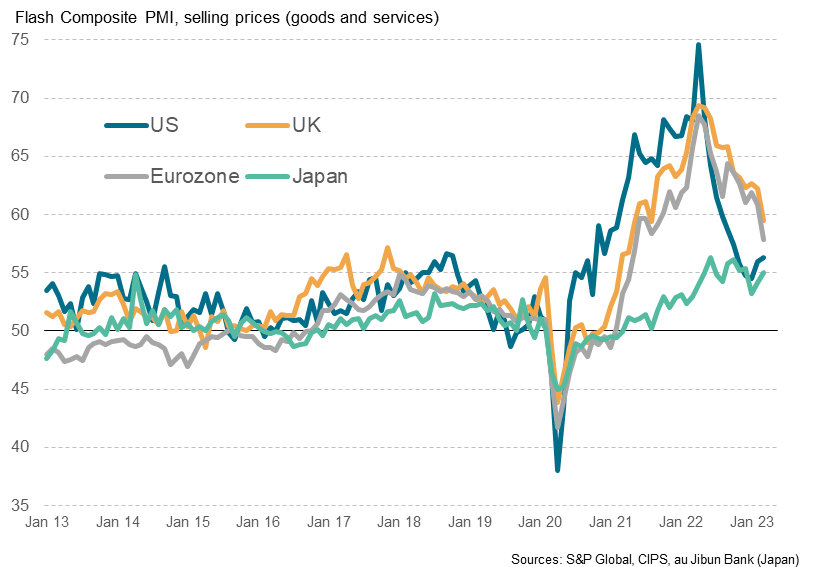

Recent PMI Data and its Positive Indicators

The latest PMI data reveals a positive economic outlook. For instance, the August 2024 Markit US Composite PMI came in at 52.7 (source: insert reputable source here, e.g., Markit Economics website), indicating continued expansion in the US economy. This figure represents a slight increase from the previous month's reading and surpasses analysts' expectations. This growth was particularly robust in the services sector, suggesting strong consumer spending and business activity.

- Specific PMI numbers and their interpretation: A PMI of 52.7 indicates a healthy growth rate, exceeding the neutral 50 mark.

- Comparison with previous months/years' data: Comparing this figure to previous months and years provides a clear indication of the trend – whether growth is accelerating or decelerating.

- Focus on key sectors driving positive growth: The strong performance in the services sector suggests a healthy consumer market and robust business activity.

The unexpected positive surprise in the PMI data, exceeding many analysts' forecasts, further bolstered market confidence.

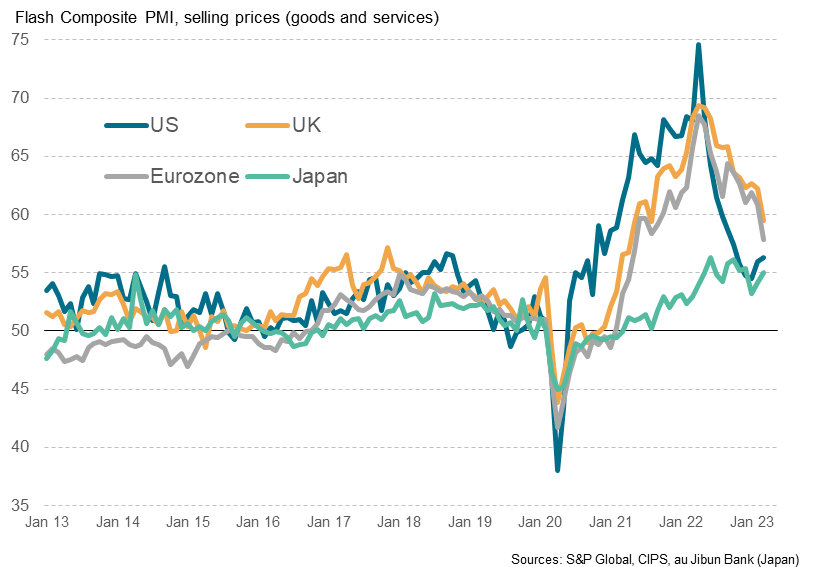

Dow Jones Performance in Relation to Positive PMI

The correlation between positive PMI data and Dow Jones performance is undeniable. Historically, periods of strong PMI readings have often coincided with upward trends in the Dow Jones. (Insert a chart or graph here visually demonstrating this correlation using historical data. Clearly source the data.)

The market's reaction to these positive PMI reports has been overwhelmingly positive, with the Dow Jones experiencing significant gains in the weeks following their release. While PMI is a significant driver, other factors also influence the Dow Jones, including government policies, geopolitical events, and interest rate changes.

- Historical data showing the relationship between PMI and Dow Jones: Statistical analysis can quantify this relationship and demonstrate the historical link.

- Analysis of Dow Jones performance following positive PMI releases: Examining the market's reaction to PMI releases helps establish the causal relationship.

- Mention any expert opinions or analyst forecasts: Include quotes from financial experts supporting the observed correlation.

Potential Risks and Future Outlook

While the current positive PMI data supports continued Dow Jones growth, it's crucial to acknowledge potential risks. Global economic uncertainties, such as geopolitical tensions or unexpected inflationary pressures, could negatively impact future PMI readings and subsequently affect the Dow Jones.

- Potential economic downturns or global uncertainties: A global recession or significant geopolitical event could easily reverse the current trend.

- Factors that could negatively affect PMI in the coming months: Rising interest rates, supply chain disruptions, or a sudden decline in consumer confidence could dampen growth.

- Strategies for investors to mitigate potential risks: Diversification, risk management strategies, and a long-term investment horizon can help mitigate these risks.

A balanced perspective acknowledges that while positive PMI data suggests continued growth, unforeseen circumstances could alter the trajectory.

Conclusion: Positive PMI Data Supports Continued Dow Jones Growth – What's Next?

The strong correlation between positive PMI data and the continued upward trend in the Dow Jones is clear. The recent positive PMI readings, coupled with strong market reactions, suggest a healthy economic outlook. However, maintaining vigilance and monitoring PMI data closely remains vital for anticipating shifts in market dynamics.

Continue monitoring positive PMI data for insights into Dow Jones performance. Understanding this key economic indicator provides crucial information for investors navigating the complexities of the stock market. Learn how positive PMI data impacts your Dow Jones investments by staying informed about economic trends and expert analysis. Subscribe to our newsletter for regular updates on PMI and its impact on market performance!

Featured Posts

-

How Nicki Chapman Made 700 000 From A Country Property Investment

May 24, 2025

How Nicki Chapman Made 700 000 From A Country Property Investment

May 24, 2025 -

First Look 2026 Porsche Cayenne Ev Spy Photos

May 24, 2025

First Look 2026 Porsche Cayenne Ev Spy Photos

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Camunda Con 2025 Amsterdam The Future Of Ai And Automation Through Orchestration

May 24, 2025

Camunda Con 2025 Amsterdam The Future Of Ai And Automation Through Orchestration

May 24, 2025 -

Avrupa Borsalari Artilar Ve Eksilerle Karisik Bir Kapanis

May 24, 2025

Avrupa Borsalari Artilar Ve Eksilerle Karisik Bir Kapanis

May 24, 2025

Latest Posts

-

Pre Q2 Apple Stock A Look At Current Market Conditions

May 24, 2025

Pre Q2 Apple Stock A Look At Current Market Conditions

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025 -

Mia Farrows Urgent Message Following Trumps Congressional Address Democracys Future At Stake

May 24, 2025

Mia Farrows Urgent Message Following Trumps Congressional Address Democracys Future At Stake

May 24, 2025 -

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Apple Stock Q2 Earnings And Implications For Investors

May 24, 2025

Apple Stock Q2 Earnings And Implications For Investors

May 24, 2025