Dow Jones's Measured Rise: Strong PMI Bolsters Market Confidence

Table of Contents

Keywords: Dow Jones, Dow Jones Industrial Average, PMI, Purchasing Managers' Index, market confidence, economic growth, stock market, investor sentiment, market analysis, stock market trends.

The Dow Jones Industrial Average is experiencing a measured but significant rise, largely attributed to a surprisingly strong Purchasing Managers' Index (PMI). This positive economic indicator has injected a much-needed dose of confidence into the market, prompting investors to reassess their strategies and potentially increase their holdings. This article will delve into the factors contributing to this positive trend and analyze its potential implications for the future.

Strong PMI Data as the Catalyst

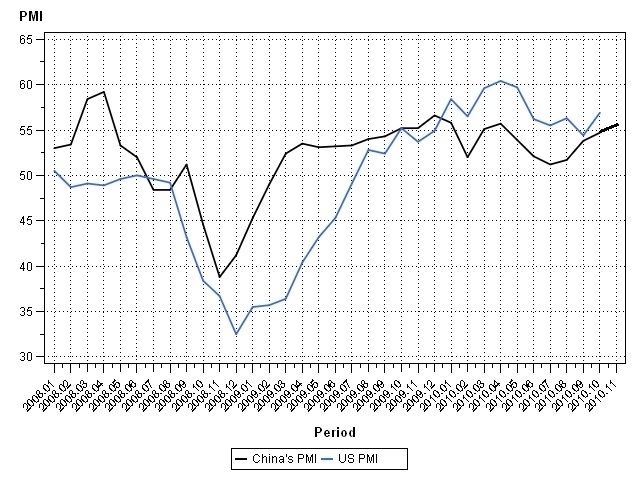

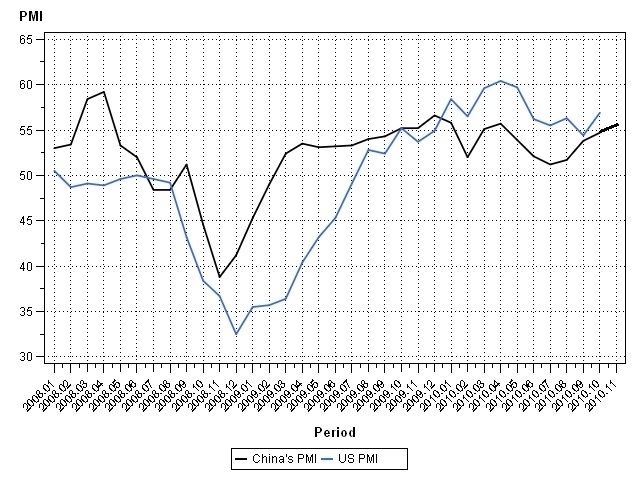

Understanding the PMI

The Purchasing Managers' Index (PMI) is a crucial economic indicator that reflects the prevailing health of the manufacturing and services sectors. It's a composite index calculated from surveys of purchasing managers in various industries. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction. Its significance lies in its ability to provide a near real-time snapshot of economic activity.

- Manufacturing Activity: The PMI tracks changes in production levels, new orders, and inventories, offering insights into the manufacturing sector's performance.

- Business Confidence: The index also reflects the confidence levels of purchasing managers, providing a gauge of future economic outlook. Optimistic managers tend to increase purchasing and production, while pessimism leads to contraction.

- Employment: Changes in employment levels within the manufacturing and service sectors are also key components of the PMI, reflecting overall economic health.

- Different PMI Variations: While the overall PMI provides a comprehensive view, separate PMIs often exist for manufacturing and services, offering a more granular understanding of sector-specific performance. Regional PMIs can also provide valuable geographic insights.

Specific PMI Numbers and Their Impact

The recently released PMI data showed a significant jump, exceeding expectations and previous readings. For instance, the August manufacturing PMI registered a robust 54.5, compared to 52.0 in July and analyst forecasts of 53.0. This substantial increase suggests a healthy expansion in the manufacturing sector.

- Data Comparison: [Insert a simple table or graph here comparing the PMI data for the last three months, including forecasts and actual results. Clearly highlight the positive deviation from expectations.]

- Regional Differences: While the national PMI showed strong growth, regional variations exist. [Discuss any regional differences and their potential impact on specific sectors of the Dow Jones, providing examples.]

Market Response to Positive PMI

Investor Sentiment and Stock Prices

The robust PMI figures have significantly boosted investor sentiment, leading to a notable increase in the Dow Jones Industrial Average. This positive correlation reflects the market's confidence in sustained economic growth.

- Positive Sector Reactions: The technology, consumer discretionary, and industrial sectors have shown particularly strong gains following the PMI release. Companies such as [mention a few specific companies and their stock performance].

- Investor Psychology: Positive economic news tends to reduce risk aversion among investors, encouraging them to invest more aggressively in the stock market. The strong PMI data has seemingly reinforced this behavior, leading to increased buying pressure and higher stock prices.

Impact on Investment Strategies

The positive market outlook generated by the strong PMI data is prompting investors to adjust their portfolios. Many are increasing their risk appetite and shifting investments towards sectors predicted to benefit most from continued growth.

- Increased Risk Appetite: Investors are less hesitant to invest in higher-risk, higher-reward assets, potentially shifting funds from bonds or cash equivalents into equities.

- Sector Rotation: There's a noticeable shift in investment strategies, with increased allocation toward cyclical sectors like industrials and consumer discretionary, which tend to perform well during periods of economic expansion.

Potential Challenges and Future Outlook

Geopolitical Risks and Economic Uncertainties

While the current market sentiment is positive, several factors could potentially impact future performance.

- Inflationary Pressures: Persistent inflation could lead to interest rate hikes, potentially dampening economic growth and impacting stock valuations.

- Geopolitical Instability: Global conflicts and political uncertainty can negatively influence market sentiment and investor confidence.

- Supply Chain Disruptions: Ongoing supply chain challenges could constrain economic activity and affect corporate earnings.

Predicting Future Dow Jones Trends

Predicting the future trajectory of the Dow Jones remains challenging, even with the positive PMI data. A cautious optimism is warranted. Continued monitoring of economic indicators, including the PMI, inflation rates, and geopolitical developments is essential.

- Continued Monitoring: Closely following economic data releases and geopolitical events will help assess the sustainability of the current positive trend.

- Further Research: Further analysis of corporate earnings reports and consumer spending data will provide a more comprehensive picture of the economic outlook.

Conclusion

The strong PMI data has undeniably played a significant role in the Dow Jones's measured rise, fueling market confidence and boosting investor sentiment. While the current outlook is positive, it's crucial to acknowledge potential challenges like inflation and geopolitical uncertainties. The positive impact of the PMI on the Dow Jones suggests a healthy economic expansion but requires continued monitoring.

Call to Action: Stay updated on the Dow Jones's performance and the influential PMI data to optimize your investment strategy and navigate the market effectively. Regularly monitor these key indicators for a clearer understanding of market trends and potential opportunities. Understanding the Dow Jones and its relationship with the PMI is critical for making informed investment decisions.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025 -

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025 -

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025 -

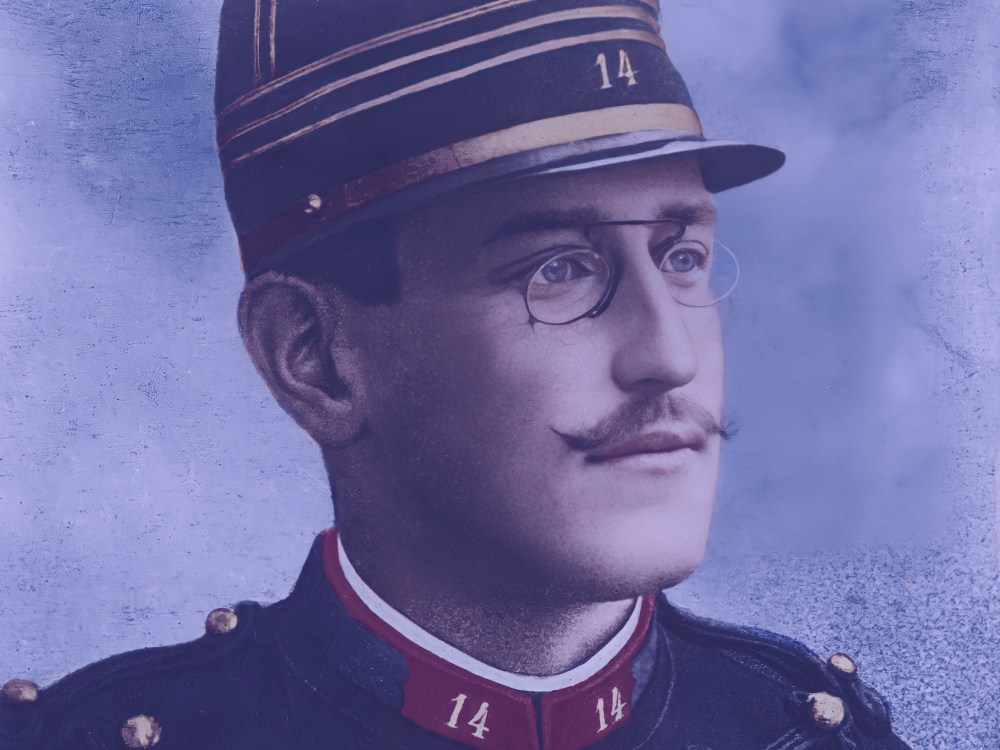

130th Anniversary Of The Dreyfus Affair A Demand For Justice

May 24, 2025

130th Anniversary Of The Dreyfus Affair A Demand For Justice

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Photo Gallery

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Photo Gallery

May 24, 2025

Latest Posts

-

Amsterdam Accueille Ces Unveiled Europe Decouvrez Les Innovations

May 24, 2025

Amsterdam Accueille Ces Unveiled Europe Decouvrez Les Innovations

May 24, 2025 -

Retour De Ces Unveiled En Europe Les Technologies De Demain A Amsterdam

May 24, 2025

Retour De Ces Unveiled En Europe Les Technologies De Demain A Amsterdam

May 24, 2025 -

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques Europeennes

May 24, 2025

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques Europeennes

May 24, 2025 -

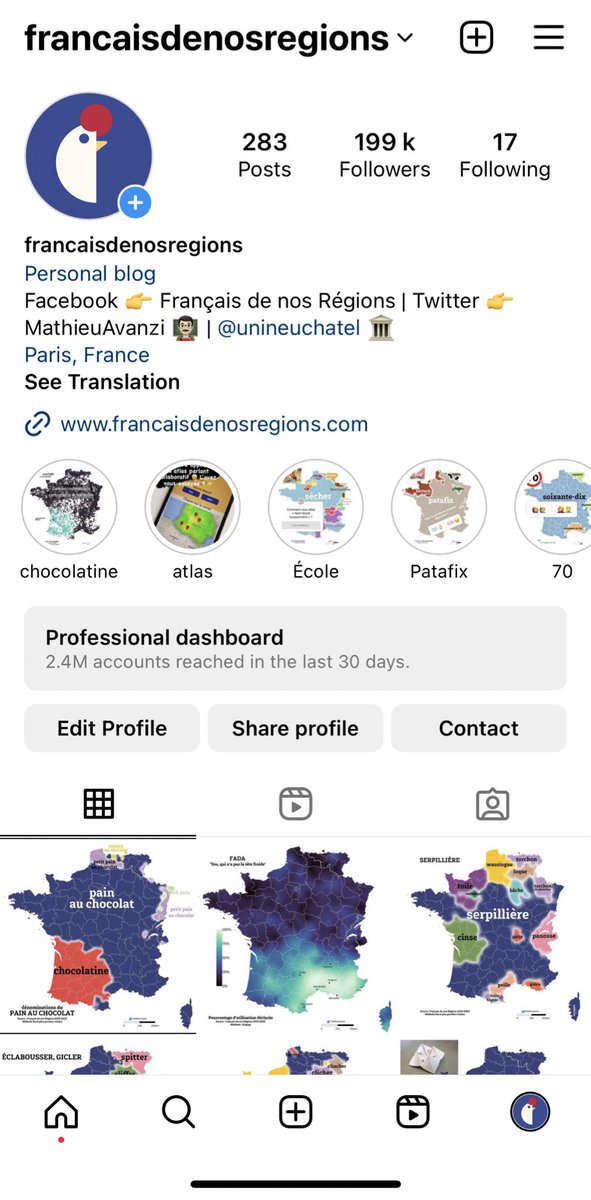

Mathieu Avanzi Pourquoi Le Francais Est Plus Qu Une Langue Scolaire

May 24, 2025

Mathieu Avanzi Pourquoi Le Francais Est Plus Qu Une Langue Scolaire

May 24, 2025 -

Mathieu Avanzi Le Francais Usages Contemporains Et Perspectives

May 24, 2025

Mathieu Avanzi Le Francais Usages Contemporains Et Perspectives

May 24, 2025