Investing In The Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Analysis

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF (Dist)?

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) aims to replicate the performance of the Dow Jones Industrial Average. Its primary investment objective is to track the index's price movements, offering investors a cost-effective way to gain broad exposure to large-cap US equities.

- UCITS Structure: The "UCITS" designation signifies that the ETF complies with the Undertakings for Collective Investment in Transferable Securities directives, a set of European Union regulations ensuring high standards of investor protection and regulatory oversight. This makes it accessible to investors across Europe and internationally.

- Distribution Policy ("Dist"): The "(Dist)" indicates a distribution policy, meaning the ETF pays out dividends to its shareholders periodically. These distributions represent the dividends collected from the underlying companies within the Dow Jones Industrial Average.

- Ticker Symbol: The specific ticker symbol will vary depending on the exchange it's listed on (e.g., it might be listed on several exchanges in Europe). Always check with your broker for the correct symbol.

Understanding Net Asset Value (NAV) and its Importance

The Net Asset Value (NAV) represents the total value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. Simply put, it's the net worth of the ETF per share.

- NAV Calculation: For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), the NAV is calculated daily by summing the market values of all the holdings (the 30 Dow Jones stocks), subtracting any liabilities (like management fees), and dividing by the number of outstanding ETF shares.

- Significance of NAV: The NAV is crucial for ETF investors because it provides a true reflection of the underlying asset value. Comparing the NAV to the market price of the ETF helps identify potential arbitrage opportunities. Tracking NAV changes over time reveals the ETF's performance.

- NAV vs. Market Price: The market price of an ETF can fluctuate throughout the trading day, differing slightly from the NAV due to supply and demand. However, significant and persistent deviations from the NAV often indicate market inefficiencies.

Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV Performance Analysis

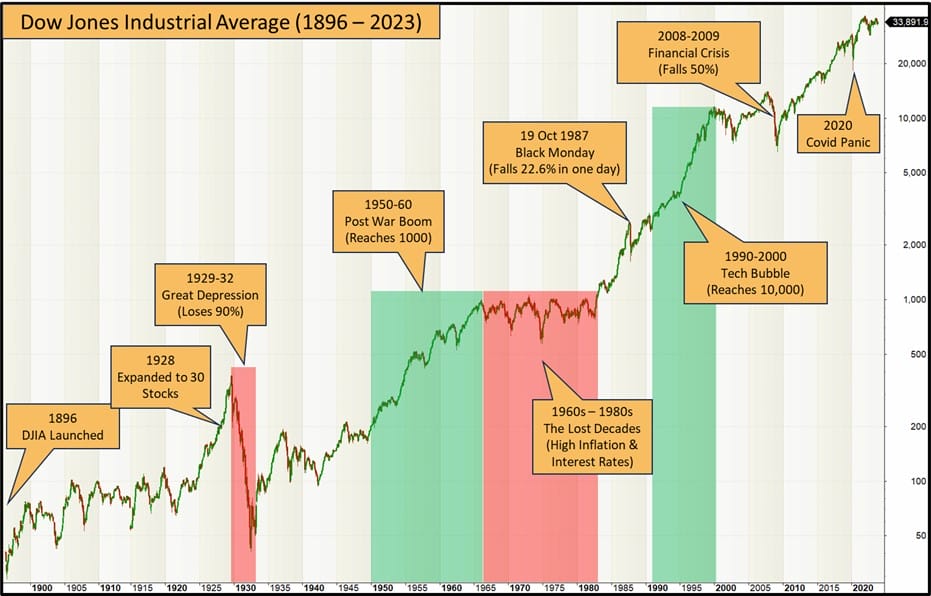

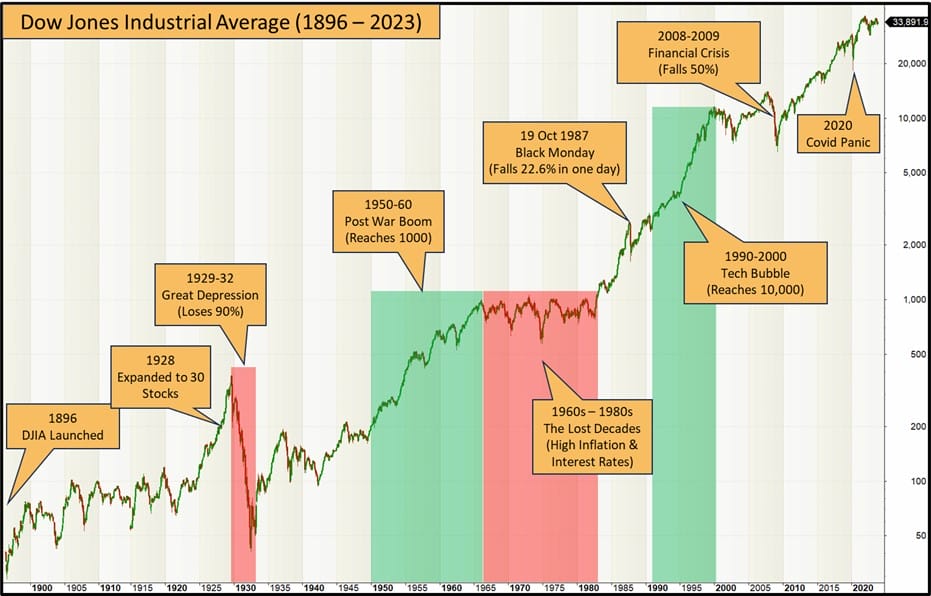

Historical NAV Data:

(Insert a visually appealing chart or graph here showing historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) over a relevant period, e.g., the last 5 years.)

NAV Growth & Volatility:

The chart above illustrates the historical NAV performance. For example, (insert specific data points, e.g., "From January 2020 to March 2020, the NAV experienced a sharp decline of X% due to the COVID-19 pandemic.") Periods of significant volatility are often correlated with broader market events. (Provide further examples of specific market events and their impact on NAV.)

NAV Comparison to Benchmark:

(Insert a chart comparing the ETF's NAV performance to the Dow Jones Industrial Average itself over the same time period.)

Tracking differences between the ETF's NAV and the Dow Jones Industrial Average are typically minimal. Any deviations can be attributed to factors like management fees and the expense ratio of the ETF.

Impact of Dividends on NAV:

Dividend distributions slightly reduce the NAV on the ex-dividend date. However, investors receive a cash payment, which offsets the decrease in NAV and contributes to the overall return. This is crucial to consider when evaluating total return.

Factors Influencing Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Market Performance:

The primary driver of the ETF's NAV is the performance of the Dow Jones Industrial Average itself. Positive performance in the index directly translates to NAV growth, and vice-versa.

Economic Factors:

Macroeconomic factors, such as interest rate changes, inflation rates, and economic growth forecasts, significantly impact the performance of the companies in the Dow Jones Industrial Average and consequently the ETF's NAV. Positive economic indicators typically correlate with higher NAVs.

Currency Fluctuations:

For investors outside the US, currency fluctuations between the US dollar and their local currency will affect the NAV expressed in their local currency. A strengthening US dollar will typically reduce the NAV for non-US investors.

Investing in the Amundi Dow Jones Industrial Average UCITS ETF (Dist): A Strategic Perspective

Risk Assessment:

Investing in this ETF carries market risk. The NAV can fluctuate significantly depending on the overall performance of the Dow Jones Industrial Average, making it unsuitable for risk-averse investors.

Diversification:

This ETF can be a component of a broader diversified portfolio, offering exposure to large-cap US equities. However, it's essential to consider other asset classes to reduce overall portfolio risk.

Suitable Investor Profiles:

This ETF is particularly suitable for long-term investors with a moderate to high-risk tolerance seeking diversified exposure to the US equity market through a passively managed strategy. It's less ideal for short-term traders or those seeking active management.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV Analysis

Understanding the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV is crucial for making informed investment decisions. Our analysis highlights the significance of NAV in evaluating ETF performance, identifying the key factors influencing it, and assessing the ETF's suitability within a broader investment strategy. To further analyze the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV, consider tracking its historical performance against the index, monitoring the impact of dividends, and examining the correlation between its NAV and macroeconomic factors. Regularly reviewing this data enables a thorough evaluation of your investment and helps you decide if this ETF aligns with your risk tolerance and financial goals. Utilize resources like the Amundi website and financial news sources to access more detailed data and insights. Remember to always conduct thorough research before investing. Analyze the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV, track Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV performance, and monitor the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV regularly for a comprehensive understanding of this investment vehicle.

Featured Posts

-

Shop Owners Murder Teen Initially Bailed Then Rearrested

May 24, 2025

Shop Owners Murder Teen Initially Bailed Then Rearrested

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation Mystery

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation Mystery

May 24, 2025 -

Access Bbc Radio 1 Big Weekend 2025 Ticket Information And Lineup

May 24, 2025

Access Bbc Radio 1 Big Weekend 2025 Ticket Information And Lineup

May 24, 2025 -

18 Brazilian Nationals Charged 100 Firearms Seized In Massachusetts Gun Trafficking Crackdown

May 24, 2025

18 Brazilian Nationals Charged 100 Firearms Seized In Massachusetts Gun Trafficking Crackdown

May 24, 2025 -

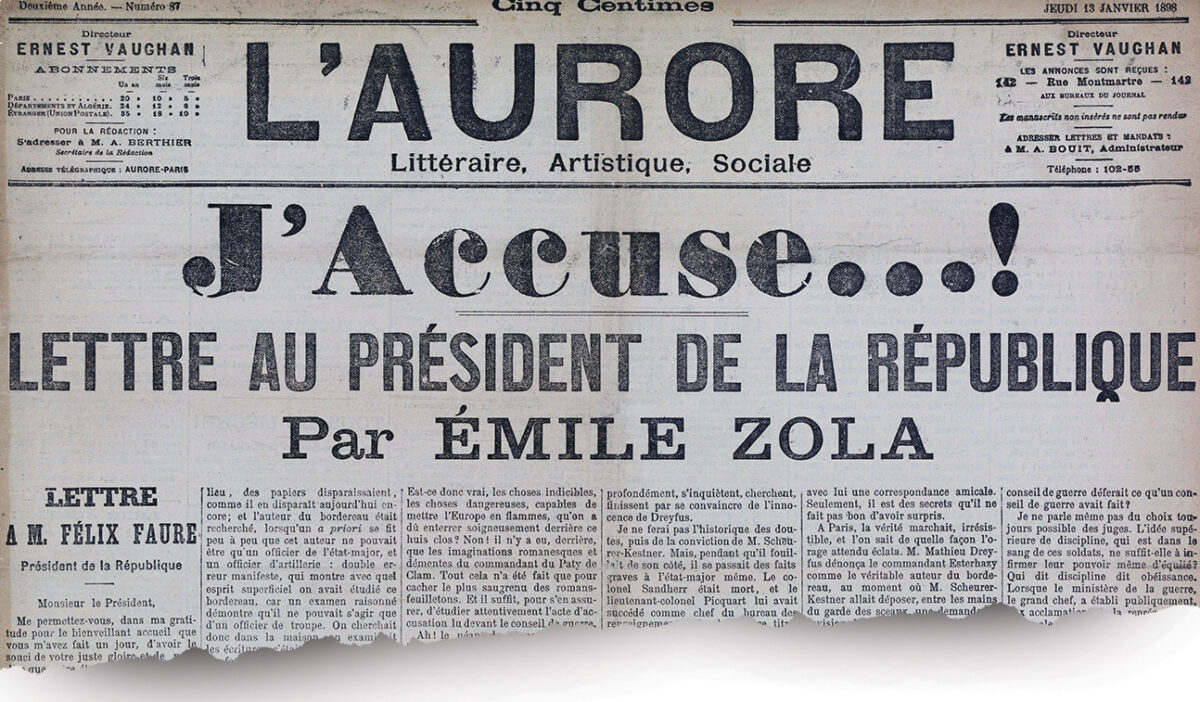

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 24, 2025

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 24, 2025

Latest Posts

-

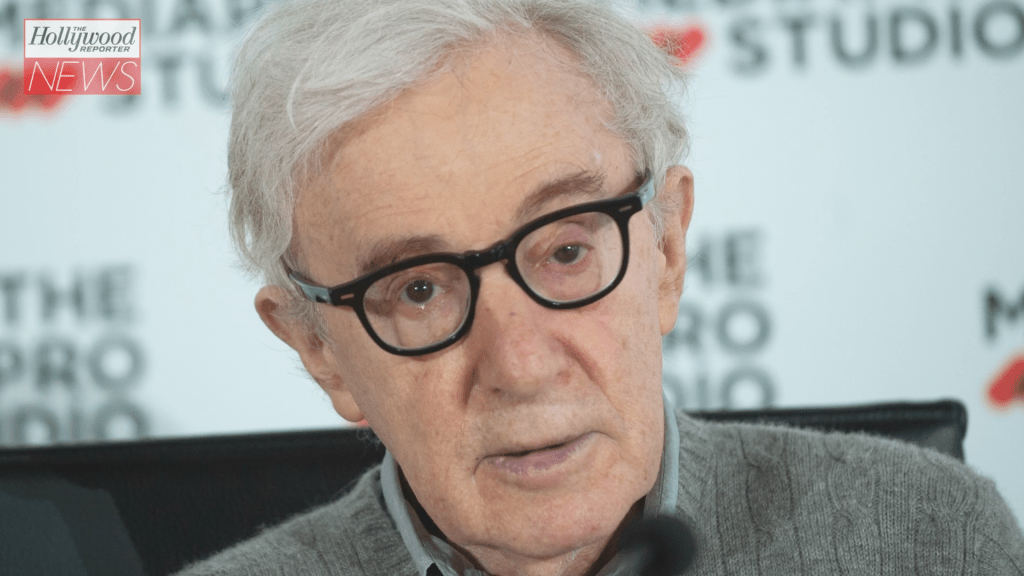

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025