Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The Net Asset Value (NAV) of an ETF represents the net asset value per share. It's essentially the total value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), this calculation is particularly relevant because its holdings directly mirror the composition of the Dow Jones Industrial Average (DJIA).

The calculation involves several key components:

- Assets: This includes the market value of all the stocks comprising the Dow Jones Industrial Average that the ETF holds. Because this ETF tracks the DJIA, its asset value fluctuates directly with the performance of those 30 major US companies.

- Liabilities: These are the ETF's expenses, including management fees and other operational costs.

- Number of Outstanding Shares: This represents the total number of ETF shares currently held by investors.

The NAV calculation is straightforward:

- Total Asset Value = Sum of market values of all holdings (DJIA components)

- Net Asset Value = (Total Asset Value – Total Liabilities) / Number of Outstanding Shares

The NAV is typically calculated daily, providing investors with an up-to-date picture of the ETF's underlying value. This daily update is crucial for accurate performance tracking and informed investment decisions.

NAV vs. Market Price: Understanding the Difference

While the NAV represents the intrinsic value of the ETF, the market price reflects the price at which the ETF shares are actually trading on the exchange. These two figures aren't always identical, and discrepancies can arise due to several factors:

- Supply and Demand: High demand for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) can push its market price above the NAV (a premium), while low demand might lead to a market price below the NAV (a discount).

- Trading Volume: High trading volume generally leads to a market price closer to the NAV, while low volume can amplify price discrepancies.

- Market Sentiment: Investor sentiment and overall market conditions can influence the market price independently of the underlying NAV.

For example, if positive news about the DJIA leads to increased investor enthusiasm, the market price of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) might temporarily rise above its NAV, creating a premium. Conversely, during periods of market uncertainty, the market price might fall below the NAV, resulting in a discount.

The Importance of NAV for Investment Decisions

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is crucial for several reasons:

- Performance Evaluation: Tracking the NAV over time allows investors to assess the ETF's performance and compare it to its benchmark, the Dow Jones Industrial Average.

- Buy/Sell Decisions: While not the sole factor, NAV can inform investment decisions. A significant discount to NAV might present a buying opportunity, while a significant premium might signal a potential overvaluation.

- Comparison with Similar ETFs: Comparing the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) with similar ETFs helps investors evaluate its relative performance and value.

- Long-term Investment Strategy: Monitoring the NAV trends helps in developing a long-term investment strategy aligned with individual financial goals.

You can usually find the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) on the ETF provider's website, financial news websites, or your brokerage account.

NAV and Distributions (Dividends) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The Amundi Dow Jones Industrial Average UCITS ETF (Distributing) distributes dividends to its shareholders. These distributions, derived from the dividends paid by the underlying DJIA companies, directly impact the NAV.

- Impact on NAV: When a distribution is paid, the NAV is reduced by the amount of the distribution per share. This is because the ETF's assets are decreased by the amount paid out.

- Ex-Dividend Date: The ex-dividend date is crucial. Investors who own shares before the ex-dividend date are entitled to the distribution; those who buy shares on or after the ex-dividend date are not.

- Distribution Policy: Understanding the ETF's distribution policy, including the frequency and timing of distributions, is essential for accurate performance evaluation and financial planning.

Conclusion: Mastering Net Asset Value (NAV) for your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) Investments

Understanding Net Asset Value (NAV) is paramount for anyone investing in ETFs, particularly the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). We've explored how NAV is calculated, its relationship to the market price, its role in investment decisions, and how distributions affect it. By regularly monitoring the NAV and understanding its implications, you can make more informed investment choices and effectively manage your holdings in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) or similar ETFs. Continue your research and use this knowledge to maximize your investment success.

Featured Posts

-

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025 -

Svadebniy Bum Na Kharkovschine 600 Brakov Za Mesyats

May 24, 2025

Svadebniy Bum Na Kharkovschine 600 Brakov Za Mesyats

May 24, 2025 -

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Latest Posts

-

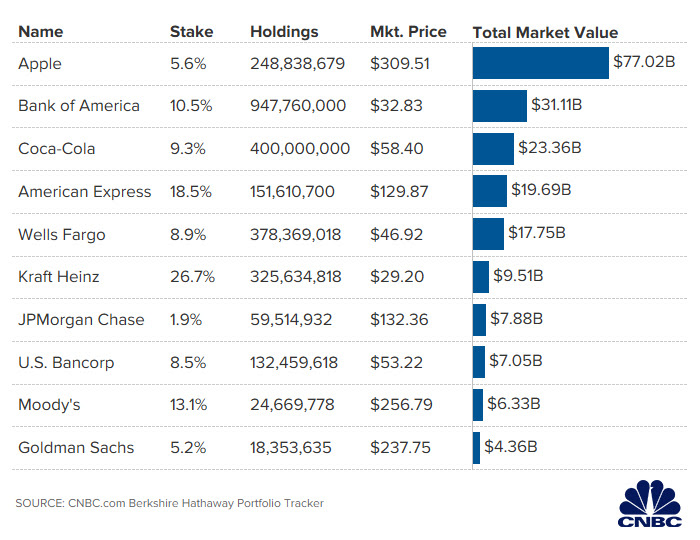

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025 -

Ai

May 24, 2025

Ai

May 24, 2025 -

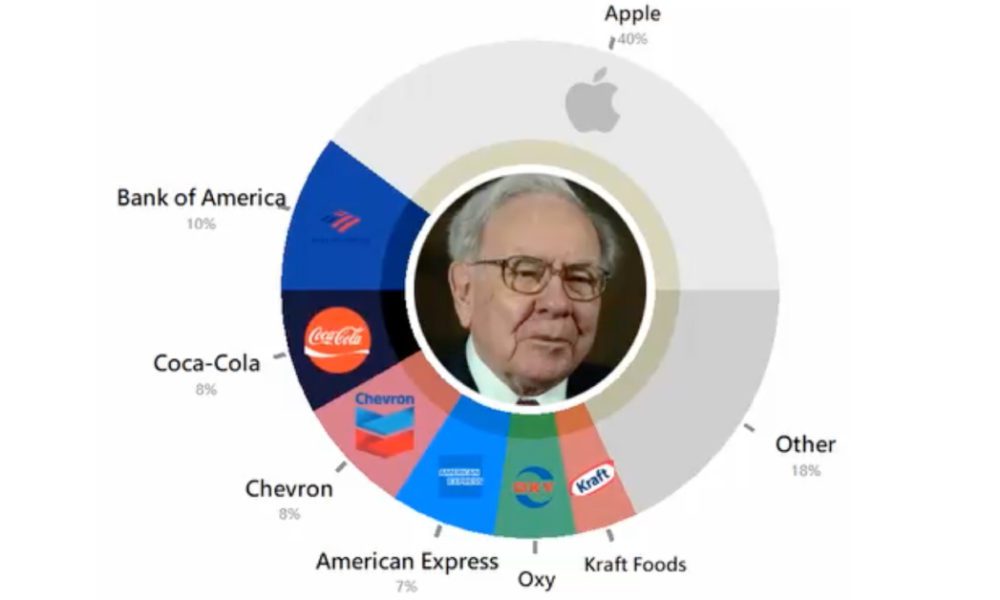

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025