Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: A Comprehensive Overview

Table of Contents

What is the Amundi MSCI World II UCITS ETF USD Hedged Dist?

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund that aims to track the performance of the MSCI World Index, a broad market capitalization-weighted index covering developed market equities globally. Let's break down the key components:

- Investment Objective: To replicate the performance of the MSCI World Index, providing investors with broad exposure to global equities.

- Underlying Index (MSCI World): This index comprises large and mid-cap companies from developed countries worldwide, offering diversification across various sectors and geographies. Its composition is regularly reviewed and adjusted to reflect changes in the market.

- USD Hedged: This crucial aspect means the ETF's returns are hedged against fluctuations in exchange rates between the investor's base currency (likely USD, EUR, or GBP depending on the investor) and the US dollar. This reduces the impact of currency risk on the investment.

- Distribution (Dist): The "Dist" indicates that the ETF distributes dividends to its shareholders periodically, usually on a quarterly or semi-annual basis. This is an important factor to consider when calculating total returns.

How is the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist Calculated?

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated daily, typically at the close of market trading. The calculation involves:

- Market Prices of Underlying Assets: The fund's holdings are valued at their respective market prices at the end of the trading day.

- Factors Affecting Daily Fluctuations: Several factors influence daily NAV changes:

- Market Performance: Positive or negative market movements directly impact the value of the underlying assets and thus the NAV.

- Currency Exchange Rates: Even with hedging, minor fluctuations in exchange rates can slightly affect the NAV.

- Dividends: Dividend payments from the underlying companies affect the NAV, usually causing a slight decrease on the ex-dividend date.

- Frequency of Publication: The NAV is typically published daily by the ETF provider, Amundi.

- NAV vs. Market Price: The NAV represents the theoretical value of the ETF's assets per share. The market price, however, can differ slightly due to the bid-ask spread (the difference between the buying and selling prices).

Accessing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

Reliable NAV data is crucial for informed investment decisions. Investors can typically find this information from several sources:

- Amundi's Website: The official source for the most accurate NAV data.

- Financial News Websites: Many reputable financial news sources (e.g., Bloomberg, Yahoo Finance) provide real-time and historical NAV data for ETFs.

- Brokerage Platforms: Most brokerage accounts display real-time or delayed NAV information for the ETFs held within the account.

It’s critical to use trustworthy sources to ensure the accuracy of your data. Inconsistent or inaccurate NAV information could lead to flawed investment decisions.

Using NAV to Make Informed Investment Decisions Regarding the Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding NAV trends is key to effective investment management.

- Interpreting NAV Changes: Tracking NAV changes over time provides insight into the ETF's performance. Consistent upward trends generally indicate positive performance, while downward trends signal underperformance.

- Calculating Returns: Comparing the NAV at different points in time allows you to calculate your returns, considering both capital appreciation and dividend distributions.

- Buying/Selling Opportunities: Comparing the NAV to the market price can help identify potential buying or selling opportunities. If the market price is significantly below the NAV, it might suggest a buying opportunity (though other factors should also be considered).

- Benchmarking Performance: Comparing the ETF's NAV performance against its benchmark (the MSCI World Index) helps assess how effectively the ETF tracks its target index.

Risks Associated with Investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist

While offering diversification, investing in this ETF carries inherent risks:

- Market Risk: The NAV is susceptible to fluctuations in the overall market. Bear markets can significantly impact the NAV.

- Currency Risk: Despite the USD hedge, residual currency risk may still exist due to exchange rate fluctuations.

- Diversification is Key: While the ETF offers broad diversification, it's crucial to remember that it's still subject to market risks. Diversifying your overall investment portfolio is essential.

- Other Risks: Other relevant risks include inflation risk, interest rate risk, and counterparty risk (related to the ETF provider).

Conclusion: Mastering the Net Asset Value of your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for making sound investment decisions. Regularly monitoring the NAV, understanding its calculation, and utilizing it to assess performance are all vital elements of effective investment management. Remember to always consider the ETF's investment strategy and associated risks before making any decisions based solely on NAV data. Stay informed about the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist and conduct further research to ensure your investments align with your financial goals.

Featured Posts

-

Finding The Perfect Porsche Macan Your Complete Buyers Guide

May 24, 2025

Finding The Perfect Porsche Macan Your Complete Buyers Guide

May 24, 2025 -

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025 -

Shop Owners Murder Teen Initially Bailed Then Rearrested

May 24, 2025

Shop Owners Murder Teen Initially Bailed Then Rearrested

May 24, 2025 -

Must Have Gear For Passionate Ferrari Owners

May 24, 2025

Must Have Gear For Passionate Ferrari Owners

May 24, 2025 -

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025

Latest Posts

-

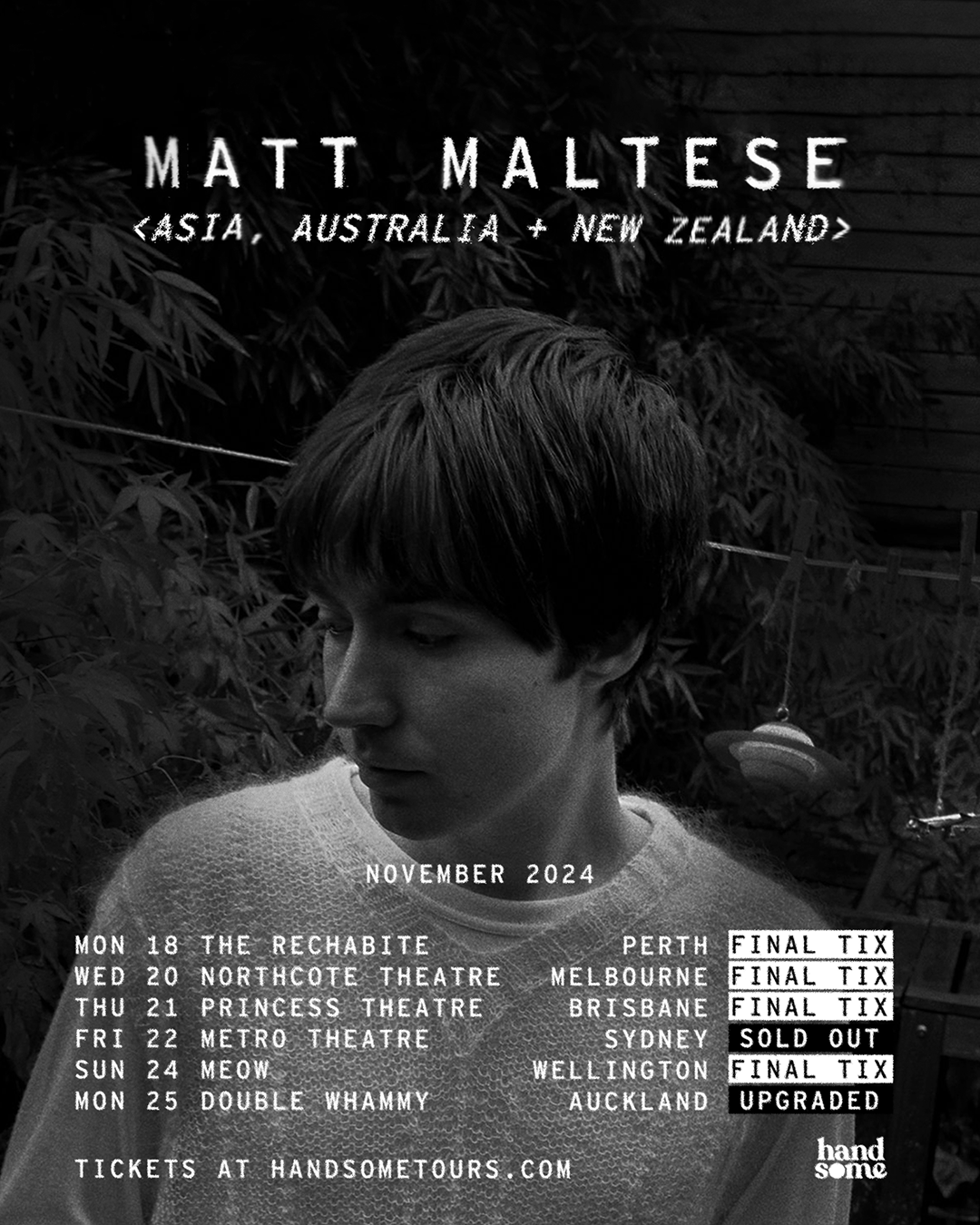

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025