Ethereum Market Crash: $67M In Liquidations And The Potential For More

Table of Contents

Ethereum Liquidation Numbers: A Deeper Dive into the $67 Million Loss

The recent Ethereum crash resulted in a staggering $67 million in liquidations, representing a significant loss for numerous traders. While the exact number of affected traders remains difficult to pinpoint, data from reputable sources like CoinGlass and Bybt paint a concerning picture. This substantial figure underscores the severity of the price drop and its impact on the broader Ethereum ecosystem.

- Specific numbers of liquidated positions across various exchanges: While precise figures vary depending on the exchange and data provider, reports suggest thousands of leveraged positions were liquidated across major platforms.

- Breakdown of liquidation types (long vs. short): The majority of liquidations were likely long positions (bets on price increases), reflecting the overall bearish market sentiment during the crash. However, some short positions (bets on price decreases) might also have been liquidated due to unexpected price bounces.

- Mention the average size of liquidated positions: The average size of liquidated positions varied, but many involved substantial sums, suggesting that significant leverage was employed by some traders.

Understanding the Triggers: Why Did Ethereum Prices Plummet?

Several factors contributed to the sharp decline in Ethereum's price. Understanding these triggers is crucial for navigating future market volatility.

-

Macroeconomic factors (e.g., inflation, interest rate hikes): The overall macroeconomic environment plays a significant role. Rising inflation and aggressive interest rate hikes by central banks globally have dampened investor risk appetite, leading to sell-offs across various asset classes, including cryptocurrencies.

-

Market sentiment and the influence of large institutional investors: Negative news and changing sentiment among large institutional investors can trigger significant price swings. A sudden shift in investor confidence can amplify selling pressure, exacerbating price declines.

-

Specific events that might have triggered selling pressure (e.g., regulatory news, specific project failures): Specific negative news, such as regulatory uncertainty or the failure of a prominent DeFi project, can create a domino effect, pushing prices down further.

-

Specific examples of negative news affecting Ethereum: Reports of regulatory scrutiny, concerns about network scalability, or issues within the decentralized finance (DeFi) ecosystem can negatively impact investor confidence.

-

Impact of overall market sentiment on cryptocurrency prices: The cryptocurrency market is highly correlated with broader investor sentiment. Periods of fear and uncertainty often lead to widespread sell-offs.

-

Role of algorithmic trading and leverage in exacerbating the drop: Algorithmic trading and high leverage can amplify price swings, contributing to the rapid and dramatic nature of the crash.

Looking Ahead: Is a Further Ethereum Price Crash Imminent?

Predicting future price movements is inherently challenging, but analyzing potential factors can help assess the risk of further declines.

-

Assess the overall health of the Ethereum network and its underlying technology: The Ethereum network's underlying technology remains robust, undergoing continuous upgrades and improvements. The long-term prospects of Ethereum depend on its adaptability and innovation.

-

Discuss the resilience of the Ethereum community: The Ethereum community is known for its resilience and commitment to the platform's long-term success. Their ability to adapt and overcome challenges is a positive indicator.

-

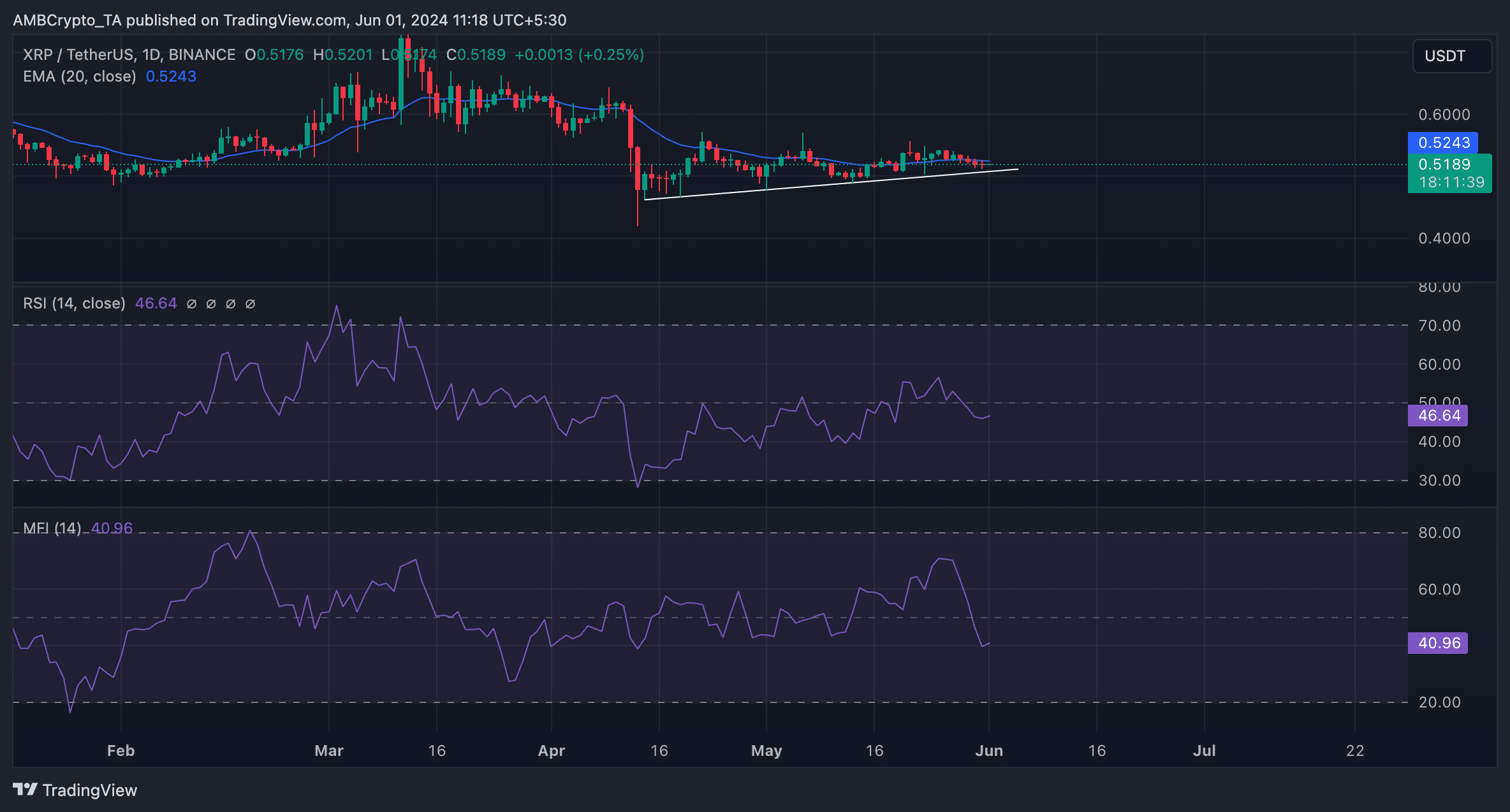

Examine technical indicators and chart analysis (mentioning specific indicators cautiously and responsibly): While technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can provide insights, they are not foolproof predictors of future price movements. Support and resistance levels can offer clues about potential price ranges, but they are not guarantees.

-

Key technical indicators to watch (e.g., RSI, MACD): Monitoring these indicators can provide some insight into short-term price trends, but should not be relied on solely for investment decisions.

-

Support and resistance levels for Ethereum: Identifying key price levels where buying or selling pressure might be stronger can offer a general sense of potential price ranges.

-

Potential scenarios for future price movements: Several scenarios are possible, including continued price declines, consolidation, or a potential rebound.

Navigating the Ethereum Market Crash – What's Next?

The recent Ethereum crash underscores the significant volatility inherent in the cryptocurrency market. The $67 million in liquidations highlights the substantial risks associated with leveraged trading. The main factors contributing to the crash included macroeconomic uncertainty, negative market sentiment, and the influence of institutional investors. Responsible risk management, including diversification and avoiding excessive leverage, is crucial for navigating the volatile nature of the cryptocurrency market. Stay informed about future Ethereum market fluctuations by regularly checking reputable news sources. Understanding the risks associated with Ethereum investments is crucial for navigating future potential crashes. Thorough research and a cautious approach are essential before engaging in any cryptocurrency investments.

Featured Posts

-

The Method Behind Matt Damons Success Ben Afflecks Perspective

May 08, 2025

The Method Behind Matt Damons Success Ben Afflecks Perspective

May 08, 2025 -

Izjava Pavla Grbovica Psg Svi Predlozi Za Prelaznu Vladu Su Na Stolu

May 08, 2025

Izjava Pavla Grbovica Psg Svi Predlozi Za Prelaznu Vladu Su Na Stolu

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Bitcoins 10x Multiplier Could It Shake Wall Street

May 08, 2025

Bitcoins 10x Multiplier Could It Shake Wall Street

May 08, 2025 -

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025