XRP News: 3 Reasons For A Potential XRP Price Surge

Table of Contents

Increased Institutional Adoption of XRP

Growing interest from institutional investors is a significant catalyst for potential XRP price growth. Large financial players are increasingly recognizing the value proposition of XRP, leading to wider adoption and increased demand.

Ripple's Strategic Partnerships

Ripple's strategic partnerships with major financial institutions are a cornerstone of this increased adoption. These partnerships facilitate the use of XRP in cross-border payments, significantly impacting transaction volume and generating positive market sentiment.

- Key Partnerships: Ripple boasts partnerships with major banks and payment providers globally, including several Tier-1 institutions. These partnerships provide a solid foundation for XRP's utility and acceptance within the financial industry. Recent announcements and press releases regularly highlight further collaborations.

- Transaction Volume: The volume of transactions facilitated through RippleNet, Ripple's payment network leveraging XRP, continues to increase. This growth demonstrates the real-world application and utility of XRP within the financial sector. The higher the transaction volume, the greater the demand for XRP.

- Positive Sentiment: The ongoing partnerships and increased transaction volume contribute significantly to positive market sentiment surrounding XRP. This positive outlook attracts further institutional investment and fuels price appreciation. The more positive news emerges, the more bullish the market becomes.

Growing Use Cases for XRP in Cross-border Payments

XRP's efficiency and cost-effectiveness in facilitating international transactions are driving its adoption. Traditional cross-border payment methods are often slow, expensive, and complex. XRP offers a compelling alternative.

- Speed and Low Fees: XRP transactions are significantly faster and cheaper than traditional methods like SWIFT. This speed and cost-effectiveness make XRP attractive to businesses and individuals alike seeking to send money internationally. Transactions can be completed in a matter of seconds, compared to days or even weeks with traditional systems.

- Transaction Costs: The low transaction fees associated with XRP are a major advantage. This significantly reduces the overall cost of sending money across borders, making it a more attractive option compared to traditional methods. Statistics regularly highlight the substantial cost savings.

- Real-world Applications: Several companies are actively using XRP for cross-border payments, demonstrating its practical application and fostering further adoption. These real-world applications build trust and confidence in XRP's utility within the payment industry.

Positive Legal Developments in the SEC Lawsuit

The outcome of the ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. A favorable ruling could trigger a substantial price surge.

Recent Court Proceedings and Expert Opinions

Recent court proceedings have seen Ripple present strong arguments and receive supportive expert opinions. These positive developments are strengthening investor confidence and improving the market outlook for XRP.

- Key Arguments: Ripple's defense centers on the argument that XRP is not a security. The arguments presented, supported by expert testimony, are crucial to the case's outcome.

- Potential Outcomes: A favorable ruling could remove significant regulatory uncertainty, leading to increased investment and price appreciation. Various market analysts have issued price predictions based on different potential outcomes.

- Legal Milestones: Significant legal milestones, such as the submission of expert testimonies and the judge's rulings on various motions, have been closely followed by the XRP community and investors.

Market Sentiment and Investor Confidence

The SEC lawsuit significantly influences investor sentiment and confidence in XRP. Positive news related to the case has a substantial impact on market sentiment and price.

- Impact of Positive News: Positive news from the court proceedings or expert opinions fuels bullish sentiment and attracts new investment. This surge in positive sentiment is a key driver of potential price increases.

- Relief Rally Potential: A favorable legal outcome could trigger a significant "relief rally," as investors who have been hesitant due to the lawsuit regain confidence and rush to buy XRP. Market predictions suggest a substantial price increase following a favorable ruling.

Technological Advancements and RippleNet Expansion

Continuous improvements to RippleNet and the broader XRP ecosystem contribute to price appreciation. Ongoing development and expansion enhance XRP's capabilities and attractiveness to institutional clients.

Enhancements to RippleNet's Functionality

RippleNet is constantly being upgraded to enhance its functionality, security, and scalability. These advancements make it an increasingly attractive payment solution for financial institutions.

- Scalability, Security, and Interoperability: Improvements in scalability ensure that RippleNet can handle a growing volume of transactions. Security enhancements protect the network and user funds, while interoperability increases compatibility with other systems.

- New Features and Integrations: New features and integrations expand the capabilities of RippleNet and make it more versatile and user-friendly for financial institutions. These improvements solidify RippleNet’s position as a leader in cross-border payment solutions.

Expansion of RippleNet's Global Reach

The growing adoption of RippleNet by financial institutions worldwide reflects the increasing demand for XRP-based payment solutions.

- Geographic Expansion: RippleNet's continued expansion into new geographical markets increases its global reach and strengthens XRP's position in the international payments landscape.

- New Partnerships: New partnerships with financial institutions in different regions further demonstrate the growing adoption and acceptance of RippleNet. This expansion fuels the network's growth and enhances XRP's utility.

- Increased Network Usage: The overall increase in network usage signifies the growing reliance on RippleNet and XRP for efficient and cost-effective cross-border payments.

Conclusion

The potential for an XRP price surge is fueled by a confluence of factors: increasing institutional adoption driven by Ripple's strategic partnerships and the growing use of XRP in cross-border payments; positive legal developments in the SEC lawsuit impacting investor confidence; and continuous technological advancements and expansion of RippleNet. Staying informed about XRP news and developments is crucial for investors. Keep following the latest XRP news and analysis to capitalize on potential price increases. By understanding these key factors, you can make informed decisions about your XRP investments. Don't miss out on the potential XRP price surge – stay updated on all the latest XRP news!

Featured Posts

-

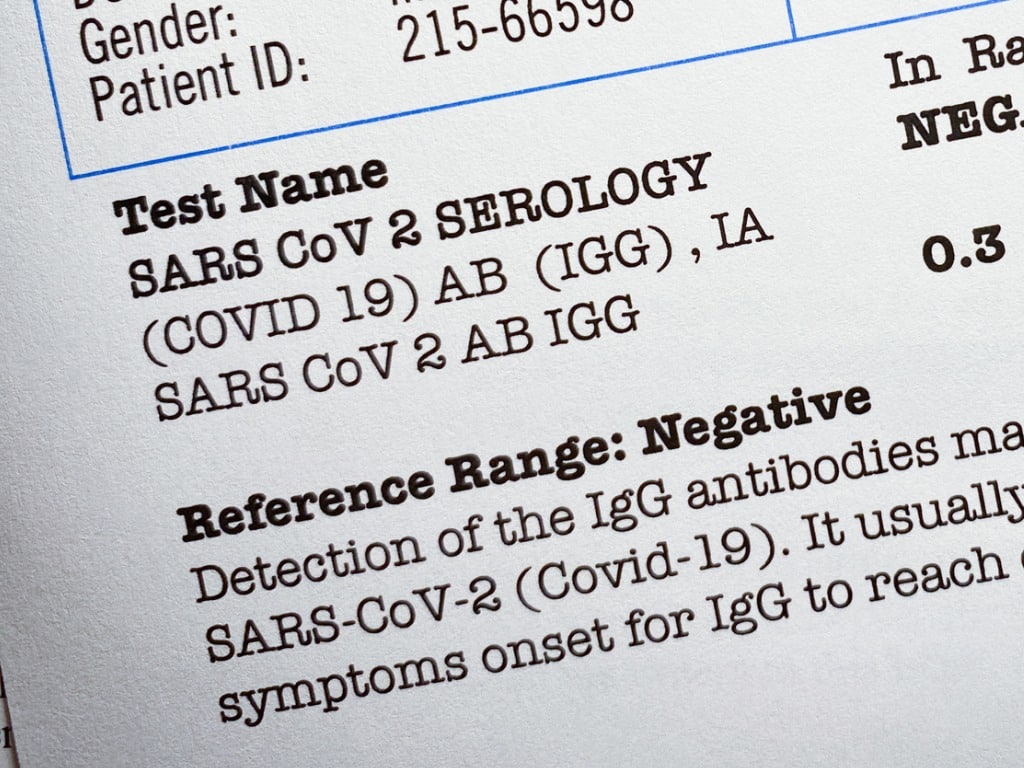

Fake Covid Test Results Lab Owners Guilty Plea

May 08, 2025

Fake Covid Test Results Lab Owners Guilty Plea

May 08, 2025 -

Veteran Wide Receiver Joins Browns Report Details Signing And Return Specialist Role

May 08, 2025

Veteran Wide Receiver Joins Browns Report Details Signing And Return Specialist Role

May 08, 2025 -

Pressure On Arteta Intensifies Arsenal News And Analysis

May 08, 2025

Pressure On Arteta Intensifies Arsenal News And Analysis

May 08, 2025 -

Roma Fieis Esperam Missa De Funeral Do Papa Francisco Em Vigilia Noturna

May 08, 2025

Roma Fieis Esperam Missa De Funeral Do Papa Francisco Em Vigilia Noturna

May 08, 2025 -

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025

Latest Posts

-

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Jayson Tatums Ankle Details On The Injury And Potential Recovery Timeline

May 08, 2025

Jayson Tatums Ankle Details On The Injury And Potential Recovery Timeline

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025