XRP Price Prediction: 3 Factors Pointing To A Possible Parabolic Move In XRP

Table of Contents

Ripple's Ongoing Legal Battle with the SEC: A Potential Catalyst for Growth

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has cast a long shadow over XRP's price. The SEC alleges that XRP is an unregistered security, a claim that has significantly impacted investor confidence and price volatility. However, the outcome of this lawsuit could act as a powerful catalyst for growth.

A Positive Ruling Could Unleash Explosive Growth:

The SEC lawsuit's resolution holds immense importance for XRP's future. A win for Ripple would likely lead to a surge in XRP's price, as the uncertainty surrounding its legal status would be removed. Conversely, a loss could further depress the price, at least in the short term. A settlement could also occur, potentially resulting in a less dramatic but still significant price movement.

- Ripple Win: Experts predict a potential price surge to $1 or even higher, depending on the specifics of the ruling and overall market sentiment.

- Ripple Loss: A negative ruling might temporarily suppress the price, but long-term effects would depend on market reaction and Ripple's subsequent actions.

- Settlement: A settlement could lead to a moderate price increase, reflecting a reduction in uncertainty but not a complete removal of regulatory risk.

Uncertainty Remains a Short-Term Headwind:

The uncertainty surrounding the lawsuit is a major headwind for XRP's price. Fear, uncertainty, and doubt (FUD) can significantly impact investor sentiment, leading to price fluctuations and hesitancy.

- Navigating Uncertainty: Diversification, dollar-cost averaging, and setting realistic profit targets are essential strategies for managing risk during this period.

- XRP Risk Profile: Compared to some other established cryptocurrencies like Bitcoin, XRP carries a higher risk profile due to its regulatory uncertainty. However, potential rewards could outweigh the risks if the lawsuit is resolved favorably.

- Comparing Risk: While Bitcoin has a more established market cap and regulatory landscape, XRP's potential for significant growth makes it an attractive but riskier investment for some.

Technological Advancements and Growing Adoption of XRP Ledger (XRPL)

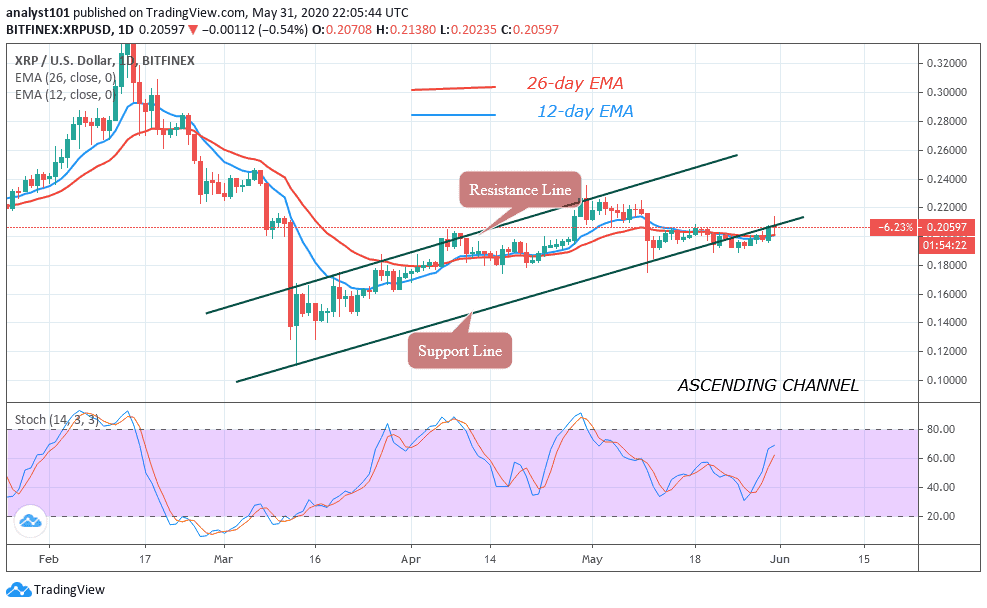

Beyond the legal battles, XRP's underlying technology and increasing adoption are key factors to consider when predicting its future price. The XRP Ledger (XRPL) offers several advantages over other blockchains.

XRPL's Scalability and Efficiency:

The XRPL boasts impressive scalability and efficiency compared to many other blockchains. Its speed, low transaction fees, and energy efficiency make it attractive for various applications.

- Speed and Efficiency: XRPL processes transactions significantly faster and more cheaply than many competitors, making it ideal for real-time applications.

- Cross-Border Payments: XRPL is increasingly used for cross-border payments, leveraging its speed and low costs.

- Decentralized Finance (DeFi): The XRPL is also finding applications in the burgeoning DeFi space, further broadening its utility.

- Real-World Applications: Several companies are leveraging XRPL for innovative solutions, including remittance services and supply chain management. These partnerships demonstrate real-world adoption and potential for future growth.

Increasing Institutional Interest:

Growing institutional interest in XRP is another bullish indicator. Several financial institutions are using or exploring the use of XRP for cross-border payments through RippleNet, Ripple's payment solution.

- RippleNet's Impact: RippleNet's expanding network of financial institutions strengthens XRP's utility and potential for wider adoption.

- Institutional Partnerships: The increasing number of partnerships between Ripple and major financial institutions signals growing confidence in XRP and its underlying technology. This adoption provides a solid foundation for future price appreciation.

Market Sentiment and Overall Crypto Market Conditions

The overall cryptocurrency market significantly impacts XRP's price. Positive market sentiment can fuel a parabolic run, while negative sentiment can dampen growth.

Positive Market Sentiment Could Fuel a Parabolic Run:

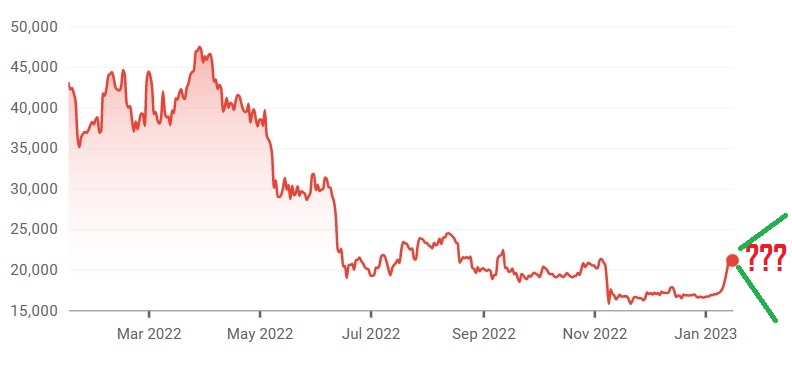

XRP's price is correlated with Bitcoin's price and the general market sentiment. Positive news regarding regulatory clarity, technological advancements, or broader market adoption can trigger a significant price increase.

- Correlation with Bitcoin: XRP often follows Bitcoin's price movements, meaning positive trends in Bitcoin can translate to gains for XRP.

- Positive Market Triggers: Positive regulatory developments, successful partnerships, or major technological upgrades to the XRPL can all contribute to positive market sentiment for XRP.

Managing Risk in a Volatile Market:

Investing in cryptocurrencies involves inherent risk. XRP, due to its regulatory uncertainty and market volatility, presents a higher risk profile than some other assets.

- Diversification: Diversifying your investment portfolio across different asset classes is crucial for managing risk.

- Risk Management Strategies: Employing strategies like dollar-cost averaging and setting stop-loss orders can help mitigate potential losses.

- Due Diligence: Thorough research and due diligence are essential before making any investment decisions in the volatile cryptocurrency market.

Conclusion:

This article analyzed three key factors that could contribute to a potential parabolic move in XRP: the Ripple-SEC lawsuit's resolution, XRPL's technological advancements and growing adoption, and the overall crypto market conditions. While a parabolic move isn't guaranteed, these factors suggest considerable upside potential. The XRP price prediction remains speculative, but understanding these key elements is vital for informed investment decisions.

Call to Action: Stay informed about the latest developments regarding XRP and conduct your own thorough research before making any investment decisions. Keep a close eye on the XRP price prediction landscape as we move forward and consider the potential for a significant XRP parabolic move. Learn more about XRP and its potential by researching further!

Featured Posts

-

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025 -

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025 -

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025 -

Superman Sneak Peek Kryptos Assault Revealed

May 08, 2025

Superman Sneak Peek Kryptos Assault Revealed

May 08, 2025 -

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Latest Posts

-

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025 -

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025