3 Key Indicators Suggesting XRP Could Be Poised For A Significant Rally

Table of Contents

Increasing On-Chain Activity Signals Growing Interest in XRP

Increased on-chain activity is often a strong indicator of growing interest and potential price appreciation in cryptocurrencies. For XRP, several metrics point towards a surge in user engagement.

Transaction Volume and Velocity

Rising transaction volume and velocity suggest increased user engagement and adoption.

- Data from various blockchain explorers show a significant increase in daily and weekly XRP transaction volume over the past [insert timeframe, e.g., quarter]. This surpasses the volume seen during previous periods of high activity, which were often followed by considerable XRP price increases.

- We've also seen a rise in transaction fees, another positive sign reflecting increased network activity. The number of active addresses interacting with the XRP ledger has also shown a notable uptick.

- You can verify this data yourself by checking reputable blockchain explorers such as [insert links to relevant blockchain explorers]. These provide a wealth of on-chain data which supports this analysis of the XRP market.

Rising Number of Unique Addresses

The increase in the number of unique addresses interacting with the XRP ledger is particularly noteworthy. This suggests a broadening user base and a rise in demand for XRP.

- Charts illustrating the growth of unique addresses over the last [insert timeframe] clearly demonstrate this upward trend. This growth correlates with past periods of significant XRP price movements.

- This expansion of the user base suggests a more sustainable increase in price, as opposed to a short-lived pump and dump. The increasing adoption of XRP across various sectors further strengthens this positive outlook for the XRP price prediction.

Positive Developments in the Ongoing SEC Lawsuit Could Trigger a Bull Run

The ongoing legal battle between Ripple and the SEC remains a significant factor influencing XRP's price. Positive developments in this case could dramatically shift market sentiment and trigger a bull run.

Legal Developments and Market Sentiment

Recent court rulings and decisions have been generally favorable to Ripple, significantly boosting market sentiment.

- [Mention specific recent court rulings or decisions favorable to Ripple, linking to reputable news sources]. These positive developments have historically led to significant short-term price increases for XRP.

- Past legal updates have shown a clear correlation between positive news and a surge in XRP's price. The market's reaction to these updates demonstrates its sensitivity to legal developments and the overall XRP market outlook.

- Several legal experts believe that a positive resolution is increasingly likely, fueling further optimism within the XRP community. Potential catalysts for a positive resolution include [mention potential catalysts].

Increased Institutional Interest

A positive resolution to the lawsuit could unlock significant institutional interest, further boosting XRP's price.

- Several financial institutions have shown a keen interest in XRP and similar assets, waiting for regulatory clarity. [Mention examples of institutions showing interest in XRP or similar assets, linking to credible sources].

- The entry of institutional investors would bring increased stability and liquidity to the XRP market, potentially leading to more sustained price growth. Institutional adoption often leads to a more mature and less volatile price action.

- The potential for partnerships and integrations with financial institutions further enhances the appeal of XRP for institutional investors. The longer-term price sustainability of XRP heavily depends on this institutional adoption.

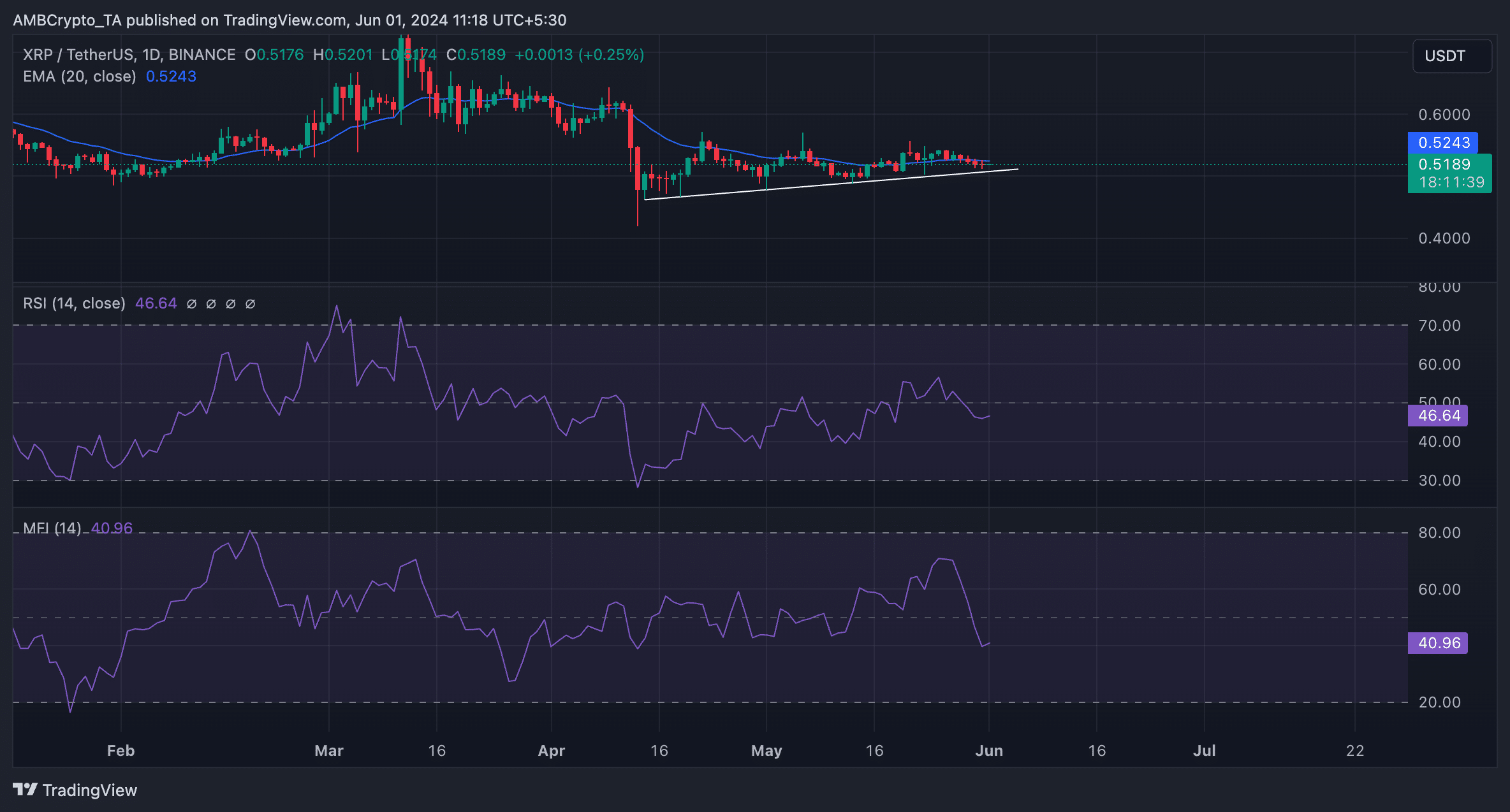

Technical Analysis Suggests a Breakout is Imminent

Technical analysis provides another layer of insight into the potential for an XRP price surge. Various indicators suggest a potential upward trend is brewing.

Chart Patterns and Indicators

Key technical indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages, are showing signs of a bullish breakout.

- [Include charts illustrating these indicators, clearly labeling support and resistance levels]. The convergence of these indicators suggests a strong potential for an upward trend.

- Support and resistance levels have been identified, suggesting potential price targets based on the technical patterns observed. A breakout above these resistance levels could signal a significant price rally.

- It's crucial to remember that technical analysis is not foolproof. Market sentiment and unforeseen events can significantly impact price movements.

Breakout Potential and Price Targets

Based on the current technical indicators and market sentiment, a price breakout is highly anticipated, potentially leading to substantial gains.

- Based on the identified patterns, realistic price targets could range from [insert realistic price range]. However, it's important to note that this is purely speculative.

- Market volatility and unexpected news can significantly impact the accuracy of these predictions. It's crucial to consider a wide range of possible scenarios.

- Investing in cryptocurrencies carries inherent risk. These predictions are based on technical analysis and are not financial advice.

Conclusion: Is XRP Poised for a Significant Rally? Take Action Now

Three key indicators—increased on-chain activity, positive legal developments, and bullish technical analysis—strongly suggest a potential XRP price surge. While the potential for significant gains is compelling, it's crucial to acknowledge the inherent risks involved in cryptocurrency investments. Conduct your own thorough research and consider investing in XRP based on your risk tolerance. Explore XRP investment opportunities carefully, analyze the XRP market outlook, and remember that responsible investing is key. Don't miss out on the potential XRP price rally; understand the risks and invest wisely. Start exploring your XRP investment options today!

Featured Posts

-

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025 -

Arsenal News Latest On Dembeles Injury And Artetas Response

May 08, 2025

Arsenal News Latest On Dembeles Injury And Artetas Response

May 08, 2025 -

Auto Analyst Links Gms Decreased Canadian Activity To Us Tariffs

May 08, 2025

Auto Analyst Links Gms Decreased Canadian Activity To Us Tariffs

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025

Latest Posts

-

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025 -

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025 -

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025