The 10x Bitcoin Multiplier: Impact On Wall Street And Beyond

Table of Contents

Wall Street's Reaction to a 10x Bitcoin Multiplier

A tenfold increase in Bitcoin's price would fundamentally alter Wall Street's relationship with cryptocurrency.

Increased Institutional Investment

A 10x Bitcoin Multiplier would undeniably attract a massive influx of institutional investment. The increased return potential would be too tempting for many to ignore.

- Hedge funds: We'd likely see a significant increase in Bitcoin allocations within hedge fund portfolios, as they seek to capitalize on the exponential growth.

- Pension funds: Pension funds, constantly searching for higher-yielding assets, would likely diversify their holdings, incorporating Bitcoin to improve returns and potentially outpace inflation.

- Bitcoin ETFs: The approval and subsequent success of Bitcoin exchange-traded funds (ETFs) would be dramatically accelerated, making Bitcoin accessible to a wider range of investors. This could lead to a surge in trading volume and liquidity.

Keywords: Institutional investors, Bitcoin ETF, hedge funds, pension funds, asset allocation, Bitcoin investment.

Regulatory Scrutiny and Adaptation

Such a dramatic price surge would inevitably lead to increased regulatory scrutiny. Governments and regulatory bodies worldwide would feel the pressure to adapt their frameworks to accommodate a significantly more valuable and influential Bitcoin.

- Increased regulatory pressure: Expect a tightening of regulations concerning Bitcoin trading, custody, and taxation.

- New compliance frameworks: Financial institutions would need to develop robust compliance frameworks to navigate the new regulatory landscape.

- Changes to existing financial regulations: Existing financial regulations might need substantial revisions to account for the increased significance of Bitcoin within the global financial system. The SEC and CFTC, for example, would play pivotal roles in this adaptation.

Keywords: Bitcoin regulation, regulatory compliance, financial regulations, SEC, CFTC, Bitcoin compliance.

Volatility and Market Impact

A 10x Bitcoin Multiplier wouldn't be without volatility. Such a rapid price increase would likely trigger significant market fluctuations.

- Correlation with other markets: We could see stronger correlations between Bitcoin's price and traditional asset classes, potentially influencing the performance of stocks, bonds, and other investments.

- Impact on investor confidence: While some investors would celebrate the gains, others might worry about a potential market correction, leading to a period of uncertainty.

- Market corrections: The likelihood of significant market corrections following such a rapid price increase is high. This would test the resilience of the cryptocurrency market and the portfolios of investors heavily invested in Bitcoin.

Keywords: Bitcoin volatility, market correlation, investor sentiment, market correction, Bitcoin price prediction.

Beyond Wall Street: Global Implications of a 10x Bitcoin Multiplier

The impact of a 10x Bitcoin Multiplier wouldn't be limited to Wall Street; its effects would ripple across the globe.

Increased Adoption and Mainstream Acceptance

A tenfold increase in value would dramatically accelerate Bitcoin's adoption as a mainstream payment method and store of value.

- Wider merchant acceptance: Businesses would be more incentivized to accept Bitcoin as a form of payment, broadening its utility.

- Increased use in everyday transactions: Bitcoin could become a more common method of payment for everyday purchases, potentially challenging traditional fiat currencies.

- Impact on international remittances: The lower transaction fees and faster transfer speeds associated with Bitcoin could make it a far more attractive option for international remittances, potentially disrupting existing money transfer services.

Keywords: Bitcoin adoption, merchant acceptance, payment methods, remittances, global payments, Bitcoin transaction fees.

Technological Advancements and Infrastructure

The surge in demand and value would likely drive significant technological advancements within the Bitcoin ecosystem.

- Bitcoin scaling solutions: The increased transaction volume would necessitate the development and implementation of more efficient scaling solutions like Layer-2 protocols to enhance network capacity and reduce transaction fees.

- Improved transaction speeds and fees: Innovations would be crucial to address potential bottlenecks and ensure the network's ability to handle increased transaction volume, leading to faster and cheaper transactions.

- Expansion of Bitcoin mining infrastructure: The increased value would incentivize further investment in Bitcoin mining infrastructure, potentially leading to more geographically diverse mining operations.

Keywords: Bitcoin scaling, Layer-2 solutions, transaction fees, Bitcoin mining, network infrastructure, Bitcoin technology.

Geopolitical Implications

A drastically increased Bitcoin valuation poses significant geopolitical implications, challenging established financial systems.

- Challenges to national currencies: The rise of Bitcoin could potentially challenge the dominance of national currencies, especially in countries with unstable or devaluing fiat money.

- Role in global financial power dynamics: Bitcoin's decentralized nature could shift global financial power dynamics, potentially reducing the influence of centralized institutions.

- Impact on international relations: The increasing adoption of Bitcoin could influence international relations, potentially leading to new forms of economic cooperation and competition.

Keywords: Bitcoin and geopolitics, decentralized finance (DeFi), national currencies, global finance, international relations, Bitcoin's impact on global economy.

Conclusion

A 10x Bitcoin Multiplier would have profound and far-reaching consequences, significantly impacting Wall Street and the global economy. The increased institutional investment, regulatory changes, widespread adoption, technological advancements, and geopolitical implications outlined above highlight the transformative potential of such a scenario. Understanding the potential of a 10x Bitcoin price increase is crucial for navigating the evolving financial landscape. Continue your research into the future of Bitcoin and its impact on global markets.

Featured Posts

-

Savage Land Showdown Rogue 2 Preview Featuring Ka Zar

May 08, 2025

Savage Land Showdown Rogue 2 Preview Featuring Ka Zar

May 08, 2025 -

March 7th Nba Thunder Vs Trail Blazers How To Watch The Game

May 08, 2025

March 7th Nba Thunder Vs Trail Blazers How To Watch The Game

May 08, 2025 -

Can You Name The Nba Playoffs Triple Doubles Leader A Challenging Quiz

May 08, 2025

Can You Name The Nba Playoffs Triple Doubles Leader A Challenging Quiz

May 08, 2025 -

Superiorite Geometrique Des Corneilles Elles Surpassent Meme Les Babouins

May 08, 2025

Superiorite Geometrique Des Corneilles Elles Surpassent Meme Les Babouins

May 08, 2025 -

Restaurante Mexicano Malaga Descubre Cantina Canalla

May 08, 2025

Restaurante Mexicano Malaga Descubre Cantina Canalla

May 08, 2025

Latest Posts

-

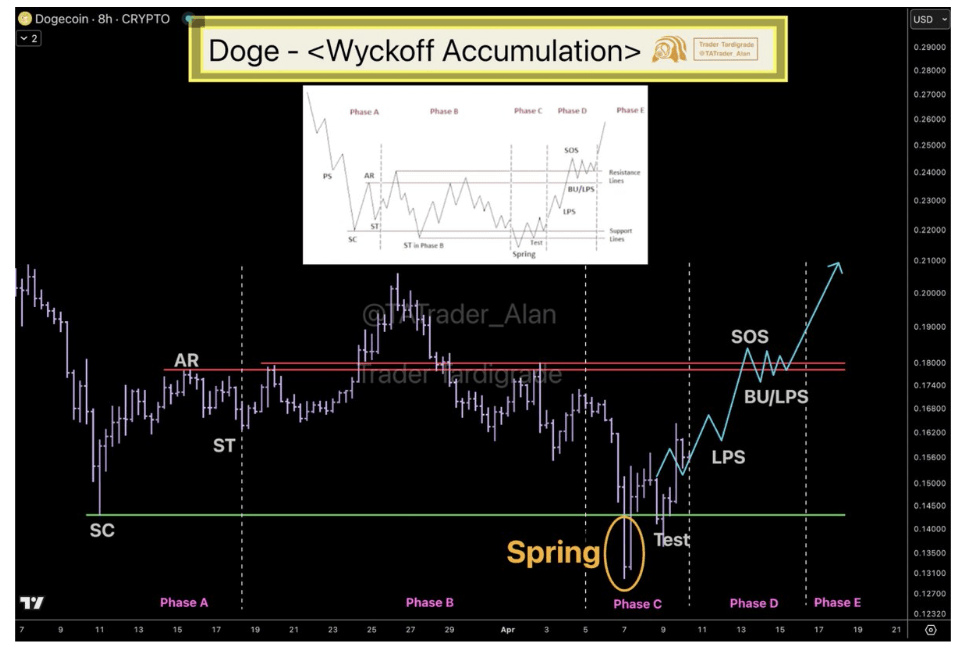

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025