Crypto Whales Target New "XRP": 5880% Potential Gains?

Table of Contents

The Allure of "New XRP" Projects

The surge in interest in projects similar to XRP isn't accidental. XRP's success, characterized by its speed, low transaction fees, and role within the Ripple ecosystem, has set a benchmark for many aspiring cryptocurrencies. "New XRP" projects aim to capitalize on this success by offering improved features and addressing some of XRP's limitations. These projects often leverage innovative technologies to attract investors. What makes them particularly compelling?

- Faster transaction speeds compared to other cryptocurrencies: Many "new XRP" projects boast significantly faster transaction processing times than established cryptocurrencies like Bitcoin or Ethereum, making them more attractive for various applications.

- Lower transaction fees: Reduced transaction costs are a key selling point, making them competitive and accessible to a wider range of users.

- Enhanced scalability solutions: Scalability issues plague many cryptocurrencies. "New XRP" projects often incorporate solutions designed to handle a larger volume of transactions without compromising speed or efficiency.

- Eco-friendly consensus mechanisms: Concerns about the environmental impact of certain cryptocurrencies are driving the development of more energy-efficient consensus mechanisms. Many "new XRP" projects prioritize sustainability.

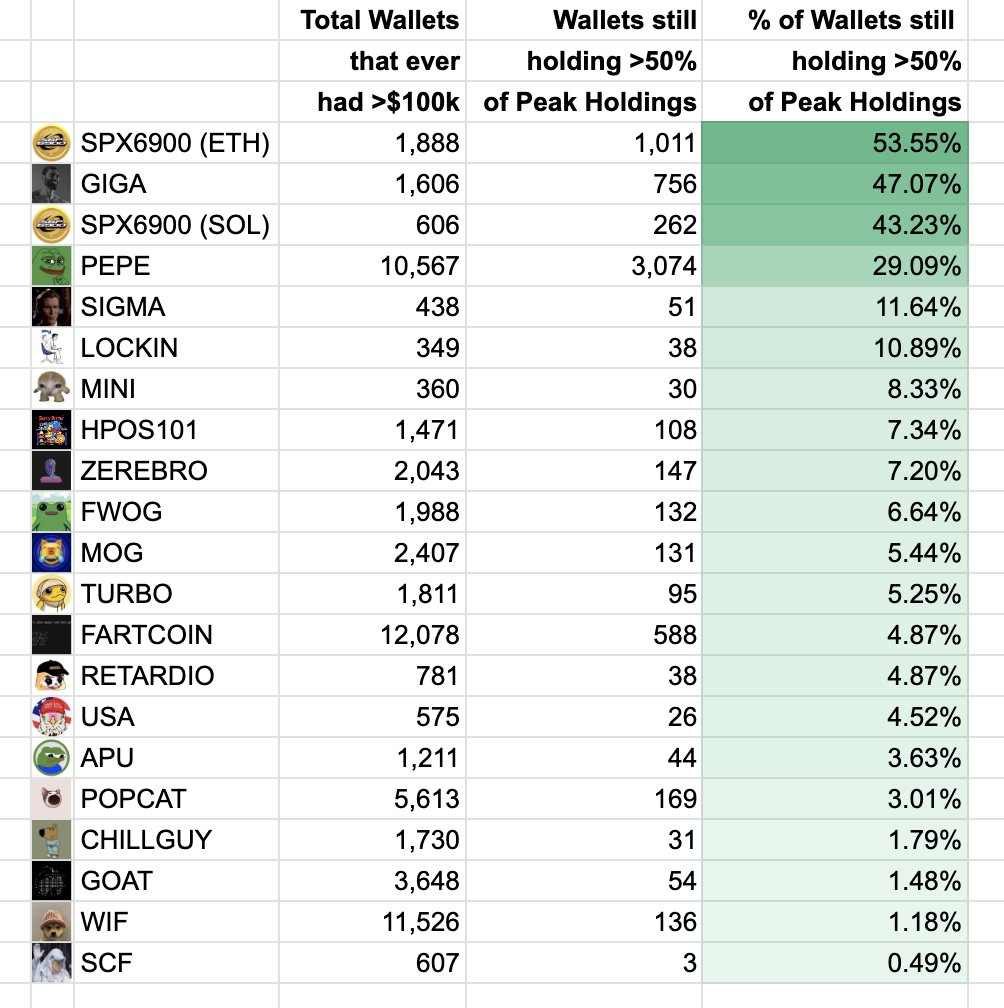

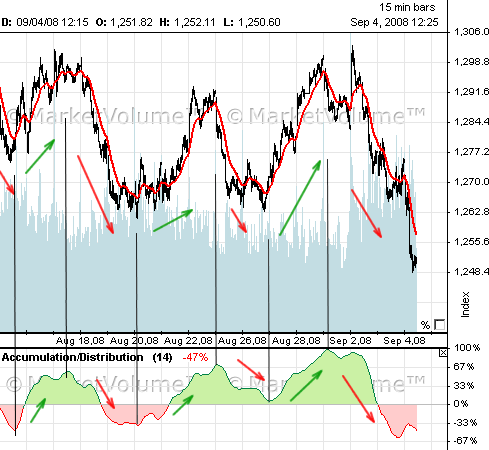

Evidence of Whale Activity in "New XRP" Coins

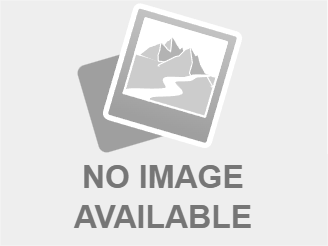

While pinpointing specific whale activity can be challenging due to the pseudonymous nature of blockchain transactions, there's growing anecdotal and analytical evidence suggesting large-scale investments in several "new XRP" projects. On-chain analysis, which involves scrutinizing blockchain data for large transaction patterns, is a crucial tool in identifying whale behavior. Wallet tracking, focusing on the accumulation of significant amounts of a particular cryptocurrency in specific wallets, is another method.

- Specific examples of large transactions or wallet accumulations: While we avoid naming specific coins without thorough verification, reports suggest significant inflows of capital into some promising projects.

- Links to credible sources (blockchain explorers, analytical platforms): Data from reputable blockchain explorers and analytical platforms can provide valuable insights, though always cross-reference information.

- Mention any publicly available information from the project team about large investors: Some project teams might disclose information about strategic investors or partnerships, providing further validation of whale involvement. However, treat such announcements with critical analysis.

Analyzing the 5880% Potential Gains Claim

The claim of a 5880% potential return must be treated with extreme caution. The cryptocurrency market is inherently volatile, and such projections are highly speculative. While significant price increases are possible, several factors could contribute to or hinder such dramatic growth.

- Factors that could contribute to significant price increases: Widespread adoption, groundbreaking technological advancements, and positive market sentiment can all fuel price appreciation.

- Factors that could hinder growth: Regulatory uncertainties, intense competition from other altcoins, and broader market corrections can severely impact even the most promising projects.

- Realistic scenarios for price appreciation: Instead of focusing on unrealistic percentages, consider more grounded analyses of market trends, technological adoption, and competitive positioning.

- Potential risks associated with high-risk investments: High-potential cryptocurrencies often come with high risk. Understand the potential for complete loss of your investment.

- Importance of diversification in a cryptocurrency portfolio: Never invest your entire portfolio in a single, high-risk asset. Diversification is crucial for mitigating potential losses.

Due Diligence Before Investing in "New XRP"

Before investing in any "new XRP" project, rigorous due diligence is paramount. Treat this process as a comprehensive investigation, not just a cursory glance.

- Reviewing the project's whitepaper for technical feasibility: A well-written whitepaper outlining the project's technology, goals, and roadmap is essential. Scrutinize it for inconsistencies or unrealistic claims.

- Assessing the team's experience and credibility: Investigate the team's background and expertise. Are they qualified to execute their vision? Look for red flags like anonymity or a lack of transparency.

- Analyzing the project's community engagement and support: A thriving and engaged community is a positive sign. Observe the level of interaction, the quality of discussions, and the overall sentiment surrounding the project.

- Understanding the risks of scams and rug pulls: The cryptocurrency space is unfortunately prone to scams. Be aware of the signs of fraudulent projects and protect yourself against rug pulls (where developers abandon the project and take investors' funds).

Conclusion: Navigating the Potential of "New XRP"

The potential for significant gains from "new XRP" projects is undeniable, but so is the inherent risk. Crypto whales are showing interest, but this doesn't guarantee success. Remember that even with promising indicators, thorough due diligence is non-negotiable. Conduct comprehensive research, analyze the risks, diversify your portfolio, and approach investments in XRP alternatives and other high-risk, high-reward cryptocurrencies responsibly. What are your thoughts on the potential of new XRP projects? Share your insights in the comments below!

Featured Posts

-

Nonprofit Control Ensured Open Ais Commitment To Ethical Ai Development

May 07, 2025

Nonprofit Control Ensured Open Ais Commitment To Ethical Ai Development

May 07, 2025 -

Open Ai Confirms Continued Nonprofit Oversight

May 07, 2025

Open Ai Confirms Continued Nonprofit Oversight

May 07, 2025 -

Dynamo Moscow Opens Door For Ovechkins Future Management Role After Nhl Retirement

May 07, 2025

Dynamo Moscow Opens Door For Ovechkins Future Management Role After Nhl Retirement

May 07, 2025 -

Minnesota Timberwolves Anthony Edwards Financial Impact Of Nba Suspension

May 07, 2025

Minnesota Timberwolves Anthony Edwards Financial Impact Of Nba Suspension

May 07, 2025 -

Is Jenna Ortega The Next Scream Queen Of Horror

May 07, 2025

Is Jenna Ortega The Next Scream Queen Of Horror

May 07, 2025

Latest Posts

-

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025 -

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025

Wyckoff Accumulation In Ethereum Price Poised For 2 700 Breakout

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying Drive Forecast

May 08, 2025 -

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025

Ethereum Market Analysis Accumulation And The Outlook For Eth Price

May 08, 2025