Bitcoin And Ethereum Options: Billions To Expire, Impact On Market Volatility

Table of Contents

Understanding Bitcoin and Ethereum Options Markets

Bitcoin and Ethereum options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of Bitcoin or Ethereum at a predetermined price (strike price) on or before a specific date (expiration date). These instruments are traded on various exchanges, providing investors with sophisticated tools for managing risk and speculating on price movements.

Key terms to understand include:

-

Open Interest: The total number of outstanding option contracts that haven't been exercised or expired. High open interest indicates significant market activity and potential volatility.

-

Implied Volatility: A measure of the market's expectation of future price volatility. Higher implied volatility suggests a greater chance of significant price swings.

-

Delta: A measure of how much an option's price is expected to change in response to a $1 change in the underlying asset's price.

-

Buying vs. Selling Options: Buying options allows you to profit from price movements in a specific direction without needing to own the underlying asset. Selling options generates income but exposes you to potentially unlimited losses if the price moves against you.

-

Hedging and Speculation: Options can be used to hedge against price declines (buying puts) or to speculate on price increases (buying calls).

The relationship between options expiration and market volatility is significant. As the expiration date approaches, traders often adjust their positions, leading to increased buying and selling pressure, which can amplify price fluctuations.

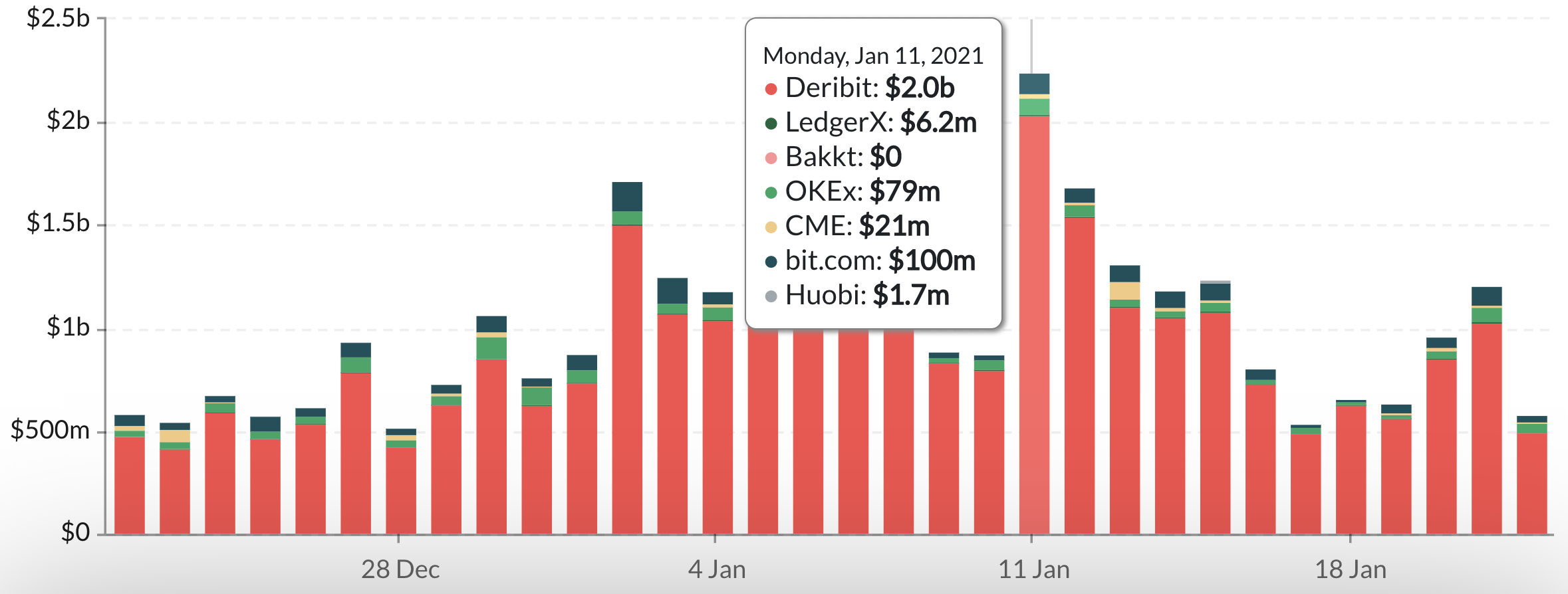

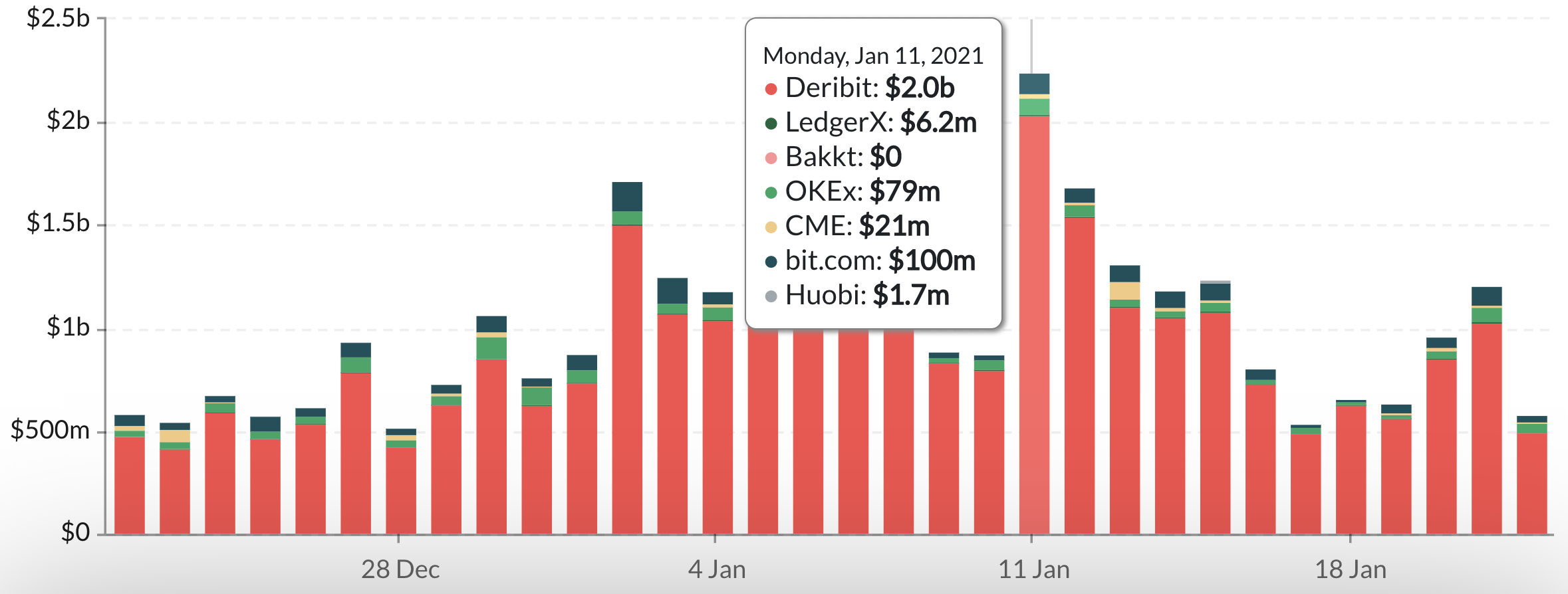

Billions in Options Expiring: The Scale of the Event

The sheer scale of the upcoming Bitcoin and Ethereum options expirations is unprecedented. Data from major exchanges like Deribit, CME Group, and Kraken shows billions of dollars in open interest approaching their expiration dates. For example, on [insert date], [insert dollar amount] in Bitcoin options and [insert dollar amount] in Ethereum options are set to expire. This represents a significant percentage of the total market capitalization of both cryptocurrencies, making this event a key factor to consider.

- Exchanges Involved: Major exchanges facilitating these options include Deribit, OKX, CME Group, and Binance.

- Comparison to Previous Expirations: The upcoming expiration size significantly surpasses [mention percentage] compared to previous expirations, highlighting its potential impact on price volatility.

These massive numbers underscore the potential for significant market movements as traders unwind their positions before expiration.

Potential Impact on Bitcoin and Ethereum Price Volatility

The upcoming Bitcoin and Ethereum options expirations could lead to considerable price volatility. Several scenarios are possible:

- Upward Price Movement: If a large number of call options are in the money (meaning the underlying asset's price is above the strike price), traders might rush to buy the underlying asset to cover their positions, leading to a price surge. This is sometimes referred to as a "gamma squeeze".

- Downward Price Movement: Conversely, a large number of put options in the money could trigger a wave of selling, pushing prices lower.

Large option positions can significantly influence price action. Market sentiment and news events also play a crucial role. Negative news could exacerbate downward pressure, while positive news might mitigate the impact of large option expirations.

- Gamma Squeezes and Other Market Mechanics: The complex interplay of delta hedging and gamma exposure can lead to amplified price movements, especially near expiration.

- Historical Examples: Past options expirations have demonstrated significant price swings in both Bitcoin and Ethereum. Analyzing these historical events provides valuable insights into potential outcomes.

This confluence of factors makes predicting the exact price impact challenging, but it highlights the need for caution and careful risk management.

Strategies for Navigating the Volatility

Navigating the potential volatility surrounding Bitcoin and Ethereum options expirations requires a robust risk management strategy. Consider these strategies:

-

Hedging: Implement hedging strategies to protect your portfolio from adverse price movements.

-

Position Sizing: Carefully manage position size to limit potential losses.

-

Risk Management Techniques: Utilize stop-loss orders and other risk management tools.

-

Monitoring Market Conditions: Stay informed about market sentiment, news events, and options data using reputable sources.

-

Diversification: Diversify your cryptocurrency holdings to reduce the impact of volatility in any single asset.

-

Following Market Analysts: Stay updated on market analysis from reputable sources.

-

Trading Plan: Adhere to a well-defined trading plan that outlines entry and exit points, risk tolerance, and position sizing.

Staying informed and proactive is key to mitigating potential losses during periods of heightened volatility.

Conclusion: Preparing for the Bitcoin and Ethereum Options Volatility Event

The upcoming Bitcoin and Ethereum options expirations represent a significant event with the potential to dramatically impact market volatility. Billions of dollars are at stake, and the potential for substantial price swings is real. Understanding the mechanics of Bitcoin and Ethereum options, the scale of the upcoming expirations, and the potential impact on price volatility is crucial for informed decision-making. Stay informed about upcoming Bitcoin and Ethereum options expirations to better understand and manage the potential volatility in the market. Learn more about effective options trading strategies today!

Featured Posts

-

Les Capacites Geometriques Exceptionnelles Des Corneilles

May 08, 2025

Les Capacites Geometriques Exceptionnelles Des Corneilles

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Grows

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Grows

May 08, 2025 -

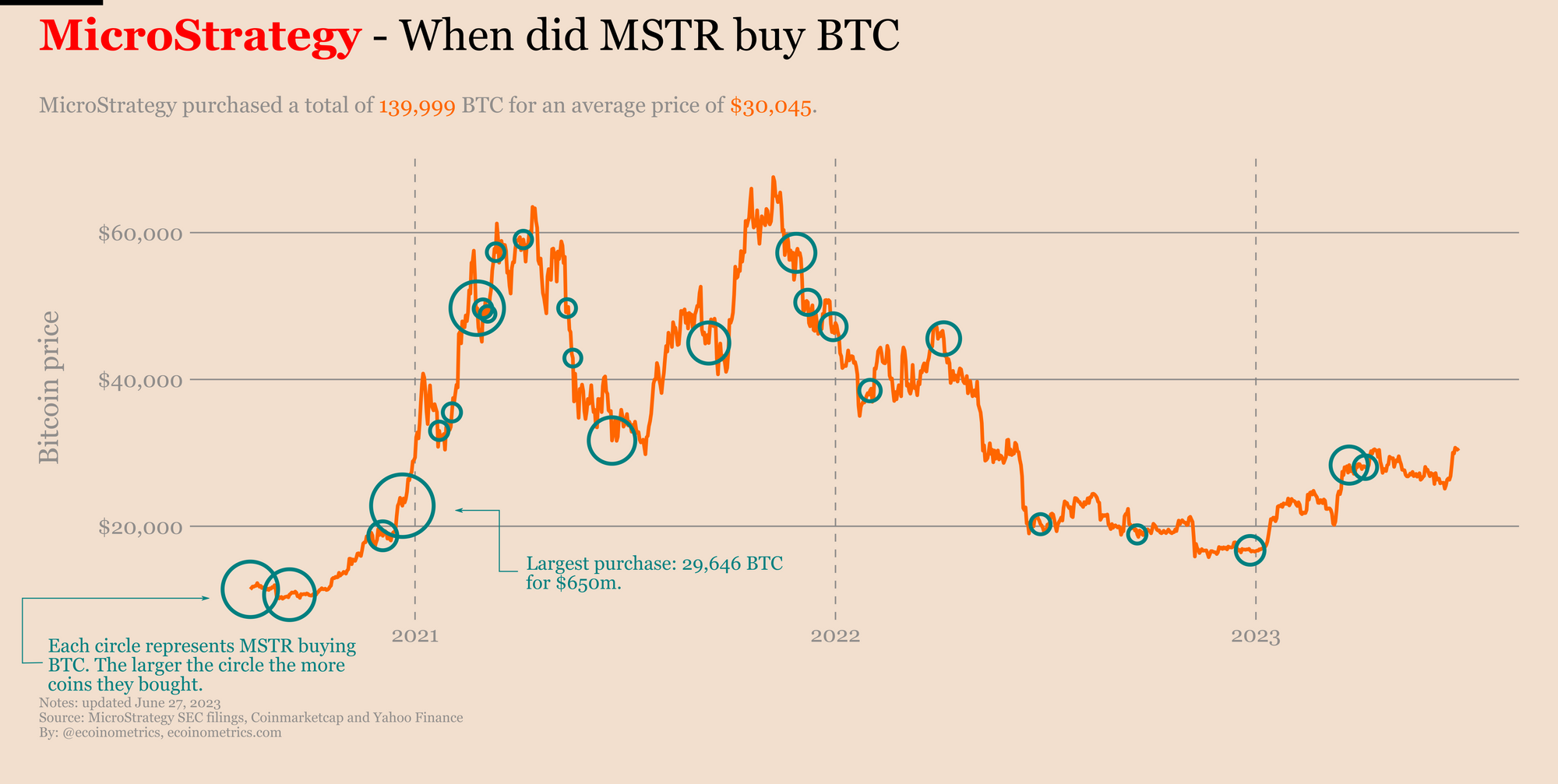

Micro Strategy Vs Bitcoin A Smart Investment Choice For 2025

May 08, 2025

Micro Strategy Vs Bitcoin A Smart Investment Choice For 2025

May 08, 2025 -

Grand Theft Auto Vi Trailer Breakdown Bonnie And Clyde Duo Revealed

May 08, 2025

Grand Theft Auto Vi Trailer Breakdown Bonnie And Clyde Duo Revealed

May 08, 2025 -

Xrp Price Prediction Impact Of Sec Lawsuit Dismissal On Xrps Value

May 08, 2025

Xrp Price Prediction Impact Of Sec Lawsuit Dismissal On Xrps Value

May 08, 2025

Latest Posts

-

Micro Strategy Vs Bitcoin Investment A 2025 Perspective

May 08, 2025

Micro Strategy Vs Bitcoin Investment A 2025 Perspective

May 08, 2025 -

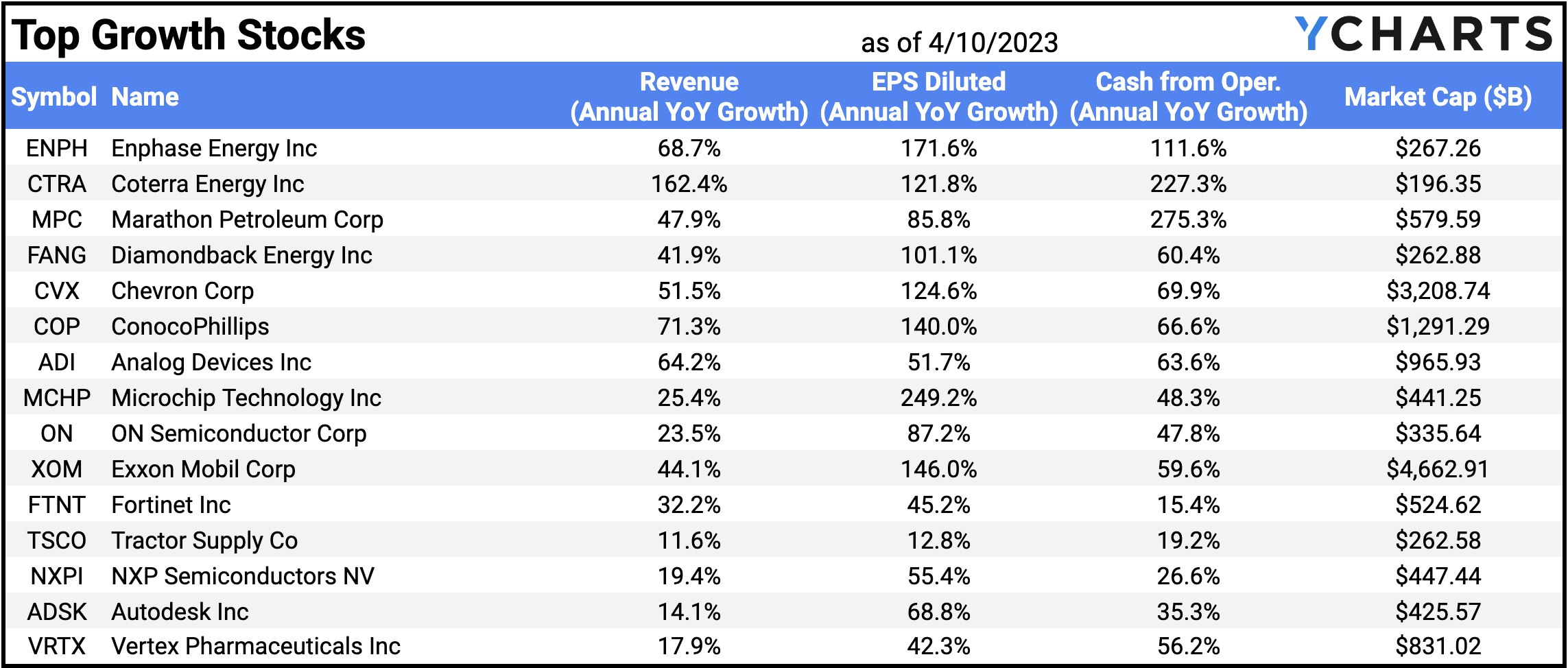

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025 -

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025 -

2025 Investment Outlook Micro Strategy Stock Vs Bitcoin

May 08, 2025

2025 Investment Outlook Micro Strategy Stock Vs Bitcoin

May 08, 2025