Wall Street Predicts 110% Growth For This BlackRock ETF In 2025

Table of Contents

Identifying the BlackRock ETF

The ETF generating this buzz is the iShares Global Clean Energy ETF (ICLN). This BlackRock ETF focuses on companies involved in the clean energy sector, encompassing renewable energy sources like solar, wind, and hydro power, as well as energy efficiency technologies. ICLN's investment strategy targets companies globally that are leaders in clean energy innovation and production. This focus has attracted significant attention from Wall Street analysts, largely due to the growing global emphasis on sustainable energy and the corresponding projected growth of the clean energy market.

- Investment Focus: Clean energy technologies, renewable energy sources, and energy efficiency solutions.

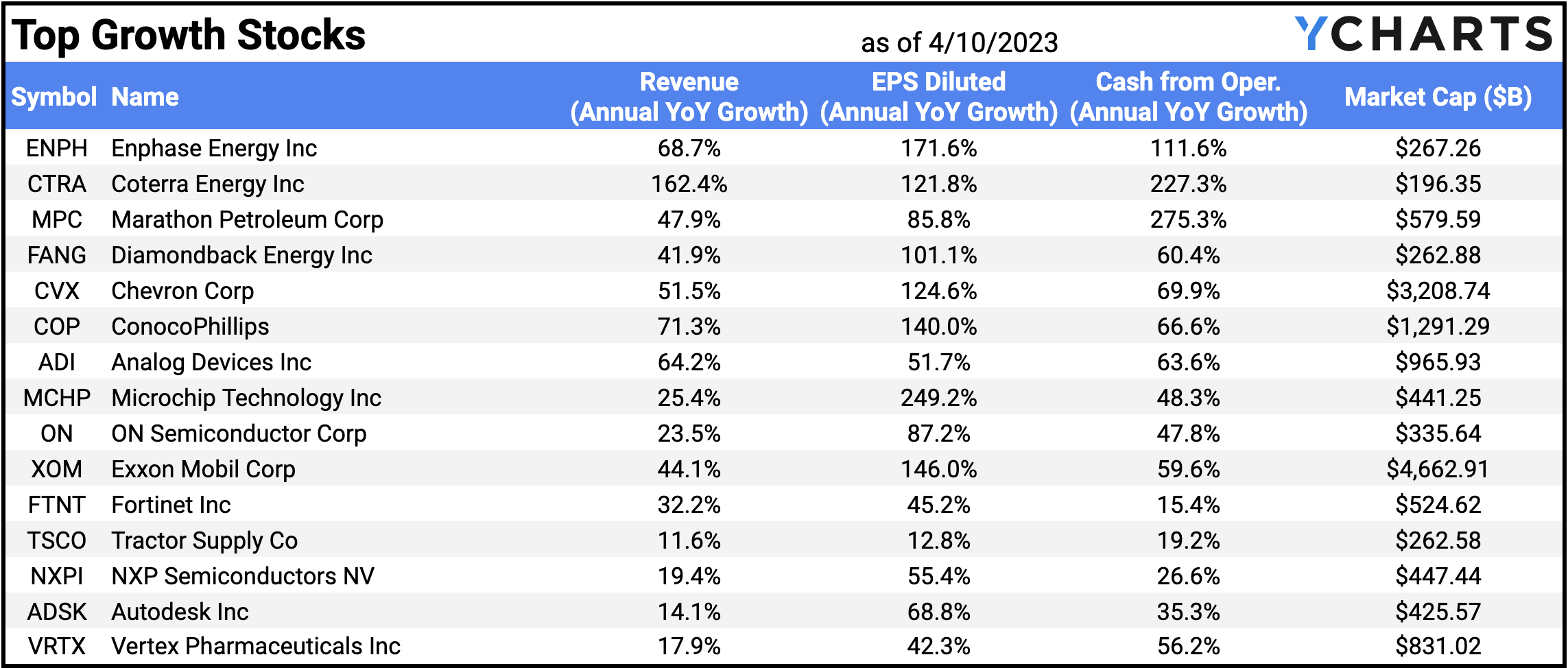

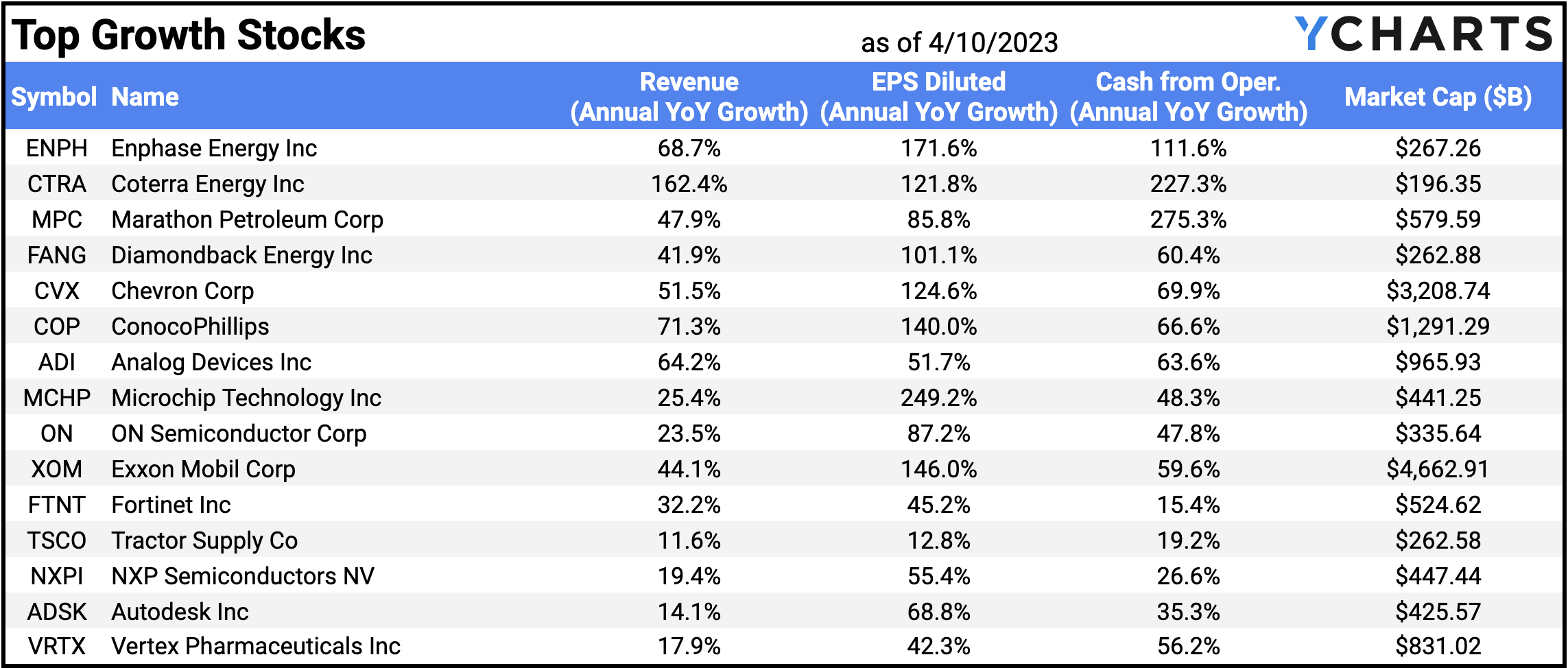

- Top Holdings: The ETF holds a diversified portfolio of leading companies in the clean energy sector, including but not limited to First Solar, Enphase Energy, and Vestas Wind Systems. (Note: Holdings are subject to change).

- Expense Ratio: ICLN has a relatively low expense ratio, making it a comparatively cost-effective way to gain exposure to the clean energy market. (Check current expense ratio on BlackRock's website for the most up-to-date information.)

Analyzing the 110% Growth Prediction

The 110% growth prediction for ICLN by 2025 stems from several factors. Analysts point to the increasing global demand for renewable energy solutions, driven by climate change concerns and government policies promoting sustainable energy initiatives. Technological advancements in clean energy production are also expected to drive significant growth in the sector. Furthermore, projections for continued economic growth in key markets could fuel demand for clean energy solutions.

- Sources: This prediction originates from various reputable financial news outlets and analyst reports, though it's crucial to remember that these are projections and not guarantees. (Specific sources should be cited here if available).

- Economic Headwinds: Potential headwinds include fluctuating commodity prices, geopolitical instability, and changes in government regulations that could impact the clean energy sector.

- Diversification: It's imperative to remember that even with a promising outlook, diversification within an investment portfolio is crucial to mitigate risk.

Understanding the Risks Involved

While the 110% growth prediction is enticing, it's crucial to acknowledge the inherent risks involved in any investment, particularly one with such a high-growth projection.

- Market Risk: Market corrections and volatility can significantly impact ETF performance, potentially leading to substantial losses. The clean energy sector, while promising, is also susceptible to market swings.

- ETF Volatility: ICLN, like any ETF, is subject to market fluctuations. Past performance is not indicative of future results.

- Due Diligence: Before investing in any ETF, especially one with such a high-growth prediction, thorough due diligence is essential. This includes understanding the ETF's holdings, investment strategy, and associated risks.

Is This BlackRock ETF Right for You?

The suitability of ICLN depends entirely on your individual investor profile, risk tolerance, and financial goals.

- Ideal Investor Profile: This ETF is generally considered suitable for investors with a high-risk tolerance and a long-term investment horizon (5+ years).

- Portfolio Diversification: ICLN can be a component of a diversified portfolio, but it shouldn't be the sole investment.

- Professional Advice: It's strongly recommended that you consult with a qualified financial advisor before making any investment decisions, particularly those involving high-growth predictions. A financial advisor can help assess your risk tolerance, financial goals, and determine if ICLN aligns with your overall investment strategy.

Conclusion

The 110% growth prediction for the iShares Global Clean Energy ETF (ICLN) by 2025 is a bold forecast driven by the anticipated growth of the clean energy sector. However, this prediction comes with significant risks, including market volatility and the inherent uncertainty of any long-term investment. Remember, past performance is not indicative of future results. Before investing in this or any high-growth BlackRock ETF, thorough research and consultation with a financial advisor are crucial. Learn more about the ICLN BlackRock ETF today and assess if this high-growth BlackRock ETF aligns with your investment goals. Don't let the allure of high growth blind you to the importance of careful planning and risk management.

Featured Posts

-

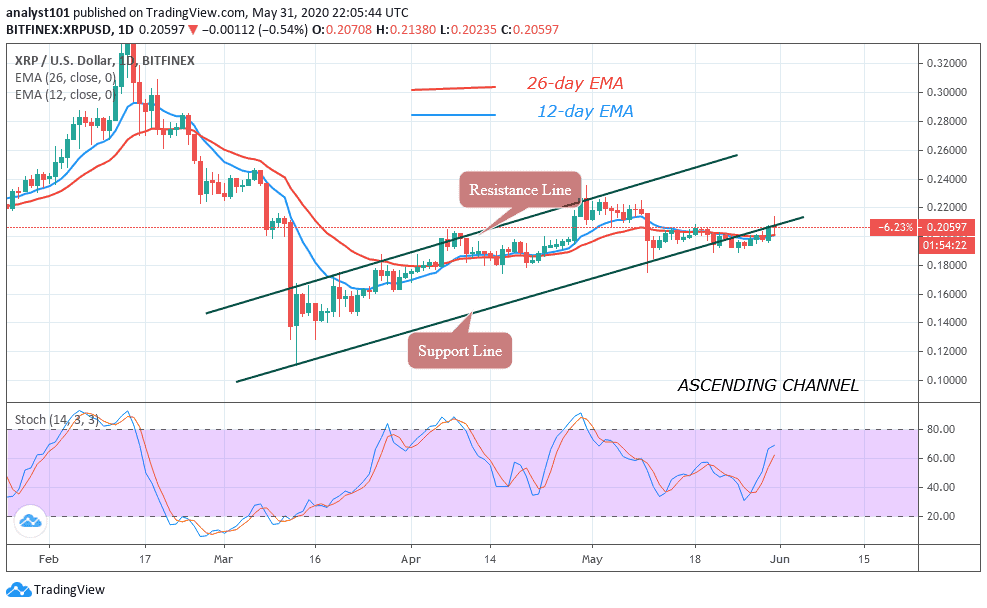

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Les Corneilles Un Don Geometrique Surprenant

May 08, 2025

Les Corneilles Un Don Geometrique Surprenant

May 08, 2025 -

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

Andor Season 1 Find Episodes 1 3 On Hulu And You Tube

May 08, 2025

Andor Season 1 Find Episodes 1 3 On Hulu And You Tube

May 08, 2025

Latest Posts

-

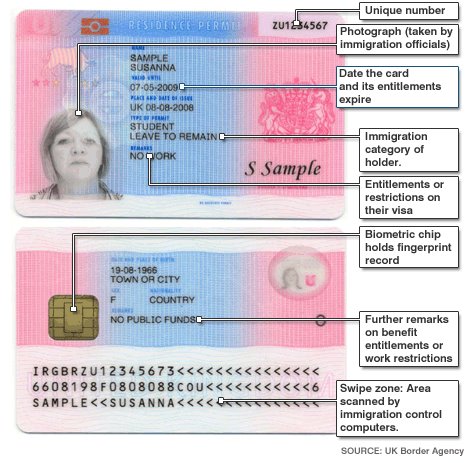

New Uk Visa Rules Impact On Specific Countries

May 09, 2025

New Uk Visa Rules Impact On Specific Countries

May 09, 2025 -

Changes To Uk Student Visa Policy Focus On Pakistan And Asylum Claims

May 09, 2025

Changes To Uk Student Visa Policy Focus On Pakistan And Asylum Claims

May 09, 2025 -

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 09, 2025

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 09, 2025 -

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025 -

Potential Uk Restrictions On Pakistani Student Visas Asylum Implications

May 09, 2025

Potential Uk Restrictions On Pakistani Student Visas Asylum Implications

May 09, 2025