2025 Investment Outlook: MicroStrategy Stock Vs. Bitcoin

Table of Contents

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is primarily known for its enterprise analytics and business intelligence software. Its software solutions help businesses gather, analyze, and visualize their data to make better strategic decisions. While this core business provides a degree of stability, the company's recent trajectory is heavily intertwined with its substantial Bitcoin holdings, making MSTR stock a unique investment proposition.

Bitcoin as a Corporate Treasury Asset

MicroStrategy's bold move to adopt Bitcoin as a significant portion of its corporate treasury reserve asset has made it a fascinating case study. The company holds a considerable amount of Bitcoin, transforming its investment strategy and significantly impacting its balance sheet.

- Size of Holdings: As of [Insert Latest Data], MicroStrategy holds [Insert Number] Bitcoin, representing a substantial portion of its total assets.

- Impact on Balance Sheet: This significant Bitcoin investment creates both opportunities and risks. While potential appreciation in Bitcoin's value could significantly boost the company's net worth, a downturn in the cryptocurrency market could negatively affect its financial performance.

- Risks and Rewards: The strategy showcases a high-risk, high-reward approach. The success hinges entirely on the future price movements of Bitcoin.

MSTR Stock Performance and Correlation to Bitcoin

The price of MSTR stock exhibits a strong correlation with Bitcoin's price. When Bitcoin's price rises, MSTR stock tends to follow suit, and vice versa. [Insert Chart/Graph showing correlation].

- Future Price Movements: Predicting future price movements is inherently challenging, but various Bitcoin price scenarios (bullish, bearish, sideways) can be used to model potential impacts on MSTR's stock price.

- Regulatory Impact: Changes in Bitcoin regulations can significantly influence both Bitcoin's price and the perceived value of MicroStrategy's Bitcoin holdings, thus affecting MSTR stock. Increased regulatory clarity might lead to a price increase, while stricter rules could cause a decline.

Bitcoin's Market Position and Future Predictions

Bitcoin's Market Dominance and Technological Advantages

Bitcoin remains the most well-known and largest cryptocurrency by market capitalization. Its decentralized nature, secured by blockchain technology, offers a unique appeal. The inherent scarcity of Bitcoin (a fixed supply of 21 million coins) is another key driver of its value proposition.

Factors Influencing Bitcoin's Price

Several key factors will influence Bitcoin's price in 2025:

- Institutional Adoption: Increased adoption by large institutional investors, such as hedge funds and pension funds, could significantly drive up demand.

- Regulatory Developments: Favorable regulatory frameworks could boost confidence and attract more investors, while unfavorable regulations could dampen its appeal.

- Technological Advancements: Developments in Bitcoin's underlying technology, such as the Lightning Network for faster and cheaper transactions, could improve its usability and further drive adoption.

- Macroeconomic Conditions: Global economic factors, such as inflation and interest rates, can also impact Bitcoin's price as investors seek alternative assets during times of economic uncertainty.

Bitcoin Price Predictions for 2025 (with caveats)

Various analysts offer Bitcoin price predictions for 2025, ranging from highly bullish to cautiously bearish. However, it's crucial to remember that these are predictions, not guarantees. The inherent volatility of Bitcoin makes accurate long-term price forecasting exceedingly difficult. [Include a range of predictions from reputable sources, citing them properly].

Risk Assessment: MicroStrategy Stock vs. Bitcoin

Volatility and Risk Tolerance

Both MicroStrategy stock and Bitcoin are known for their volatility. Bitcoin, being a cryptocurrency, is significantly more volatile than most traditional assets, while MSTR stock's volatility is largely linked to Bitcoin's price movements. Investors need to have a high-risk tolerance for both.

Diversification and Portfolio Allocation

Both MicroStrategy stock and Bitcoin should be considered within the context of a diversified investment portfolio. Do not over-allocate to either asset, as this concentrates your risk.

- Risk Management: It is crucial to understand and manage the risks associated with these volatile assets.

- Asset Allocation: Carefully consider your risk tolerance and overall investment goals before determining how much to allocate to each asset.

Regulatory and Legal Risks

The regulatory landscape for both Bitcoin and MicroStrategy is evolving. Changes in regulations can significantly impact both investments, highlighting the importance of staying updated on the latest developments.

Conclusion: Making Informed Investment Decisions in MicroStrategy Stock and Bitcoin

This comparison of MicroStrategy stock and Bitcoin highlights the unique characteristics and risks of each asset. While MicroStrategy offers exposure to Bitcoin through its holdings, its core business also contributes to its overall valuation. Bitcoin, on the other hand, is a purely speculative investment tied to its acceptance and utility as a digital currency.

Remember to conduct thorough research and understand your risk tolerance before investing in either MicroStrategy stock or Bitcoin. Invest wisely in MicroStrategy and Bitcoin only after carefully considering the information presented here and conducting your own due diligence. Make informed investment choices in the MicroStrategy/Bitcoin market based on your individual financial situation and risk appetite.

Featured Posts

-

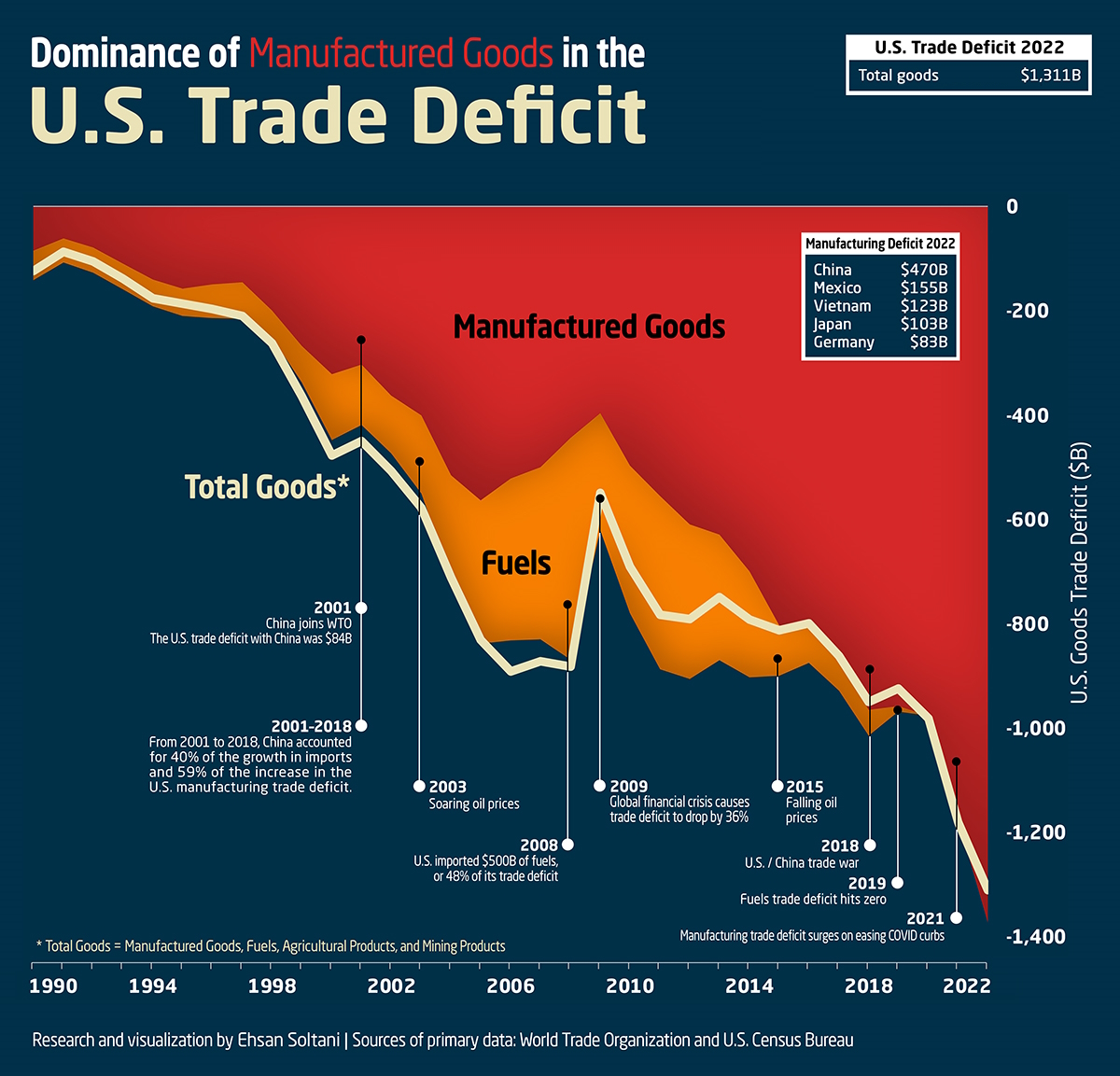

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025 -

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025 -

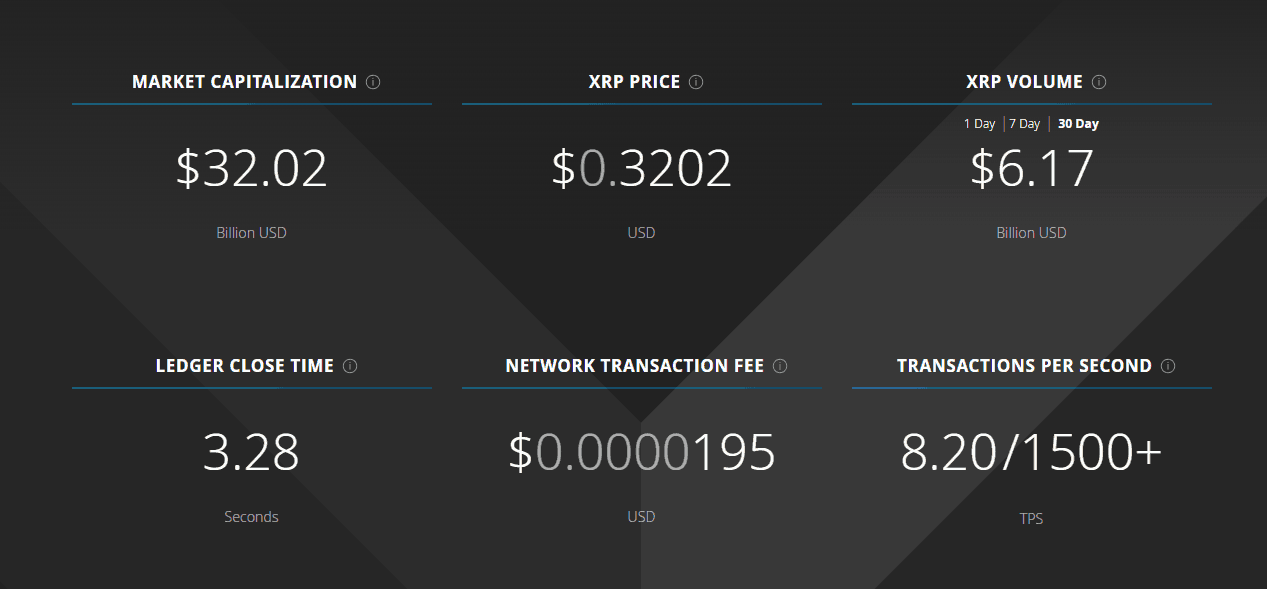

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025 -

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025

Latest Posts

-

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025 -

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025 -

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025 -

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025