XRP Price Prediction: Impact Of SEC Lawsuit Dismissal On XRP's Value

Table of Contents

Immediate Impact of the SEC Lawsuit Dismissal on XRP Price

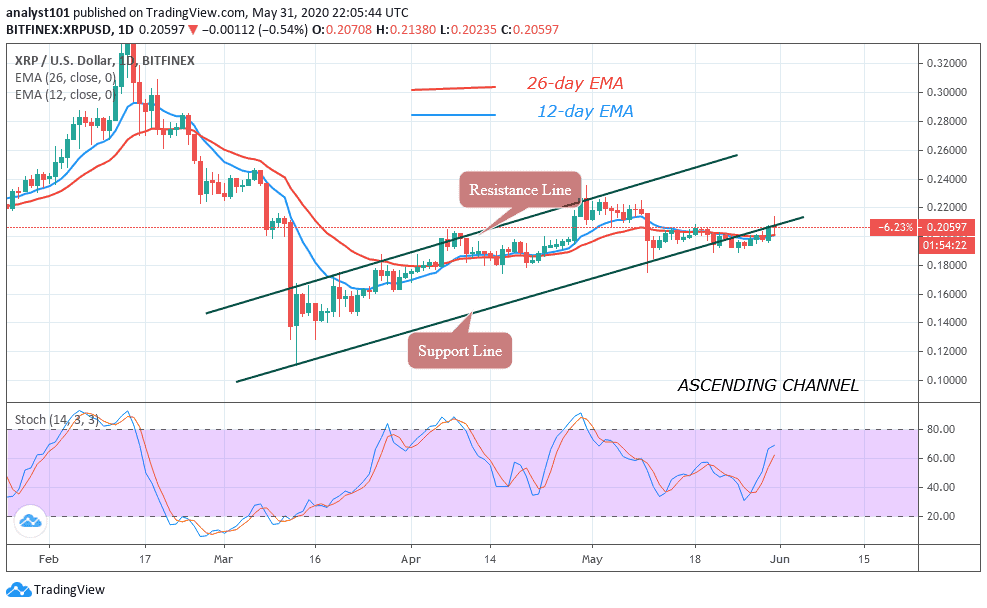

The immediate aftermath of the SEC lawsuit dismissal saw a dramatic surge in XRP's price. Understanding this immediate impact is crucial for any XRP price prediction.

Short-Term Price Volatility

The initial price jump was a direct result of the removed regulatory uncertainty surrounding XRP. Investors, previously hesitant due to the legal battle, regained confidence, leading to a significant increase in buying pressure. However, this initial surge was followed by some consolidation and minor corrections, a common occurrence in the volatile cryptocurrency market.

This short-term volatility is expected. The market needs time to absorb the news and adjust to the new reality.

- Increased trading volume: The dismissal spurred a massive increase in XRP trading volume across various exchanges.

- Increased investor confidence: The positive ruling boosted investor confidence, leading to renewed interest in XRP.

- Short-term price speculation: Many traders engaged in short-term speculation, buying low and aiming for quick profits.

- Potential for profit-taking: As the price rose, some investors took profits, leading to temporary price dips.

[Insert chart/graph illustrating XRP price movements post-dismissal]

Increased Trading Volume and Liquidity

The SEC lawsuit significantly impacted XRP's liquidity and accessibility. Many exchanges delisted XRP during the legal battle, limiting trading opportunities. The dismissal, however, has reversed this trend.

- Restoration of listings on major exchanges: Several major cryptocurrency exchanges have reinstated XRP listings, increasing its accessibility to a broader range of investors.

- Increased institutional interest: The positive ruling could attract greater interest from institutional investors seeking exposure to the digital asset market.

- Improved market depth: Increased trading volume and a wider range of buyers and sellers contribute to a more liquid and stable XRP market.

Long-Term Price Prediction for XRP: Factors to Consider

Predicting the long-term price of XRP requires considering several interconnected factors beyond the immediate impact of the SEC lawsuit.

Ripple's Future Developments and Partnerships

Ripple's ongoing projects and partnerships will play a significant role in shaping XRP's future. The company's continued development of its RippleNet payment system and its expansion into new markets are key drivers for potential growth.

- On-going development of RippleNet: Enhancements and expansion of RippleNet's capabilities will increase its adoption by financial institutions, driving demand for XRP.

- Expansion into new markets: Ripple's strategic expansion into new geographical regions will expose XRP to a larger user base.

- Strategic partnerships with banks and payment providers: Collaborations with established financial institutions will provide XRP with increased legitimacy and broader acceptance.

Regulatory Clarity and Global Adoption

The SEC ruling’s impact extends beyond XRP. It could influence regulatory clarity across the cryptocurrency landscape, potentially leading to increased institutional investment and broader adoption.

- Potential for increased institutional investment: Greater regulatory clarity might encourage institutional investors to allocate more capital to the cryptocurrency market, including XRP.

- Wider acceptance by businesses and consumers: Increased clarity and reduced legal uncertainty could lead to greater acceptance of XRP for cross-border payments and other financial transactions.

- Increased regulatory certainty: A clearer regulatory framework could stimulate innovation and growth within the cryptocurrency industry as a whole.

Overall Market Conditions and Macroeconomic Factors

The price of XRP is not solely determined by its own fundamentals. Broad market trends and macroeconomic factors significantly influence its price.

- Overall cryptocurrency market sentiment: The general sentiment towards cryptocurrencies, particularly Bitcoin, often influences the price of altcoins like XRP.

- Global economic outlook: Macroeconomic factors such as inflation, interest rates, and geopolitical events can significantly impact the cryptocurrency market.

- Bitcoin price movements: Bitcoin’s price often serves as a benchmark for the entire cryptocurrency market. A strong Bitcoin typically leads to positive sentiment across the board.

Risk Assessment and Investment Considerations

While the SEC lawsuit dismissal is positive news for XRP, investors must acknowledge inherent risks.

Potential Risks and Challenges

Investing in cryptocurrencies, including XRP, carries significant risk.

- Market volatility: The cryptocurrency market is known for its extreme volatility, and XRP is no exception.

- Regulatory uncertainty: While the SEC lawsuit is dismissed, future regulatory challenges remain a possibility.

- Security risks: As with all digital assets, there are risks associated with security breaches and hacking.

Diversification and Risk Management Strategies

To mitigate risk, investors should employ sound risk management practices.

- Diversify your investment portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes.

- Only invest what you can afford to lose: Never invest money you cannot afford to lose completely.

- Conduct thorough research before investing: Before investing in any cryptocurrency, conduct thorough research and understand the associated risks.

Conclusion

The dismissal of the SEC lawsuit against Ripple is a significant development that has had a positive impact on the XRP price. While short-term price fluctuations are to be expected, the long-term XRP price prediction hinges on Ripple's future endeavors, regulatory clarity, and overall market conditions. Before investing in XRP, thorough research and a clear understanding of the inherent risks are paramount. Diversify your portfolio, invest responsibly, and stay informed about the latest news and developments to make informed investment decisions concerning XRP. Remember that this is not financial advice, and the XRP price prediction is inherently speculative.

Featured Posts

-

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025 -

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025 -

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025 -

The Vaticans Financial Troubles Pope Francis Unfinished Reform

May 08, 2025

The Vaticans Financial Troubles Pope Francis Unfinished Reform

May 08, 2025 -

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025

Latest Posts

-

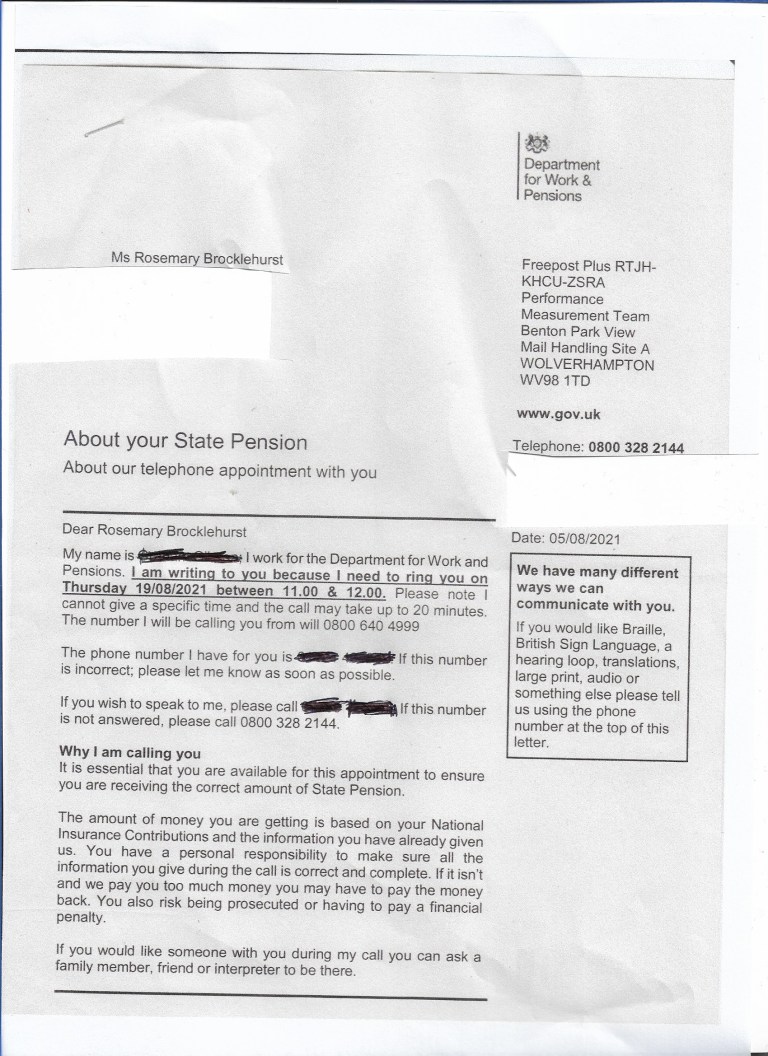

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025 -

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025 -

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025