MicroStrategy Vs. Bitcoin Investment: A 2025 Perspective

Table of Contents

MicroStrategy's Bitcoin Strategy: A Deep Dive

MicroStrategy's Holdings and Market Influence

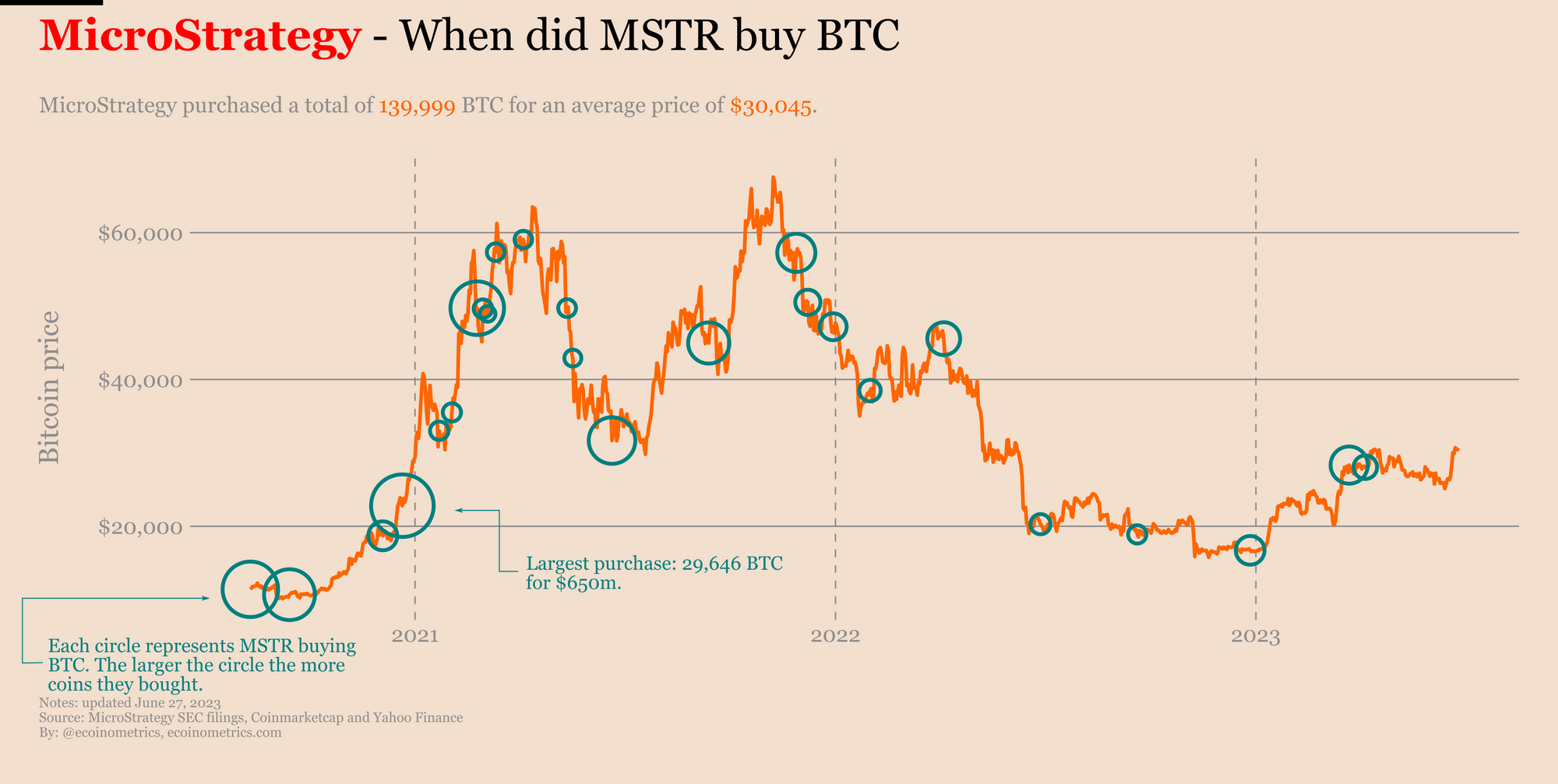

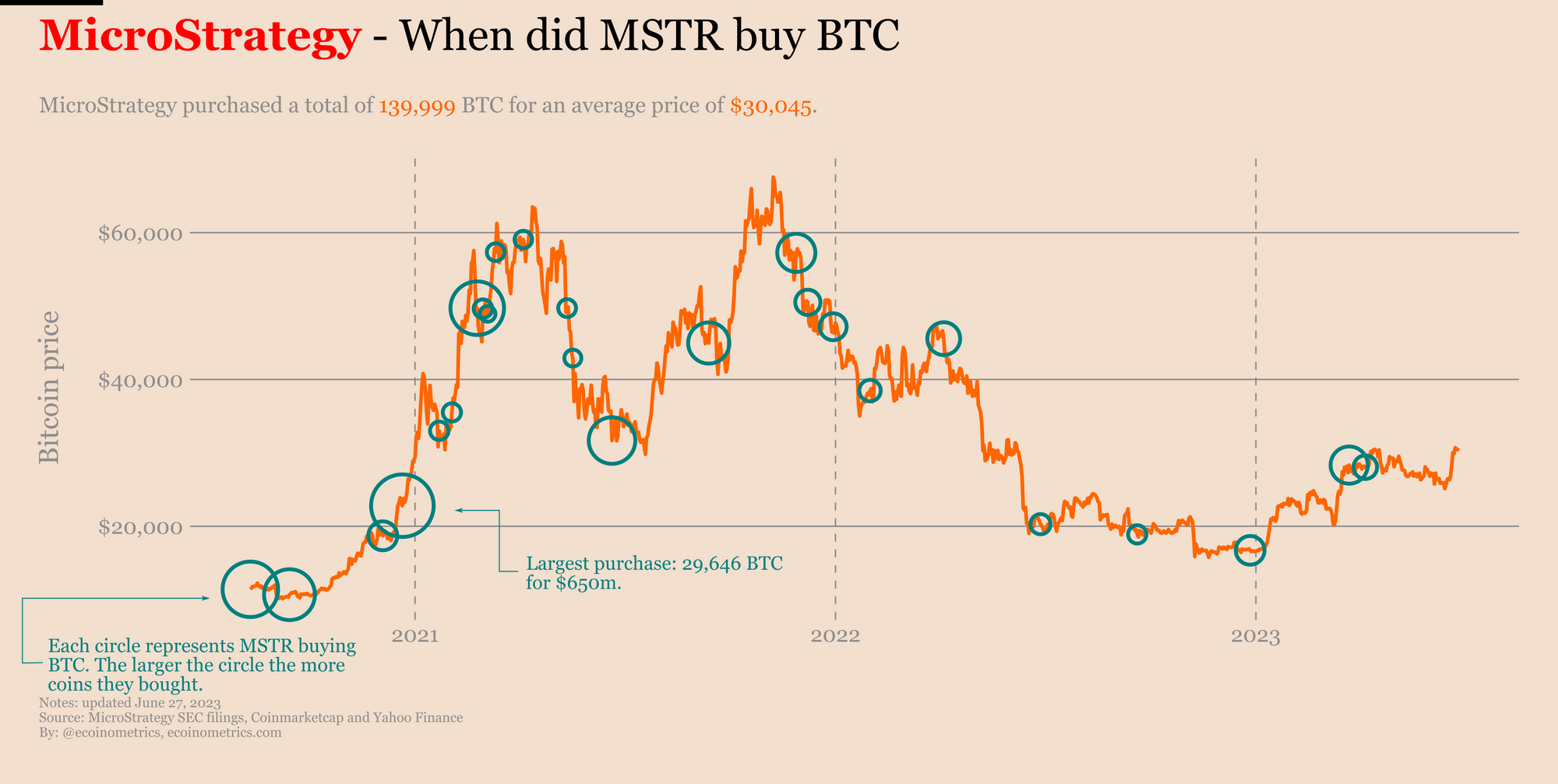

MicroStrategy's substantial Bitcoin holdings have made it a major player in the cryptocurrency market. Its bold investment strategy has significantly impacted market sentiment and price action.

- Massive Holdings: MicroStrategy holds a considerable amount of Bitcoin, making it one of the largest corporate holders globally. The exact amount fluctuates with market conditions and further acquisitions, but its sheer scale influences market psychology.

- Strategic Accumulation: MicroStrategy hasn't adopted a passive approach; their purchases have often been timed strategically, sometimes during periods of market downturn, suggesting a long-term perspective.

- Market Sentiment Shifter: MicroStrategy's actions often serve as a signal to other institutional investors, contributing to increased confidence in Bitcoin as a viable asset class. This has a ripple effect, influencing the overall Bitcoin price.

Keywords: MicroStrategy Bitcoin holdings, MicroStrategy investment strategy, Bitcoin market influence, institutional Bitcoin investment.

Risks and Rewards of MicroStrategy's Approach

Mimicking MicroStrategy's strategy presents significant potential, but also considerable risks.

- High Reward Potential: MicroStrategy's bet on Bitcoin has, at times, yielded substantial returns. If Bitcoin continues its upward trajectory, similar strategies could bring immense profits.

- Volatility Risk: Bitcoin's price is notoriously volatile. A sharp downturn could severely impact the value of any investment, potentially leading to significant losses. MicroStrategy's strategy highlights the need for a long-term perspective to mitigate this.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains in flux. Changes in regulations could significantly impact the value and legality of Bitcoin holdings, creating substantial risk.

Keywords: Bitcoin volatility, regulatory risk, institutional Bitcoin investment risks, long-term Bitcoin investment.

MicroStrategy's Financial Performance and Bitcoin's Impact

Analyzing MicroStrategy's financial performance since its significant Bitcoin acquisitions is crucial for understanding the implications of this strategy.

- Stock Performance Correlation: There's a notable correlation between MicroStrategy's stock price and the price of Bitcoin. This highlights the significant impact of its Bitcoin holdings on investor perception of the company's overall financial health.

- Profitability and Losses: While Bitcoin's price fluctuations directly impact the reported value of MicroStrategy's holdings, the overall effect on profitability is complex and influenced by numerous market factors. Analyzing financial reports is vital to forming a comprehensive view.

- Investor Sentiment: MicroStrategy's decision to embrace Bitcoin has attracted both praise and criticism from investors. Tracking investor sentiment provides valuable insights into the market's perception of this strategy.

Keywords: MicroStrategy stock price, Bitcoin impact on financial performance, corporate Bitcoin adoption, financial analysis of Bitcoin investment.

Direct Bitcoin Investment: A Retail Investor's Perspective

Understanding Bitcoin's Volatility and Risk Tolerance

Direct Bitcoin investment exposes retail investors to significant price volatility.

- High-Risk, High-Reward: Bitcoin’s price swings are extreme. While potentially lucrative, this inherent volatility requires a high-risk tolerance.

- Diversification: Investing only in Bitcoin is incredibly risky. Diversification across various asset classes is crucial for mitigating potential losses.

- Emotional Discipline: Navigating Bitcoin's price fluctuations requires emotional discipline to avoid impulsive buying or selling decisions driven by fear or greed.

Keywords: Bitcoin price volatility, Bitcoin risk management, retail Bitcoin investment, cryptocurrency risk.

Methods of Direct Bitcoin Investment

Retail investors can access Bitcoin through various platforms.

- Exchanges: Platforms like Coinbase and Binance allow buying, selling, and trading Bitcoin. Security and reliability vary greatly between exchanges, so due diligence is paramount.

- Wallets: Securely storing Bitcoin requires using a cryptocurrency wallet—either hardware wallets for maximum security or software wallets for easier access.

- Direct Purchase: Some brokerage firms now offer direct purchase options for Bitcoin, simplifying the process for some investors.

Keywords: Bitcoin exchanges, Bitcoin wallets, cryptocurrency trading, buying Bitcoin.

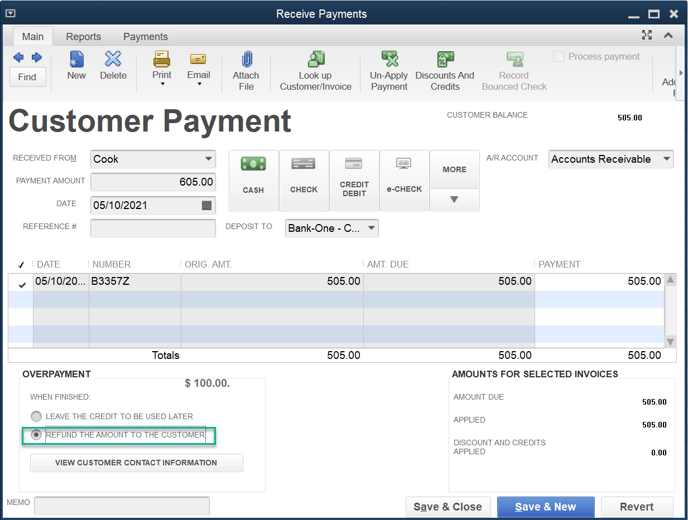

Tax Implications and Regulatory Considerations

The tax and legal aspects of Bitcoin investment are complex and vary by jurisdiction.

- Capital Gains Tax: Profits from selling Bitcoin are usually subject to capital gains taxes. Understanding the specific tax laws in your region is crucial.

- Reporting Requirements: Accurate reporting of cryptocurrency transactions to tax authorities is mandatory in many countries. Failure to comply can result in severe penalties.

- Evolving Regulations: The regulatory environment for cryptocurrencies is constantly evolving. Staying informed about changes is essential for legal compliance.

Keywords: Bitcoin tax implications, cryptocurrency regulations, tax reporting cryptocurrency, legal aspects of Bitcoin investment.

MicroStrategy vs. Direct Investment: A Comparative Analysis

Risk Profiles

Direct Bitcoin investment carries significantly higher risk than mirroring MicroStrategy's diversified approach. MicroStrategy, as a large corporation, can absorb losses more effectively, something individual investors cannot typically replicate.

Potential Returns

While both strategies offer the potential for significant returns, the direct investment approach has a higher potential upside but also a much higher potential downside. MicroStrategy's approach is comparatively less volatile but may offer lower potential maximum gains.

Accessibility and Resources

Direct Bitcoin investment is relatively accessible; many exchanges and platforms allow for easy entry. However, understanding and managing the risks inherent in this strategy requires significant effort and financial literacy. Following MicroStrategy's approach requires a deeper understanding of corporate finance and market analysis.

Conclusion

In 2025, both direct Bitcoin investment and the MicroStrategy model present unique opportunities and challenges. Direct investment offers greater flexibility but demands a higher risk tolerance and a deep understanding of the cryptocurrency market. The MicroStrategy approach, while potentially less volatile in the short-term, requires careful analysis of their financial strategy and the broader macroeconomic landscape. Ultimately, the best choice depends on your individual risk tolerance, investment goals, and understanding of the Bitcoin investment landscape. Carefully consider your options before making any decisions and remember to diversify your portfolio. Start researching your Bitcoin investment strategy today!

Featured Posts

-

The Life Of Chuck Movie Trailer Stephen Kings Positive Review

May 08, 2025

The Life Of Chuck Movie Trailer Stephen Kings Positive Review

May 08, 2025 -

Nuggets Celebrate Jokics Birthday With Westbrooks Leading Performance

May 08, 2025

Nuggets Celebrate Jokics Birthday With Westbrooks Leading Performance

May 08, 2025 -

Finding A Ps 5 Before The Price Goes Up Best Retailers And Tips

May 08, 2025

Finding A Ps 5 Before The Price Goes Up Best Retailers And Tips

May 08, 2025 -

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025 -

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025

Latest Posts

-

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025 -

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025 -

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025 -

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025