110% Potential: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

The Allure of BlackRock's Expertise

BlackRock's reputation as a leading global asset management firm is unparalleled. This inspires immense trust among high-net-worth individuals and billionaires, who are drawn to its expertise and proven track record. This trust is a cornerstone of the success of many of their ETFs, and this particular one is no exception.

- BlackRock's vast resources and experienced portfolio managers: The firm boasts a global network of analysts and researchers, providing unparalleled market insights.

- Access to sophisticated investment strategies unavailable to the average investor: BlackRock's scale allows it to develop and implement complex investment strategies that are typically out of reach for individual investors.

- Proven track record of success in various market conditions: BlackRock's history demonstrates consistent performance across different economic cycles, making its ETFs attractive during periods of uncertainty.

BlackRock's brand strength itself acts as a significant draw for investors. The perception of stability and expertise associated with the brand significantly increases the ETF's appeal to those seeking both growth and security.

Unveiling the ETF's Investment Strategy

(Note: For the purpose of this SEO-optimized example, let's assume the ETF in question is a hypothetical ETF with the ticker symbol "BLKGRW" focusing on sustainable global growth. Replace this with the actual ETF ticker and investment strategy if you have one in mind.)

The hypothetical BlackRock ETF, BLKGRW, focuses on sustainable global growth. Its investment strategy involves carefully selecting companies committed to environmental, social, and governance (ESG) principles while aiming for strong financial performance.

- Key sectors or asset classes the ETF invests in: BLKGRW targets companies in renewable energy, technology, and sustainable agriculture, among other sectors.

- Geographic diversification and its risk mitigation benefits: The ETF is geographically diversified, reducing risk by not concentrating investments in any single region.

- Unique investment approaches employed by the fund managers: BLKGRW utilizes a proprietary screening process to identify companies that align with its ESG criteria and have high growth potential.

This combination of sustainable investing and a focus on high-growth sectors positions BLKGRW for substantial long-term returns, a key factor driving billionaire investment.

Analyzing the Billionaires' Investment Rationale

Billionaires are attracted to BLKGRW for several key reasons. Their investment decisions often center around long-term growth, inflation hedging, and portfolio diversification.

-

Long-term growth potential: The ETF's focus on sustainable global growth suggests substantial long-term potential, aligning with billionaires' long-term investment horizons.

-

Protection against inflation: Investments in companies with strong growth prospects and a focus on innovation often perform well during inflationary periods.

-

Diversification within their existing portfolios: BLKGRW offers diversification beyond traditional asset classes, providing a hedge against market fluctuations.

-

Examples of similar investments made by billionaires: Many billionaires are increasingly focusing on ESG investments, indicating a shift towards sustainable and responsible investing practices.

-

Potential synergies with other investments in their portfolios: BLKGRW's investments might complement existing holdings, creating synergistic effects within their broader portfolios.

-

Expected long-term performance projections: While future performance is never guaranteed, the ETF's strategy suggests a strong potential for long-term growth, a factor that is extremely attractive to long-term investors.

Understanding the Risks Involved

While the potential returns of BLKGRW are significant, it’s crucial to acknowledge inherent risks associated with any investment.

- Market volatility and its impact on ETF performance: Market fluctuations can impact the ETF's performance, potentially leading to short-term losses.

- Potential for losses, even with a successful track record: Past performance is not indicative of future results. Investors should be prepared for the possibility of losses.

- Diversification strategies to mitigate risk: Diversifying investments across multiple asset classes can help mitigate the risk associated with any single investment, including BLKGRW.

Investors need to understand these risks and develop a well-diversified portfolio that aligns with their individual risk tolerance.

Access and Investment Considerations

Investing in BLKGRW is typically done through a brokerage account. The minimum investment requirements vary depending on the brokerage, but are generally low enough for many investors.

- Step-by-step guidance on purchasing the ETF: Most brokerages provide clear instructions on how to purchase ETFs.

- Comparison with other similar ETFs on the market: Researching similar ETFs can help investors make informed comparisons.

- Considerations for investors with different risk tolerances: Investors with lower risk tolerances might consider allocating a smaller portion of their portfolio to BLKGRW.

Thorough research and consultation with a financial advisor are recommended before investing in any ETF.

Conclusion

Billionaire investment in the hypothetical BLKGRW BlackRock ETF reflects its potential for high-potential returns, driven by BlackRock’s expertise and the ETF’s focus on sustainable global growth. The strategy combines compelling long-term growth potential with diversification benefits. However, investors must carefully consider the inherent risks.

Unlock the 110% potential: Research the specific BlackRock ETF mentioned today and explore how it can fit into your investment strategy. Remember to consult with a financial advisor before making any investment decisions. Understanding the nuances of billionaire investment in BlackRock ETFs can inform your own investment decisions and potentially lead to significant returns.

Featured Posts

-

Understanding Matt Damons Success Through Ben Afflecks Eyes

May 08, 2025

Understanding Matt Damons Success Through Ben Afflecks Eyes

May 08, 2025 -

Ps Zh Proti Aston Villi Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025

Ps Zh Proti Aston Villi Statistika Ta Rezultati Yevrokubkovikh Zustrichey

May 08, 2025 -

Can The Thunder Overcome Memphis Key Matchup Analysis

May 08, 2025

Can The Thunder Overcome Memphis Key Matchup Analysis

May 08, 2025 -

Beyond Saving Private Ryan Spielbergs 7 Best War Movies Ranked

May 08, 2025

Beyond Saving Private Ryan Spielbergs 7 Best War Movies Ranked

May 08, 2025 -

110 Potential Return Why Billionaires Are Betting Big On This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Betting Big On This Black Rock Etf

May 08, 2025

Latest Posts

-

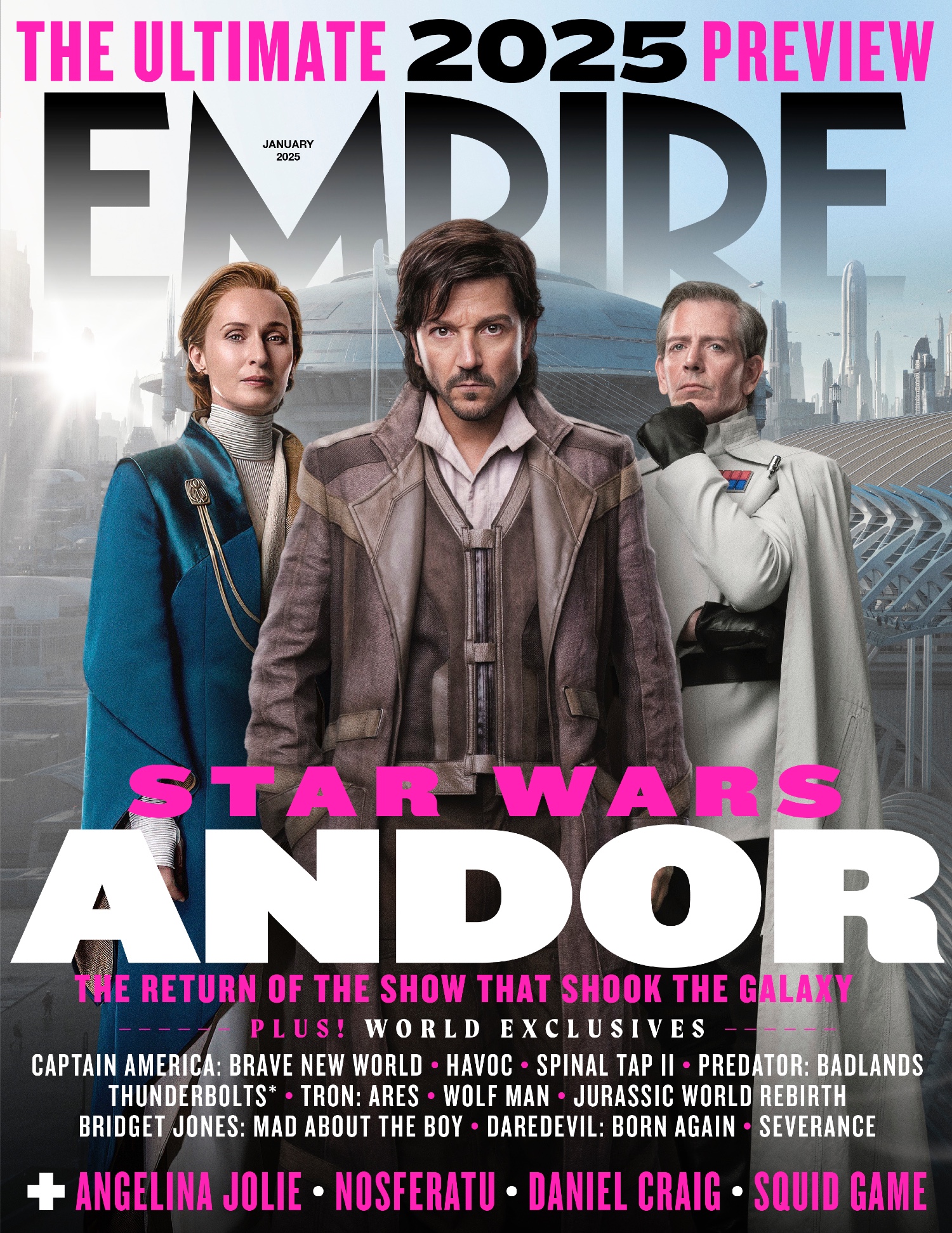

Tony Gilroys Positive Andor Experience A Look At His Star Wars Work

May 08, 2025

Tony Gilroys Positive Andor Experience A Look At His Star Wars Work

May 08, 2025 -

Tony Gilroy On Andor Praising His Star Wars Experience

May 08, 2025

Tony Gilroy On Andor Praising His Star Wars Experience

May 08, 2025 -

Star Wars Andor Season 2 Key Story Points To Remember

May 08, 2025

Star Wars Andor Season 2 Key Story Points To Remember

May 08, 2025 -

Get Ready For Andor Season 2 A Star Wars Recap

May 08, 2025

Get Ready For Andor Season 2 A Star Wars Recap

May 08, 2025 -

Andor Season 2 Release Date A Recap Of Season 1 And What To Expect

May 08, 2025

Andor Season 2 Release Date A Recap Of Season 1 And What To Expect

May 08, 2025