Amundi Dow Jones Industrial Average UCITS ETF: Interpreting And Using NAV Data

Table of Contents

What is NAV and Why is it Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets, minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this NAV reflects the collective value of its holdings, which aim to track the performance of the Dow Jones Industrial Average. Understanding this Amundi ETF's daily NAV is critical for several reasons:

- NAV reflects the underlying asset value: The NAV provides a snapshot of the true worth of the ETF's investments. Changes in the NAV directly reflect the gains or losses of the underlying assets.

- Changes in NAV indicate ETF performance: Tracking daily or weekly changes in the Amundi Dow Jones Industrial Average UCITS ETF NAV helps investors assess the ETF's performance and compare it to the benchmark index (Dow Jones Industrial Average).

- NAV is crucial for buy/sell decisions: Investors often use NAV data in conjunction with the market price to identify potential arbitrage opportunities. This is especially relevant for actively traded ETFs like the Dow Jones Industrial Average ETF offered by Amundi.

- NAV helps compare ETF performance against benchmarks: By monitoring the NAV, you can gauge how effectively the Amundi ETF is tracking its target index. This is essential for evaluating the fund manager's performance and making informed decisions about continued investment.

Accessing and Interpreting Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Finding reliable Amundi Dow Jones Industrial Average UCITS ETF NAV data is straightforward. You can typically access this information through:

- Amundi's official website: The asset manager's website is the primary source for accurate and up-to-date NAV data.

- Financial news sources: Major financial news providers regularly publish ETF NAV information, including that for the Amundi ETF.

- Brokerage platforms: Most brokerage accounts provide real-time or near real-time NAV data for ETFs held within the account.

The NAV data may be presented in different formats:

- Tables: Simple tables showing daily or historical NAV figures.

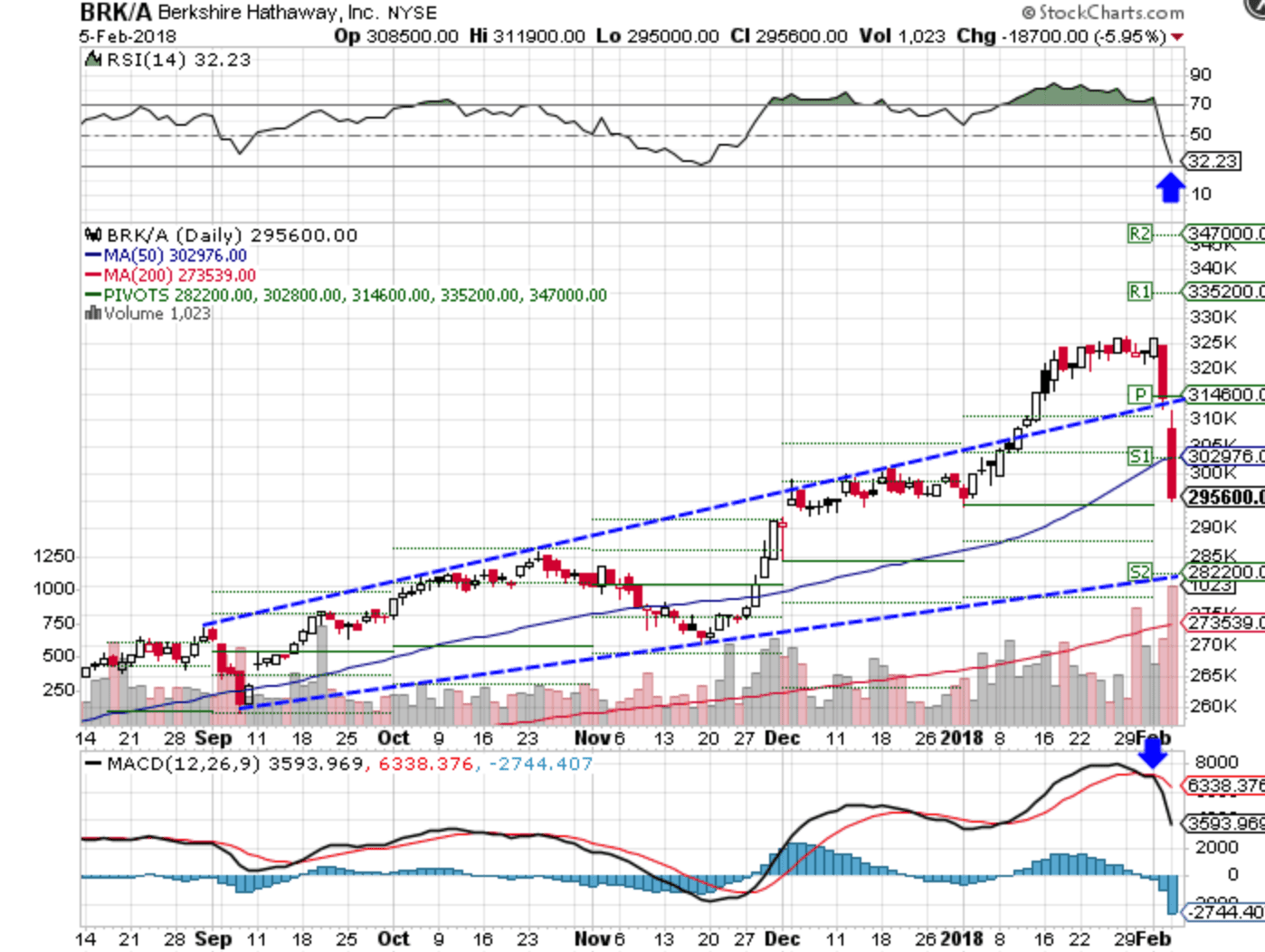

- Charts: Line graphs illustrating NAV trends over time, providing a visual representation of performance.

Interpreting this UCITS ETF's NAV data involves monitoring daily fluctuations and identifying trends. A rising NAV suggests positive performance, while a falling NAV indicates negative performance. Comparing the NAV to the ETF's market price can reveal potential pricing inefficiencies.

Using NAV Data to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV allows investors to make more informed decisions:

- NAV as an indicator for buying low and selling high: While not a foolproof strategy, comparing the NAV to the market price can reveal opportunities to buy low and sell high, potentially enhancing returns.

- Using NAV to evaluate investment performance against benchmarks: Comparing the Amundi ETF's NAV to the Dow Jones Industrial Average provides a clear picture of its tracking accuracy.

- Integrating NAV data into a broader investment strategy: NAV data should be considered alongside other factors, such as expense ratios and trading volume, within a holistic investment approach.

- Importance of considering other relevant factors: While NAV is essential, it shouldn't be the sole determinant of investment decisions. Market sentiment, economic indicators, and other relevant news also play a vital role.

Potential Pitfalls and Considerations When Using Amundi Dow Jones Industrial Average UCITS ETF NAV Data

While invaluable, Amundi Dow Jones Industrial Average UCITS ETF NAV data has limitations:

- Lagging NAV reporting: NAV is typically calculated at the end of the trading day, meaning there might be a delay between the actual market close and the official NAV release. This lag can impact short-term trading decisions.

- The difference between NAV and market price: The market price of an ETF can deviate from its NAV due to supply and demand. This difference can be significant during periods of high volatility.

- The need for a holistic investment approach: Relying solely on NAV data for investment decisions is risky. A comprehensive analysis incorporating various factors is crucial.

- Considering other market indicators: Market trends, economic forecasts, and news events should all be considered alongside NAV data for a well-rounded investment strategy.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Data for Successful Investing

Understanding and utilizing Amundi Dow Jones Industrial Average UCITS ETF NAV data is critical for successful investing in this popular ETF. By accessing reliable data sources, interpreting the information accurately, and integrating it into a broader investment strategy, investors can enhance their decision-making process. Remember to consider the limitations of NAV data and combine it with other relevant market indicators. Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV data today to optimize your investment strategy!

Featured Posts

-

Ferraris 10 Quickest Standard Production Models A Track Comparison

May 24, 2025

Ferraris 10 Quickest Standard Production Models A Track Comparison

May 24, 2025 -

Amsterdams Camunda Con 2025 How Orchestration Drives Ai And Automation Success

May 24, 2025

Amsterdams Camunda Con 2025 How Orchestration Drives Ai And Automation Success

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025 -

Finding The Perfect Porsche Macan Your Complete Buyers Guide

May 24, 2025

Finding The Perfect Porsche Macan Your Complete Buyers Guide

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Comprehensive Overview

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Comprehensive Overview

May 24, 2025

Latest Posts

-

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025